Remote bookkeeping services are transforming how businesses manage their finances. At Optimum Results Business Solutions, we’ve seen firsthand how this approach can benefit companies of all sizes.

In this post, we’ll explore the advantages of remote bookkeeping, essential tools for success, and best practices for implementation. Get ready to discover how you can streamline your financial processes and boost your bottom line.

Why Remote Bookkeeping Makes Financial Sense

Remote bookkeeping has revolutionized financial operations for businesses. This approach offers significant advantages over traditional in-house bookkeeping methods.

Cost Reduction Without Compromise

Small businesses can reduce their bookkeeping expenses when they choose remote services. This cost-effectiveness results from lower overhead, as companies eliminate the need for office space, equipment, and full-time salaries. These savings allow businesses to redirect resources to core activities and growth initiatives.

Access to Expert Knowledge

Remote bookkeeping services provide businesses with a diverse team of financial professionals. Companies can leverage the collective knowledge of experienced experts instead of relying on a single in-house bookkeeper. This breadth of expertise ensures efficient and accurate handling of complex financial issues.

Flexibility for Growth

As businesses expand, their financial management needs evolve. Remote bookkeeping services offer unmatched flexibility and scalability. Companies can adjust their service level based on current requirements without the hassle of hiring or training new staff. This adaptability proves crucial for businesses experiencing rapid growth or seasonal fluctuations.

Enhanced Data Security

Data security stands as a top priority in financial management. Remote bookkeeping services often employ advanced security measures that surpass those of many small businesses. Cloud-based solutions use encryption and secure servers to protect sensitive financial information. Additionally, remote services typically include robust backup systems, safeguarding financial data from physical disasters or hardware failures.

Remote bookkeeping transforms financial management for businesses of all sizes. This approach offers cost savings, expert insights, scalability, and enhanced security. As we move forward, let’s explore the essential tools that make effective remote bookkeeping possible.

Powerful Tools for Remote Bookkeeping Success

Remote bookkeeping depends on robust digital tools to streamline financial processes. These technologies drive efficiency and accuracy in remote financial management.

