Ecommerce sales tax compliance has become increasingly complex as states expand their economic nexus laws. The Supreme Court’s 2018 Wayfair decision fundamentally changed how online retailers handle tax obligations across multiple jurisdictions.

We at Optimum Results Business Solutions see businesses struggle with varying state thresholds, product taxability rules, and filing requirements. This guide provides actionable steps to navigate these challenges effectively.

What Sales Tax Requirements Apply to Your Business

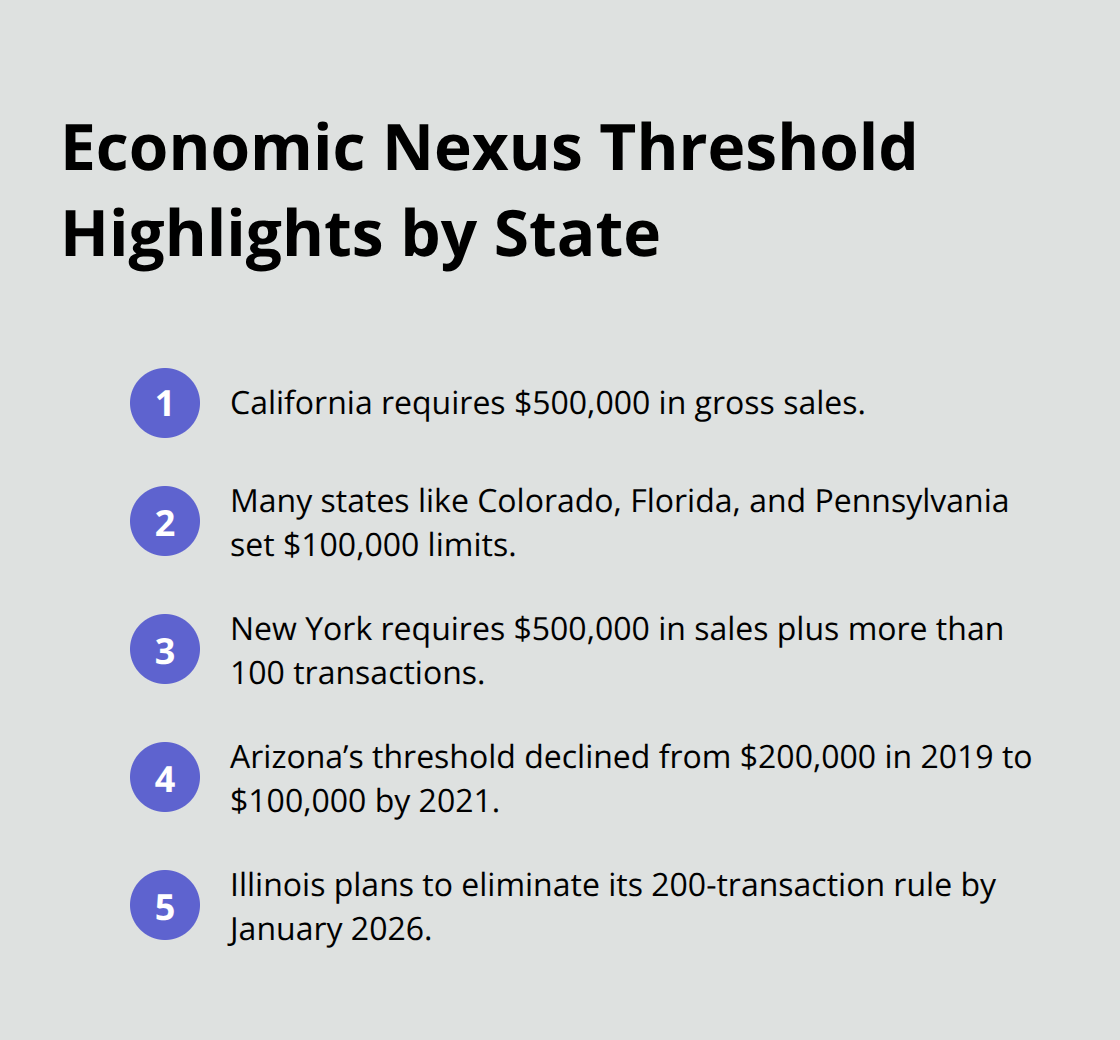

Economic nexus thresholds vary dramatically across states and create significant compliance challenges for ecommerce sellers. As of 2025, every state with a sales tax has economic nexus requirements for remote out-of-state sellers following the 2018 South Dakota v. Wayfair decision. California maintains the highest threshold at $500,000 in gross sales, while most states like Colorado, Florida, and Pennsylvania set their limits at $100,000. New York requires both $500,000 in sales and more than 100 transactions within 12 months. Arizona implemented a system that declines over time, with thresholds that started at $200,000 in 2019 and dropped to $100,000 by 2021.

