Opening Balance Equity in QuickBooks Online appears when your books don’t balance during initial setup or data migration. This account should always show zero for accurate financial reporting.

We at Optimum Results Business Solutions see this issue frequently with new QuickBooks Online users. The good news is that fixing opening balance equity requires just a few systematic steps to identify and correct the underlying problems.

Understanding Opening Balance Equity in QuickBooks Online

What Opening Balance Equity Represents

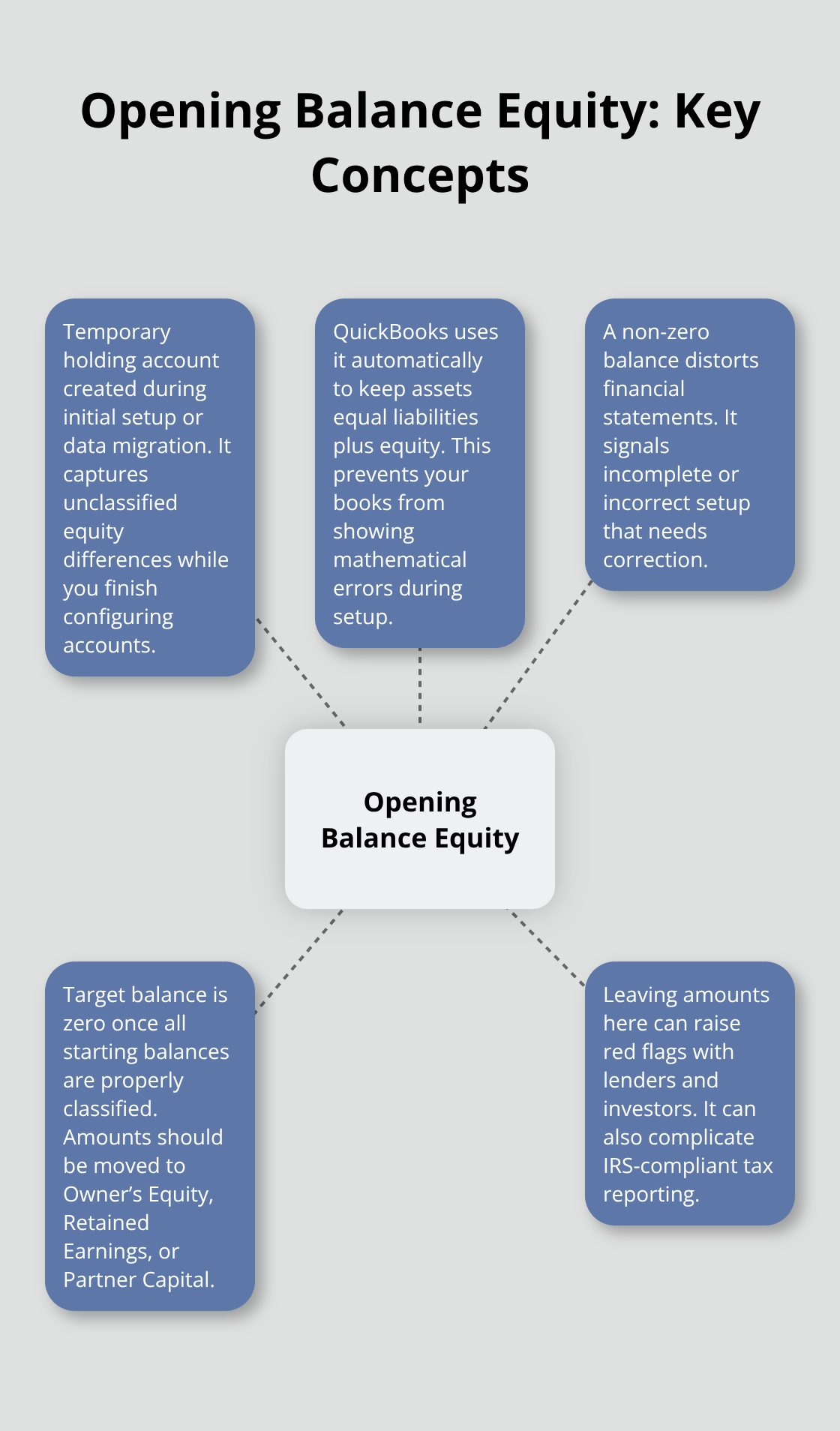

Opening Balance Equity shows the difference between your assets and liabilities when you first set up QuickBooks Online or import data from another system. QuickBooks creates this temporary account automatically to maintain the fundamental accounting equation where assets must equal liabilities plus equity. When you enter starting balances for various accounts without corresponding equity entries, QuickBooks uses Opening Balance Equity as a placeholder to keep your books mathematically balanced.

