At Optimum Results Business Solutions, we understand the challenges small business owners face when managing their finances. That’s why we’re excited to introduce you to Intuit QuickBooks Online Simple Start, a powerful tool designed for beginners.

This user-friendly accounting software simplifies financial management, allowing you to focus on growing your business. In this guide, we’ll walk you through the essential features and provide practical tips to help you make the most of QuickBooks Online Simple Start.

How to Set Up QuickBooks Online Simple Start

Creating Your Account

To start with QuickBooks Online Simple Start, visit the QuickBooks website and sign up for a new account. You’ll need to provide basic information about your business (name, industry, tax details). After account creation, you’ll access the QuickBooks dashboard.

Navigating the Dashboard

The dashboard serves as your central hub for financial management. It displays an overview of your business’s financial health (income, expenses, profit). The left-hand menu offers quick access to key features like invoicing, expenses, and reports. Spend time to familiarize yourself with the layout and available options.

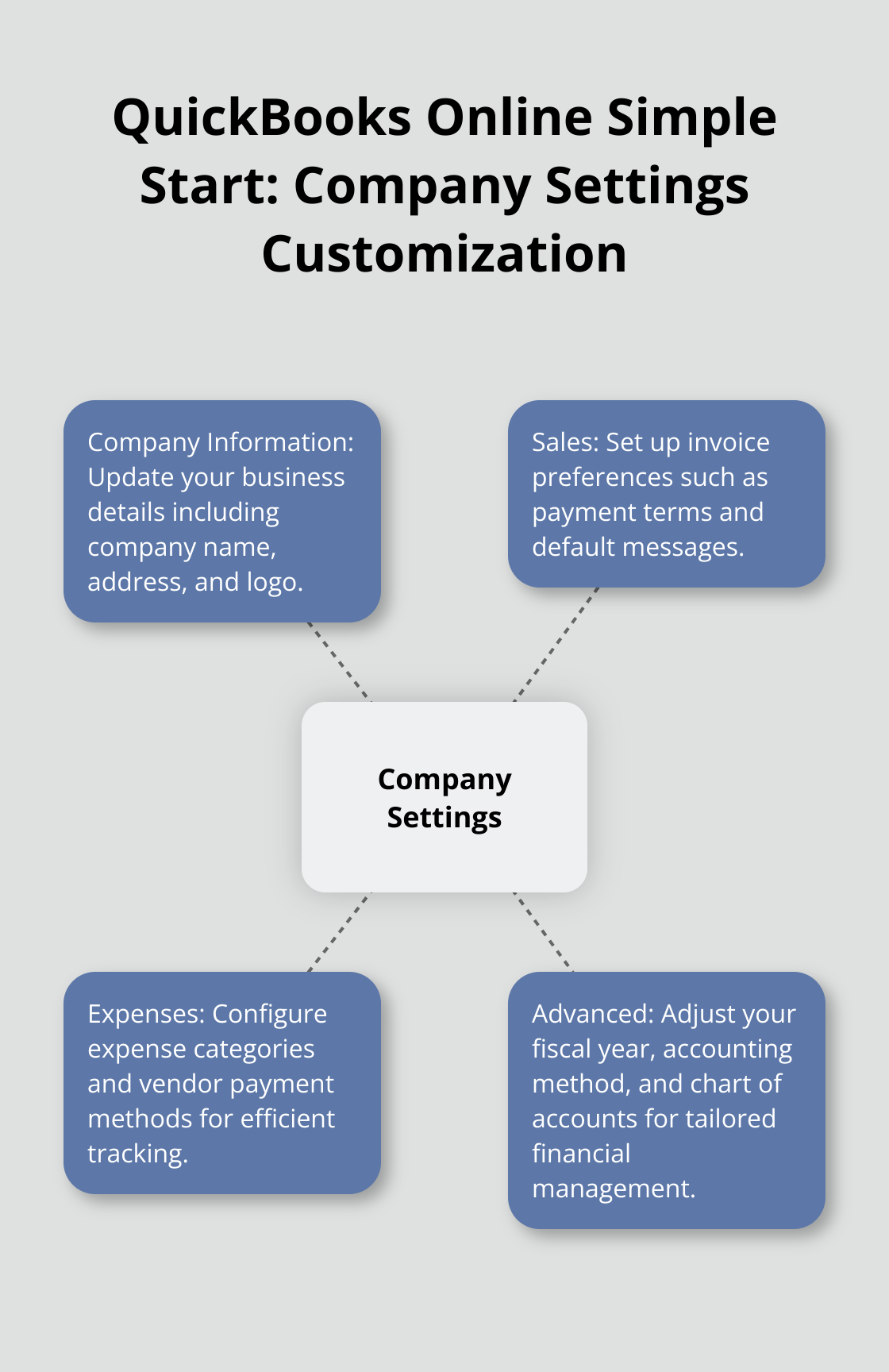

Customizing Company Settings

To tailor QuickBooks to your business needs, click the gear icon in the top right corner and select ‘Account and Settings’. Here, you can customize various aspects:

- Company Information: Update your business details (company name, address, logo).

- Sales: Set up invoice preferences (payment terms, default messages).

- Expenses: Configure expense categories and vendor payment methods.

- Advanced: Adjust your fiscal year, accounting method, and chart of accounts.

Linking Bank Accounts

QuickBooks Online Simple Start can connect directly to your bank accounts, which automates data entry and reduces errors. To set this up:

- Select Transactions from the left menu. Select the Bank Transactions tab.

- Select the green Connect account button.

- Select your bank

For more detailed instructions, you can refer to the QuickBooks support page.

Seeking Professional Assistance

While QuickBooks Online Simple Start is designed for beginners, some users might need additional support. If you find yourself struggling with setup or ongoing management, consider seeking help from a QuickBooks ProAdvisor. These certified professionals can provide exclusive discounts, tools, training, and events to help you retain talent and expand your business.

