Online accounting and payroll administration programs have revolutionized how businesses manage their finances. These powerful tools streamline operations, reduce errors, and save valuable time.

At Optimum Results Business Solutions, we’ve seen firsthand how the right software can transform a company’s financial management. In this post, we’ll explore top accounting programs, essential payroll features, and tips for choosing the perfect solution for your business needs.

Top 5 Online Accounting Programs for Small Businesses

Small businesses need reliable, user-friendly accounting software to manage their finances effectively. We’ve evaluated numerous options and narrowed down the top five choices that offer the best features, value, and ease of use for small business owners.

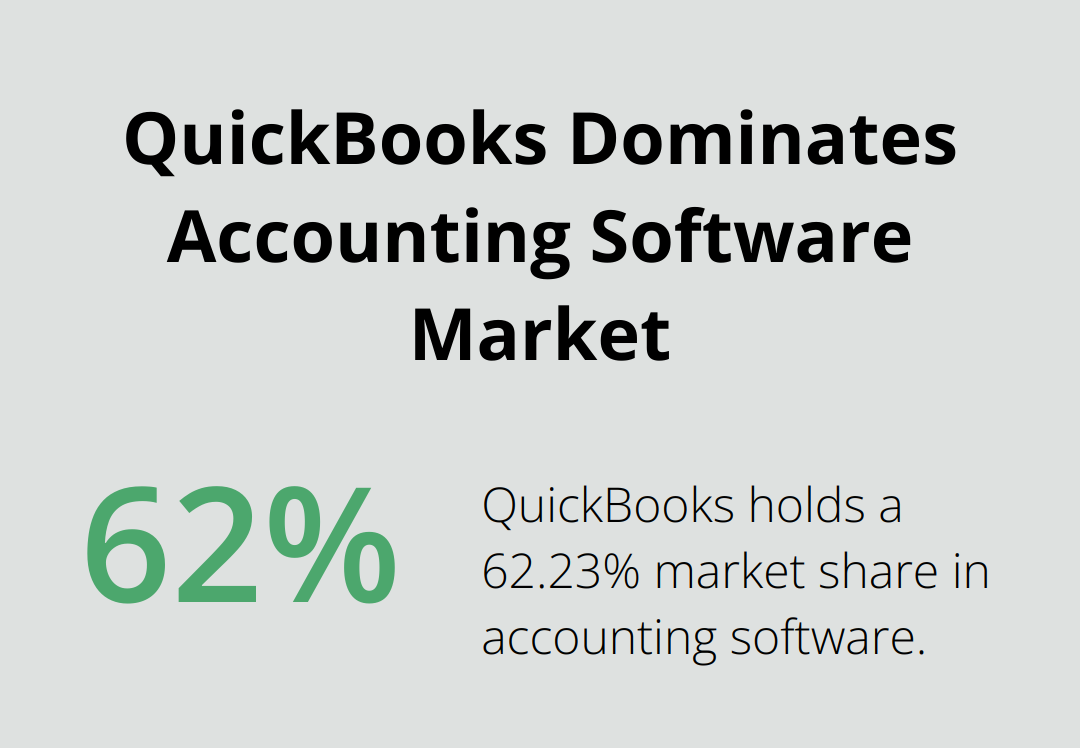

QuickBooks Online: The Industry Standard

QuickBooks Online leads the pack with its comprehensive features and widespread adoption. QuickBooks constitutes a 62.23% market share in accounting software, far beyond its competitors. Its intuitive interface, robust reporting capabilities, and extensive integration options make it a top choice for many small businesses. QuickBooks Online offers tiered pricing plans (starting at $30 per month for the Simple Start plan), which cater to businesses of various sizes and needs.

Xero: The Cloud-Based Contender

Xero has gained popularity as a strong alternative to QuickBooks Online. It offers unlimited users on all plans, which makes it an excellent choice for businesses with multiple team members needing access to financial data. Xero’s pricing starts at $12 per month for the Early plan, which includes basic features suitable for very small businesses or startups.

FreshBooks: Ideal for Service-Based Businesses

FreshBooks excels in its focus on service-based businesses and freelancers. Its time tracking and project management features prove particularly useful for businesses that bill by the hour. FreshBooks offers a Lite plan starting at $15 per month, which includes features like unlimited invoices and expense entries.

Wave Accounting: The Free Option

Wave Accounting stands out by offering its core accounting features completely free. This makes it an attractive option for very small businesses or startups operating on a tight budget. While the basic accounting and invoicing features come at no cost, Wave charges for payroll services and payment processing.