This account acts as a catch-all for unclassified equity amounts that appear during initial setup. The system generates this balance to prevent your books from showing mathematical errors while you complete the setup process.

Common Causes of Opening Balance Equity Issues

Most Opening Balance Equity issues stem from incomplete initial setup procedures. Users often enter bank account balances, outstanding invoices, and unpaid bills without properly accounting for the corresponding equity positions. Data migration from other accounting systems frequently creates these imbalances when historical transactions import incorrectly or when opening dates don’t align across all accounts.

Another major cause occurs when businesses enter partial information during setup. They record only assets while ignoring corresponding liabilities or equity accounts. Manual data entry errors also contribute to these problems, especially when users input incorrect amounts or assign transactions to wrong account categories.

Why Zero Balance Matters for Financial Accuracy

Opening Balance Equity must show zero because it represents unclassified equity that distorts your financial statements. A non-zero balance indicates incomplete or incorrect setup that affects the accuracy of your Balance Sheet and makes it impossible to track true owner equity, retained earnings, or partner distributions.

Financial institutions and investors view non-zero Opening Balance Equity as a red flag that indicates poor bookkeeping practices. Tax reporting becomes problematic when this account carries balances, as it represents equity that hasn’t been properly classified according to IRS requirements, which can complicate year-end filings.

Clean financial records require all equity components to be properly categorized in their appropriate accounts rather than sitting in this temporary holding account. Once you understand these underlying issues, you can take specific steps to identify and correct the problems that create Opening Balance Equity balances.

