Setting up accounting for your startup is a critical step in building a solid financial foundation. At Optimum Results Business Solutions, we’ve seen many entrepreneurs struggle with this process.

This guide will walk you through the essential steps to establish a robust accounting system for your new venture. From choosing the right accounting method to implementing the best software, we’ll cover everything you need to know to set your startup on the path to financial success.

Choosing Your Startup’s Accounting Method

Cash vs. Accrual: The Fundamental Decision

When you set up accounting for your startup, you must decide between cash and accrual accounting methods. This choice will shape how you track and report your financial activities.

Cash Accounting: Simplicity with Limitations

Cash accounting records income when you receive payment and expenses when you pay them. Many small startups prefer this method for its straightforward approach. It provides a clear snapshot of your available cash at any given time.

However, cash accounting has drawbacks. It doesn’t offer a complete view of your financial health, especially if you extend credit to customers or have unpaid bills. This can result in misleading financial statements, particularly for startups experiencing rapid growth or complex transactions.

Accrual Accounting: Comprehensive but Complex

Accrual accounting records income when it’s earned and expenses when they’re incurred, regardless of cash flow timing. This method presents a more accurate picture of your startup’s financial position and performance over time.

Tech startups or those seeking venture capital often prefer accrual accounting. It aligns with Generally Accepted Accounting Principles (GAAP), which many investors require.

Factors to Consider in Your Decision

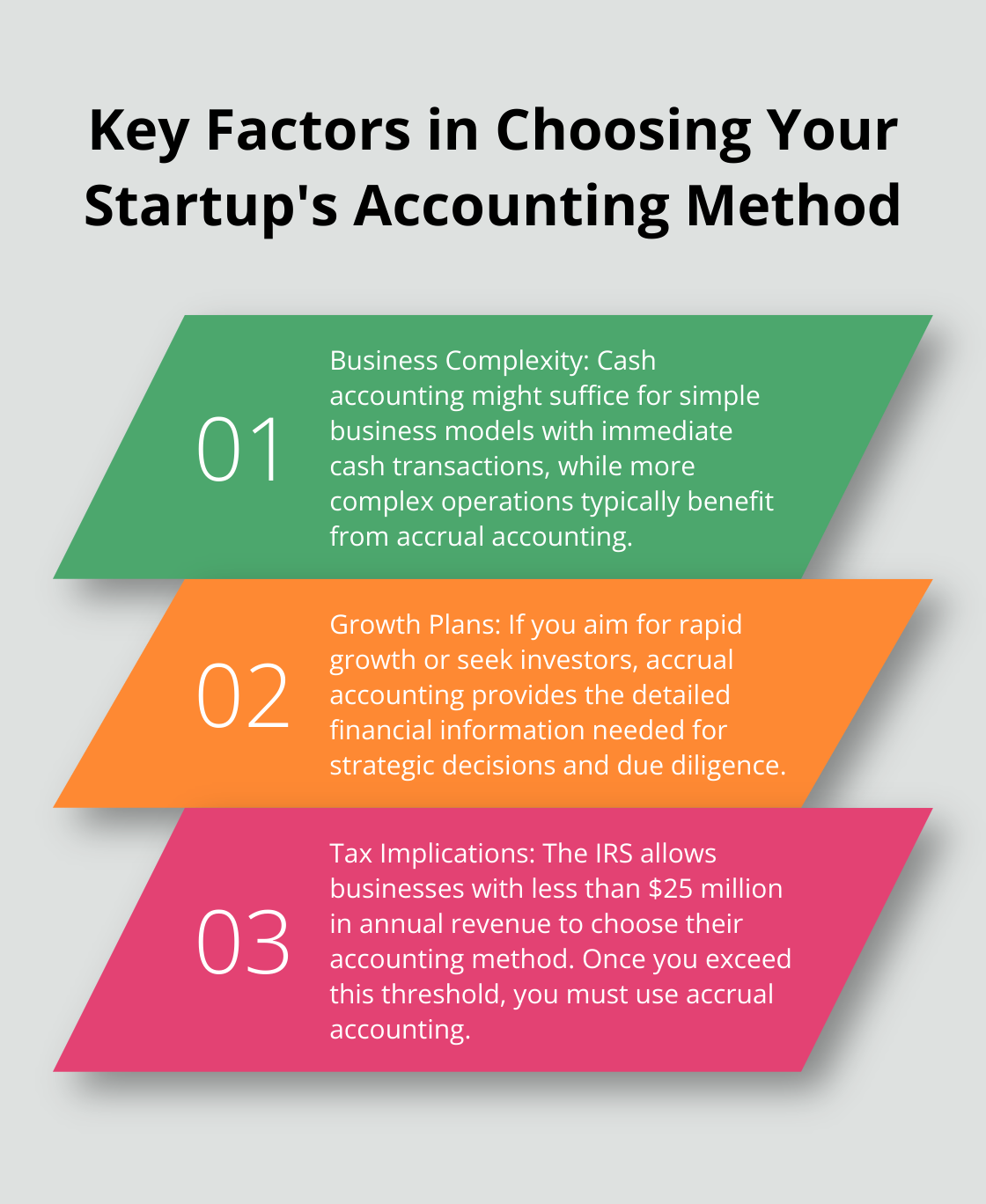

Your choice should depend on several key factors:

- Business Complexity: Cash accounting might suffice for simple business models with immediate cash transactions. More complex operations typically benefit from accrual accounting.