As you move forward with your QuickBooks setup, you’ll want to explore its essential features for small business owners. Let’s examine how to create and manage invoices, a critical task for maintaining healthy cash flow.

Mastering Essential QuickBooks Features

Creating Professional Invoices

QuickBooks Online Simple Start empowers small business owners to create polished invoices quickly. Click ‘New Invoice’ on your dashboard to begin. Input your customer’s details, list your products or services, and set payment terms.

QuickBooks automatically tracks income and expenses, sorts transactions from connected accounts into tax categories, and helps organize receipts. You can customize invoice templates with your logo and brand colors for a professional appearance.

Pro tip: Set up recurring invoices for regular clients. This automation saves time and ensures consistent cash flow.

Efficient Expense Tracking

Accurate expense tracking supports tax compliance and provides insights into your business’s financial health. QuickBooks simplifies this process. The mobile app allows you to photograph receipts on the go. The software uses optical character recognition (OCR) to extract key information, which reduces manual data entry.

Categorize expenses as you enter them. This practice makes tax preparation less stressful and offers clearer insights into your spending patterns. Proper expense tracking can significantly reduce the time spent on tax preparation.

Seamless Bank Integration

Connecting your bank accounts and credit cards to QuickBooks transforms your financial management. It eliminates manual data entry and reduces errors. To set this up, navigate to ‘Banking’ in the left menu and click ‘Add Account’. Follow the prompts to securely link your financial institutions.

Once connected, QuickBooks automatically imports and categorizes your transactions. Review these regularly to ensure accuracy. This integration provides real-time visibility into your financial position, which enables better decision-making.

A word of caution: While QuickBooks offers robust security measures, always follow best practices for online financial management. Use strong, unique passwords and enable two-factor authentication for added protection.

Customizing Reports

QuickBooks Online Simple Start offers various report options to help you understand your business’s financial health. You can generate profit and loss statements, balance sheets, and cash flow reports with a few clicks. Try to customize these reports to focus on the metrics most relevant to your business (e.g., sales by product, expenses by category).

