Construction bookkeeping is a complex field with unique challenges that set it apart from standard accounting practices.

At Optimum Results Business Solutions, we understand the intricacies of managing finances in the construction industry.

Our specialized construction bookkeeping services are designed to address the specific needs of contractors, builders, and construction companies.

This blog post will explore the key components and benefits of expert financial management in the construction sector.

Why Construction Bookkeeping Demands Specialized Attention

Construction bookkeeping presents unique challenges that set it apart from standard accounting practices. The project-based nature of the industry creates a web of financial intricacies that require specialized attention and expertise.

Project-Based Accounting: A Financial Puzzle

In construction, each project functions as its own mini-business. This structure necessitates the tracking of costs, revenues, and profits for multiple projects simultaneously. CFMA’s 2022 Annual Financial Survey provides critical benchmarking data and financial information about the construction industry, highlighting the importance of proper project-based accounting in the construction industry.

Job Costing: The Backbone of Construction Finance

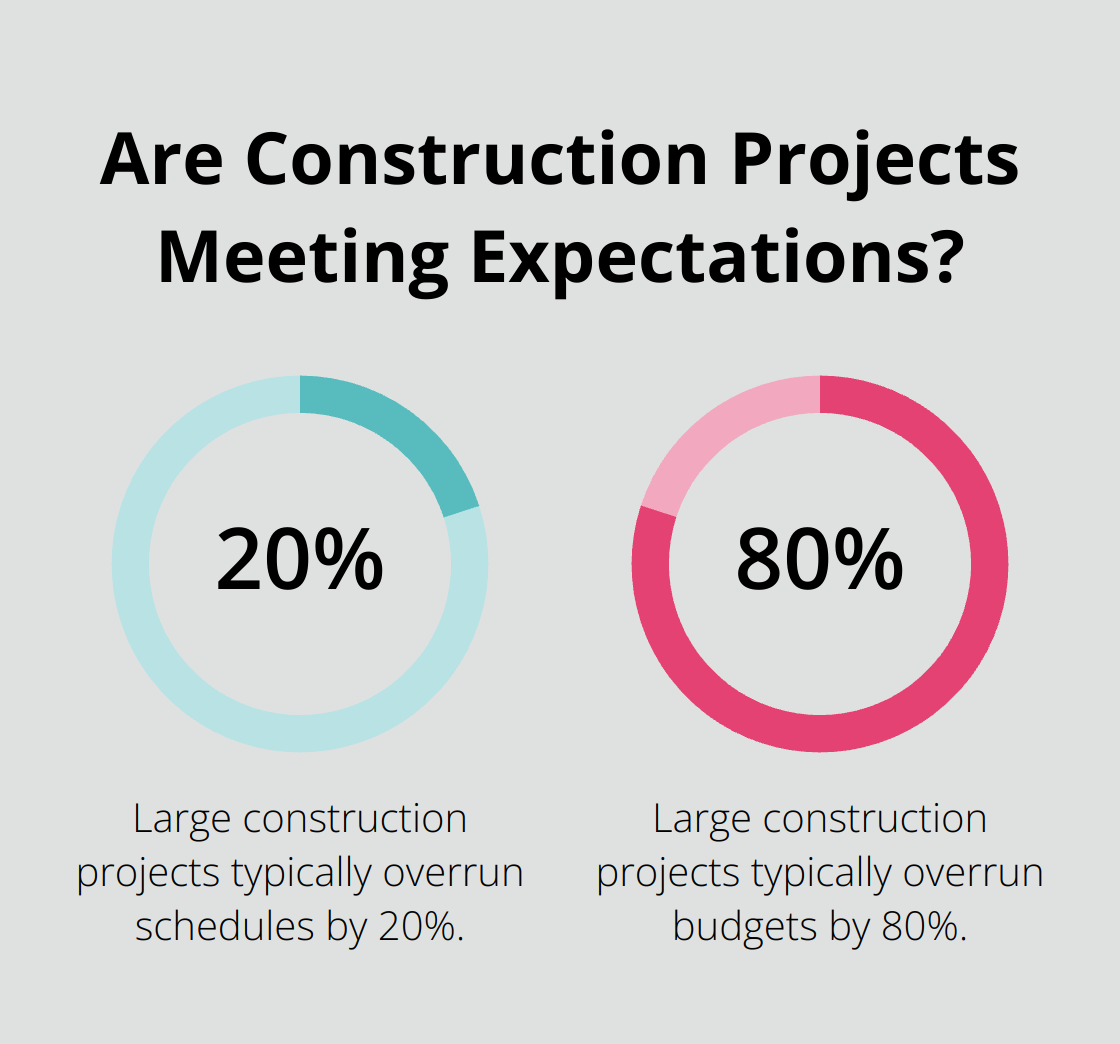

Job costing forms the foundation of construction bookkeeping. This process involves meticulous tracking of all expenses related to a specific project (including materials, labor, and overhead). McKinsey reported that large projects across asset classes typically overrun schedules by 20% and overrun budgets by 80%. Accurate job costing can significantly reduce this overrun. Advanced software solutions help ensure every expense is accounted for, which aids in maintaining profitability.