Methods to Clear Opening Balance Equity

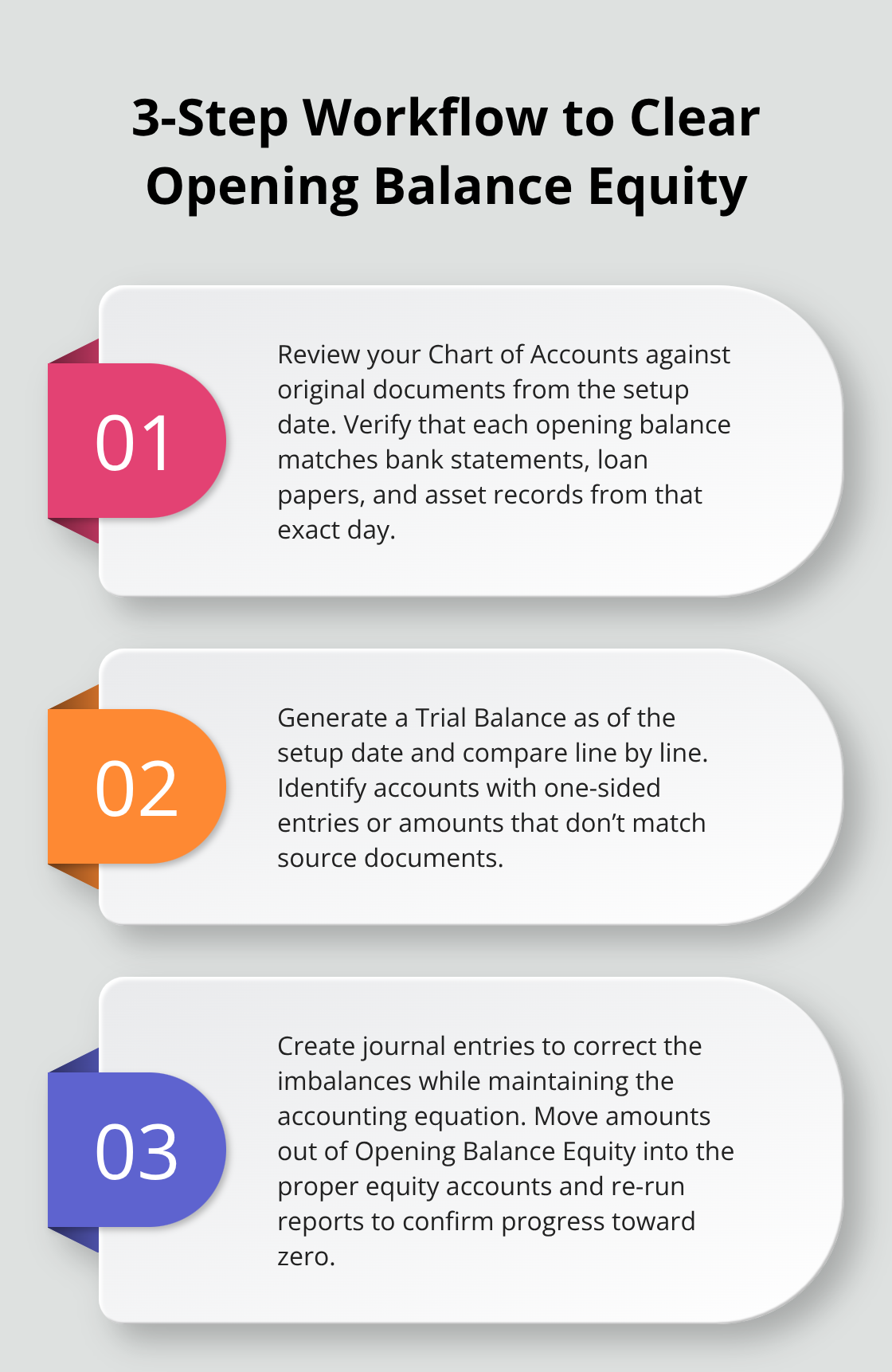

Review Your Chart of Accounts Against Source Documents

Access your Chart of Accounts and examine each account balance against your original documentation from the setup date. Print bank statements, loan documents, and asset records from that specific date to verify every opening balance entry. Most errors occur when users enter current balances instead of historical balances from their chosen start date.

QuickBooks requires exact amounts from the specific date you designated as your start point, not approximations or current figures. Users who enter today’s bank balance instead of the historical balance from six months ago create immediate imbalances that flow directly into Opening Balance Equity.

Generate and Analyze Your Trial Balance Report

Create a Trial Balance report as of your setup date and compare it line by line with your source documents. Look for accounts where you entered only one side of transactions without corresponding entries. Common mistakes include recording a loan balance without the related asset purchase, or entering accounts receivable without the corresponding revenue recognition.

This report reveals exactly where your books fall out of balance and shows you which accounts need correction. Focus on accounts with unexpected balances or amounts that don’t match your source documentation.

Create Journal Entries to Correct Imbalances

Access the Plus icon, select Journal Entry, and record the missing transactions with proper account classifications. Each correction must maintain the accounting equation while moving amounts out of Opening Balance Equity into their proper equity accounts (like Owner’s Equity, Retained Earnings, or Partner Capital accounts).

For example, if you recorded a $50,000 equipment purchase but forgot the corresponding loan, create a journal entry that debits the loan payable account and credits Opening Balance Equity for $50,000. This correction moves the balance from the temporary account into its proper classification.

Verify Your Progress After Each Correction

Run another Trial Balance after each correction to verify the Opening Balance Equity moves closer to zero. The account should show exactly zero when all historical balances are properly classified and all missing transactions are recorded.

This systematic approach addresses the root causes of Opening Balance Equity rather than simply transferring balances around. Once you complete these corrections, you can implement specific practices that prevent these issues from recurring in the future.

