Tax compliance mistakes cost small businesses over $40 billion annually in penalties and interest charges. The IRS processed 11.2 million business tax returns in 2023, with audit rates increasing 15% for companies with poor documentation.

We at Optimum Results Business Solutions see businesses struggle with complex tax requirements daily. This tax compliance example guide shows real companies that transformed their tax processes and avoided costly penalties through proper planning and execution.

Understanding Tax Compliance Requirements

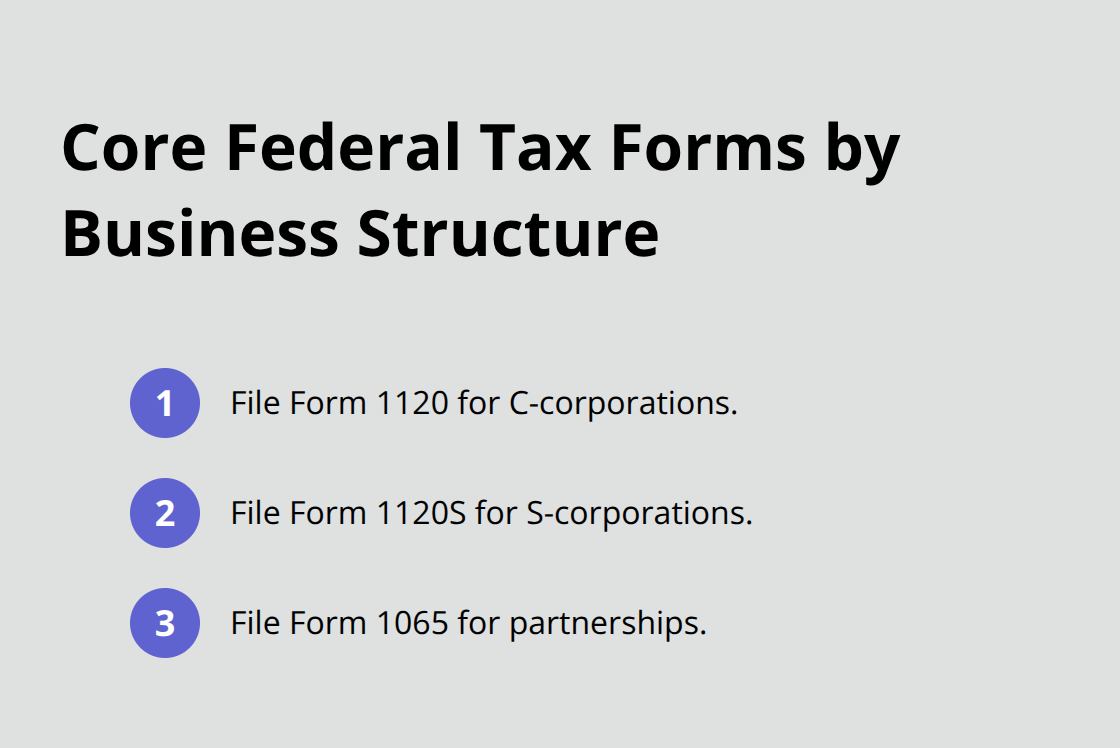

Small businesses face a web of federal, state, and local tax obligations that change based on business structure, location, and industry. The IRS requires C-corporations to file Form 1120, S-corporations to submit Form 1120S, and partnerships to complete Form 1065, each with different deadlines and requirements. State obligations vary dramatically – California imposes a minimum $800 franchise tax on LLCs regardless of income, while Delaware charges based on assumed par value capital. Sales tax adds another layer of complexity, with over 13,000 tax jurisdictions across the United States that maintain different rates and exemption rules.

Federal and State Tax Obligations for Small Businesses

Business structure determines your federal tax obligations and deadlines. Sole proprietors report business income on Schedule C with their personal returns (due April 15), while partnerships must file by March 15. C-corporations face double taxation on profits and distributions, but S-corporations allow pass-through taxation for up to 100 shareholders. State requirements often conflict with federal rules – New York requires separate state S-corporation elections, and Texas imposes franchise taxes on LLCs despite no state income tax.