Cash Flow Management: Steering Through Choppy Waters

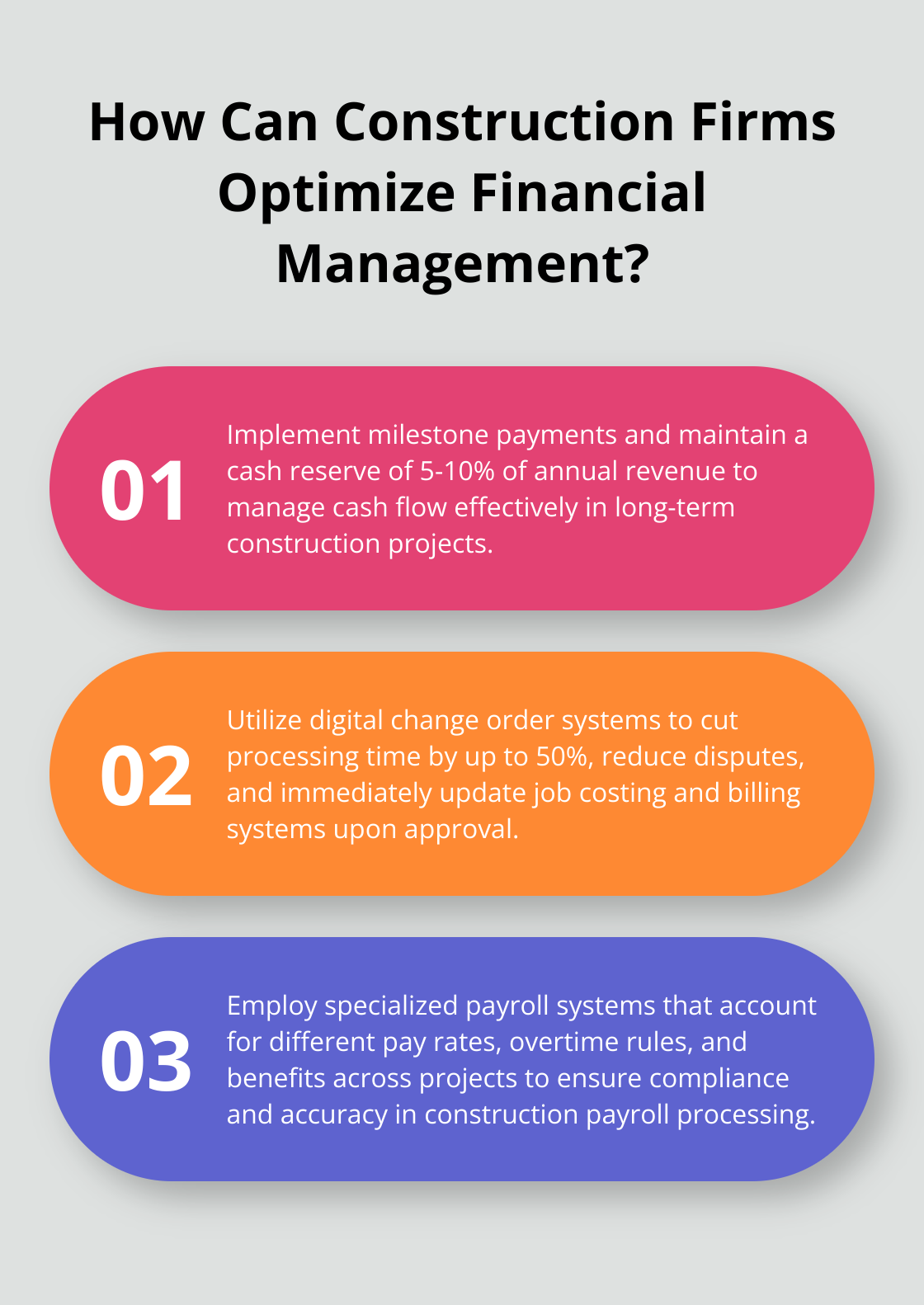

Cash flow management in construction resembles steering a large ship through turbulent seas. Long-term projects often demand substantial upfront investments before any revenue generation occurs. To mitigate cash flow issues, companies should implement milestone payments and maintain a cash reserve of at least 5-10% of their annual revenue.

