At Optimum Results Business Solutions, we understand the unique financial challenges nonprofits face. That’s why we’re excited to explore QuickBooks Online for nonprofits in this comprehensive guide.

QuickBooks Online offers powerful tools tailored to nonprofit organizations, helping them manage donations, track expenses, and generate crucial reports. We’ll walk you through setting up and optimizing QuickBooks Online for your nonprofit, ensuring you make the most of this versatile platform.

How to Set Up QuickBooks Online for Your Nonprofit

Selecting the Right Plan

QuickBooks Online offers several plans for nonprofits. The Plus plan ($45/month for the first three months) suits most organizations. It supports up to five users and includes automated record-keeping and donation tracking. Larger nonprofits might prefer the Advanced plan ($100/month) with support for up to 25 users and enhanced features.

When you create your account, select “Nonprofit Organization” as your company type. This aligns your QuickBooks setup with IRS Form 990 requirements (which simplifies tax filing).

Customizing Your Chart of Accounts

Your chart of accounts forms the backbone of your nonprofit’s bookkeeping system. Review the default accounts and modify them to reflect your specific income sources and expense categories.

Add accounts for various donation types, grants, and program-specific expenses. For example:

- Income accounts: individual donations, corporate sponsorships, government grants

- Expense accounts: program costs, fundraising expenses, administrative overhead

Implementing Fund Accounting

Fund accounting is essential for nonprofit financial management. Nonprofits follow a specific type of accrual accounting called “fund accounting,” which tracks expenses and income in separate accounts. Use classes or locations in QuickBooks to represent different funds or programs. This allows you to track revenues and expenses for each fund separately, providing clear insights into individual initiative performance.

For restricted funds, create specific accounts or use QuickBooks’ custom fields to tag transactions. This enables easy tracking and reporting on funds designated for specific purposes.

Syncing Bank Accounts

Connect your nonprofit’s bank accounts to QuickBooks Online. Intuit has designed online links between QuickBooks software and financial institutions to allow a direct connection or import of all credit card transactions. This automation reduces manual data entry and improves accuracy. QuickBooks will import transactions, categorize them (based on your rules), and simplify reconciliation.

Setting Up Donation Tracking

Configure QuickBooks to track donations effectively. Create product/service items for different donation types (e.g., cash donations, in-kind contributions). This allows you to generate detailed reports on your fundraising efforts and donor activity.

The setup process can be complex. If you need assistance, consider working with a QuickBooks ProAdvisor or a nonprofit accounting specialist (like Optimum Results Business Solutions). They can ensure your QuickBooks Online configuration aligns with your organization’s financial management needs and compliance requirements.

With your QuickBooks Online setup complete, you’re ready to explore its key features for nonprofit financial management. Let’s examine how QuickBooks can streamline your donation and grant tracking processes.