Illinois plans to eliminate its 200-transaction requirement by January 2026 and will keep only the $100,000 sales threshold.

State Registration Process Variations

Registration requirements differ significantly between states, with some states that demand immediate compliance upon threshold crossings while others provide grace periods. New Jersey requires sellers to collect tax on their first taxable sale but offers a 30-day window for registration. Alabama bases its $250,000 threshold on retail sales specifically and excludes wholesale transactions from nexus calculations. Massachusetts lowered its threshold from $500,000 to $100,000 in October 2019, which caught many sellers off guard. Kansas eliminated transaction requirements entirely in July 2021 and focuses solely on the $100,000 sales threshold. Registration fees range from free in many states to $100 in others, with renewal requirements that vary by jurisdiction.

Product Classification and Tax Exemptions

Product taxability rules create additional complexity as states treat digital goods, services, and physical products differently. States have varying approaches to digital products, with Louisiana taxing digital audio and audiovisual works, digital books, digital codes, digital apps and games effective January 1, 2025. Food and clothing exemptions exist in various states, but definitions vary significantly. Shipping charges face different treatment across jurisdictions, with some states that tax shipping regardless of promotional terms (like free shipping offers). Bundled products require careful classification, as some states tax the entire bundle price even when individual components have different tax treatments. Exemption certificate management becomes critical for B2B sellers, as missing or expired certificates can trigger tax liabilities during audits.

Multi-State Compliance Challenges

Sellers who operate across multiple states must track different rules simultaneously and monitor their sales activity in each jurisdiction. States like Virginia and Georgia both require remote sellers to meet a $100,000 threshold, but their registration processes and filing frequencies differ substantially. Pennsylvania mandates economic nexus if total taxable sales exceed $100,000 in the previous 12-month period (with specific calculation methods). The complexity increases when marketplace sales count toward nexus thresholds in many states, which affects how sellers calculate their total exposure. These variations make manual compliance nearly impossible for businesses that sell across state lines.

Once you understand your nexus obligations and product taxability requirements, the next step involves implementation of systems that can handle these complex calculations automatically.

How Do You Implement Tax Collection Systems

Automated tax calculation software eliminates the manual complexity of tracking tax jurisdictions across the United States. TaxJar automates sales tax compliance across all these jurisdictions and serves over 20,000 high-growth businesses with seamless integration into popular platforms like Amazon, Shopify, and WooCommerce. The platform provides real-time calculations that charge accurate sales tax at checkout, even during peak demand periods like Black Friday. Address validation becomes critical here, as precise location data determines the correct tax rate among thousands of local jurisdictions. Arizona’s threshold system that declined from $200,000 to $100,000 demonstrates why businesses need software that adapts to new regulations automatically rather than relying on static rate tables.