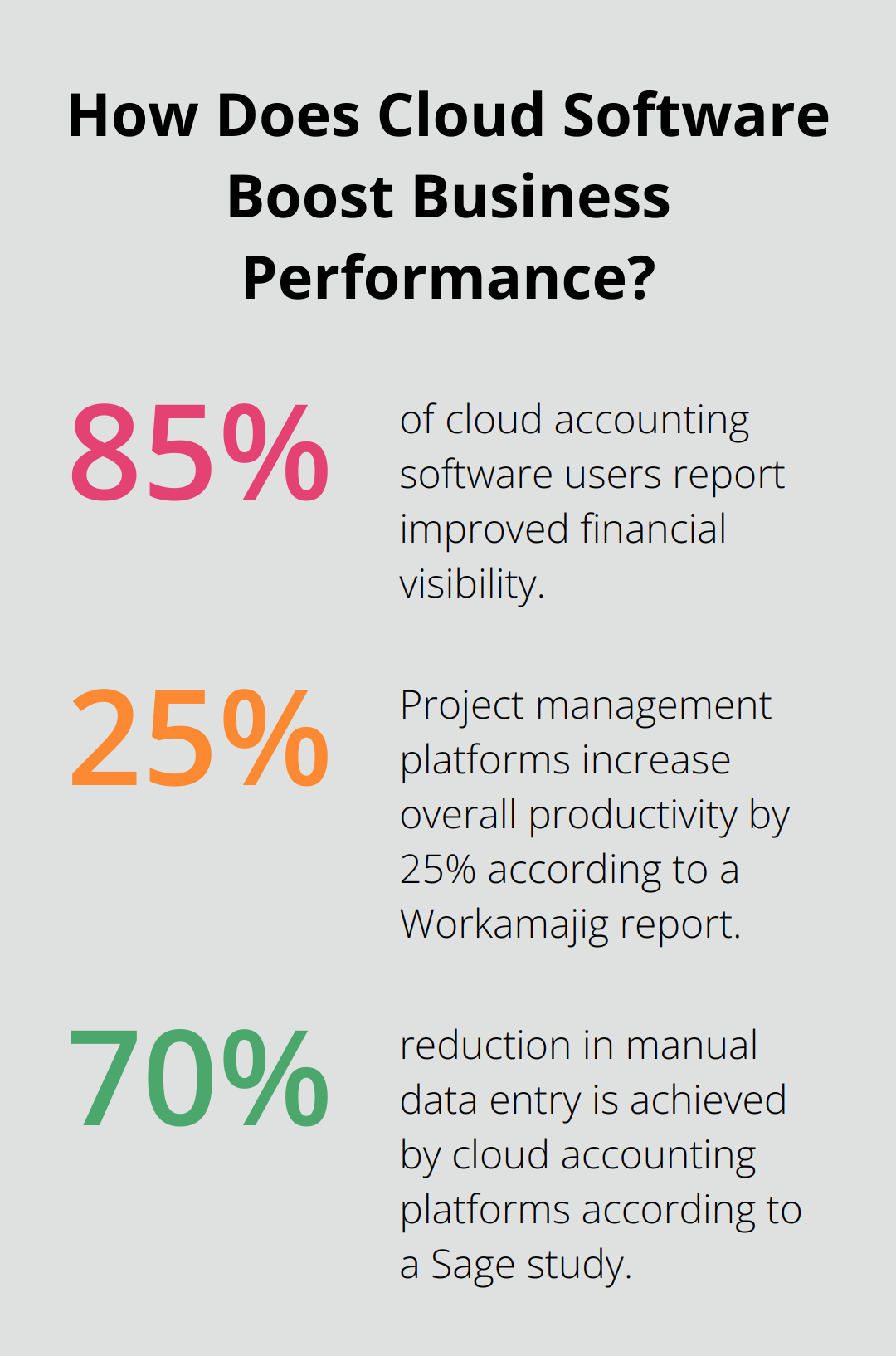

Cloud-Based Accounting Software

Cloud accounting platforms form the backbone of remote bookkeeping. QuickBooks Online and Xero lead the market, offering real-time financial data access and automated bank feeds. These tools reduce manual data entry by up to 70% (according to a study by Sage). They also facilitate collaboration between businesses and bookkeepers, with 85% of users reporting improved financial visibility.

Secure Document Management

Digital document management systems organize financial records effectively. Platforms like Hubdoc focus on remote document collection, allowing users to capture and sync bills, receipts, bank statements, and other relevant documents. Secure cloud storage protects financial documents and makes them easily accessible, eliminating the need for physical storage.

Communication and Collaboration

Effective communication plays a vital role in remote bookkeeping. Tools like Slack and Microsoft Teams enable instant messaging and file sharing, reducing email clutter by up to 40%. Video conferencing platforms (such as Zoom) facilitate face-to-face meetings, which 78% of remote workers say improves productivity, according to a survey by Owl Labs.

Time Tracking and Project Management

Accurate time tracking is essential for service-based businesses. Tools like Harvest and Toggl Track allow for precise billing and project profitability analysis. Project management platforms such as Asana or Trello help bookkeepers organize tasks and deadlines, increasing overall productivity by 25% according to a report by Workamajig.

The implementation of these tools can significantly enhance the efficiency of remote bookkeeping operations. However, selecting the right combination of software requires careful consideration of your business needs and integration capabilities. The next section will explore best practices for implementing remote bookkeeping to ensure a smooth transition and maximize the benefits of these powerful tools.

How to Implement Remote Bookkeeping Successfully

Establish a Robust Communication Framework

Effective communication forms the foundation of successful remote bookkeeping. Set up a centralized communication hub using tools like Slack or Microsoft Teams. Create dedicated channels for different financial topics, such as accounts payable, payroll, and financial reporting. This organization allows for quick information sharing and reduces email overload.

Schedule regular video conferences with your remote bookkeeping team. Nearly one in three workers (31%) desire improved video conferencing technologies that can better replicate the human experience. These face-to-face interactions foster better relationships and ensure everyone aligns on financial goals and processes.

Implement a Structured Reporting System

Develop a clear reporting schedule with your remote bookkeeping team. Define which financial reports you need, their frequency, and the format they should take. For example, you might require weekly cash flow reports, monthly profit and loss statements, and quarterly balance sheets.

Use cloud-based dashboards to provide real-time access to key financial metrics. This transparency allows for quick decision-making and helps identify potential issues before they escalate.

Prioritize Data Security and Compliance

Data security takes precedence in remote bookkeeping. Implement multi-factor authentication for all financial software and ensure that your remote team uses secure, encrypted connections when accessing financial data.

Stay updated on financial regulations and compliance requirements specific to your industry. Regularly audit your remote bookkeeping processes to ensure they meet these standards. This proactive approach can save significant time and resources in the long run.

Invest in Comprehensive Training

Provide thorough training on all tools and software used in your remote bookkeeping setup. This includes accounting software, document management systems, and communication platforms.

Create detailed process documentation for all financial tasks. This resource serves as a reference guide for your remote team and ensures consistency in financial operations. Update these documents regularly to reflect any changes in processes or software.

Choose the Right Service Provider

Selecting the right remote bookkeeping service provider is critical for success. Look for providers (like Optimum Results Business Solutions) with expertise in your industry and a track record of delivering accurate, timely financial information. Consider factors such as their technology stack, security measures, and ability to scale with your business. A compatible service provider will become a valuable partner in your financial management journey.

Final Thoughts

Remote bookkeeping services revolutionize financial management for businesses of all sizes. Companies reduce costs, access expert knowledge, and benefit from enhanced flexibility and data security. Cloud-based accounting software, secure document management systems, and effective communication platforms enable seamless collaboration between businesses and their financial teams.

Successful implementation of remote bookkeeping requires a structured approach with clear processes and regular check-ins. Establishing robust communication channels, setting up regular reporting schedules, and prioritizing data security optimize financial operations. Comprehensive training ensures teams leverage the full potential of chosen tools and processes.

Optimum Results Business Solutions specializes in expert remote bookkeeping services for small service-based businesses and tech startups. Our team of QuickBooks Online ProAdvisors offers customized solutions to streamline financial processes, ensure compliance, and provide valuable insights. Partner with us to focus on your core business activities while we handle your financial management with precision and care.