Multiple Revenue Streams: A Financial Juggling Act

Construction companies often handle various revenue streams and payment schedules. From progress billings to retainage, each type of income requires different accounting treatments. These systems streamline financial operations and improve cash flow management.

The complexities of construction bookkeeping demand specialized knowledge and attention to detail. As we move forward, we’ll explore the key components that make up effective construction bookkeeping services and how they address these unique challenges.

Essential Elements of Construction Bookkeeping

Precision in Job Costing and Billing

Job costing accuracy determines construction profitability. Robust variance analysis systems experienced a 15% improvement in profitability. This process requires precise tracking of labor hours, material costs, and overhead expenses for each project. Progress billing, based on completed work phases, maintains steady cash flow. Specialized construction accounting software that integrates with project management tools enables real-time cost tracking and billing accuracy.

Effective Change Order Management

Change orders significantly impact project finances. The Construction Industry Institute focused on quantifying the cumulative impact that change orders have on overall project productivity. Effective management involves prompt documentation, cost estimation, and client approval processes. Digital change order systems can cut processing time by up to 50% and reduce disputes. Immediate updates to job costing and billing systems upon change order approval maintain financial accuracy.

Streamlined Subcontractor Payment Processes

Subcontractor management plays a critical role in construction bookkeeping. Late payments can cause project delays and legal issues. A structured payment schedule aligned with project milestones and clear communication channels prove essential. Automated payment systems reduce processing time and errors. Accurate tracking of retainage (typically 5-10% of the contract value) ensures proper cash flow management and contract compliance.

Strategic Asset Tracking

Equipment and asset tracking directly affects a construction company’s bottom line. A robust asset tracking system monitors depreciation, maintenance costs, and utilization rates. This data informs decisions on equipment purchases, rentals, or leases, optimizing capital expenditure. Regular equipment inventory audits prevent theft and unnecessary rentals, further reducing costs.

Specialized Payroll Processing

Construction payroll presents unique challenges due to varying job sites, union requirements, and prevailing wage regulations. Accurate time tracking across multiple projects and locations is paramount. Specialized payroll systems that account for different pay rates, overtime rules, and benefits across projects ensure compliance and accuracy. These systems also facilitate certified payroll reporting, often required for government contracts.

The implementation of these essential elements can transform a construction company’s financial management and project profitability. The next section will explore the tangible benefits that specialized construction bookkeeping services bring to the table, highlighting why expert assistance proves invaluable in navigating the complex financial landscape of the construction industry.

How Specialized Construction Bookkeeping Boosts Your Bottom Line

Specialized construction bookkeeping services offer numerous benefits that directly impact a company’s financial health and operational efficiency. These services transform construction businesses through tailored financial management.