Payment Processor Integration Requirements

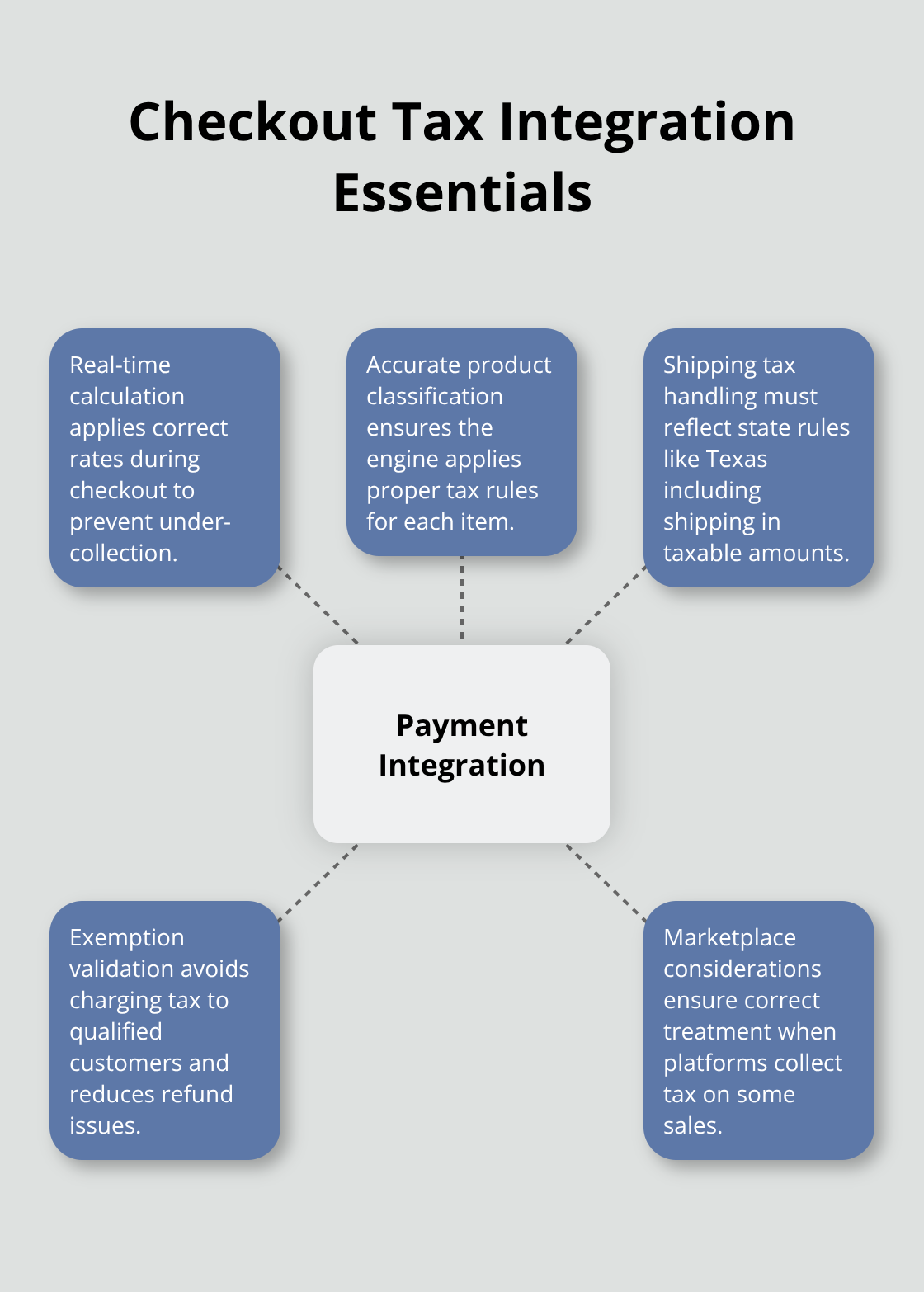

Modern payment processors must connect directly with tax calculation engines to apply rates at the point of sale rather than after transaction completion. Stripe Tax and similar solutions calculate tax in real-time during checkout, but require proper product classification to function correctly.

Businesses that misclassify digital goods face significant costs, as SaaS sales tax laws vary by state with some states taxing it, some not, and some having conditional rules. The integration must handle shipping tax implications correctly, since states like Texas include shipping charges in taxable amounts regardless of promotional terms. Payment processor APIs need configuration for exemption certificate validation, as tax collection from exempt customers creates unnecessary refund complications and compliance risks.

Certificate Management Automation

Electronic exemption certificate capture reduces audit risks substantially compared to manual paper-based systems that businesses often lose or fail to renew. Automated tools track certificate expiration dates and prompt customers for renewals before certificates become invalid, which protects sellers from future tax liabilities. Invalid certificates expose businesses to back taxes plus penalties during state audits (making proactive management essential rather than reactive responses). The system must verify certificate authenticity against state databases where available and maintain detailed audit trails for compliance documentation.

