At Optimum Results Business Solutions, we’ve seen firsthand how QuickBooks Online Accountant revolutionizes financial management for accounting professionals.

This powerful cloud-based software streamlines workflows, enhances collaboration, and boosts productivity for accountants and bookkeepers alike.

In this post, we’ll explore the key features and benefits of QuickBooks Online Accountant, comparing it to traditional methods and showing how it can transform your accounting practice.

What Makes QuickBooks Online Accountant Stand Out?

Cloud-Based Accessibility

QuickBooks Online Accountant (QBOA) transforms financial management for accounting professionals. Its cloud-based platform enables access from any location at any time. This flexibility empowers modern accountants to work remotely or on-the-go, adapting to the evolving needs of their clients and practices. All you need is an internet connection or data plan to access and manage your books from your computer, laptop, tablet, or smartphone.

Efficient Multi-Client Management

QBOA excels in its ability to manage multiple clients from a single dashboard. This centralized approach saves time and minimizes errors that often occur when switching between different systems. Accountants can swiftly toggle between client accounts, review financial data, and perform tasks without repeated logins (a common frustration with traditional software).

Customizable Workspace

The customizable dashboard in QBOA is a powerful tool for accountants. It allows professionals to tailor their workspace to specific needs and preferences. Accountants can arrange widgets and prioritize key information, creating a workflow that maximizes productivity. This level of customization sets QBOA apart from many traditional accounting software options.

Integrated Financial Tools

QBOA integrates payroll and tax tools within its platform, eliminating the need for separate software for these critical functions. This integration reduces costs and complexity for accounting practices. Accountants can manage payroll, prepare taxes, and handle other financial tasks seamlessly within the same environment. The result? Consistency across all financial processes and significant time savings.

Automation for Accuracy and Efficiency

Automated bank feeds and reconciliation features in QBOA revolutionize accounting workflows. These tools significantly reduce manual data entry (a time-consuming and error-prone task). QBOA automatically imports and categorizes transactions, allowing accountants to shift their focus from data input to high-value activities like analysis and advisory services. You can save time reconciling bank transactions with the automation of transaction categorization and matching payee/vendors.

As we transition to exploring the benefits of QBOA for accountants and bookkeepers, it’s clear that these standout features lay a solid foundation for increased efficiency and productivity in modern accounting practices. Invoice management shines as another standout feature, enabling small businesses to create professional-looking invoices, send them directly to clients, and track payments effectively.

How QuickBooks Online Accountant Benefits Accounting Professionals

QuickBooks Online Accountant (QBOA) offers a range of advantages that significantly enhance the work of accounting professionals. This powerful tool transforms accounting practices in several key ways.

Efficiency and Productivity Boost

QBOA’s automation features dramatically reduce time spent on manual data entry. The free premier support provided by QuickBooks can be utilized during implementation and occasionally thereafter, potentially saving time for accounting professionals. This time savings allows professionals to focus on high-value activities such as financial analysis and strategic planning for clients.

Real-Time Client Collaboration

Real-time collaboration revolutionizes accountant-client relationships. QBOA’s shared access feature enables instant updates and communication, eliminating the need for back-and-forth emails and reducing response times. QuickBooks Online Accountant allows accounting professionals to track clients’ invoices in real-time, helping clients get paid faster.

Scalable Practice Growth

QBOA’s multi-client management capabilities make it easy to scale your practice. As your client base expands, the platform effortlessly accommodates additional accounts without compromising performance. This scalability proves crucial for small to medium-sized practices looking to expand their services without significant infrastructure investments.

Enhanced Data Security

Data security stands paramount in accounting. QBOA employs bank-level encryption and multi-factor authentication to protect sensitive financial information. Regular automatic backups ensure data integrity and provide peace of mind. These security features often surpass what many small accounting firms can implement independently.

Professional Development Opportunities

The ProAdvisor program, exclusive to QBOA users, offers valuable resources for professional growth. It includes free training, certification opportunities, and marketing tools. This program not only enhances skills but also boosts credibility in a competitive market.

QBOA’s comprehensive features position it as a valuable asset for practices of all sizes. As we transition to comparing QBOA with traditional accounting methods, it becomes clear how this modern solution addresses longstanding challenges in the industry. QuickBooks bookkeeping services can further streamline your business operations effectively.

How QBOA Outperforms Traditional Accounting Methods

QuickBooks Online Accountant (QBOA) represents a significant advancement over traditional accounting methods. This powerful tool transforms accounting practices, offering advantages that traditional approaches cannot match.

Automation Revolutionizes Efficiency

QBOA’s automation capabilities drastically reduce time spent on manual data entry. AI can automate routine tasks like data entry and reconciliation, reducing time spent on repetitive tasks and minimising errors. This time savings allows professionals to focus on high-value activities such as financial analysis and strategic planning for clients.

Technology Enhances Accuracy

Human error poses a significant concern in traditional accounting. QBOA’s automated systems minimize these errors. The software’s built-in checks and balances catch discrepancies that might slip past human eyes. For instance, QBOA’s bank reconciliation feature automatically matches transactions, reducing the risk of misclassification or omission.

