Small businesses often struggle with tight budgets, but neglecting bookkeeping can lead to financial chaos. At Optimum Results Business Solutions, we understand the challenges of managing finances on a shoestring.

Affordable bookkeeping services are not just a luxury; they’re a necessity for maintaining financial health and compliance. This post explores cost-effective solutions that can help small businesses stay on top of their finances without breaking the bank.

Why Bookkeeping Matters for Small Businesses

Bookkeeping forms the foundation of financial success for small businesses. It’s not just about record-keeping; it’s about making informed decisions that fuel growth.

Empowering Financial Decision-Making

Accurate bookkeeping provides a clear picture of your business’s financial health. It allows you to track income, expenses, and profitability in real-time. This visibility proves essential for strategic decisions. A study by the Small Business Administration found that businesses with organized financial records are 30% more likely to secure funding.

Streamlining Tax Compliance

Tax season doesn’t have to be stressful. Regular bookkeeping simplifies tax preparation and ensures compliance. The IRS reports that small businesses often overpay taxes due to poor record-keeping. Maintaining organized books helps you identify all possible deductions and credits (potentially saving thousands of dollars annually).

Mastering Cash Flow

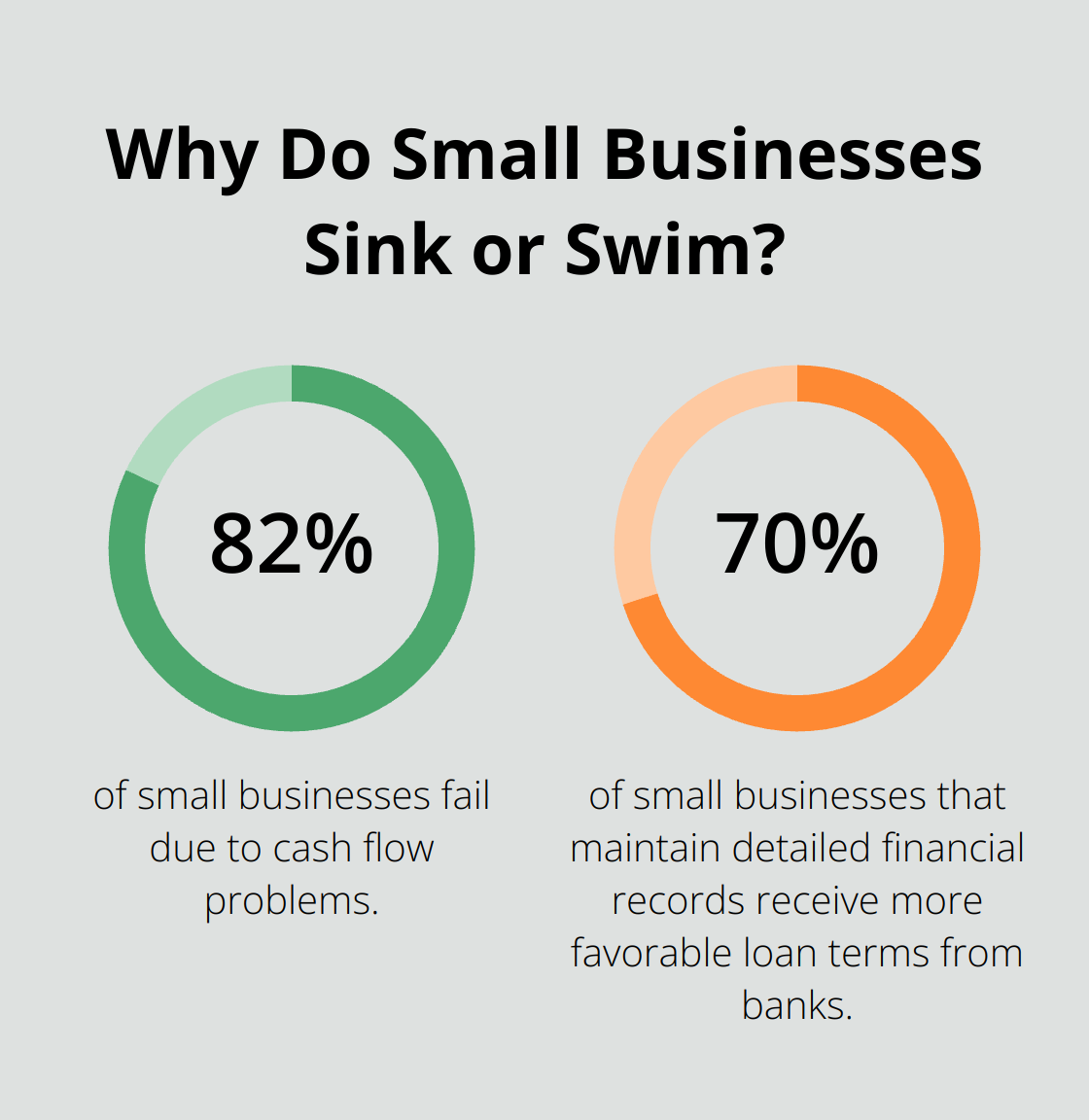

Cash flow powers any business. Effective bookkeeping helps you monitor and manage it efficiently. According to SCORE, 82% of small businesses fail due to cash flow problems. Proper bookkeeping allows you to forecast cash flow, anticipate shortfalls, and make timely adjustments to keep your business thriving.

