At Optimum Results Business Solutions, we understand the challenges businesses face in managing their finances effectively.

Why should you outsource bookkeeping services? The answer lies in the numerous benefits it offers to companies of all sizes.

From cost savings to improved accuracy and compliance, outsourcing your bookkeeping can transform your financial management processes.

How Outsourcing Bookkeeping Cuts Costs

Outsourcing your bookkeeping services is a smart financial move that can significantly reduce your company’s expenses. Let’s explore how this strategy can lead to substantial cost savings.

Slash Overhead Costs

Outsourcing eliminates the need for office space, equipment, and software dedicated to an in-house bookkeeping team. According to a 2023 report by Deloitte, 59% of businesses outsource to save money, but nearly 57% also do it to improve their ability to focus. This saving alone can make a substantial difference to your bottom line.

Eliminate Full-Time Salary Expenses

Full-time bookkeepers come with significant costs beyond just salaries. Companies must also cover benefits, payroll taxes, and training. The Bureau of Labor Statistics reports that employer costs for employee compensation for civilian workers averaged $47.92 per hour worked in March 2025. Outsourcing allows you to pay only for the services you need, when you need them. This flexibility can result in significant savings compared to maintaining an in-house team.

Access Expertise Without the Price Tag

Outsourcing provides access to a team of professionals with diverse skills and experience. Instead of paying top dollar for a highly qualified in-house bookkeeper, you can tap into a pool of experts at a fraction of the cost. This arrangement allows you to benefit from specialized knowledge in areas like tax compliance, financial reporting, and industry-specific accounting practices (without the hefty price tag of full-time salaries).

Scalable Solutions for Growing Businesses

As your business grows, your bookkeeping needs will change. Outsourcing offers scalable solutions that adapt to your evolving requirements. You won’t need to hire additional staff or invest in expensive training programs. Instead, you can simply adjust your service package to match your current needs, ensuring cost-effective financial management at every stage of your business growth.

Technology-Driven Efficiency

Outsourced bookkeeping services often leverage advanced accounting software and automation tools. These technologies streamline processes, reduce errors, and increase efficiency. The result? Lower costs for you. You benefit from these cutting-edge tools without the need to purchase, maintain, or upgrade them yourself (a significant cost saving in itself).

Now that we’ve explored how outsourcing can cut costs, let’s turn our attention to another crucial benefit: the time it saves and how it allows you to focus on your core business activities.

How Outsourcing Frees Up Your Time

Reclaim Hours for Strategic Planning

Outsourcing your bookkeeping eliminates the need to spend hours each week on financial record-keeping. A survey by the National Small Business Association found that 40% of small business owners spent more than 80 hours a year preparing taxes. Outsourcing allows you to focus on core business activities, such as strategic planning, market research, or product development-activities that directly contribute to your business growth.

Streamline Financial Processes

Outsourced bookkeeping services often come with streamlined processes and efficient systems. Many use cloud-based accounting software that automates data entry and reconciliation. This automation can save hours of manual work each month. A report by Sage found that businesses using cloud accounting software spend 15% less time on customer invoicing and 11.5% less time on compiling management reports.

Focus on Revenue-Generating Activities

With bookkeeping off your plate, you and your team can dedicate more time to revenue-generating activities. This could mean more client meetings, increased sales efforts, or improved customer service. According to a survey by Clutch, 60% of small businesses outsource their bookkeeping to avoid errors and focus on growing their business.

Reduce Stress and Improve Work-Life Balance

Outsourcing bookkeeping can significantly reduce stress levels for business owners. Instead of worrying about financial record-keeping (often during evenings and weekends), you can enjoy more personal time. This improved work-life balance can lead to increased productivity and better decision-making when you’re at work.

Enhance Team Productivity

When you outsource bookkeeping, your in-house team can focus on their core responsibilities. This shift in focus can lead to improved productivity across your organization. Your team members won’t need to split their attention between their primary roles and financial tasks, allowing them to excel in their areas of expertise.

The time-saving benefits of outsourcing bookkeeping are clear, but what about the accuracy and compliance aspects? Let’s explore how professional bookkeeping services can enhance the precision of your financial records and ensure you stay on the right side of regulations.