Regular review of these reports can help you identify trends, spot potential issues, and make informed business decisions.

As you become more comfortable with these essential features, you’ll find that QuickBooks Online Simple Start significantly streamlines your financial management processes. Next, let’s explore how to leverage the reporting capabilities of QuickBooks to gain deeper insights into your business’s financial health.

How to Leverage QuickBooks Reports for Financial Insights

Generating Key Financial Reports

QuickBooks Online Simple Start offers powerful reporting tools that transform raw financial data into actionable insights. These reports are essential for making informed business decisions and maintaining a clear picture of your financial health.

To access these reports, navigate to the Reports section in the left menu. Here, you’ll find options like the Balance Sheet, Profit and Loss, and Statement of Cash Flows.

The Balance Sheet provides a snapshot of your business’s financial position at a specific point in time. It lists your assets, liabilities, and equity. Run this report monthly to track changes in your overall financial health.

The Profit and Loss report (also known as an Income Statement) shows your revenue, expenses, and net income over a specified period. This report helps you understand your business’s profitability and identify areas where you might need to cut costs or increase revenue.

Understanding Your Profit and Loss Statement

Your Profit and Loss statement contains valuable information about your business’s financial performance. To maximize its utility, customize it to show comparisons between different periods. This allows you to spot trends and seasonality in your business.

Focus on your gross profit margin, which is the difference between your revenue and the cost of goods sold. A declining gross profit margin might indicate rising costs or pricing issues that need addressing.

Analyze your operating expenses carefully. Look for unexpected spikes. Consider ways to reduce costs without impacting your business operations. Regular review of these details can lead to significant cost savings over time.

Monitoring Cash Flow

Cash flow is the lifeblood of any business, and QuickBooks Online Simple Start provides tools to help you manage it effectively. The Statement of Cash Flows lets you know how your business is doing by showing you the amount of cash that flows into your business.

To improve your cash flow, use QuickBooks to set up payment reminders for overdue invoices. You can also use the Accounts Receivable Aging report to identify clients who consistently pay late and consider adjusting your payment terms for these accounts.

Another useful feature is the Cash Flow Forecast report. While not as comprehensive as in higher-tier QuickBooks versions, it still provides valuable projections based on your recurring transactions and upcoming bills and invoices.

