At Optimum Results Business Solutions, we’ve seen firsthand how Lean Startup Innovation Accounting revolutionizes the way startups measure progress and make decisions.

This powerful approach shifts focus from traditional financial metrics to actionable insights that drive growth and innovation.

In this post, we’ll explore the core principles of innovation accounting, key metrics to track, and practical steps for implementation in your startup.

What is Innovation Accounting?

Innovation Accounting transforms how startups measure progress and make data-driven decisions. This approach shifts focus from traditional financial metrics to actionable insights that drive growth and innovation.

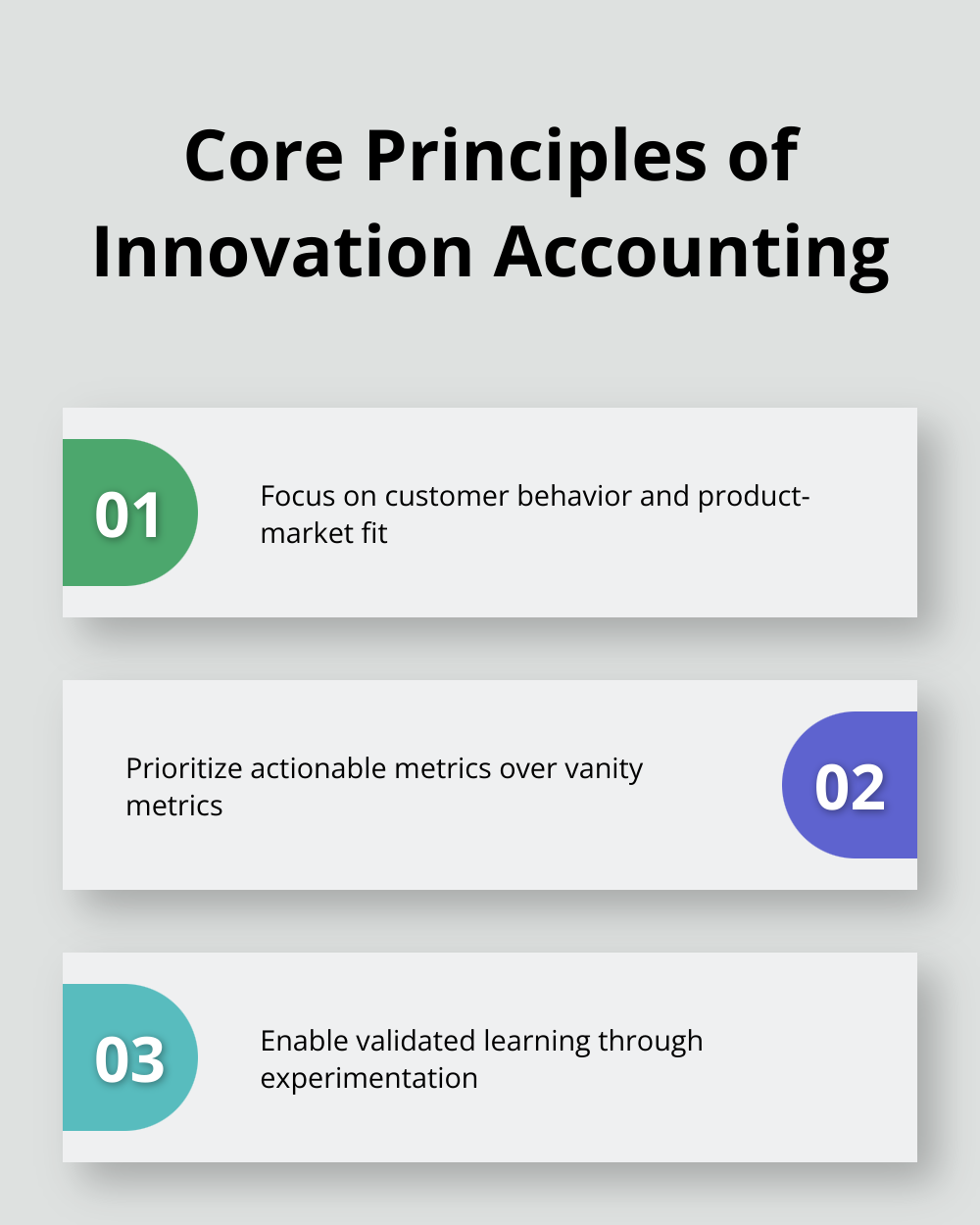

Core Principles of Innovation Accounting

Innovation Accounting measures what matters most for startups – customer behavior and product-market fit. It prioritizes actionable metrics over vanity metrics. For instance, instead of tracking app downloads, it focuses on daily active users.

Eric Ries, the pioneer of Lean Startup methodology, emphasizes that Innovation Accounting helps startups navigate uncertainty through validated learning. This involves constant testing of business model and product hypotheses through real-world experiments.

Differences from Traditional Accounting Methods

Traditional accounting methods often fail startups in highly uncertain environments. These methods typically rely on historical data and financial projections that may not apply to new ventures.

Innovation Accounting provides a framework for measuring progress when traditional metrics (like revenue and profit margins) are effectively zero. It enables startups to make informed decisions based on leading indicators of success, rather than lagging financial metrics.

Innovation Accounting in Lean Startup Methodology

Innovation Accounting forms a key component of the Build-Measure-Learn feedback loop in Lean Startup methodology. It provides the ‘Measure’ element, allowing startups to quickly and effectively assess the impact of their product iterations.

This approach facilitates rapid experimentation and learning, which is essential in the fast-paced startup environment. By tracking the right metrics, startups can determine whether to pivot or persevere with their current strategy.