Zoho Books: Part of a Larger Ecosystem

Zoho Books is part of the larger Zoho suite of business applications, which makes it a good fit for businesses already using other Zoho products. It offers strong inventory management features and a user-friendly interface. Zoho Books’ pricing starts at $15 per month for the Basic plan, which includes features like bank reconciliation and custom invoices.

When selecting an online accounting program, consider factors such as your business size, industry, budget, and specific accounting needs. It’s also important to ensure the software integrates well with other tools you use, such as payroll systems or e-commerce platforms. Most small businesses spend between $300 to $2,000 per month on virtual bookkeeping services.

Now that we’ve explored the top accounting programs, let’s move on to the essential features you should look for in payroll administration software.

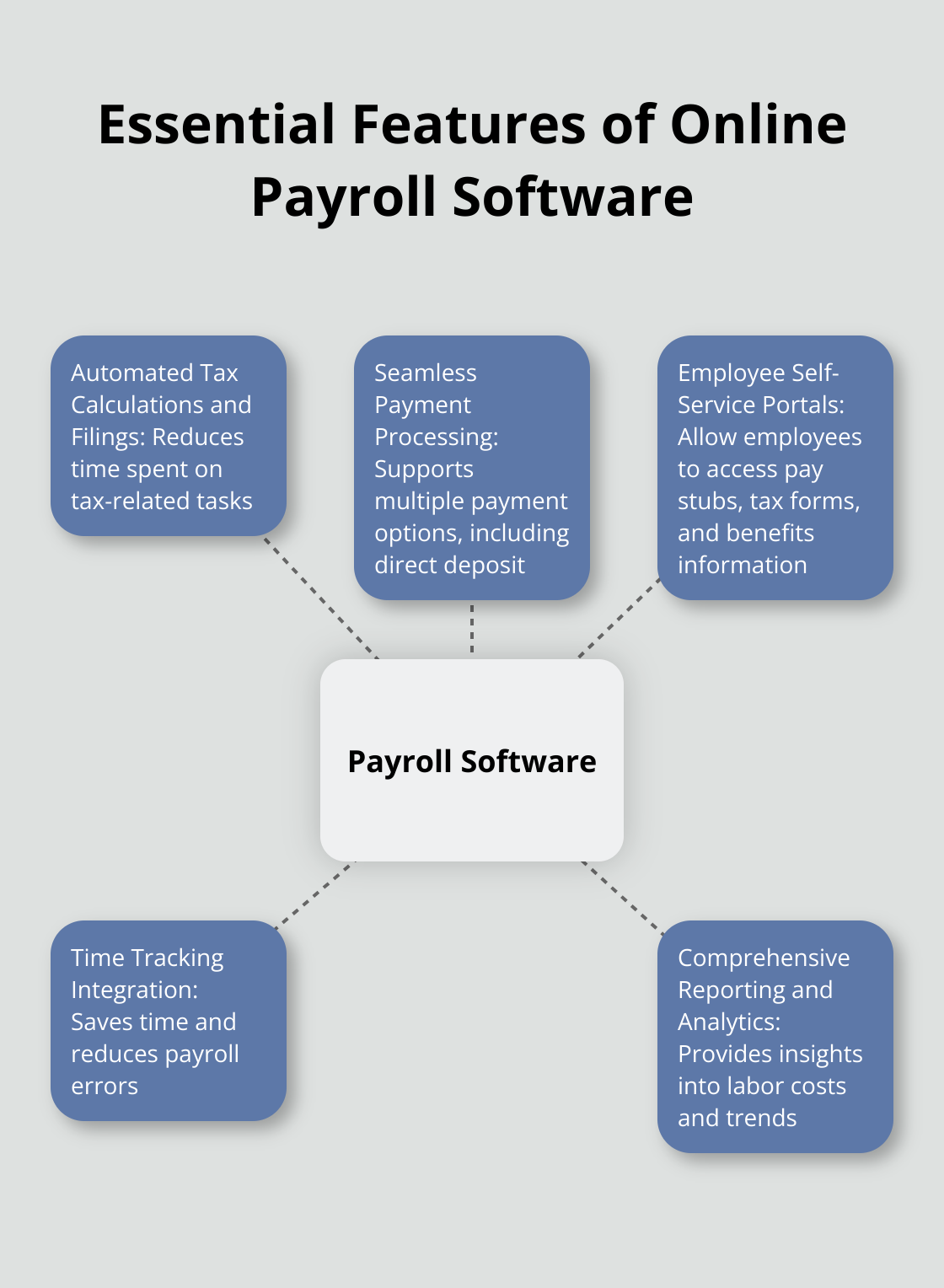

Essential Features of Online Payroll Administration Software

Online payroll administration software has become indispensable for businesses of all sizes. The right payroll software can dramatically streamline operations and reduce errors. Let’s explore the key features that make these tools essential for modern businesses.

