At Optimum Results Business Solutions, we understand that navigating bookkeeping service rates can be challenging for businesses of all sizes.

This blog post will break down the factors influencing these rates, explore common pricing models, and provide insights into average costs across different business scales.

We’ll also share valuable tips to help you choose the right bookkeeping service that aligns with your budget and needs.

What Drives Bookkeeping Service Rates?

Bookkeeping service rates vary widely, influenced by several key factors. Understanding these can help you budget effectively and choose the right service for your business needs.

Business Complexity and Size

The size and complexity of your business significantly impact bookkeeping costs. A small startup with straightforward finances will typically pay less than a large corporation with multiple revenue streams and complex financial structures. For example, a sole proprietorship might pay around $300 monthly for basic bookkeeping, while a medium-sized business could expect to pay $1,000 or more.

Transaction Volume

The number of financial transactions your business processes each month is a major cost driver. More transactions mean more work for bookkeepers, leading to higher fees. A business with 100 monthly transactions might pay half as much as one with 500 transactions. Some bookkeeping services use transaction volume as a basis for tiered pricing structures (e.g., a flat $39 monthly fee for up to 30 transactions and only $0.95 for additional transactions).

Industry-Specific Requirements

Certain industries have unique bookkeeping needs that can affect pricing. Construction companies often require job costing, while e-commerce businesses need inventory tracking. These specialized services can increase costs.

Service Level and Expertise

The level of service you require also impacts costs. Basic bookkeeping services (such as data entry and bank reconciliation) cost less than advanced services like financial analysis or tax preparation. If you need a bookkeeper with specialized expertise, such as familiarity with specific software or industry regulations, expect to pay more.

Technology and Software

The technology and software used by bookkeeping services can influence rates. Cloud-based accounting platforms (like QuickBooks Online) often streamline processes, potentially reducing costs. However, some advanced software solutions might increase fees due to licensing costs or specialized training required for their use.

As we move forward, let’s explore the common pricing models used by bookkeeping services to help you understand how these factors translate into actual costs for your business. For virtual bookkeeping services, pricing can vary based on the specific services included and the needs of your business.

