Starting a business is exciting, but it comes with financial challenges. Accounting for startup costs is a critical aspect that many entrepreneurs overlook.

At Optimum Results Business Solutions, we’ve seen how proper financial management can make or break a new venture. This guide will walk you through the essentials of startup cost accounting, helping you set a solid foundation for your business’s financial future.

What Are Startup Costs?

Definition and Scope

Startup costs encompass all expenses a business incurs before it becomes operational. These costs can vary widely depending on the industry, location, and scale of the business. Understanding these costs is essential for proper financial planning and management.

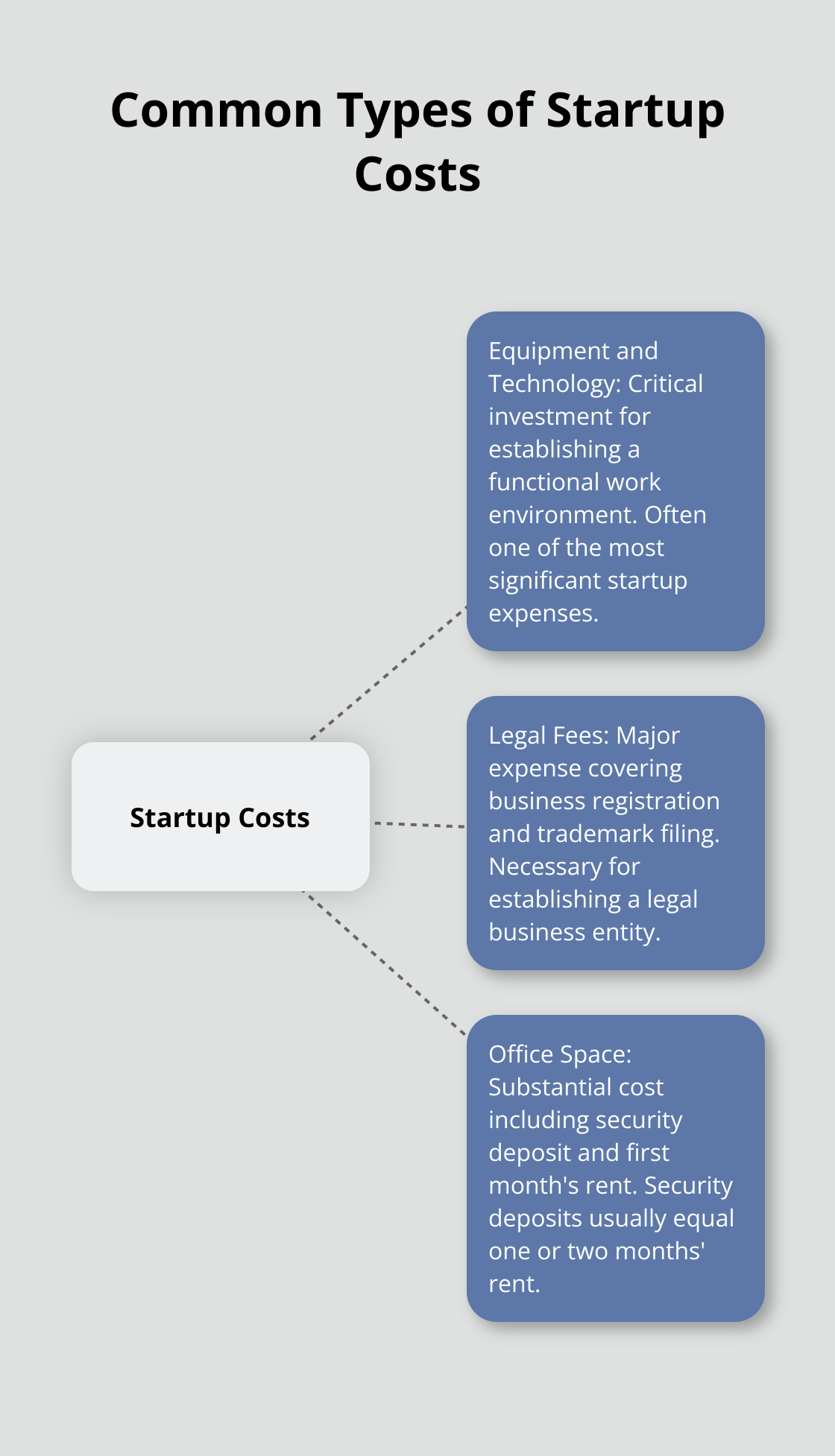

Common Types of Startup Costs

Equipment and Technology

One of the most significant startup expenses is often equipment and technology. This investment is critical for establishing a functional work environment.

Legal Fees

Legal fees represent another major expense. Business registration and trademark filing are necessary for establishing a legal business entity.

Office Space

Office space remains a substantial cost for many new businesses, despite the trend towards remote work. Initial costs include a security deposit and possibly the first month’s rent. Security deposits usually equal one or two months’ rent.

Importance of Accurate Accounting

Proper accounting of startup costs impacts several aspects of your business:

- Tax Implications: The IRS provides basic federal tax information for people who are starting a business, including information on keeping records.

- Financial Health: Detailed financial records provide a clear picture of your business’s financial status, which is essential when seeking funding from investors or lenders.

- Budgeting and Forecasting: Understanding your startup costs helps estimate how much runway you have before needing additional funding.

Effective Tracking Methods

To track startup costs effectively, use accounting software from the beginning of your venture. QuickBooks Online is an excellent tool for this purpose, allowing you to categorize expenses, generate reports, and maintain accurate financial records.