- Growth Plans: If you aim for rapid growth or seek investors, accrual accounting provides the detailed financial information needed for strategic decisions and due diligence.

- Tax Implications: The IRS allows businesses with less than $25 million in annual revenue to choose their accounting method. Once you exceed this threshold, you must use accrual accounting.

- Industry Standards: Some industries favor one method over the other. Research what’s common in your sector to align with industry norms.

Transitioning Between Methods

Many startups begin with cash accounting for its simplicity but transition to accrual as they grow. This transition can be smooth with proper planning and expert guidance (which companies like Optimum Results Business Solutions can provide).

Your accounting method affects everything from financial reporting to tax filings. It’s not just about compliance; it’s about setting up your startup for financial success and scalability.

As you consider these factors, you’ll need to set up a chart of accounts tailored to your startup’s needs. This crucial step will help organize your financial data effectively.

Innovation Accounting

For startups operating in uncertain environments, innovation accounting has transformed how success is measured and decisions are made. This approach provides a clear path to growth and can complement traditional accounting methods.

Setting Up Your Startup’s Chart of Accounts

Essential Categories for Financial Organization

A well-structured chart of accounts forms the foundation of your startup’s financial management system. It should include five main categories: Assets, Liabilities, Equity, Income, and Expenses. Within these, create subcategories that reflect your startup’s specific operations. For tech startups, this might include accounts for software development costs, cloud hosting expenses, or subscription revenue.

Customizing for Your Unique Business Model

Tailor your chart of accounts to your startup’s specific needs. If you operate in e-commerce, you might have accounts for inventory, shipping costs, and returns. SaaS startups might focus on recurring revenue streams and customer acquisition costs.

Avoid creating too many accounts, as this can lead to confusion and errors. Try to balance detail and manageability. Most startups can effectively manage with 30-50 accounts.

Best Practices for Effective Organization

Use a logical numbering system for your accounts. For example, assets might start with 1000, liabilities with 2000, and so on. This makes it easier to locate and categorize transactions.

Review and update your chart of accounts regularly. As your startup grows, you may need to add or remove accounts to reflect changes in your business model or reporting requirements.

Consider using sub-accounts to provide more detailed financial information without cluttering your main chart of accounts. For instance, under “Marketing Expenses,” you might have sub-accounts for social media advertising, content creation, and event sponsorships.

Leveraging Technology for Efficiency

Modern accounting software can significantly streamline the process of setting up and managing your chart of accounts. As of March 2025, some of the best accounting software for startups include QuickBooks Online, Xero, FreshBooks, Wave, Zoho Books, NetSuite, Sage, and Campfire. These tools often come with pre-built templates tailored to various industries, which you can further customize to fit your startup’s unique needs.

With a well-organized chart of accounts in place, you’ll be ready to take the next step in setting up your startup’s accounting system: implementing the right accounting software. This crucial decision will impact how efficiently you can manage your finances and make data-driven decisions for your business.

Choosing the Right Accounting Software for Your Startup

Popular Options in the Market

QuickBooks Online stands out as a leading choice for startups, offering robust features and scalability. Xero competes strongly with its user-friendly interface and robust reporting capabilities. FreshBooks excels in invoicing and time tracking, making it suitable for service-based startups.

Wave provides free accounting features with paid add-ons for payroll and payments, appealing to budget-conscious entrepreneurs. Zoho Books offers comprehensive functionality at a competitive price point, particularly attractive for startups already using other Zoho products.

Key Features to Prioritize

When evaluating software options, focus on features that match your startup’s specific needs. Prioritize the following key features:

Robust reporting capabilities are essential. The software should generate key financial statements and provide insights into your startup’s financial health. Multi-currency support becomes important if you operate internationally.

Cloud-based solutions offer accessibility and collaboration features, allowing you to manage finances from anywhere. They also provide flexibility, real-time updates, scalability, and cost efficiency compared to traditional accounting software.

Integration Capabilities

Your accounting software should integrate smoothly with other tools in your startup’s tech stack. Look for native integrations with your e-commerce platform, CRM system, and payment processors. QuickBooks Online, for instance, offers over 650 app integrations, providing extensive flexibility.

Consider future needs as well. As your startup grows, you may require more advanced features like inventory management or project costing. Choose software that can scale with your business or offers easy data migration to more robust solutions.

Security and Compliance

Ensure the accounting software you select adheres to industry-standard security protocols (such as encryption and multi-factor authentication). It should also comply with relevant financial regulations and standards in your industry and region.

User Experience and Support

The software’s interface should be intuitive and user-friendly. This reduces the learning curve and improves adoption across your team. Additionally, evaluate the quality of customer support offered. Responsive and knowledgeable support can be invaluable, especially during initial setup and when troubleshooting issues.

Final Thoughts

Setting up accounting for your startup requires careful planning and consideration. The right accounting method, a tailored chart of accounts, and suitable software form the foundation for financial success. These elements ensure compliance with regulations and provide valuable insights into your startup’s financial health.

Professional guidance can help you navigate complex financial decisions and optimize your accounting setup. Optimum Results Business Solutions specializes in providing customized accounting solutions for startups and small businesses. We strive to give you the financial clarity needed to make informed decisions.

Proper accounting for startups yields substantial long-term benefits. Accurate financial records facilitate better decision-making, improve investor relations, and streamline tax preparation. A robust accounting system adapts to increasing complexity as your startup grows (providing detailed financial information for strategic planning).