Automated Tax Calculations and Filings

One of the most valuable features of payroll software is its ability to automate tax calculations and filings. Full-service payroll with automated federal, state, and local tax filings can significantly reduce the time spent on tax-related tasks. Some software even offers unlimited payroll runs, providing flexibility for businesses of all sizes.

Seamless Payment Processing

Modern payroll systems offer multiple payment options, with direct deposit being the most popular. This method not only saves time but also reduces the risk of lost or stolen checks. Additionally, many systems now support alternative payment methods like pay cards or even cryptocurrency for more flexibility.

Employee Self-Service Portals

Employee self-service portals transform the way employers and employees interact. These portals allow employees to access their pay stubs, tax forms, and benefits information without involving HR staff. They reduce HR administrative tasks, improve efficiency, and empower employees to manage their own data.

Time Tracking Integration

Integrated time tracking features can save businesses significant time and reduce payroll errors. Look for software that offers mobile time tracking, geofencing for remote workers, and easy approval processes for managers.

Comprehensive Reporting and Analytics

Robust reporting and analytics tools are essential for making informed business decisions. Advanced payroll software provides insights into labor costs, overtime trends, and departmental spending. These reports can help identify areas for cost savings and improve overall financial planning.

The features discussed above form the backbone of effective payroll administration software. However, selecting the right software for your business involves more than just checking off a list of features. In the next section, we’ll discuss how to choose the perfect accounting and payroll software for your specific business needs.

