E-commerce has revolutionized the way businesses operate, but it also brings unique financial challenges. Accurate bookkeeping is essential for online retailers to thrive in this competitive landscape.

At Optimum Results Business Solutions, we understand the complexities of e-commerce bookkeeping services. This guide will explore key strategies and tools to help you master your online sales accounting, from managing multiple sales channels to leveraging cutting-edge technology for financial insights.

What Makes E-commerce Bookkeeping Unique?

E-commerce bookkeeping differs significantly from traditional retail accounting due to its digital nature and specific challenges. This chapter explores the unique aspects of e-commerce bookkeeping and highlights key financial metrics for online business success.

High Transaction Volume and Diverse Payment Methods

Online stores process a high volume of transactions daily, often involving various payment methods. From credit cards and PayPal to Apple Pay and cryptocurrencies, tracking these diverse payment streams accurately presents a challenge. Online payment providers usually generate revenue through transaction fees. Recently, brick-and-mortar retailers and shops have also begun adopting these payment methods.

Multi-Channel Sales Tracking

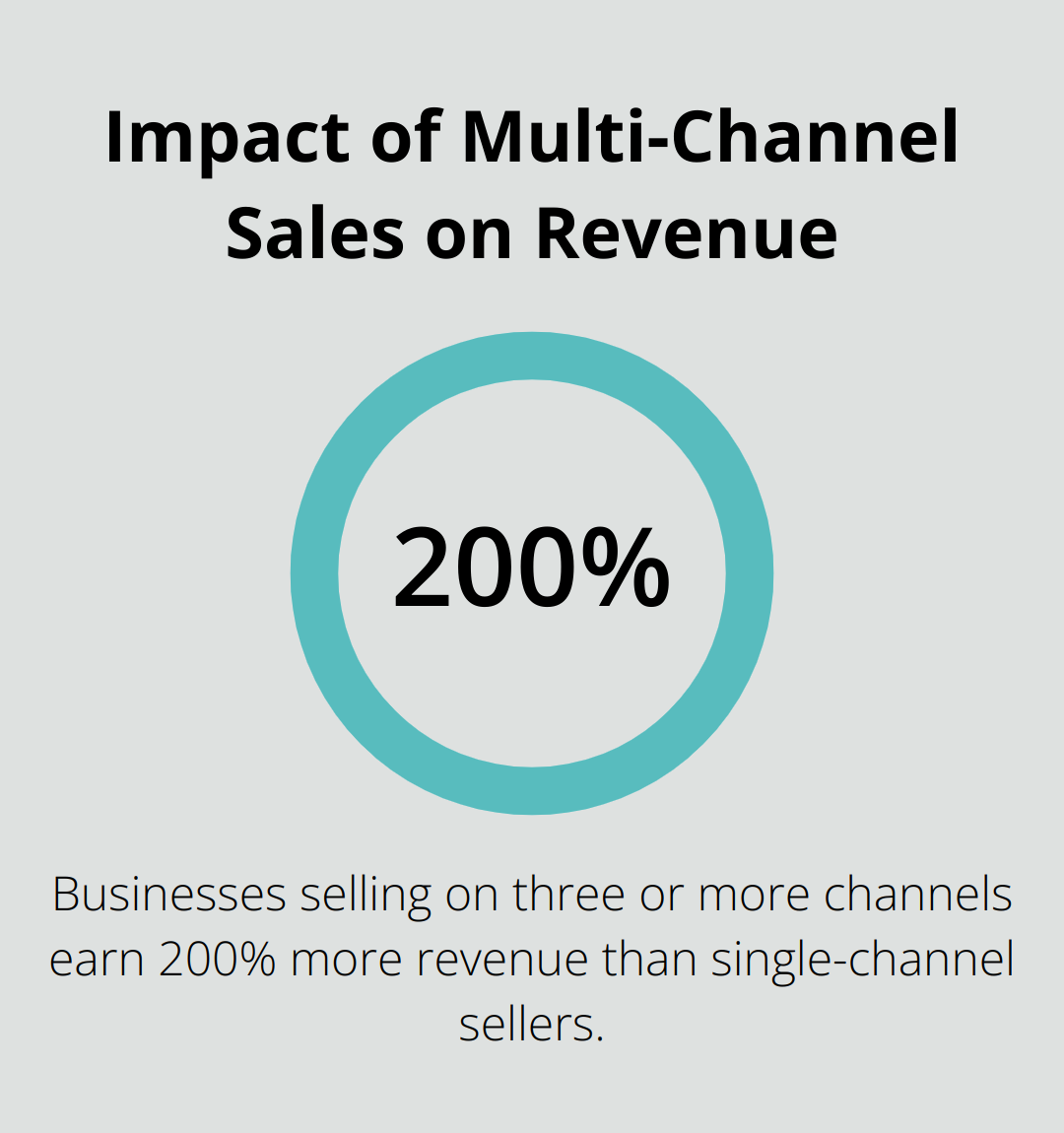

E-commerce businesses frequently sell across multiple platforms (their own website, Amazon, eBay, and social media channels). Each platform has its own reporting system and fee structure, making data consolidation complex. A BigCommerce report indicates that businesses selling on three or more channels earn 200% more revenue than single-channel sellers, emphasizing the importance of efficient multi-channel tracking.

Real-Time Inventory Management

Online businesses must update stock levels in real-time across all sales channels to prevent overselling. This requires sophisticated inventory management systems integrated with accounting software. The 2023 State of Small Business Report shows that 43% of small e-commerce businesses struggle with inventory management, which impacts their financial reporting accuracy.

Key Financial Metrics for E-commerce Success

To thrive in the online marketplace, e-commerce businesses must focus on specific financial metrics that provide insights into their performance and profitability.

