Bookkeeping services are the backbone of financial management for businesses of all sizes. At Optimum Results Business Solutions, we understand the critical role these services play in maintaining accurate financial records and ensuring compliance with tax regulations.

Our comprehensive guide to bookkeeping services description will help you navigate the various types available and their benefits. Whether you’re a small business owner or a growing enterprise, understanding these services is key to making informed financial decisions and driving your company’s success.

What Does a Bookkeeper Do?

The Core of Bookkeeping

Bookkeeping involves the systematic recording and organization of financial transactions in a business. It creates a clear and accurate picture of a company’s financial health. This process forms the foundation for all financial decision-making and reporting.

Daily Tasks of a Bookkeeper

A bookkeeper’s responsibilities are diverse and essential. They:

- Record all financial transactions (sales, purchases, payments, and receipts)

- Categorize each transaction correctly

- Reconcile bank statements with internal financial records

- Detect errors or potential fraud early

These tasks require attention to detail and a solid understanding of the business’s operations.

Advanced Bookkeeping Functions

Modern bookkeepers extend beyond basic record-keeping. Their expanded role often includes:

- Managing accounts payable and receivable

- Processing payroll

- Preparing initial financial statements

These tasks directly impact a company’s cash flow and financial planning. Effective bookkeeping can transform a company’s financial outlook, providing insights that help businesses make informed decisions about spending, investment, and growth strategies.

Bookkeeping vs. Accounting: Understanding the Distinction

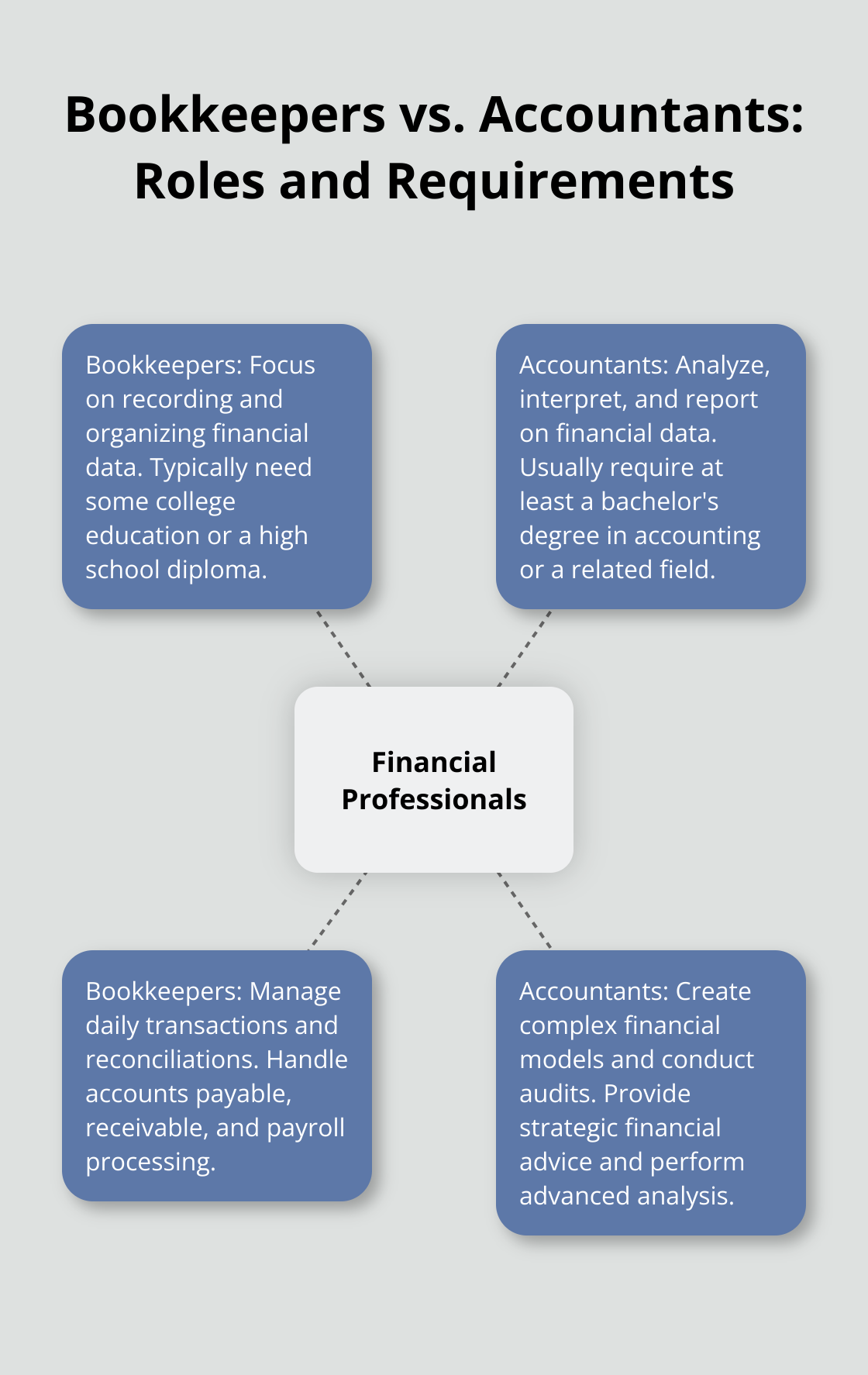

While related, bookkeeping and accounting serve different functions:

Bookkeepers:

- Focus on recording and organizing financial data

- Typically need some college education or a high school diploma

Accountants:

- Analyze, interpret, and report on financial data

- Create complex financial models

- Conduct audits

- Provide strategic financial advice

- Usually require at least a bachelor’s degree in accounting or a related field

The Bureau of Labor Statistics confirms these educational differences between bookkeepers and accountants.

In smaller businesses, the line between bookkeeping and accounting can blur. However, understanding this distinction helps companies allocate resources effectively and ensure they receive the right level of financial support.

As we move forward, let’s explore the various types of bookkeeping services available to businesses today. These services range from basic transaction recording to comprehensive financial management solutions.

Types of Bookkeeping Services

Bookkeeping services come in various forms, each tailored to meet specific business needs. Different types of bookkeeping can significantly impact a company’s financial health. This chapter explores the main categories of bookkeeping services available today.

Basic Bookkeeping

Basic bookkeeping forms the foundation of financial record-keeping. This service typically includes:

- Transaction recording

- Bank reconciliation

- Simple financial statement preparation

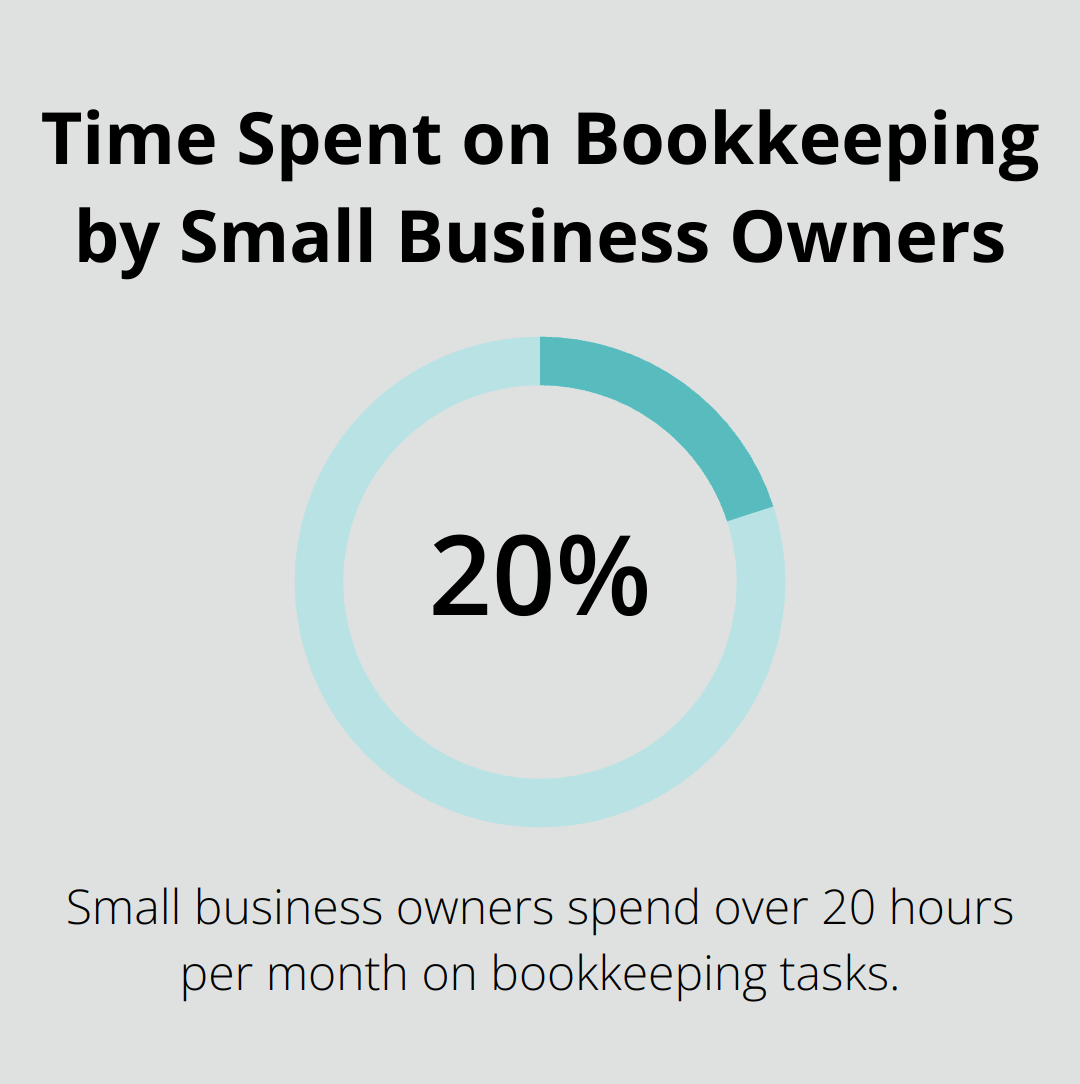

It’s ideal for small businesses with straightforward finances. According to SCORE, a small business mentoring organization, small business owners spend more than 20 hours per month handling bookkeeping tasks. Outsourcing basic bookkeeping can free up this valuable time for core business activities.