Precision and Compliance in Financial Management

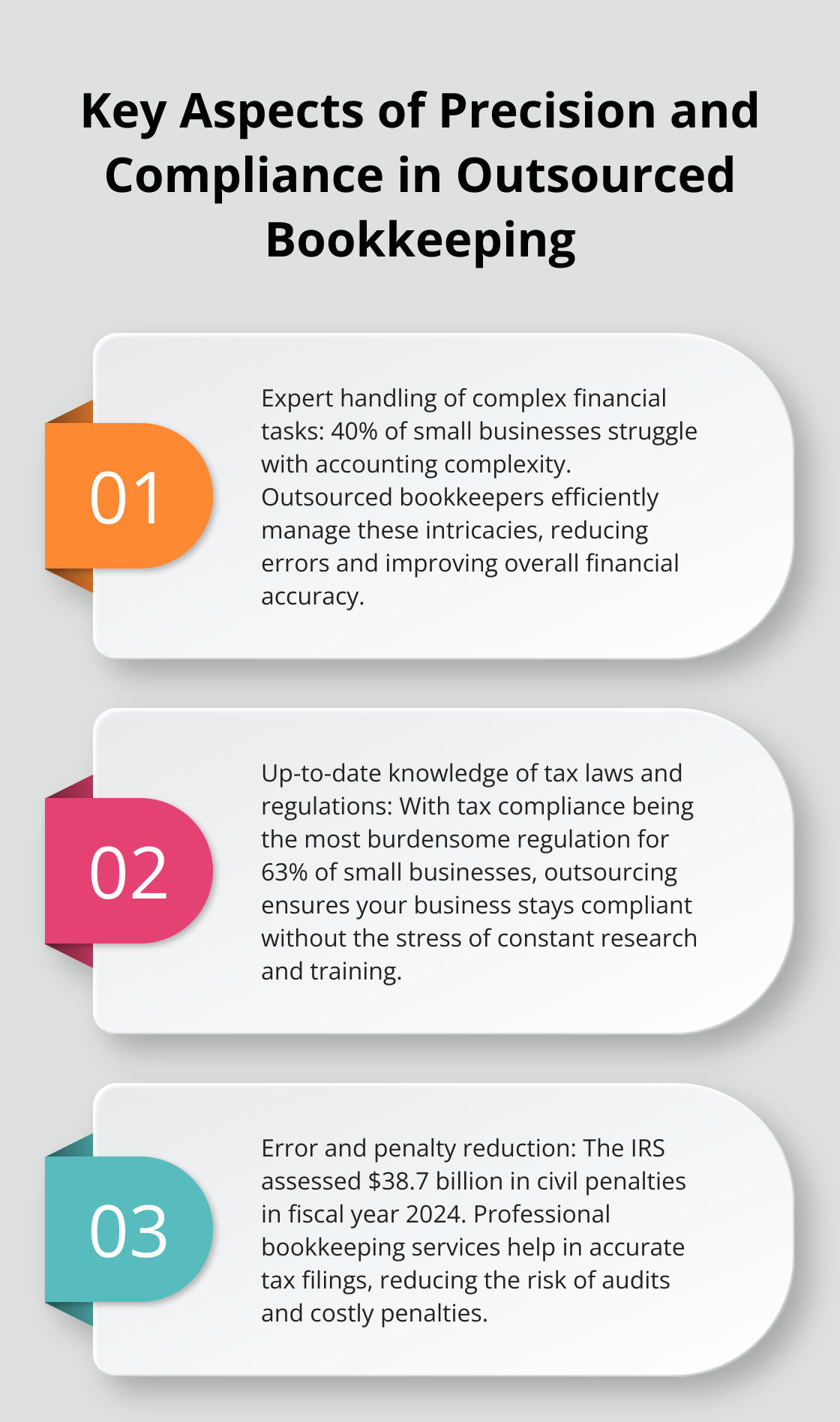

Expert Handling of Complex Financial Tasks

Professional bookkeepers excel at managing intricate financial tasks that often challenge in-house staff. A study by the American Institute of CPAs revealed that 40% of small businesses struggle with the complexity of accounting tasks. Outsourced bookkeepers efficiently handle these complexities, which reduces errors and improves overall financial accuracy.

Up-to-Date Knowledge of Tax Laws and Regulations

Tax laws and financial regulations constantly change. Keeping up with these changes requires full-time dedication. Outsourcing bookkeeping services offers key advantages, including enhanced accuracy and compliance. The National Small Business Association reports that tax compliance ranks as the most burdensome regulation for 63% of small businesses. Outsourcing taps into a knowledge base that remains current, which ensures your business stays compliant without the stress of constant research and training.

Error and Penalty Reduction

Financial errors cost businesses dearly, both in penalties and missed opportunities. The IRS assessed $38.7 billion in civil penalties during fiscal year 2024 (many resulting from unintentional errors or oversights). Professional bookkeeping services help in accurate tax filings and reduce the risk of audits and penalties. They also provide an additional layer of scrutiny on your financials, catching mistakes that might otherwise go unnoticed.

Enhanced Data Security

Outsourced bookkeeping services often implement robust security measures to protect sensitive financial data. They use encrypted systems and secure cloud storage solutions to safeguard your information from cyber threats. This level of security (often beyond what small businesses can implement internally) helps prevent data breaches and maintains the confidentiality of your financial records.

Improved Financial Reporting

Professional bookkeepers produce accurate and timely financial reports. These reports offer valuable insights into your business’s financial health, cash flow, and profitability. With access to this reliable data, you make informed decisions about your business strategy, investments, and growth opportunities. Regular, precise financial reporting also helps you identify trends and potential issues before they become significant problems.

Final Thoughts

Outsourcing bookkeeping services offers a powerful combination of cost savings, time efficiency, and enhanced accuracy. Companies can allocate resources more effectively by reducing overhead expenses and accessing professional expertise without high salaries. The time saved from handling complex financial tasks allows businesses to focus on core activities, fostering growth and innovation.

Professional bookkeepers ensure precision and compliance with their up-to-date knowledge of tax laws and regulations. This reduces the risk of costly errors and penalties, providing businesses with reliable financial insights for informed decision-making and strategic planning. Why should you outsource bookkeeping services? The answer lies in the transformative impact it can have on your business operations.

Optimum Results Business Solutions understands the unique financial challenges faced by small service-based businesses and tech startups. Our team of experts provides customized bookkeeping solutions, ensuring compliance with regulations while offering valuable financial insights. You can enhance your operational efficiency and reduce financial management costs by partnering with us, allowing you to focus on growing your business.