Maximizing QuickBooks Online for Nonprofit Success

Streamline Donation and Grant Tracking

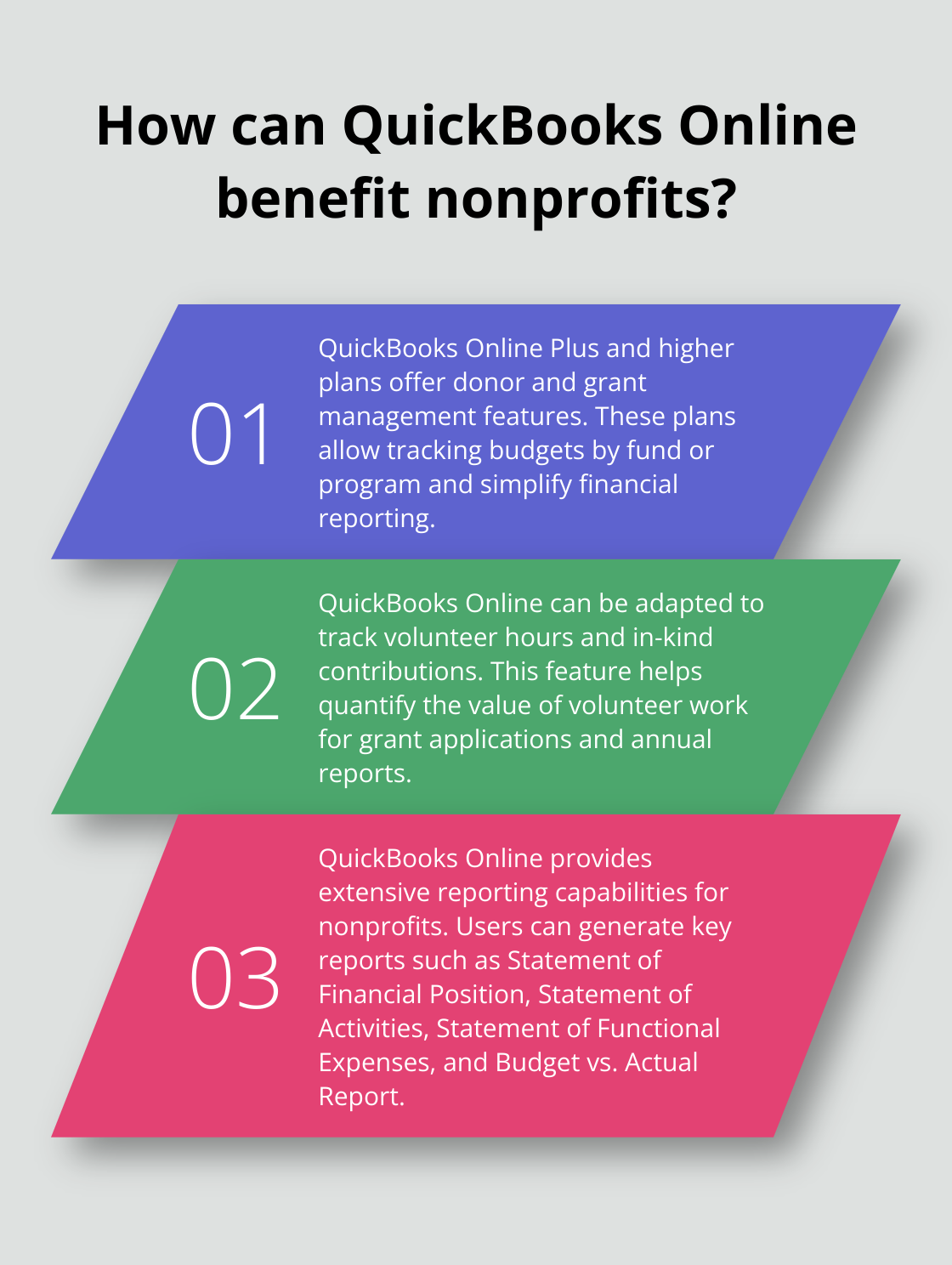

QuickBooks Online simplifies donation and grant management. Track budgets by fund or program with donor and grant management, financial reporting, and bank reconciliations. This feature is available only in QuickBooks Online Plus and higher plans.

For grants, set up separate income accounts to track each funding source. Use QuickBooks’ class tracking feature to allocate expenses to specific grants. This method simplifies reporting and compliance, allowing you to generate detailed statements for grantors that demonstrate how funds were used.

Manage Volunteers and In-Kind Contributions Efficiently

While QuickBooks Online lacks a built-in volunteer management system, you can adapt its features to track volunteer hours and contributions. Create a service item for volunteer time and use it to record hours contributed. This approach allows you to quantify the value of volunteer work for grant applications and annual reports.

For in-kind contributions, create non-inventory items to record donated goods or services. Assign a fair market value to these contributions and record them as both income and expense. This method ensures your financial statements accurately reflect the full scope of support your organization receives.

Generate Insightful Reports for Stakeholders

QuickBooks Online offers extensive reporting capabilities, allowing you to create custom reports tailored to your nonprofit’s needs. For board meetings, consider generating these key reports:

- Statement of Financial Position (Balance Sheet)

- Statement of Activities (Income Statement)

- Statement of Functional Expenses

- Budget vs. Actual Report

Customize these reports to show comparisons to previous periods or years, which helps stakeholders understand your organization’s financial trends. Use QuickBooks’ class tracking feature to create program-specific reports, demonstrating the financial performance of individual initiatives.