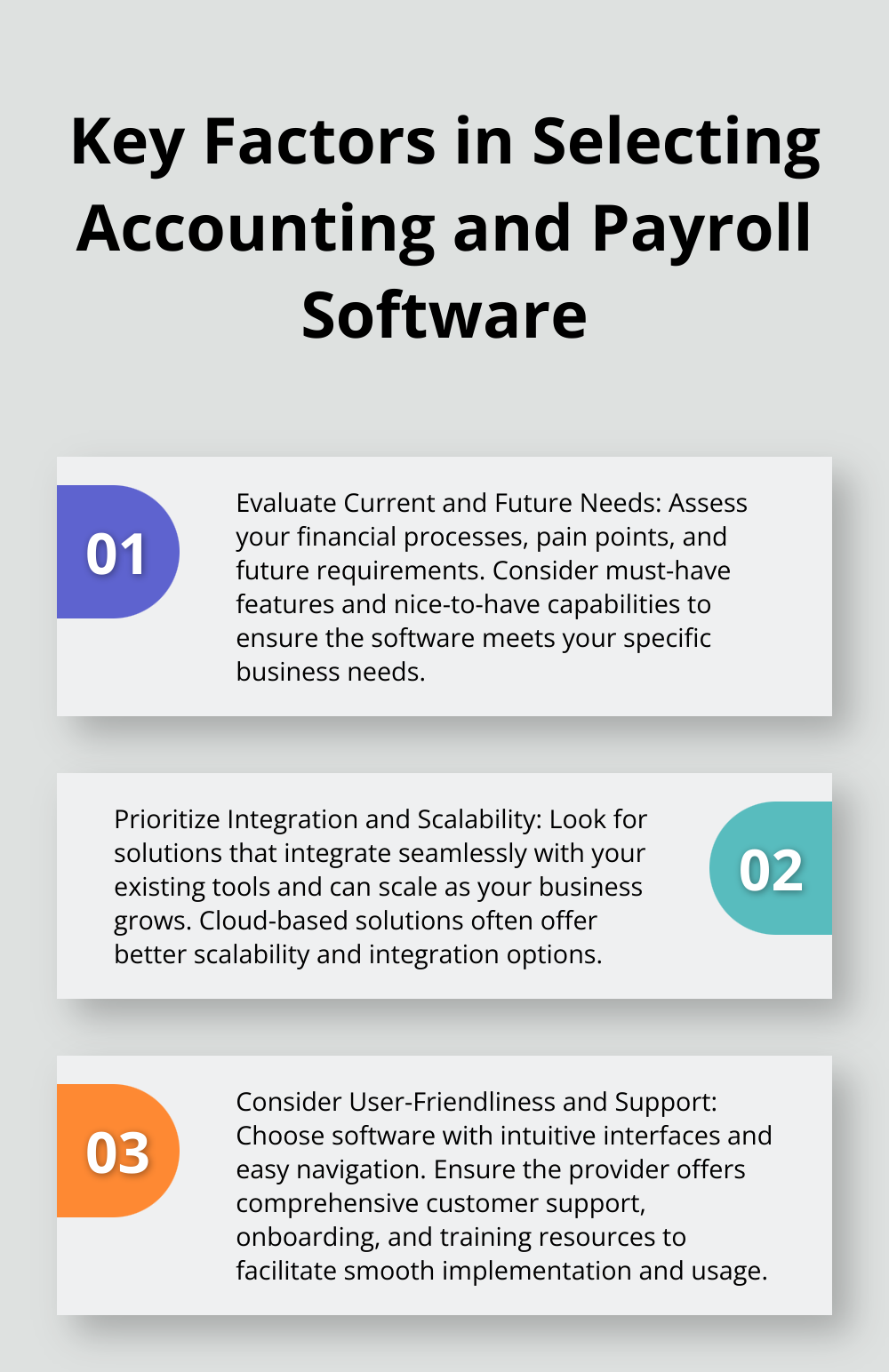

How to Select the Perfect Accounting and Payroll Software

Evaluate Your Current and Future Needs

Start by assessing your current financial processes and pain points. Do you struggle with manual data entry? Do you need better inventory management? Make a list of must-have features and nice-to-have capabilities. Consider your future needs as well. A study by Sage found that 67% of accountants prefer cloud solutions for their ability to scale with business growth.

Next, examine your budget. According to a survey by Software Path, small businesses spend an average of $175 per month on accounting software. However, costs can vary widely based on features and the number of users. Factor in potential savings from increased efficiency when considering price.

Prioritize Integration and Scalability

Your accounting and payroll software shouldn’t exist in a vacuum. Look for solutions that integrate seamlessly with your existing tools. If you use a specific CRM or e-commerce platform, ensure your chosen software can connect with these systems. This integration reduces data silos and improves overall efficiency.

Scalability is equally important. As your business grows, your software should handle increased transaction volumes and more complex financial operations. Cloud-based solutions often offer better scalability than on-premise options. A report by Finances Online shows that 67% of accountants believe cloud accounting increases their productivity.

Test User-Friendliness and Support

User-friendliness can make or break your software implementation. Look for intuitive interfaces and easy navigation. Many providers offer free trials – take advantage of these to test the software yourself. Involve key team members in the trial process to ensure the software meets everyone’s needs.

Don’t underestimate the importance of customer support. According to a study by SuperOffice, 78% of customers say that competent customer service representatives are key to a happy customer experience. Check the provider’s support hours, available channels (phone, email, chat), and response times. Look for providers offering comprehensive onboarding and training resources.

Consider Industry-Specific Features

Different industries have unique accounting and payroll needs. For instance, construction companies might need job costing features, while retailers require robust inventory management. Research industry-specific solutions or look for customizable options that can be tailored to your sector.

Prioritize Security and Compliance

In an era of increasing cyber threats and stringent data protection regulations, security should be a top priority. Look for software with strong encryption, regular security updates, and compliance with relevant standards (like GDPR or CCPA).

For payroll software, ensure it stays up-to-date with tax laws and labor regulations. Understand the different types of penalties, how to avoid getting a penalty, and what you need to do if you get one. Choosing software with automatic tax updates can help avoid costly mistakes.

The right accounting and payroll software can transform your financial management processes. Take the time to thoroughly evaluate your options, and don’t hesitate to seek expert advice if needed. The investment in finding the perfect solution will pay dividends in improved efficiency and accuracy for years to come. When exploring bookkeeping services, consider how they might complement or replace your software needs.

Final Thoughts

Online accounting and payroll administration programs transform financial management for businesses. These tools increase accuracy, improve efficiency, and save time by automating routine tasks and providing real-time financial insights. The right software aligns with specific needs, integrates with existing systems, and scales as businesses grow.

Optimum Results Business Solutions understands the complexities of implementing new accounting and payroll systems. Our team of experts can guide you through the selection process for the best accounting and payroll administration online program. We offer customized solutions, QuickBooks Online ProAdvisor support, and comprehensive services including payroll administration and sales tax management.

Optimum Results Business Solutions aims to streamline your financial processes, reduce costs, and provide valuable insights to drive your business forward. Our secure and confidential approach (combined with our expertise in serving small service-based businesses and tech startups) makes us an ideal partner for your financial management needs.