Maintain all receipts and invoices, even for small purchases. Documentation for all expenses is vital for tax purposes and potential audits.

Startup costs don’t end when you open your doors for business. Many expenses incurred in the first few months of operation can still fall under this category. Tracking these ongoing expenses is as important as recording your initial outlays.

As we move forward, let’s explore the different accounting methods you can use to effectively manage these startup costs and set your business on a path to financial success.

Choosing the Right Accounting Method for Your Startup

Cash Basis Accounting: Simple but Limited

Cash basis accounting records income when you receive payment and expenses when you pay them. This method suits very small businesses or those with simple financial structures. It offers a clear picture of your cash flow and simplifies bookkeeping.

However, cash basis accounting has drawbacks. It doesn’t account for accounts receivable or payable, which can distort your financial picture. For instance, if you’ve performed services but haven’t received payment, your income statement won’t reflect this earned revenue.

Accrual Basis Accounting: Comprehensive but Complex

Accrual accounting records income when it’s earned and expenses when they’re incurred, regardless of cash transactions. This method provides a more accurate picture of your financial position and performance over time.

For startups that plan to scale quickly or seek investor funding, accrual accounting often proves the better choice. It aligns with Generally Accepted Accounting Principles (GAAP) and gives potential investors a clearer view of your business’s financial health.

Capitalization vs. Expensing: Strategic Decisions

When accounting for startup costs, you must decide whether to capitalize or expense certain items. Capitalization means recording an expense as an asset on your balance sheet and depreciating it over time. Expensing means recording the full cost immediately on your income statement.

Startup costs that are otherwise deductible as ordinary and necessary business expenses under Sec. 162 can be treated as startup costs. The IRS allows businesses to deduct up to $5,000 in startup costs in the first year (with the remainder amortized over 15 years). This can provide immediate tax benefits, but you must consider the long-term implications of your choices.

Selecting the Best Method for Your Startup

Your choice of accounting method can significantly impact your taxes, financial reporting, and ability to secure funding. Consider these factors when making your decision:

Professional guidance can help ensure you set your startup on the right financial path from day one. Optimum Results Business Solutions, for example, offers expert advice on selecting and implementing the most appropriate accounting method for your specific business needs.

As you weigh your options, consider how each method will affect your ability to track and manage your startup costs effectively. The next section will explore the tax implications of startup costs, providing further insight into how your accounting choices can impact your business’s financial health.

How Startup Costs Impact Your Taxes

Understanding IRS Guidelines

The Internal Revenue Service (IRS) has specific rules for how businesses should treat startup costs. These guidelines can significantly affect your tax liability and cash flow during the early stages of your business.

Deductible Startup Costs

The IRS allows new businesses to deduct up to $5,000 of business start-up costs and up to $5,000 of organizational costs. This deduction can provide immediate tax relief, helping to offset some of the initial financial burden of starting a business. However, there’s a limitation – if your total startup costs exceed $50,000, the amount you can deduct in the first year decreases.

For example, if your startup costs total $52,000, your first-year deduction would decrease by $2,000, leaving you with a $3,000 deduction. This reduction continues until the deduction reaches zero for startup costs of $55,000 or more.

Non-Deductible Expenses

Not all startup expenses qualify for tax deductions. The IRS specifically excludes certain costs from the startup deduction category. These non-deductible expenses include:

- Costs for acquiring business assets

- Expenses related to corporate organizational costs

- Research and experimental costs

It’s important to categorize your expenses carefully to ensure you don’t claim non-deductible items as startup costs. Misclassification can lead to issues with the IRS in the future.

Amortization of Remaining Costs

Any startup costs beyond the $5,000 first-year deduction aren’t lost – you can amortize them over a 15-year period. This means you can deduct an equal portion of these costs each year for 15 years, starting with the month your business begins.

For instance, if you have $20,000 in qualifying startup costs, you could deduct $5,000 in the first year and then amortize the remaining $15,000 over 15 years (deducting $1,000 per year).

This amortization can provide ongoing tax benefits, helping to reduce your taxable income for years to come. However, it’s essential to keep detailed records of these costs and their amortization schedule.

Seeking Professional Advice

Tax laws can change, and individual circumstances vary. While this guide provides a general overview, it’s always best to consult with a tax professional or accountant who can provide advice tailored to your specific situation. They can help you develop a tax strategy that aligns with your business goals and maximizes your financial benefits.

At Optimum Results Business Solutions, we offer expert bookkeeping and accounting services for small service-based businesses and tech startups. Our team can help you navigate these complex tax rules (ensuring you maximize your deductions while staying compliant with IRS regulations).

Final Thoughts

Accounting for startup costs requires a strategic approach to set a solid financial foundation for new ventures. Entrepreneurs must understand different expense types, select appropriate accounting methods, and navigate tax implications to ensure compliance and gain financial insights. Proper expense tracking, categorization, and regular financial reviews will help businesses make informed decisions and capitalize on available tax deductions.

Professional expertise often proves invaluable when dealing with the complexities of startup cost accounting. Qualified accountants and financial advisors can provide tailored guidance on tax strategies, financial planning, and regulatory compliance. Their support allows business owners to focus on growth while managing financial intricacies effectively.

Optimum Results Business Solutions offers expert bookkeeping and accounting services for small service-based businesses and tech startups. Our team can assist with startup cost accounting, regulatory compliance, and financial insights to drive business growth. Partnering with experienced professionals can help transform financial challenges into opportunities for long-term success and prosperity.