Real-Time Rate Updates and Product Classification

Tax rates change frequently across jurisdictions, with local municipalities that adjust rates quarterly or annually based on budget requirements. Software platforms must update rates automatically to prevent undercollection or overcollection scenarios that create compliance issues. Product classification engines use AI-driven categorization to streamline the assignment of tax codes for various product types, including digital goods that face different treatment across states. Businesses must configure their systems to handle bundled products correctly, as some states tax the entire bundle price even when individual components have different tax treatments (creating potential liability exposure).

Multi-Channel Sales Integration

E-commerce businesses that sell across multiple channels need unified tax calculation systems that work consistently across all platforms. Amazon FBA sellers face unique challenges as the marketplace handles tax collection in some states but not others, requiring sellers to track which transactions need additional compliance attention. The integration must synchronize inventory data, customer locations, and exemption certificates across all sales channels to maintain accurate tax calculations. This coordination becomes particularly important during high-volume sales periods when manual oversight becomes impossible and automated systems must handle complex scenarios without human intervention. Professional bookkeeping services can help maintain organized financial records throughout this complex implementation process.

With your tax collection systems properly configured and integrated across all sales channels, the next phase focuses on meeting your ongoing obligations through accurate filing and remittance processes.

How Do You File Sales Tax Returns Correctly

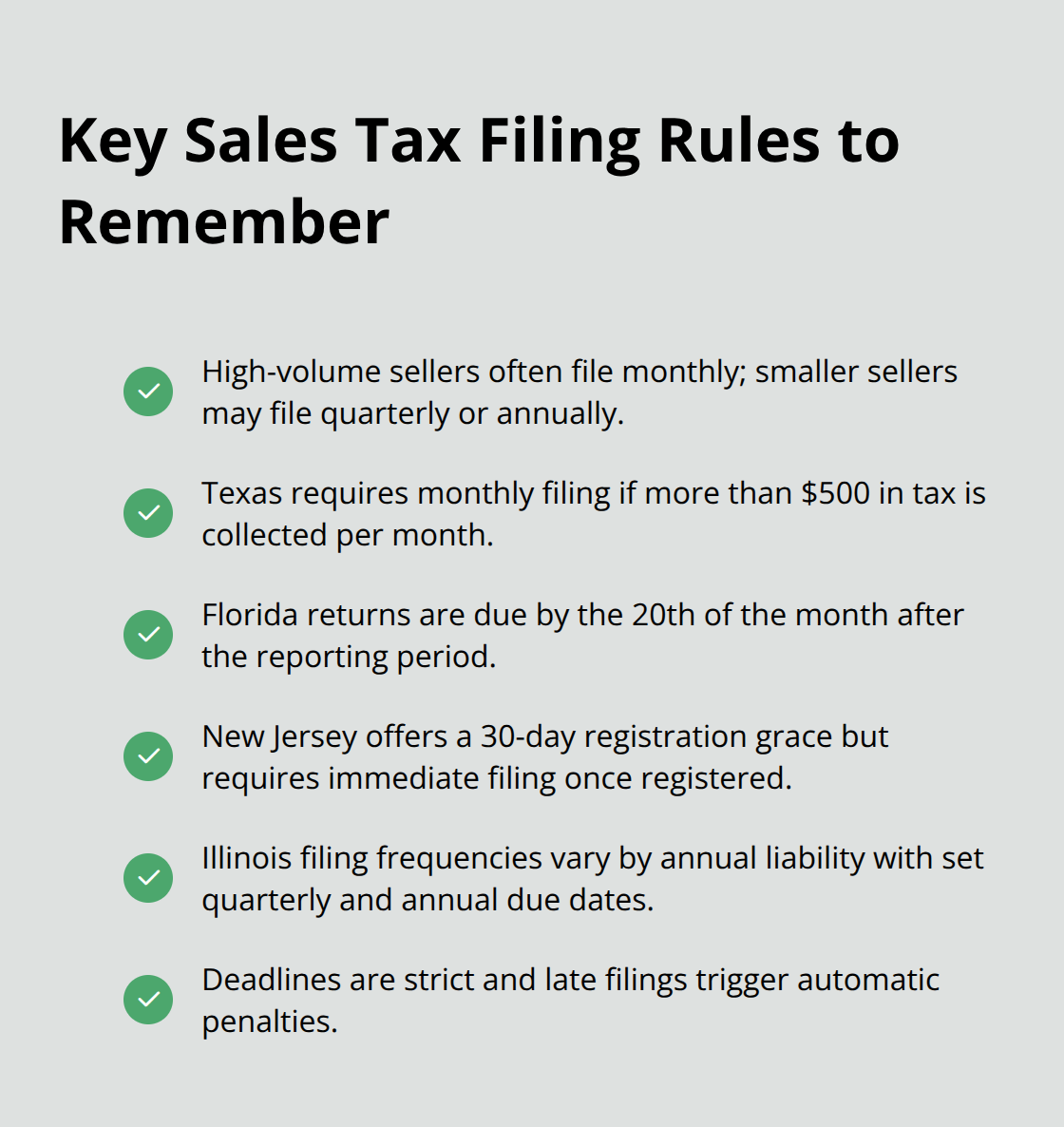

State filing deadlines create a rigid framework that businesses must follow to avoid penalties and interest charges. Most states require monthly filing for high-volume sellers, while smaller businesses may qualify for quarterly or annual filing schedules based on their tax liability amounts. Texas requires monthly filing for businesses that collect more than $500 in tax per month, while businesses with lower volumes can file quarterly. Florida mandates filing by the 20th of the month after the reporting period, regardless of filing frequency. New Jersey provides a 30-day grace period for registration but requires immediate filing once registered.

Illinois offers different filing frequencies based on annual tax liability, with quarterly returns due the 20th day of the month following the quarter and annual returns due January 20th. These deadlines are non-negotiable, and late filing triggers automatic penalties that compound monthly.

Tax Liability Calculations Across Jurisdictions