Practical Application of Innovation Accounting

Many startups (including those working with Optimum Results Business Solutions) have experienced the benefits of Innovation Accounting. It provides a clear decision-making framework, helps allocate resources more efficiently, and focuses activities on real business growth.

Innovation Accounting encourages startups to:

- Define clear, measurable hypotheses

- Design experiments to test these hypotheses

- Collect and analyze relevant data

- Make informed decisions based on results

As we move forward, we’ll explore the key metrics that form the backbone of Innovation Accounting and how they drive startup success.

Key Metrics in Innovation Accounting

Innovation Accounting relies on specific metrics that provide actionable insights for startups. These metrics help measure progress, guide decision-making, and drive growth. Let’s explore the key metrics that form the foundation of Innovation Accounting.

Actionable Metrics: The Foundation of Innovation

Innovation Accounting prioritizes actionable metrics over vanity metrics. These metrics directly impact business decisions and provide a clear picture of a startup’s health.

Examples of actionable metrics include:

- Daily active users (instead of total downloads)

- Revenue per customer (rather than gross revenue)

- Customer retention rate (as opposed to total registered users)

These metrics guide strategy and offer insights into the true performance of a business.

Customer Acquisition Cost (CAC): Measuring Investment Efficiency

CAC reveals the cost of acquiring each new customer. To calculate CAC, divide total marketing and sales costs by the number of new customers acquired in a specific period.

A high CAC might indicate:

- Inefficient marketing strategies

- Misalignment between product and target market

Companies should try to lower their CAC over time through targeted marketing and improved conversion rates.

Customer Lifetime Value (CLV): Long-Term Revenue Potential

Customer lifetime value (CLV/LTV) is the projected revenue a customer will generate during their lifetime. This metric helps businesses understand the long-term value of their acquisition efforts.

Churn Rate: Customer Retention Insights

Churn rate measures the percentage of customers who stop using a product or service over a given period. To calculate churn rate, divide the number of customers lost during a period by the number of customers at the start of that period.

A high churn rate signals potential issues with:

- Product-market fit

- Customer satisfaction

- Competitive pressures

Companies should try to minimize their churn rate through continuous product improvement and excellent customer service.

Net Promoter Score (NPS): Customer Satisfaction Gauge

NPS measures customer satisfaction and loyalty. It is one of the non-standard financial metrics that may be used alongside other indicators such as active users, hours on a website, and revenue per user.

These key metrics provide valuable insights into business performance and enable data-driven decision-making. The next section will explore how to implement Innovation Accounting effectively in your startup.

How to Implement Innovation Accounting

Implementing Innovation Accounting in your startup requires a systematic approach. By following these steps, you can establish a robust framework for measuring progress and making data-driven decisions.

Set Clear Goals and Hypotheses

Start by defining clear, measurable goals for your startup. These goals should align with your overall business strategy. For each goal, develop specific hypotheses that you can test.

For example, if your goal is to increase user engagement, a hypothesis might be: “A gamification feature will increase daily active users by 20% within 30 days.”

Choose the Right Metrics

Select metrics that directly relate to your goals and hypotheses. Avoid vanity metrics that look good but don’t provide actionable insights.

For the example above, relevant metrics might include:

- Daily active users

- Time spent in the app

- Number of actions performed per session

Establish a Data Collection System

Innovation Accounting is the next big tool for startups and new ventures to measure progress & financial value. Implement tools to collect and analyze your chosen metrics. This could involve analytics platforms, customer relationship management (CRM) systems, or custom-built dashboards.

Ensure your data collection remains consistent and reliable. Set up regular data quality checks to maintain accuracy.

Conduct Cohort Analysis

Cohort analysis tells you if the number of paid accounts increased over time. It provides the ability to differentiate between segments of users. For instance, you might compare the retention rates of users who joined during different marketing campaigns. This can help you identify which acquisition strategies lead to more loyal customers.

Run Experiments and Iterate

With your measurement framework in place, start running experiments to test your hypotheses. A/B testing is a powerful tool for this purpose.

For our gamification example, you might roll out the feature to 50% of your users and compare their engagement metrics to the control group.

Based on the results, decide whether to:

- Persevere: If the data supports your hypothesis, implement the change fully.

- Pivot: If the results are negative or inconclusive, adjust your strategy and test a new hypothesis.

- Kill: If multiple iterations show no promise, consider abandoning the idea and focusing resources elsewhere.

Innovation Accounting is an ongoing process. Schedule regular reviews of your metrics and experiments (weekly for fast-moving startups or monthly for more established businesses). During these reviews, assess the effectiveness of your current metrics. Don’t hesitate to adjust your measurement framework if they no longer provide valuable insights.

The goal of Innovation Accounting is to drive growth through data-driven decision-making. These steps will set you on the path to startup success.

Final Thoughts

Innovation Accounting has transformed how startups measure success and make decisions. This approach provides a clear path to growth in uncertain environments through its focus on actionable metrics and customer behavior. Startups should set clear goals, choose the right metrics, and establish robust data collection systems to implement Innovation Accounting successfully.

The principles of lean startup innovation accounting will likely extend beyond the startup world, influencing how established companies approach innovation and product development. We expect to see further refinement of startup metrics and measurement techniques as data analytics tools become more sophisticated. This shift towards more agile, data-driven decision-making processes will prove essential for businesses to stay competitive in rapidly changing markets.

At Optimum Results Business Solutions, we’ve witnessed the transformative power of effective Innovation Accounting for startups. Our expertise in bookkeeping and accounting for small service-based businesses and tech startups allows us to provide valuable financial insights that complement Innovation Accounting practices. The combination of our services with these innovative measurement techniques enables startups to gain a comprehensive view of their financial health and growth potential.

Leave A Comment