How Bookkeeping Services Price Their Work

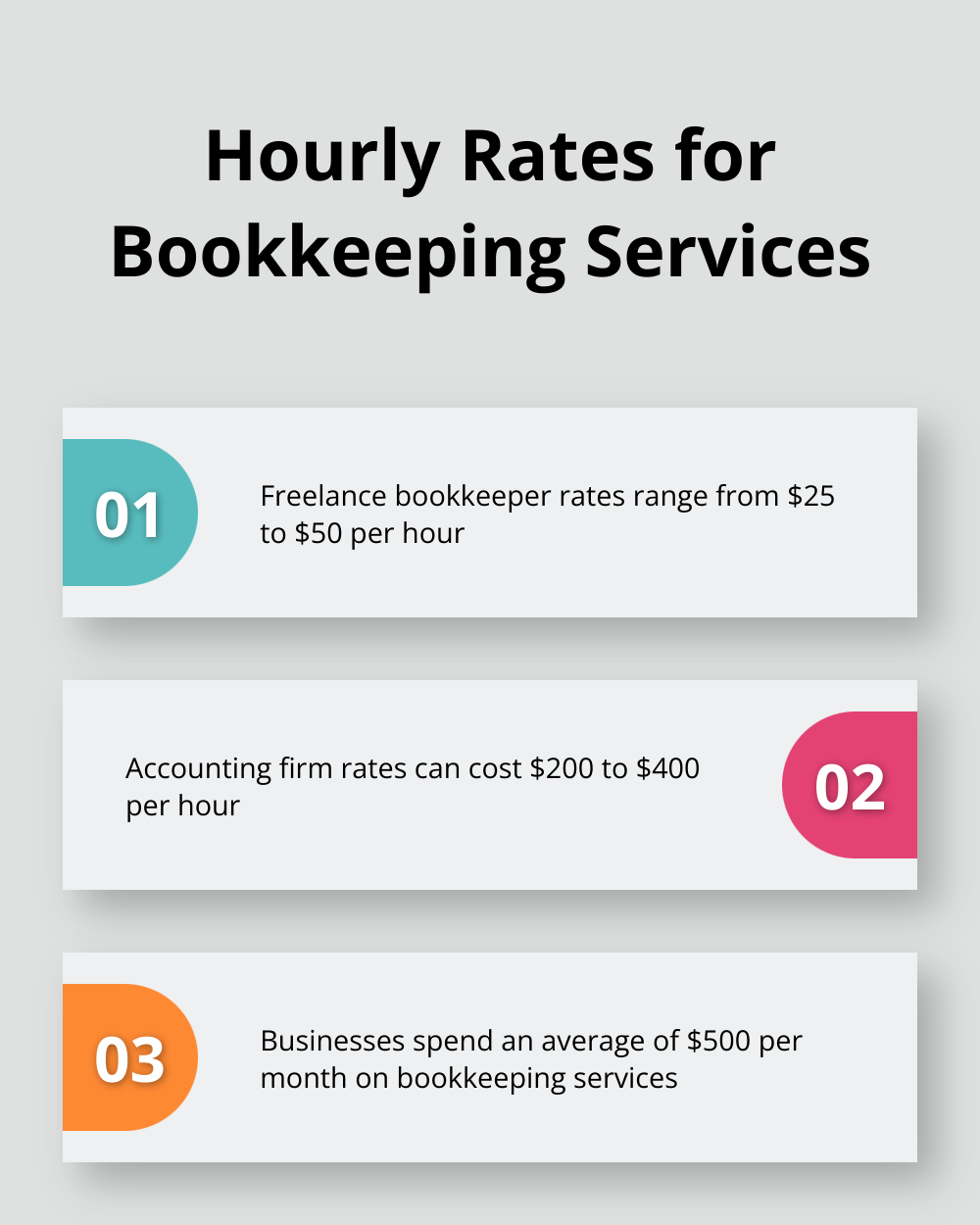

Hourly Rates: Flexibility with a Catch

Many bookkeepers charge by the hour, with rates typically ranging from $30 to $90. This model works well for businesses with fluctuating workloads. However, it can lead to unpredictable monthly costs. Hourly rates often result in higher overall costs for clients compared to other pricing models.

Fixed Monthly Fees: Predictability for Your Budget

Fixed monthly fees have gained popularity among bookkeeping services. This model offers predictable costs, which makes budgeting easier for businesses. Prices usually range from $500 to $2,500 per month, depending on the complexity of your finances and the services included. A small service-based business might pay around $800 monthly for comprehensive bookkeeping, while a tech startup with more complex needs could expect to pay closer to $2,000.

Per-Transaction Pricing: Pay for What You Use

Some bookkeepers charge based on the number of transactions processed. This model can be cost-effective for businesses with low transaction volumes. Typical rates range from $0.50 to $2.50 per transaction. However, costs can quickly escalate for high-volume businesses. Businesses have saved up to 30% by switching from per-transaction to fixed monthly fees.

Tiered Pricing: Scalable Solutions

Tiered pricing structures offer different service levels at set price points. This model allows businesses to choose a package that fits their needs and budget, with the flexibility to upgrade as they grow. For instance, a basic tier might cost $300 monthly for up to 100 transactions, while a premium tier at $1,500 could include unlimited transactions and additional services (like financial reporting and tax preparation).

When you select a pricing model, consider your business’s specific needs, growth projections, and budget constraints. Don’t hesitate to ask potential bookkeeping services about their pricing structures and how they align with your financial goals. The cheapest option isn’t always the best value – try to find a service that offers the right balance of cost and quality for your business.

Now that we’ve explored various pricing models, let’s examine the average rates you can expect to pay for bookkeeping services based on your business size and industry.

What Are Average Bookkeeping Service Rates?