Maximizing Project Profitability

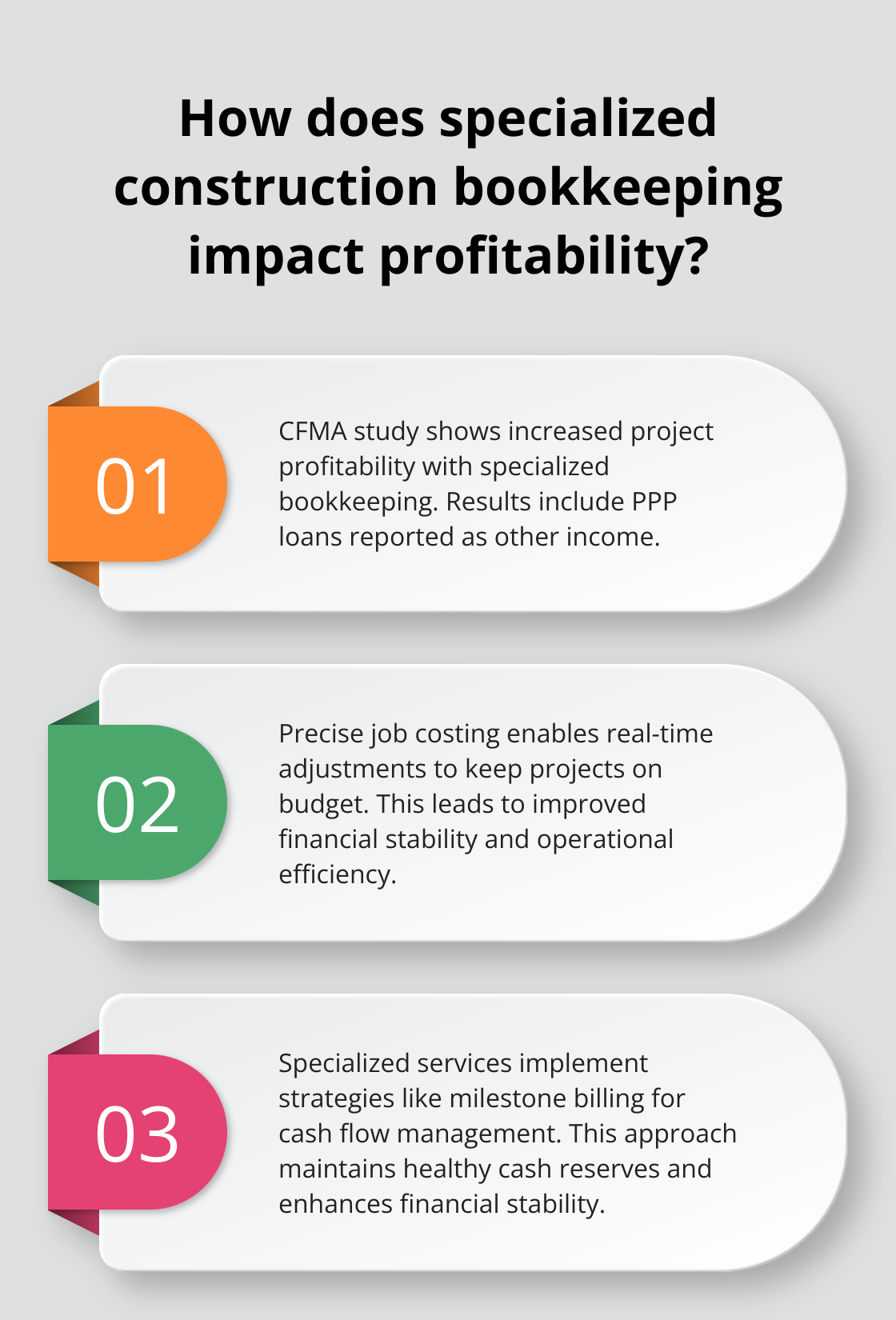

Accurate project profitability tracking forms the cornerstone of financial success in construction. The Construction Financial Management Association (CFMA) found that companies using specialized bookkeeping services increased their project profitability. The results of this study are inclusive of PPP loans, which are reported as other income, if forgiven or recognized using the grant approach accounting method. This boost results from precise job costing, which allows for real-time adjustments to keep projects on budget.

Navigating Cash Flow Challenges

Cash flow management is critical in an industry where expenses often precede revenue. Cash flow management is crucial for subcontractors, as highlighted by the importance of cash flow reporting. Specialized bookkeeping services implement strategies like milestone billing and retainage management to maintain healthy cash reserves. This approach can improve a company’s financial stability.

Data-Driven Decision Making

Real-time financial data changes the game for construction managers. Companies using current financial insights for decision-making can improve project management. This improvement stems from the ability to quickly reallocate resources, adjust schedules, and make informed bids based on up-to-date financial information.

Navigating Regulatory Complexities

Construction is heavily regulated, with compliance requirements varying by project type and location. Specialized bookkeeping services ensure adherence to regulations (such as certified payroll for government contracts and state-specific labor laws), which mitigates risks.

Streamlining Tax Processes

Tax preparation in construction is notoriously complex due to factors like multi-state operations and long-term contracts. Specialized bookkeeping services can improve efficiency through ongoing tax planning and organized financial records. This efficiency not only saves time but also maximizes deductions and minimizes audit risks (a significant benefit for any construction business).

Final Thoughts

Construction bookkeeping demands specialized attention due to its unique challenges and complexities. The project-based nature of the industry, intricate job costing requirements, and fluctuating cash flows require expert financial management. Construction bookkeeping services enhance project profitability, improve cash flow management, and enable data-driven decisions that propel businesses forward.

Expert construction bookkeeping services provide invaluable benefits, from ensuring compliance with industry-specific regulations to streamlining tax preparation processes. These services save time and resources while minimizing financial risks and maximizing growth opportunities. Accurate financial data forms the foundation for successful project execution and overall business success in construction.

Construction businesses that seek to optimize their financial management and gain a competitive edge should consider professional assistance as a wise investment. Optimum Results Business Solutions offers expert construction bookkeeping services tailored to the unique needs of the industry. Our team of QuickBooks Online ProAdvisors provides customized solutions, ensuring compliance with regulations while delivering accurate financial statements and valuable insights.