Average Order Value (AOV)

AOV indicates the typical amount spent by customers in a single transaction. Increasing AOV can boost profitability without necessarily increasing customer acquisition costs. Shopify data shows that businesses actively working on improving their AOV see a 10-15% increase in overall revenue.

Customer Acquisition Cost (CAC)

CAC represents the total marketing and sales costs required to acquire a new customer. In e-commerce, where digital advertising costs rise, keeping CAC in check is essential for profitability. Recent data shows that both B2B and B2C CAC have increased by roughly 60% compared to five years ago, emphasizing the need for efficient marketing strategies.

Gross Profit Margin

This metric helps businesses understand the profitability of each product after accounting for the cost of goods sold, shipping, and platform fees. A recent survey by Digital Commerce 360 found that successful e-commerce businesses maintain an average gross profit margin of 45.25%.

As we move forward, it becomes clear that mastering these unique aspects of e-commerce bookkeeping and focusing on key performance indicators can give online businesses a competitive edge. The next chapter will explore essential bookkeeping practices that address these challenges and help e-commerce businesses thrive in the digital marketplace.

How to Master E-commerce Bookkeeping

Streamline Inventory Management

Effective inventory tracking propels e-commerce success. A perpetual inventory system provides ongoing updates regarding purchases and sales. This approach minimizes the risk of overselling and provides accurate cost of goods sold (COGS) data. A recent study by Wasp Barcode Technologies revealed that 46% of small businesses either don’t track inventory or use manual methods. Automated inventory management can reduce stockouts by 30% and increase profit margins by 10%.

Integrate Multiple Sales Channels

Sales management across various platforms presents challenges. A centralized system consolidates data from all sales channels. This integration simplifies reconciliation and offers a comprehensive view of business performance. A survey by Stitch Labs found that retailers selling on two marketplaces experienced a 190% increase in revenue compared to those selling on just one.

Navigate Sales Tax Complexities

E-commerce businesses often face complex sales tax obligations across different jurisdictions. Automated tax calculation software that integrates with e-commerce platforms helps deliver more accurate rates for each transaction. The Avalara 2021 Sales Tax Report indicates that 45% of businesses find managing sales tax to be somewhat or extremely difficult, underscoring the need for specialized solutions.

Implement Robust Cash Flow Management

Healthy cash flow is vital for e-commerce businesses. Cash flow forecasting tools help anticipate future financial needs and identify potential shortfalls. A U.S. Bank study found that 82% of business failures result from poor cash management. Regular cash flow analysis informs decisions about inventory purchases, marketing spend, and expansion plans.

Leverage Professional Bookkeeping Services

Many e-commerce businesses benefit from professional bookkeeping services. These experts (like those at Optimum Results Business Solutions) understand the unique challenges of online retail and can provide tailored solutions. Professional bookkeepers ensure accurate financial records, timely reporting, and compliance with tax regulations. They also offer valuable insights that can drive business growth and profitability. Affordable bookkeeping services can help manage finances efficiently, even on a tight budget.

E-commerce bookkeeping demands a proactive approach and the right tools. The next chapter will explore how technology can further enhance your e-commerce bookkeeping practices, from cloud-based accounting software to advanced data analytics tools.

How Technology Revolutionizes E-commerce Bookkeeping

Cloud-Based Accounting Software: The Game-Changer

E-commerce businesses improve their financial management with cutting-edge technology. Cloud-based accounting software offers real-time access to financial data from anywhere. This facilitates collaboration between team members and accountants. As of June 2024, there are 147 top cloud accounting software apps available on the market, catering to various accounting needs.

Seamless Integration for Comprehensive Financial Oversight

E-commerce platforms integrate with accounting systems to eliminate manual data entry and reduce errors. Shopify users connect directly to QuickBooks Online, which automatically syncs sales, fees, and payouts. Amazon sellers use A2X to automate the reconciliation of Amazon settlements and provide accurate financial reports.

Automation: Efficiency in Bookkeeping

Automation tools streamline various bookkeeping processes, from invoice generation to expense categorization. Receipt Bank uses OCR technology to extract data from receipts and invoices, reducing manual data entry. Zapier allows e-commerce businesses to create custom workflows (such as creating QuickBooks entries for new Shopify orders).

Data Analytics for Strategic Decision-Making

Advanced data analytics tools provide e-commerce businesses with valuable financial insights. As of December 2024, there are 14 best analytics tools for ecommerce designed to streamline data collection, unification, and analysis. These tools help identify trends, forecast cash flow, and analyze profitability by product or channel.

Choosing the Right Technology Partner

Selecting the appropriate technology solutions for e-commerce bookkeeping requires expertise. Professional services (like Optimum Results Business Solutions) help e-commerce businesses implement these technological solutions. They ensure businesses have the tools and expertise to thrive in the digital marketplace. When considering technology partners, try to find a team that stays up-to-date with the latest advancements in e-commerce bookkeeping technology.

Final Thoughts

E-commerce bookkeeping presents unique challenges that require specialized strategies and tools. Online businesses must stay on top of their financial management to thrive in the digital marketplace. Accurate inventory tracking, streamlined cash flow management, and technology leverage form key components of successful e-commerce bookkeeping.

Professional e-commerce bookkeeping services play a vital role in helping online businesses navigate these complexities. Optimum Results Business Solutions understands the intricacies of e-commerce financial management. Our team provides tailored solutions to help small service-based businesses and tech startups optimize their bookkeeping processes, ensure compliance, and gain valuable financial insights.

The e-commerce landscape continues to evolve, making it important to stay ahead of financial management trends and leverage cutting-edge technology. With the right strategies, tools, and professional support, e-commerce businesses can master their online sales accounting. This positions them for long-term success in the digital marketplace.