Full-Charge Bookkeeping

Full-charge bookkeeping takes financial management a step further. This comprehensive service covers all aspects of a company’s financial operations, including:

- Accounts payable and receivable

- Payroll processing

- More complex financial reporting

The American Institute of Professional Bookkeepers reports that full-charge bookkeepers can save businesses up to 30% on accounting costs. These bookkeepers handle tasks that would otherwise require an accountant’s expertise.

Virtual Bookkeeping

The rise of cloud-based accounting software has paved the way for virtual bookkeeping services. This modern approach allows bookkeepers to work remotely while providing real-time financial insights. The increased adoption of cloud technology has changed account reconciling from performing tasks as a batch to performing tasks dynamically in real-time.

Industry-Specific Bookkeeping

Some industries require specialized bookkeeping knowledge due to unique financial regulations or practices. For example:

- Construction companies often need bookkeepers familiar with job costing and progress billing

- Non-profit organizations require bookkeepers who understand fund accounting

The Bureau of Labor Statistics notes that bookkeepers with industry-specific expertise can command higher salaries, reflecting the value of this specialized knowledge.

The choice of bookkeeping service type plays a vital role in maintaining accurate financial records and supporting informed business decisions. The next chapter will explore the numerous benefits that professional bookkeeping services bring to businesses of all sizes.

Why Professional Bookkeeping Matters

Precision in Financial Records

Accurate financial records form the foundation of sound business decisions. Professional bookkeepers use advanced software and techniques to record every transaction correctly. This level of precision makes a significant difference. A study by the American Institute of CPAs found that businesses with professional bookkeeping services were 30% less likely to make costly financial errors.

Time Savings for Business Owners

Time is a precious commodity for business owners. Outsourcing bookkeeping tasks reclaims a substantial portion of that time. The National Small Business Association reports that small business owners spend an average of 41 hours per year on tax preparation alone. Professional bookkeeping services handle these tasks more efficiently, allowing owners to focus on core business activities.

Data-Driven Decision Making

Accurate and up-to-date financial information enables businesses to make informed decisions quickly. Professional bookkeepers provide regular financial reports that offer insights into cash flow, profitability, and growth opportunities. This data-driven approach to decision-making leads to better outcomes. Data visualisation can lead to increased profitability, and real-time data can result in making informed business decisions.

Tax Compliance and Savings

Tax laws and regulations change constantly, and staying compliant challenges many businesses. Professional bookkeepers stay updated with the latest tax laws and regulations, ensuring that businesses meet all their tax obligations. This expertise leads to significant savings. The IRS reports that small businesses often overpay their taxes due to poor record-keeping. Professional bookkeeping services help identify all eligible deductions and credits, potentially saving thousands in tax liabilities.

Early Detection of Financial Issues

Professional bookkeepers act as an early warning system for financial discrepancies. They spot unusual transactions, cash flow issues, or potential fraud before they become major problems. The Association of Certified Fraud Examiners states that businesses with professional financial oversight detect fraud 50% faster than those without, potentially saving thousands in losses.

Professional bookkeeping services offer a strategic advantage in today’s competitive business landscape. They provide the financial clarity and expertise needed to make informed decisions, save time, and ensure compliance. As businesses grow and financial complexities increase, the value of these services becomes even more apparent.

Final Thoughts

Bookkeeping services form the cornerstone of financial management for businesses of all sizes. These services provide a clear picture of a company’s financial health, enable data-driven decision-making, and ensure compliance with tax regulations. The importance of professional bookkeeping extends beyond simple record-keeping, contributing significantly to business success through accurate financial records, timely reporting, and expert insights.

When selecting a bookkeeping service, businesses should consider factors such as industry expertise, technological capabilities, and the range of services offered. A comprehensive bookkeeping services description should outline not just the tasks performed, but also the value added through financial insights and strategic support. Companies should look for providers who can tailor their approach to specific needs and grow with the business.

Optimum Results Business Solutions understands the unique challenges faced by small service-based businesses and tech startups. Our team provides customized bookkeeping solutions, leveraging advanced tools to deliver accurate, timely, and insightful financial information. We offer a comprehensive suite of services designed to enhance operational efficiency and reduce financial management costs.