Industry-Specific Tax Regulations and Standards

Healthcare practices must navigate HIPAA compliance alongside standard tax rules, while restaurants face sales tax compliance on prepared foods versus grocery exemptions in 32 states. Construction companies deal with prevailing wage requirements and specialized deduction rules for equipment depreciation. The IRS’s audit rates for Schedule C filers with gross receipts over $100,000 face 1.5–2% compared to lower rates for corporations. Professional services (law firms, accounting practices) often qualify for the Section 199A deduction, reducing taxable income by up to 20%.

Record-Keeping Requirements and Documentation Standards

The IRS requires businesses to maintain records for at least three years after filing, but practical experience shows seven years protects against most audit scenarios. Digital tax systems show positive effects on tax compliance among small businesses, while paper-only systems increase audit preparation time by an average of 120 hours. Receipts under $75 don’t require supporting documentation for travel and entertainment expenses, but mileage logs must include business purpose, destination, and odometer readings for every trip.

These compliance requirements create the foundation for tax success, but many businesses still make preventable mistakes that trigger penalties and audits.

What Tax Mistakes Cost Businesses the Most

Employee misclassification represents the most expensive compliance error businesses make, as misclassified employees may not receive minimum wage and overtime pay they’re entitled to under federal law. The Department of Labor estimates 10-30% of employers misclassify workers, which triggers payroll tax liabilities, overtime payments, and benefits claims that average $3,500 per misclassified worker. The IRS applies the common law test that examines behavioral control, financial control, and relationship type – workers who set their own schedules but use company equipment and work exclusively for one business typically qualify as employees despite 1099 forms. Small businesses face automatic penalties of $50 per incorrect 1099 plus backup withholding requirements when the IRS reclassifies contractors.

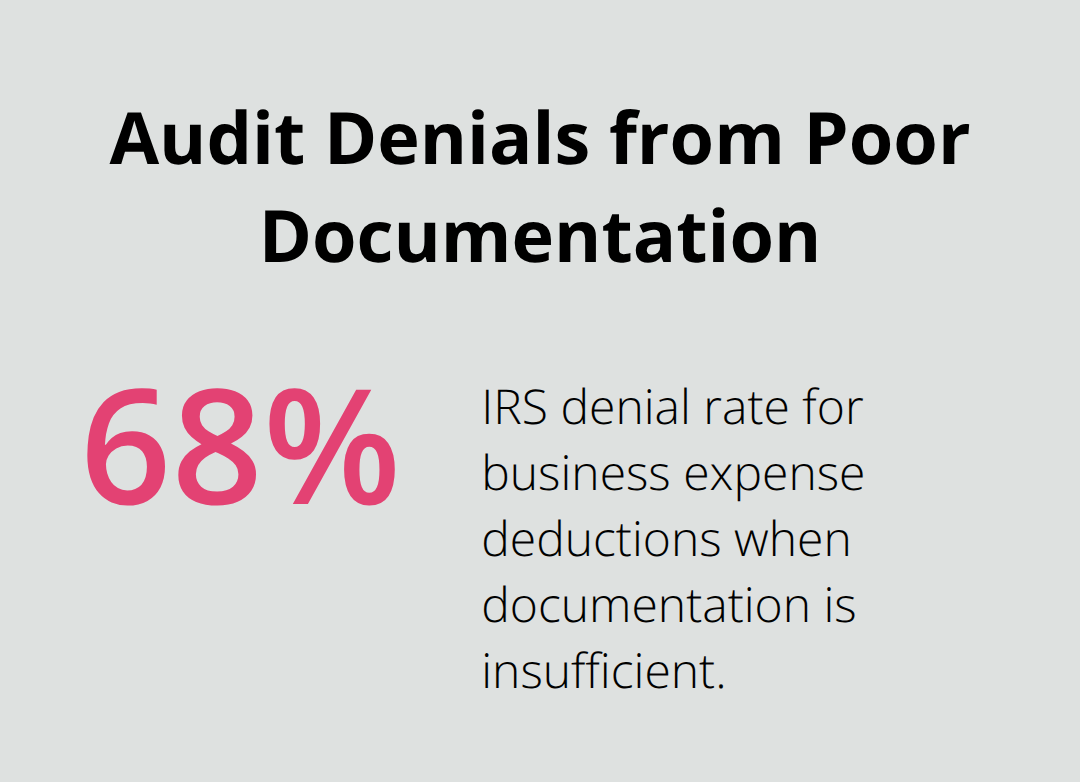

Poor Expense Documentation Triggers Audit Flags

Poor expense tracking costs businesses an average of $7,500 annually in lost deductions according to the National Association of Tax Professionals. The IRS denies 68% of business expense deductions during audits when businesses lack proper documentation, particularly for meals, travel, and home office expenses.