Tax liability calculations become complex when businesses operate across multiple states with different rules for credits, exemptions, and rate applications. States handle bad debt deductions differently, with some that allow immediate deductions while others require specific documentation and timing requirements. Pennsylvania allows bad debt deductions in the period when the debt becomes uncollectible, but requires detailed documentation of collection efforts. Credit calculations for overpayments vary significantly, with some states that apply credits automatically to future returns while others require specific requests for refunds. Marketplace facilitator laws complicate these calculations because platforms like Amazon collect tax on some transactions but not others (which requires sellers to reconcile which sales need additional attention).

Documentation Requirements for Exempt Sales

Businesses must track exempt sales separately and maintain detailed records of exemption certificates to support these exclusions during audits. States have different requirements for supporting documentation, with New York that requires detailed transaction records while California focuses on summary information. The complexity increases when states have different rules for promotional discounts, bundled products, and shipping charges in tax calculations. Invalid certificates expose businesses to back taxes plus penalties during state audits, which makes proactive certificate management essential rather than reactive responses.

Multi-State Return Management Systems

TaxJar automates filing across all jurisdictions and provides detailed reports by state and local jurisdiction to support accurate return preparation. The platform tracks filing frequencies automatically and sends deadline reminders to prevent late submissions that trigger penalties. Businesses should establish monthly reconciliation processes that compare collected tax amounts with calculated liabilities to identify discrepancies before filing deadlines. Professional accounting services become valuable here, as tax professionals help businesses maintain organized records and meet complex multi-state filing requirements efficiently. The key lies in consistent monthly processes rather than scrambling to meet deadlines (which reduces errors and compliance risks substantially).

Final Thoughts

Ecommerce sales tax compliance demands systematic monitoring of nexus thresholds across all states where you sell products. Businesses must track their sales activity monthly to identify when they cross economic nexus limits and trigger new registration requirements. Automated tax calculation software becomes essential as manual tracking fails when you operate across multiple jurisdictions with different rules.

Professional tax management services provide significant advantages for businesses that want to scale operations efficiently. We at Optimum Results Business Solutions help small service-based businesses and tech startups maintain accurate financial records while managing complex compliance requirements. Our team works with QuickBooks Online to streamline your accounting processes and reduce the administrative burden of multi-state tax obligations.

Your implementation plan should start with nexus analysis to identify current obligations, then move to software selection and integration with your existing payment systems. Register in required states immediately to avoid penalties, then establish monthly reconciliation processes that track collected taxes against calculated liabilities. Regular compliance reviews help identify changes in state laws that affect your business operations (and prevent costly mistakes during peak sales periods).