Recording payroll accurately in QuickBooks Online protects your business from costly compliance issues and keeps your financial records organized. The IRS reports that 40% of small businesses pay an average penalty of $845 annually for payroll mistakes.

We at Optimum Results Business Solutions see businesses struggle with payroll setup and processing daily. This guide shows you exactly how to record payroll in QuickBooks Online without errors.

How Do You Get Started with QuickBooks Online Payroll?

The primary admin must log into QuickBooks Online and navigate to Payroll then Overview to begin the setup process. The system guides you through three essential configuration stages that determine how smoothly your payroll runs throughout the year. Your business address and payroll contact information form the foundation of your setup, and QuickBooks uses this data to calculate the correct tax withholdings for your location. Most businesses complete the initial setup within 30 minutes, though you should gather employee documentation beforehand to speed up the process significantly.

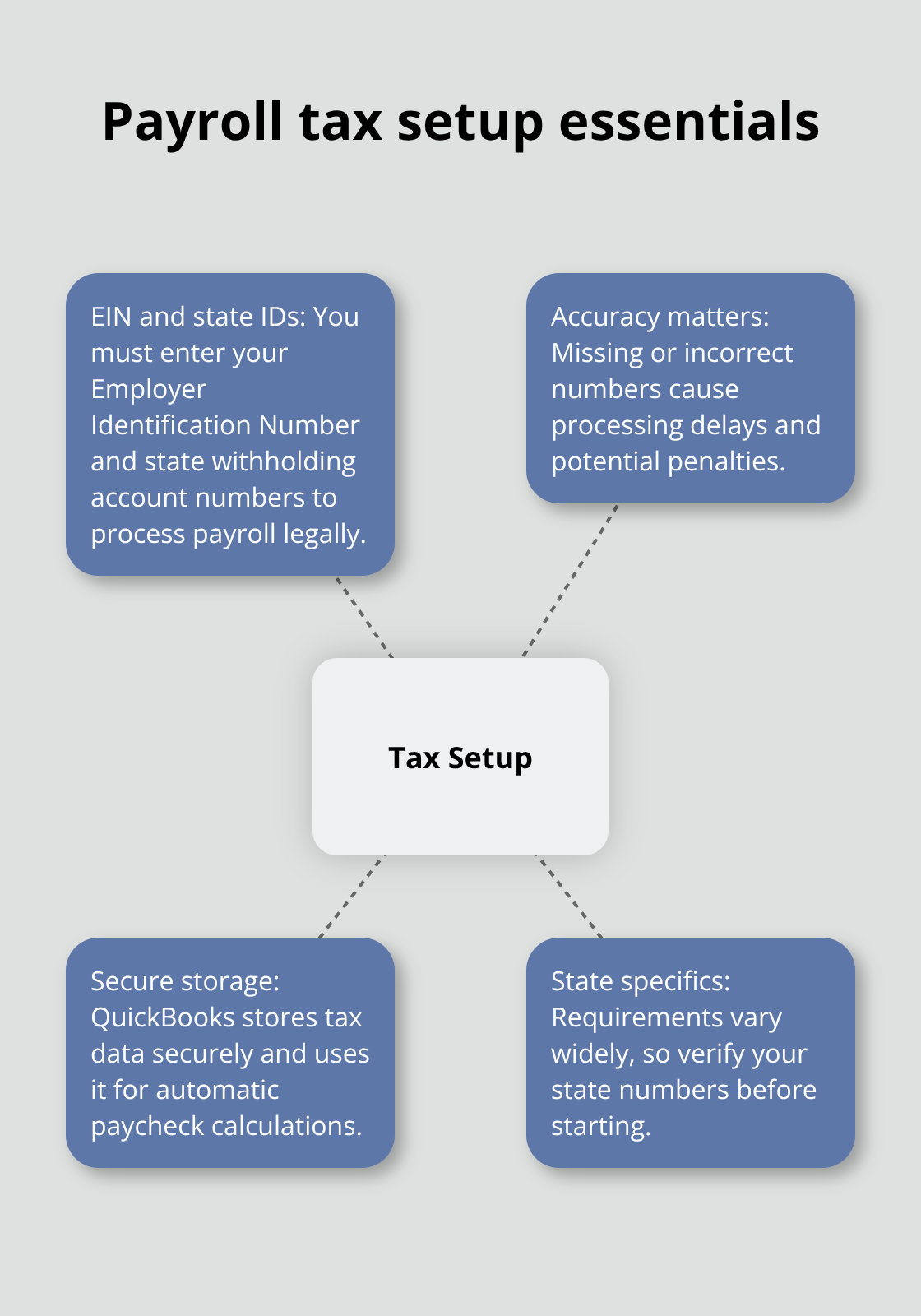

Enter Your Federal and State Tax Information

You must enter your Employer Identification Number and state withholding account numbers during setup to process payroll legally. The IRS requires this information for tax reports, and missing or incorrect numbers cause processing delays that can cost your business penalties. QuickBooks stores your tax information securely and uses it to generate automatic tax calculations for each paycheck. State requirements vary widely, so verify your specific state withholding numbers through your state revenue department before you start the setup process.