Real-Time Collaboration Improves Transparency

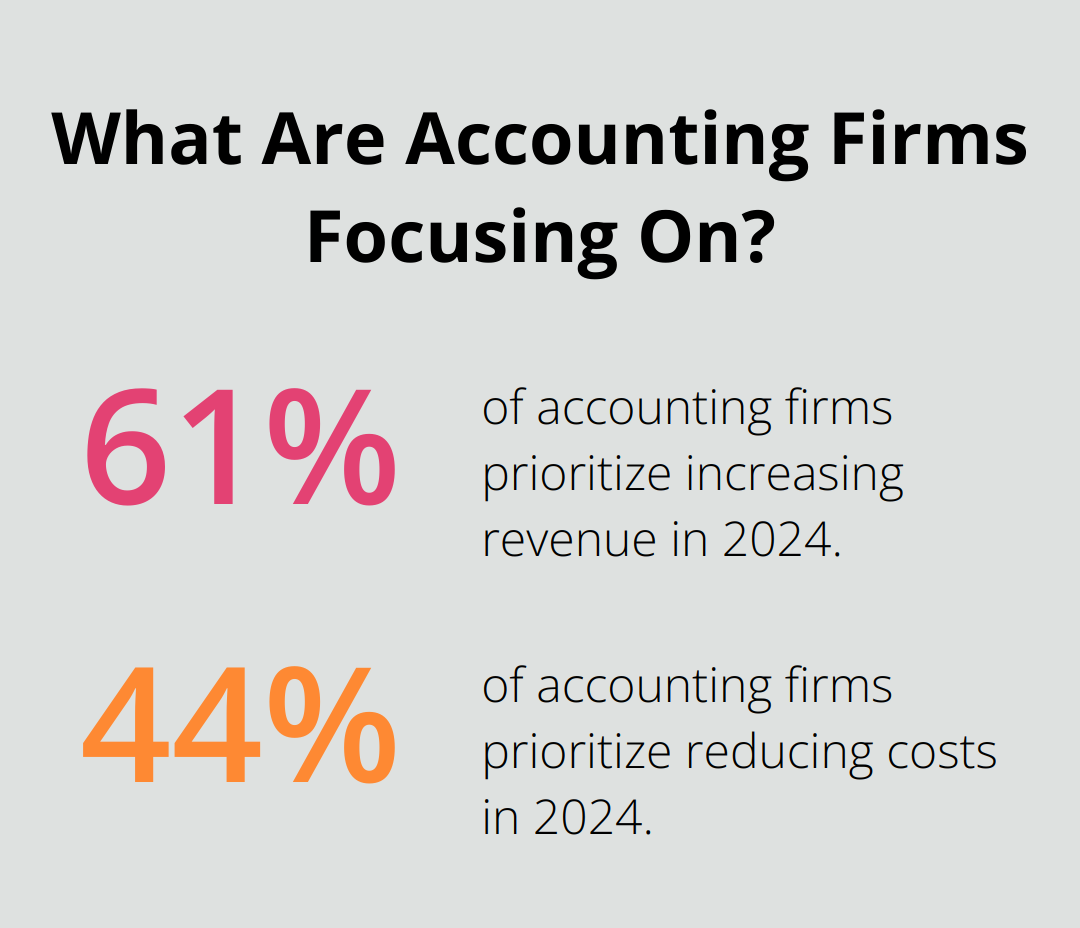

QBOA eliminates the need to email spreadsheets back and forth. It enables real-time collaboration between accountants and clients. This instant access to up-to-date financial information improves decision-making and strengthens client relationships. A survey reveals that the industry’s top priorities for 2024 are increasing revenue (61%), improving client service (50%), and reducing costs (44%).

Remote Work Flexibility Expands Possibilities

The COVID-19 pandemic highlighted the importance of remote work capabilities. QBOA’s cloud-based platform allows accountants to work from anywhere with an internet connection. This flexibility not only improves work-life balance but also expands the potential client base beyond geographical limitations.

Cost-Effectiveness Supports Growing Practices

For small to medium-sized practices, QBOA offers a cost-effective solution. Traditional accounting methods often require significant investments in software licenses, hardware, and IT support. QBOA’s subscription model eliminates these upfront costs and provides regular updates at no additional charge. A report found that cloud-based accounting solutions like QBOA can reduce IT costs by up to 50% compared to traditional on-premise solutions.

Final Thoughts

QuickBooks Online Accountant revolutionizes the accounting industry with its cloud-based platform and advanced features. It empowers accounting professionals to increase efficiency, collaborate in real-time, and scale their practices effortlessly. The platform’s automation capabilities and integrated tools streamline workflows, improve accuracy, and facilitate remote work, which proves essential in today’s digital landscape.

Optimum Results Business Solutions harnesses the power of QuickBooks Online Accountant to provide tailored bookkeeping and accounting solutions for small service-based businesses and tech startups. Our expert team utilizes QBOA’s features to ensure compliance and deliver valuable financial insights to our clients. The platform’s regular updates and scalability allow practices to adapt and grow without significant additional investments.

Accounting professionals who embrace QuickBooks Online Accountant position themselves for success in an increasingly competitive environment. QBOA’s powerful features enable practitioners to elevate their services, drive efficiency, and deliver greater value to their clients (while staying ahead of industry trends). The adoption of cloud-based accounting solutions like QBOA will continue to shape the future of the accounting profession.

Leave A Comment