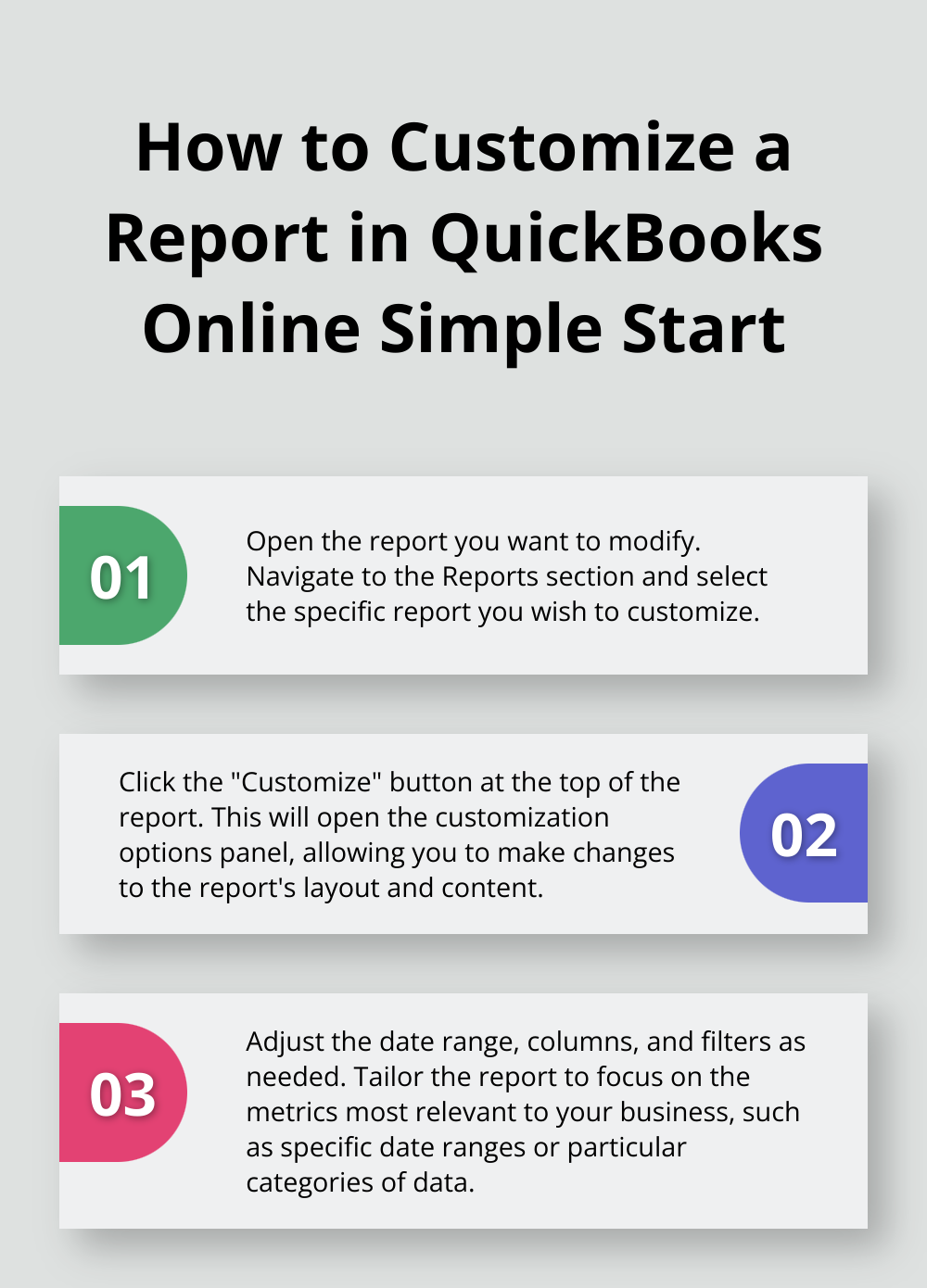

Customizing Reports for Your Business

QuickBooks allows you to tailor reports to your specific needs. Try to customize these reports to focus on the metrics most relevant to your business (e.g., sales by product, expenses by category).

To customize a report:

- Open the report you want to modify

- Click the “Customize” button at the top of the report

- Adjust the date range, columns, and filters as needed

- Save your customized report for future use

Acting on Report Insights

The key to effective financial management is not just generating these reports, but understanding and acting on the information they provide. Use these reports to:

- Identify trends in your business performance

- Spot potential issues before they become major problems

- Make data-driven decisions about pricing, expenses, and investments

Regular review and analysis of these reports will empower you to make informed decisions that improve your business’s financial health.

Final Thoughts

Intuit QuickBooks Online Simple Start provides small business owners with powerful tools to manage their finances effectively. The software streamlines tasks such as invoice creation, expense tracking, and report generation, which allows users to focus on business growth. Regular account reconciliation, report customization, and mobile app utilization will maximize the benefits of this accounting solution.

As businesses expand, they may require more advanced features or professional assistance. Upgrading to a higher-tier QuickBooks plan or consulting a QuickBooks ProAdvisor can offer valuable insights and support. These experts can help users optimize their accounting processes and make informed financial decisions.

Optimum Results Business Solutions offers comprehensive bookkeeping and accounting services tailored to meet specific business needs. Our team of experts can guide users through Intuit QuickBooks Online Simple Start and provide additional support to enhance financial management. We strive to help businesses establish a strong foundation for their financial future through effective use of accounting software and professional guidance.