Mixed-use expenses require allocation formulas – home office deductions need exact square footage calculations and exclusive business use proof, while vehicle expenses require mileage logs with business purpose documentation for every trip. Cash payments over $600 to vendors require 1099-NEC forms, and businesses that file forms late face $280 penalties per occurrence that compound during multi-year audits.

Quarterly Payment Failures Create Compound Penalty Problems

Quarterly estimated tax underpayments generate penalties that start at 0.5% monthly and reach 25% maximum on unpaid amounts. Businesses must pay 90% of current year tax liability or 100% of prior year taxes through quarterly installments, with safe harbor rules that require 110% payments for companies with prior year income exceeding $150,000.

The number 100% seems to be not appropriate for this chart. Please use a different chart type. The IRS sets quarterly interest rates for individuals and businesses to calculate interest on underpayment and overpayment amounts. Late quarterly payments compound because each missed quarter increases the penalty calculation base, which makes December catch-up payments ineffective for penalty avoidance. Virtual bookkeeping services can help automate these calculations and ensure timely payments.

These common mistakes demonstrate why businesses need systematic approaches to tax compliance. The following success stories show how companies transformed their tax processes and avoided these costly errors through strategic implementation.

How Real Businesses Achieve Tax Compliance Success

Service Business Transforms Operations Through Strategic Bookkeeping

A Chicago-based marketing consultancy with 12 employees reduced their IRS penalty risk from high to zero after they implemented monthly bookkeeping reconciliation and expense categorization systems. Businesses with organized financial records save $62,000 annually through maximized deductions and avoided compliance penalties. Their new system tracks all business expenses through QuickBooks Online with receipt scanning technology, maintains separate accounts for different expense categories, and generates quarterly tax estimates automatically. The business now processes 1099-NEC forms for contractors through integrated payroll software, which eliminated their previous penalty exposure. Monthly financial statements help the owners make quarterly tax payments early, while digital receipt storage significantly reduced audit preparation time.

Technology Startup Maximizes Tax Benefits Through Professional Preparation

A San Francisco software startup saved significant taxes during their second year when they worked with tax professionals who identified R&D tax credits and Section 199A deductions. The company qualified for the Research & Development Tax Credit when they documented software development activities, employee time allocation, and contractor payments for code work. Their tax preparer restructured employee stock option plans to minimize tax obligations for both the company and employees, while they timed equipment purchases to maximize first-year depreciation benefits under Section 179. The startup also established an accountable plan for employee reimbursements, which converts non-deductible employee expenses into fully deductible business expenses.

Restaurant Chain Automates Multi-State Sales Tax Compliance

A restaurant chain that operates in Texas, Nevada, and Arizona eliminated sales tax compliance errors when they implemented automated sales tax software that handles rate changes across multiple tax jurisdictions. The company previously spent significant time monthly on sales tax calculations and faced penalties for incorrect filings. Their new system automatically updates tax rates, files returns electronically, and remits payments to each state taxation authority. The software distinguishes between prepared food sales, alcoholic beverages, and retail merchandise sales (each with different tax rates). Monthly sales tax liability dropped from manual calculations that took hours per location to automated processing completed quickly across all locations.

Final Thoughts

Tax compliance success demands systematic record-keeping, proper expense documentation, and timely quarterly payments. These tax compliance examples show how businesses transform their operations through strategic implementation of bookkeeping systems, professional tax preparation, and automated compliance tools. Companies that adopt organized approaches avoid costly penalties and maximize their deductions.

Professional tax support delivers measurable benefits for small businesses. Companies with organized financial records save $62,000 annually through maximized deductions and avoided penalties. Expert preparation identifies valuable credits like R&D tax benefits and Section 199A deductions that businesses often miss.

Monthly bookkeeping reconciliation, digital receipt storage, and quarterly tax payment automation form the foundation of effective compliance. Consider working with Optimum Results Business Solutions for expert bookkeeping and accounting services that help small service-based businesses and tech startups maintain compliance. Professional support reduces financial management costs while protecting your business from audit risks (and the stress that comes with them).