Building Credibility with Stakeholders

Accurate financial records prove essential when dealing with investors, lenders, or potential buyers. They demonstrate your business’s financial stability and growth potential. According to a survey by Intuit, 70% of small businesses that maintain detailed financial records receive more favorable loan terms from banks.

The Power of Professional Support

While some businesses attempt DIY bookkeeping, professional services (like those offered by Optimum Results Business Solutions) can provide expert insights and save valuable time. These services ensure accuracy, compliance, and strategic financial management tailored to your specific business needs.

As we explore cost-effective bookkeeping solutions in the next section, you’ll discover how to harness the power of proper financial management without straining your budget.

Cost-Effective Bookkeeping Solutions for Small Businesses

Small businesses don’t need to sacrifice quality financial management due to budget constraints. Several affordable options exist that balance expertise with cost-effectiveness.

DIY Bookkeeping with Software Tools

Software tools offer an economical starting point for businesses new to bookkeeping. QuickBooks Online and Xero provide user-friendly interfaces and essential features at reasonable prices. A Clutch survey found that 45% of small business owners use accounting software to manage their finances. This approach requires time to learn the software and maintain consistent data entry (which can be challenging for busy entrepreneurs).

Virtual Bookkeepers: Expertise Without Overhead

Virtual bookkeeping offers cost-effective, efficient, and flexible options without the cost of in-house staff. These remote professionals handle tasks like transaction categorization, reconciliations, and financial reporting. This option provides flexibility and scalability as your business grows.

Outsourcing to Professional Services

Professional bookkeeping services often prove more cost-effective than many business owners expect. A Deloitte report found that 59% of businesses cited cost reduction as a primary reason for outsourcing. Professional services provide expertise, advanced tools, and scalable solutions that adapt to your business needs. This approach frees up valuable time for core business activities while ensuring financial accuracy.

Automated Bookkeeping Systems

AI’s impact on efficiency and cost reduction in operations, sales, customer service, and accounting is revolutionizing financial management for small businesses. These systems use artificial intelligence and machine learning to categorize transactions, reconcile accounts, and generate reports with minimal human intervention. The initial setup may require an investment, but long-term savings in time and resources can be substantial.

Choosing the Right Solution

The ideal bookkeeping solution depends on your business’s specific needs, budget, and growth stage. Consider factors like transaction volume, industry-specific requirements, and your comfort level with financial management. Professional services like Optimum Results Business Solutions offer customized solutions that grow with your business, ensuring you receive the right level of support at every stage.

As you evaluate these cost-effective options, it’s important to understand how to maximize the value of your chosen bookkeeping solution. The next section will explore strategies to get the most out of affordable bookkeeping services, regardless of which approach you select.

How to Maximize Value from Affordable Bookkeeping Services

Prioritize Essential Financial Tasks

Small businesses must identify and focus on the most critical financial activities. These typically include accurate income and expense tracking, timely invoicing, and regular bank reconciliations. A Wasp Barcode Technologies survey revealed that 60% of small business owners lack confidence in their accounting and finance knowledge. Concentrating on these core tasks will establish a solid financial foundation without overwhelming you with less important details.

Leverage Technology for Enhanced Efficiency

The right technology can significantly increase the efficiency of your bookkeeping processes. Cloud-based accounting software (such as QuickBooks Online or Xero) automates many routine tasks. A Sage study found that businesses using cloud accounting software reduce time spent on administrative tasks by 15%. Look for features that streamline your workflow, including automatic bank feeds, recurring invoice creation, and expense categorization.

Schedule Regular Financial Reviews

Don’t wait for tax season or a financial crisis to examine your books. Set up monthly reviews of your profit and loss statement, balance sheet, and cash flow. These regular check-ups will help you identify trends, spot potential problems, and make informed decisions about your business’s financial health. According to a U.S. Bank study, 82% of businesses that fail do so because of cash flow problems, underscoring the importance of frequent financial oversight.

Bundle Services for Cost Savings

Many bookkeeping service providers offer package deals that can reduce your overall expenses. For example, combining bookkeeping with tax preparation services often costs less than purchasing these services separately. Comprehensive packages tailored to small business needs ensure you receive all necessary financial support without paying for unnecessary extras.

Invest Time in Financial Education

While outsourcing your bookkeeping, allocate some time to understand basic financial concepts. The Small Business Administration offers free online courses on financial management. This knowledge will improve your use of bookkeeping services and enhance communication with your financial advisors. (It’s an investment that pays dividends in better financial decision-making.)

Final Thoughts

Affordable bookkeeping services offer more than cost savings; they provide a strategic investment in your business’s future. Small businesses can choose from DIY software solutions, virtual bookkeepers, or professional outsourcing to maintain financial health without overspending. These options empower informed decision-making, ensure tax compliance, manage cash flow effectively, and build credibility with stakeholders.

Don’t let budget constraints prevent you from accessing quality bookkeeping support. Optimum Results Business Solutions specializes in expert bookkeeping and accounting services for small service-based businesses and tech startups. Our customized solutions and QuickBooks Online ProAdvisor support can streamline your financial processes and provide valuable insights for growth.

Take action today to secure your business’s financial future. Implementing a solid bookkeeping system is an essential step towards achieving your business goals (regardless of whether you start with basic software tools or partner with a professional service). Affordable bookkeeping services can transform financial management from a challenging task into a powerful tool for success.