Connect Your Bank Account for Direct Deposits

Bank account connection enables direct deposit and automatic tax payments, which saves businesses time per payroll cycle compared to manual processing. QuickBooks requires your business bank login credentials and principal officer information to establish this connection securely. The system encrypts all financial data and maintains strict security protocols throughout the connection process.

Add Employee Information and Documentation

Employee setup involves you gathering completed W-4 forms, pay rates, and deduction information for each team member. The QuickBooks Workforce feature allows employees to enter their own information directly, which reduces data entry errors compared to manual input methods. Import options exist for businesses that switch from providers like ADP or Gusto, and these preserve year-to-date payroll history for accurate tax reports. Once you complete the employee setup, you can move forward to process your first payroll run and handle the actual transaction recording.

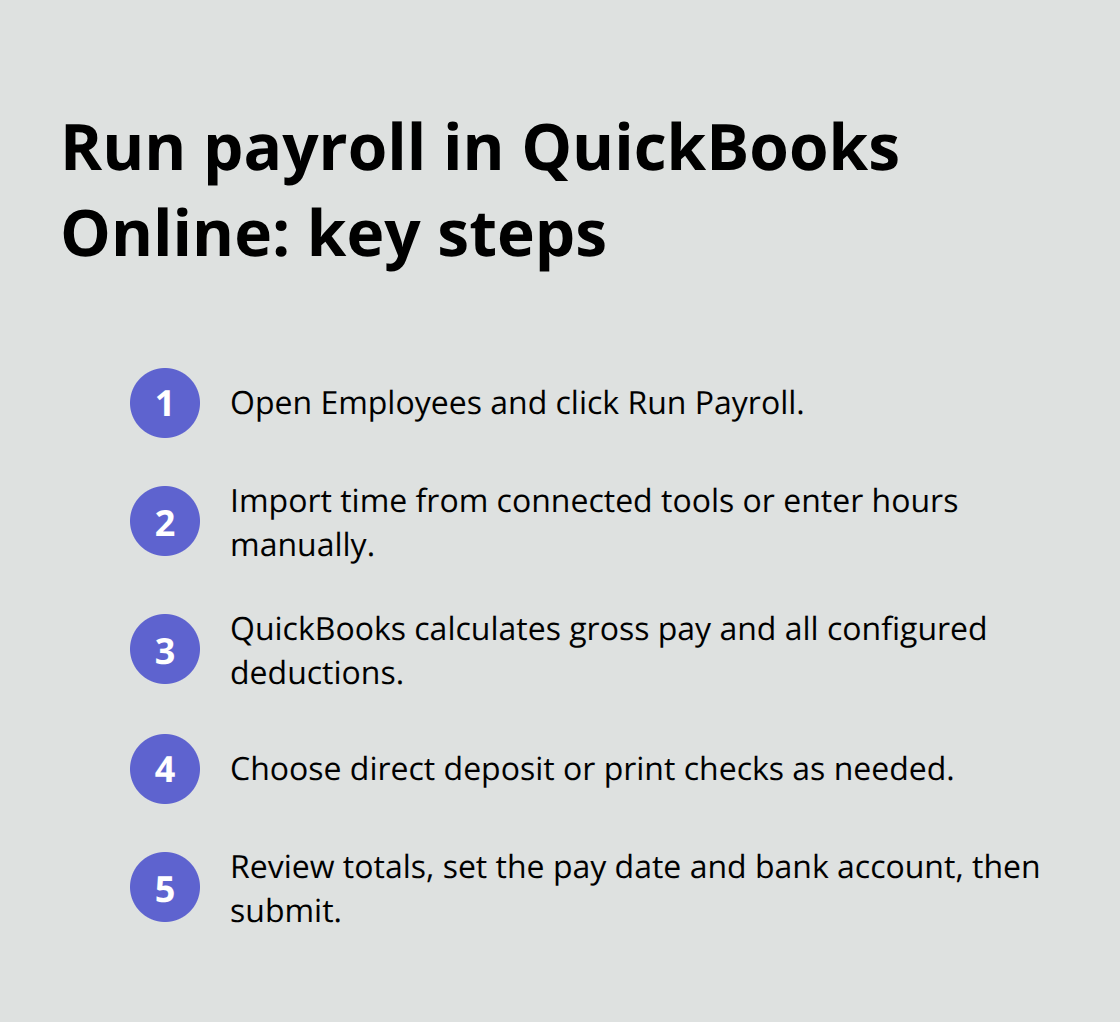

How Do You Process Payroll in QuickBooks Online?

Access the Employees tab and select Run Payroll to start your transaction sequence. QuickBooks pulls employee hours from connected time tracking systems automatically, though you can enter hours manually for each employee during this step.

The system calculates gross pay when it multiplies hourly rates by hours worked, then applies all configured deductions including federal withholding, Social Security at 6.2%, Medicare at 1.45%, and state-specific taxes based on your business location.

Direct deposit processing takes one to two business days, while paper checks print immediately through QuickBooks-compatible check stock. The system handles all calculations automatically once you input the basic payroll data.

Verify Tax Calculations Before Processing

QuickBooks applies tax rates automatically, but you must verify these calculations match current IRS guidelines and state requirements before you finalize any payroll. The system calculates federal income tax withholding based on employee W-4 information and current tax brackets, while state taxes vary significantly by location (with rates ranging from zero in states like Texas to over 13% in California).

Review each employee’s net pay calculation to confirm deductions align with their benefit elections and tax filing status. The payroll summary screen displays total employer costs including your matching Social Security and Medicare contributions, unemployment taxes, and workers compensation premiums where applicable.

Complete Final Review and Submit Payroll

The final approval screen shows total payroll costs, individual employee payments, and all tax liabilities before you submit the batch for processing. QuickBooks Online requires you to confirm the pay date and bank account for direct deposits during this final step, and changes become impossible once you approve the payroll run.

Tax payments process automatically if you selected this option during setup, with federal deposits occurring within two business days and state payments following their respective schedules. The system generates all required payroll reports immediately after processing, including pay stubs for employees and detailed records for your accounting files.

Once you complete payroll processing, you need to understand how QuickBooks handles the reporting and compliance requirements that keep your business compliant with federal and state regulations.

What Reports Do You Need for Payroll Compliance?