Best Practices to Prevent Future Opening Balance Equity Issues

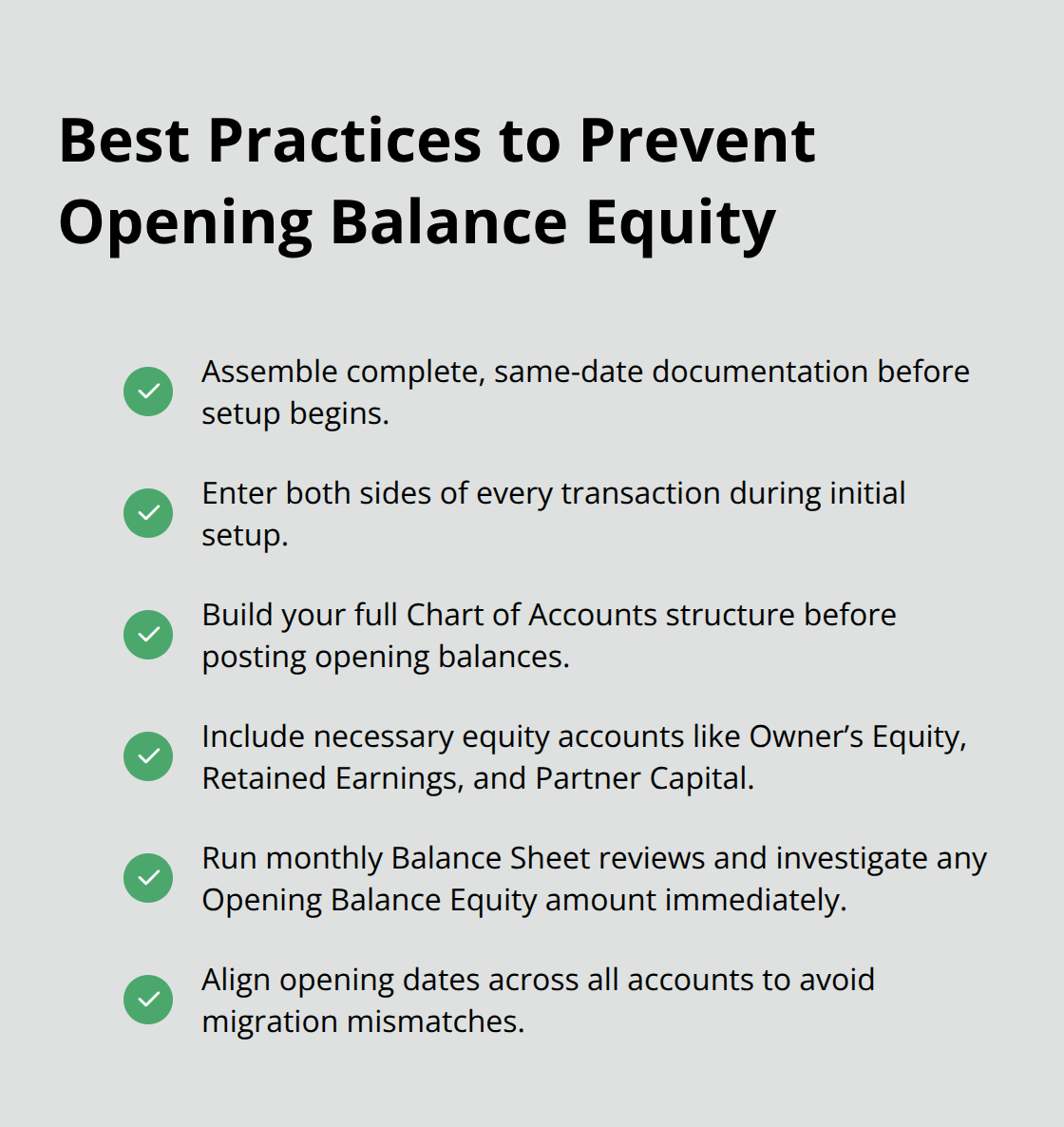

Start with Complete Documentation Before Setup

Collect every financial document from your chosen start date before you touch QuickBooks Online. Bank statements, loan agreements, credit card statements, accounts receivable reports, and accounts payable summaries must all reflect balances from the exact same date. Most businesses choose January 1st as their start date, but any date works as long as you have complete documentation from that specific day.

Even one missing account balance creates immediate imbalances that flow into Opening Balance Equity.

Professional accountants recommend that you wait until you have 100% of your documentation rather than start with partial information and add accounts later. Each additional account you add after initial setup increases the risk of new Opening Balance Equity balances.

Enter All Related Transactions at the Same Time

Input corresponding debits and credits for every transaction during your initial setup session. When you record a business loan, immediately enter both the cash received and the loan liability. When you add accounts receivable, record the corresponding revenue or inventory reduction. QuickBooks Online creates Opening Balance Equity when it sees only one side of transactions that should have offsetting entries.

QuickBooks training materials show that incomplete transaction entry during setup creates these problems instantly. Users who enter asset balances without corresponding liability or equity entries generate Opening Balance Equity issues immediately.

Set Up Your Chart of Accounts Structure First

Create your complete Chart of Accounts before you enter any opening balances. This approach prevents you from posting transactions to incorrect accounts or missing account categories entirely. Include all equity accounts (Owner’s Equity, Retained Earnings, or Partner Capital) that you’ll need for proper balance classification.

A well-structured Chart of Accounts makes it obvious where each opening balance belongs and reduces the chance of posting errors. You can modify account names later, but the basic structure should exist before data entry begins.

Implement Monthly Balance Sheet Reviews

Generate your Balance Sheet report on the last day of each month and scan for any Opening Balance Equity balance. Any amount in this account indicates recent data entry errors or incomplete transactions that need immediate correction. Set up automatic email reminders in QuickBooks Online to send you this report monthly (this makes it impossible to ignore emerging problems).

Monthly reviews catch errors while they remain fresh and easy to trace. Businesses that wait until year-end often struggle to identify the source of Opening Balance Equity balances because the original documentation becomes harder to locate.

Final Thoughts

Opening Balance Equity in QuickBooks Online requires systematic identification and correction of setup errors through careful documentation review, trial balance analysis, and proper journal entries. The process becomes straightforward when you address root causes rather than simply move balances between accounts. Clean financial records form the foundation of successful business operations and accurate tax reporting.

Opening Balance Equity QuickBooks Online issues signal incomplete setup procedures that compromise your financial statement accuracy and create compliance risks with lenders and tax authorities. These problems indicate that your initial setup missed critical steps or contained data entry errors. Professional resolution prevents these issues from affecting your ongoing bookkeeping and financial reporting.

Complex Opening Balance Equity situations often require professional expertise to resolve properly (especially when multiple years of data need correction). We at Optimum Results Business Solutions provide QuickBooks Online support and customized bookkeeping solutions for businesses. Our team handles compliance requirements and delivers accurate financial statements while reducing your financial management costs.