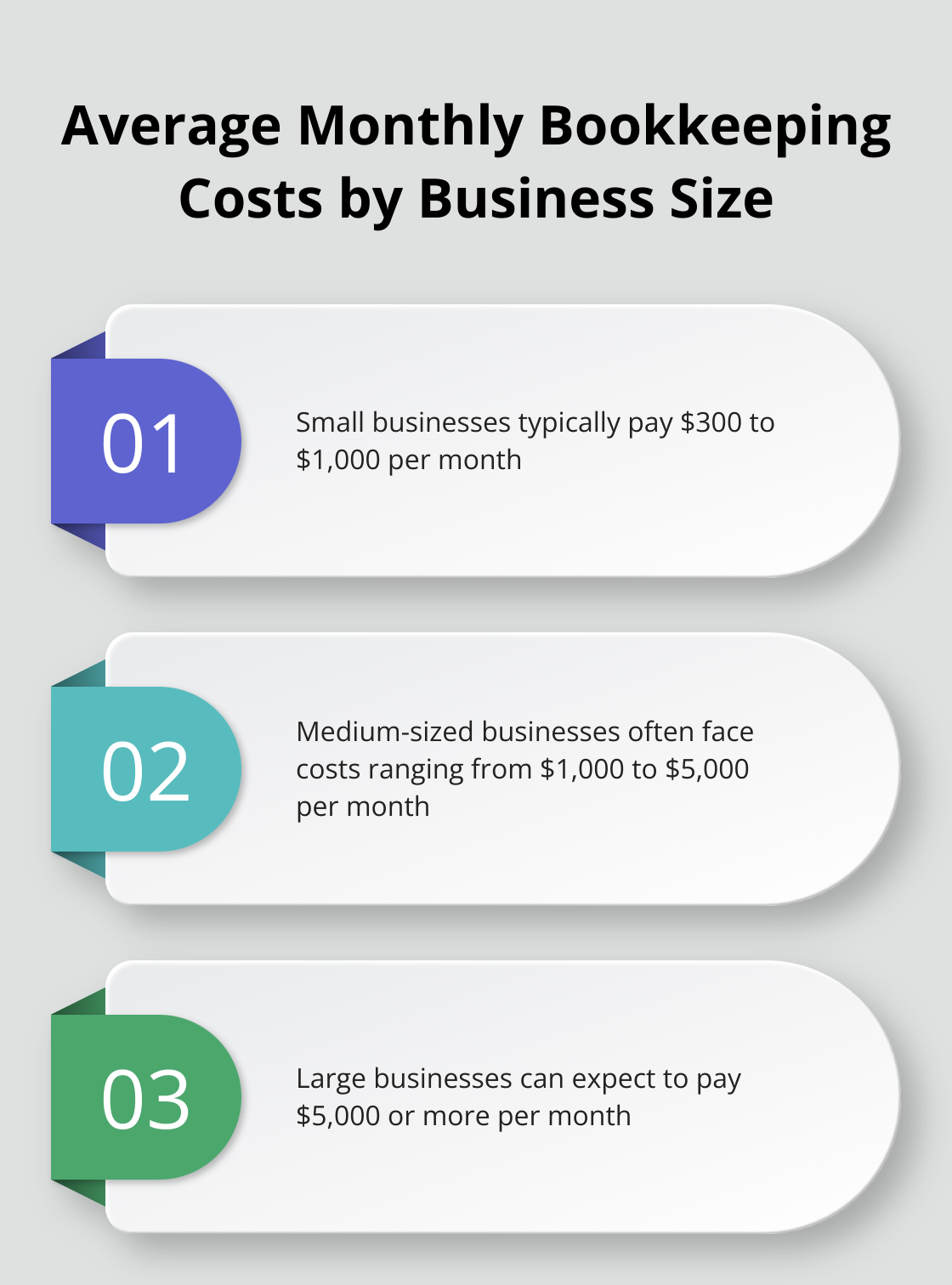

Small Business Rates

Small businesses typically pay between $300 to $1,000 per month for bookkeeping services. A survey by Clutch.co revealed that 27% of small businesses spend $500 or less per month on accounting services, while 31% spend between $501 and $1,000. A local coffee shop with 200 monthly transactions might pay around $400 for basic bookkeeping services.

Medium-Sized Business Rates

Medium-sized businesses often face monthly bookkeeping costs ranging from $1,000 to $5,000. A survey by Clutch.co revealed that 27% of small businesses spend $500 or less per month on accounting services, while 31% spend between $501 and $1,000. A growing e-commerce business with 1,000 monthly transactions and inventory tracking needs might pay $2,500 for comprehensive bookkeeping services.

Large Business Rates

Large businesses can expect to pay $5,000 or more per month for bookkeeping services. The complexity of their financial operations often requires a team of bookkeepers or a full-service accounting firm. A manufacturing company with multiple locations and international transactions might spend $10,000 or more monthly for advanced bookkeeping and financial management services.

Industry-Specific Rate Variations

Certain industries face higher bookkeeping costs due to specialized requirements. Construction companies often pay 20-30% more than average due to the need for job costing and progress billing. Non-profit organizations might see rates 15% lower than for-profit businesses but face additional compliance requirements.

Tech Startup Rates

Tech startups often require specialized bookkeeping services. These businesses might pay 10-20% more than traditional service-based companies due to the need for equity tracking and complex revenue recognition. Optimum Results Business Solutions specializes in providing expert bookkeeping services tailored to the unique needs of tech startups and small service-based businesses.

When you consider bookkeeping services, don’t focus solely on cost. The value provided through accurate financial records, timely reporting, and expert insights can far outweigh the expense. Always request detailed quotes and service breakdowns to ensure you get the best value for your investment in financial management. Generally speaking, a freelance bookkeeper can cost $25-$50 per hour, while going through an accounting firm may cost upwards of $200-$400 per hour. On average, businesses can expect to spend about $500 per month on bookkeeping services.

Final Thoughts

Bookkeeping services rates vary based on business size, transaction volume, and industry requirements. The cheapest option doesn’t always provide the best value. We recommend focusing on finding a provider that offers scalable solutions and adapts to your changing needs.

Optimum Results Business Solutions specializes in expert bookkeeping services for small service-based businesses and tech startups. Our team offers customized solutions, QuickBooks Online ProAdvisor support, and ensures compliance with regulations. We prioritize client compatibility and operational efficiency in our approach.

The right bookkeeping service manages your finances and provides valuable insights to drive your business forward. You can find a solution that fits your budget and supports your long-term success if you carefully consider your options. Focus on value rather than just cost when making your decision.