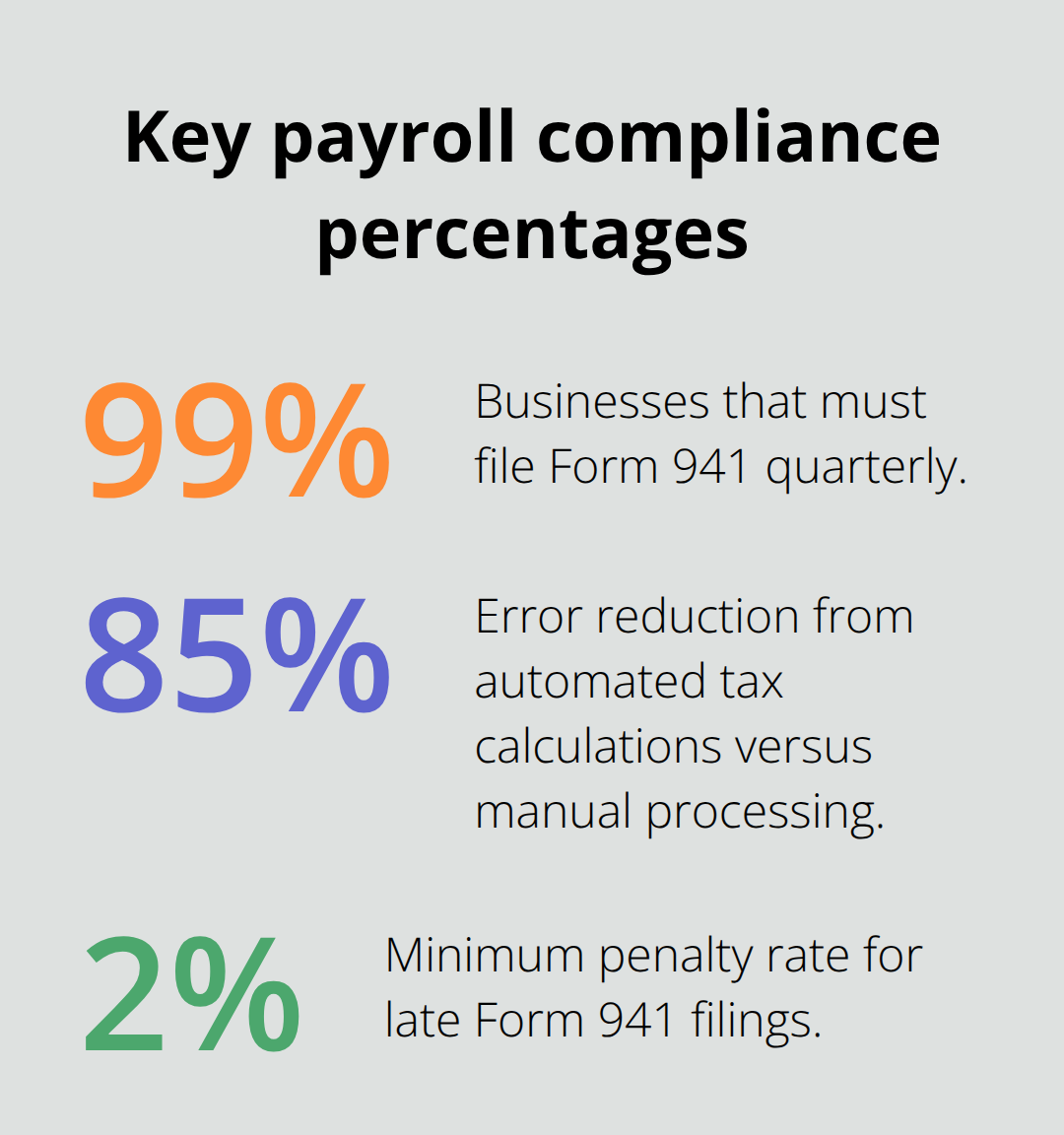

QuickBooks Online creates Form 941 quarterly reports automatically, which 99% of businesses must file to report federal income tax and Social Security/Medicare withholdings. The system pulls data directly from your processed payroll runs and calculates the exact amounts you owe, including your employer matching contributions that equal 7.65% of employee wages. Access these reports through Reports then Payroll Tax and Forms, where QuickBooks displays filing deadlines and payment due dates for each quarter. The IRS requires Form 941 by the last day of the month following each quarter, with penalties starting at 2% of unpaid taxes for late filings.

Track Labor Costs Through Detailed Payroll Reports

The Payroll Summary report breaks down your total labor expenses by employee, department, and pay period. This gives you precise cost data for business decisions. QuickBooks tracks direct labor costs separately from benefits and payroll taxes, which typically add 25-30% to your base wage expenses (according to Bureau of Labor Statistics data). Create this report monthly to monitor labor cost trends and identify departments where expenses exceed budget projections. The Employee Details report shows individual worker costs including overtime premiums, which federal law requires at 1.5 times regular rates for hours over 40 per week.

Handle Year-End Tax Forms and Compliance Deadlines

Form W-2 creation happens automatically in January, with QuickBooks pulling all wage and tax data from your processed payroll throughout the year. The system creates individual W-2s for each employee and produces the required W-3 transmittal form for Social Security Administration submission by January 31st. State unemployment tax reports vary by location, with rates ranging from 0.1% in states like Florida to over 6% in Alaska. QuickBooks handles these calculations based on your business location settings. The system tracks your State Unemployment Tax liability throughout the year and creates required quarterly reports that most states require by the last day of the month following each quarter.

Final Thoughts

Proper payroll recording in QuickBooks Online protects your business from IRS penalties that average $845 annually for small businesses. The automated tax calculations reduce human error by 85% compared to manual processing, while direct integration with your chart of accounts maintains accurate financial records throughout the year. Most businesses complete their first payroll run within 15 minutes after setup.

The most expensive mistakes happen when businesses skip the verification step before they finalize payroll runs. Incorrect employee classifications cost companies thousands in back taxes and penalties. Missing quarterly tax deadlines triggers immediate IRS interest charges that compound monthly (with rates starting at 3% annually). Wrong bank account selections for tax payments create cash flow problems that take weeks to resolve.

How to record payroll in QuickBooks Online becomes complex when your business grows beyond basic wage payments. Multiple pay rates, commission structures, and benefit deductions require advanced setup knowledge that most business owners lack. We at Optimum Results Business Solutions help service-based businesses and tech startups handle these complexities while maintaining full compliance with federal and state regulations.