For major donors or grantors, create custom reports that show how their contributions were used. This level of transparency can strengthen relationships and encourage continued support.

Leverage QuickBooks Online’s Nonprofit-Specific Features

QuickBooks Online offers several features specifically designed for nonprofits. Use the fund accounting capabilities to track restricted and unrestricted funds separately. This feature ensures you comply with donor restrictions and maintain accurate financial records.

Try the built-in donation receipt templates to quickly generate acknowledgments for donors (which is essential for tax purposes). These templates can be customized to include your organization’s branding and specific information about the donation.

The next chapter will explore best practices for nonprofit bookkeeping with QuickBooks Online, ensuring you maximize the platform’s potential for your organization’s financial management.

How to Optimize QuickBooks Online for Nonprofit Bookkeeping

Categorize Transactions Accurately

Precise categorization of income and expenses forms the foundation of sound nonprofit bookkeeping. The nonprofit chart of accounts tracks revenue and expenses and is the heart of every nonprofit accounting system. Create detailed subcategories for your chart of accounts in QuickBooks Online. Break down “Donations” into “Individual Donations,” “Corporate Sponsorships,” and “Grants.” This granularity provides deeper insights into your funding sources.

For expenses, use QuickBooks’ class tracking feature to allocate costs to specific programs or funds. This method allows you to generate program-specific financial reports, which prove invaluable for grant reporting and board presentations.

Automate and Reconcile Regularly

Use QuickBooks Online’s bank feed feature to automate transaction imports. Set up rules to automatically categorize recurring transactions, which saves time and reduces manual entry errors.

Reconcile your accounts at least monthly. Regular reconciliation helps catch discrepancies early and ensures your financial records match your bank statements. QuickBooks Online simplifies this process with its reconciliation tool, which flags potential issues and guides you through resolving them.

Leverage Nonprofit-Specific Integrations

QuickBooks Online’s ecosystem includes several integrations tailored for nonprofits. QuickBooks integrates with donation pages, plugins, payment processors, and donor management or nonprofit CRM software like Kindful. These integrations can significantly improve your workflow.

Implement Strict Internal Controls

Maintain financial integrity by setting up user permissions in QuickBooks Online. Assign roles based on staff responsibilities, which ensures that sensitive financial data is only accessible to authorized personnel. This practice not only protects your organization but also demonstrates good governance to donors and auditors.

Create a clear audit trail by requiring detailed memo entries for each transaction. This habit provides context for future reference and simplifies the audit process. QuickBooks Online’s audit log feature automatically tracks all user activities, which adds an extra layer of accountability.

Utilize Custom Fields for Detailed Tracking

QuickBooks Online allows you to create custom fields, which can be powerful tools for nonprofit bookkeeping. Use these fields to track additional information such as grant deadlines, donor preferences, or program-specific metrics. This extra data can inform strategic decisions and enhance your reporting capabilities.

For instance, create a custom field for “Funding Cycle” to track multi-year grants effectively. This approach allows you to generate reports that show upcoming funding renewals, which helps you plan your grant writing efforts proactively.

Final Thoughts

QuickBooks Online for nonprofits provides a comprehensive solution to manage the unique financial challenges of charitable organizations. The platform empowers nonprofits to maintain accurate records, comply with regulations, and make data-driven decisions through streamlined donation tracking and customizable reporting. Successful implementation of QuickBooks Online requires careful setup and ongoing attention to detail, including customizing the chart of accounts and regular account reconciliation.

Accurate financial management builds trust with donors, simplifies grant reporting, and provides a clear picture of an organization’s financial position. QuickBooks Online allows nonprofits to focus more on their mission and less on administrative tasks. Organizations can achieve greater financial transparency, streamline operations, and ultimately make a bigger impact in their community.

Optimum Results Business Solutions offers specialized services tailored to nonprofits seeking expert guidance in optimizing their QuickBooks Online setup (and ongoing financial management). As QuickBooks Online ProAdvisors, we provide customized solutions to enhance operational efficiency and ensure compliance with nonprofit accounting standards. The power of QuickBooks Online for nonprofits lies not just in its features, but in how effectively you use them to support your mission and drive your organization forward.