At Optimum Results Business Solutions, we understand the importance of effective financial management for businesses of all sizes.

Choosing the right bookkeeping method can significantly impact your company’s efficiency and financial health. This blog post explores different types of bookkeeping services available to businesses today.

We’ll examine traditional manual methods, computerized systems, and cloud-based solutions to help you make an informed decision for your organization.

Is Manual Bookkeeping Still Relevant?

The Basics of Manual Bookkeeping

Traditional manual bookkeeping involves the recording of financial transactions by hand in physical ledgers or journals. This method documents sales, purchases, receipts, and payments using a system of debits and credits. While it may appear outdated, manual bookkeeping provides a solid foundation for understanding basic accounting principles.

Advantages for Small Businesses

For very small businesses with simple financial structures, manual bookkeeping offers a cost-effective solution. It requires no software investment and can be implemented without extensive training. Some business owners find that the hands-on nature of manual bookkeeping gives them a more intimate understanding of their financial position.

Limitations and Risks

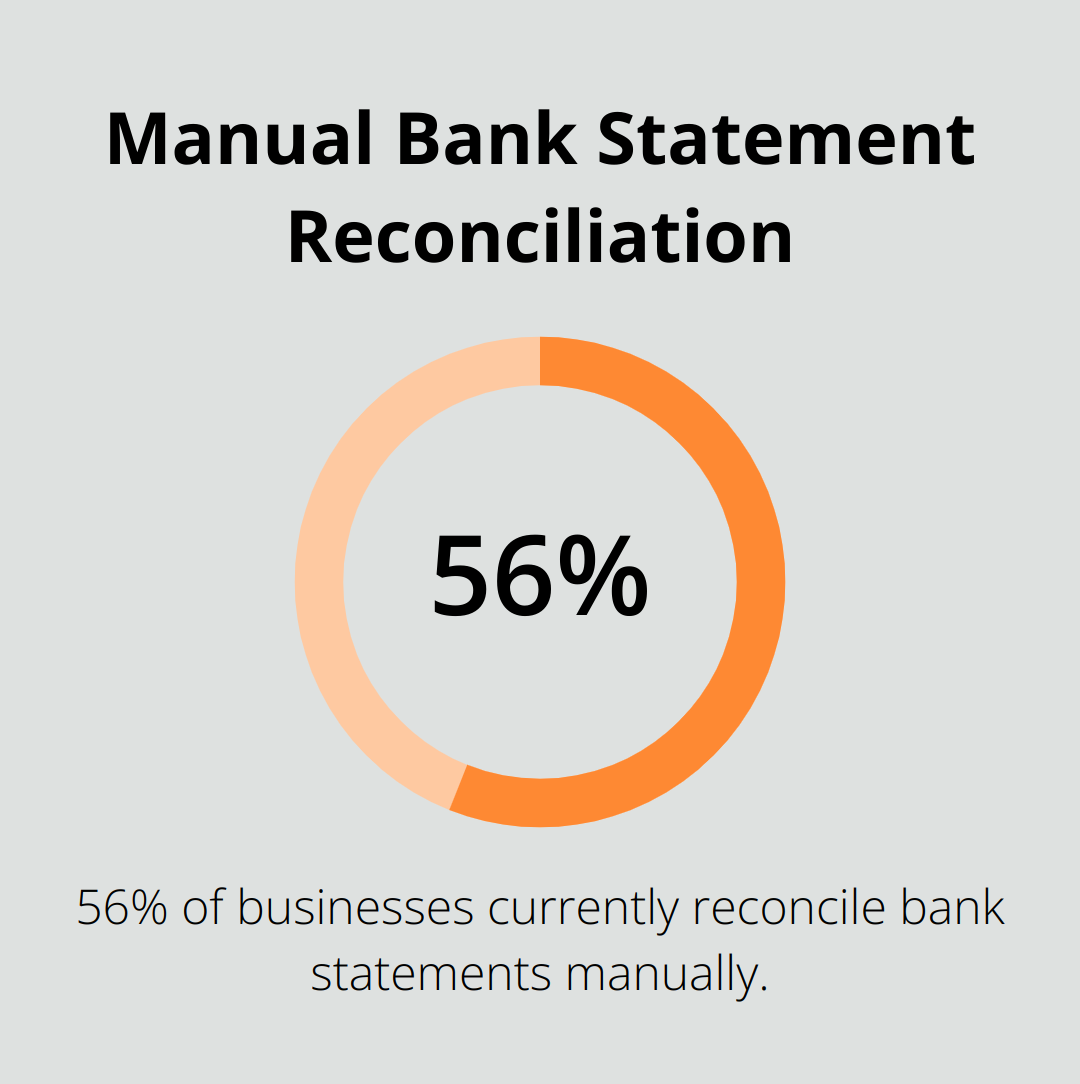

Manual bookkeeping consumes time and increases the risk of human error. As businesses grow, the volume of transactions can quickly become overwhelming, which leads to inaccuracies and delays in financial reporting. A survey found that 56% of businesses currently reconcile bank statements manually.

Suitable Business Types

Manual bookkeeping might suit businesses with fewer than 100 monthly transactions. Sole proprietorships, small service-based businesses, and some non-profits with simple financial structures could benefit from this approach. However, as transaction volumes increase (or financial complexity grows), a transition to computerized or cloud-based systems becomes necessary for efficiency and accuracy.

The Shift to Modern Solutions

Most businesses today benefit from more advanced solutions. Companies like Optimum Results Business Solutions help clients assess their needs and implement the most appropriate bookkeeping methods. This could include a modernized approach or a hybrid system that incorporates some manual elements alongside digital tools.

As we move forward, let’s explore the world of computerized bookkeeping and how it addresses many of the limitations of manual methods.

How Computerized Bookkeeping Transforms Business Finance

The Rise of Accounting Software

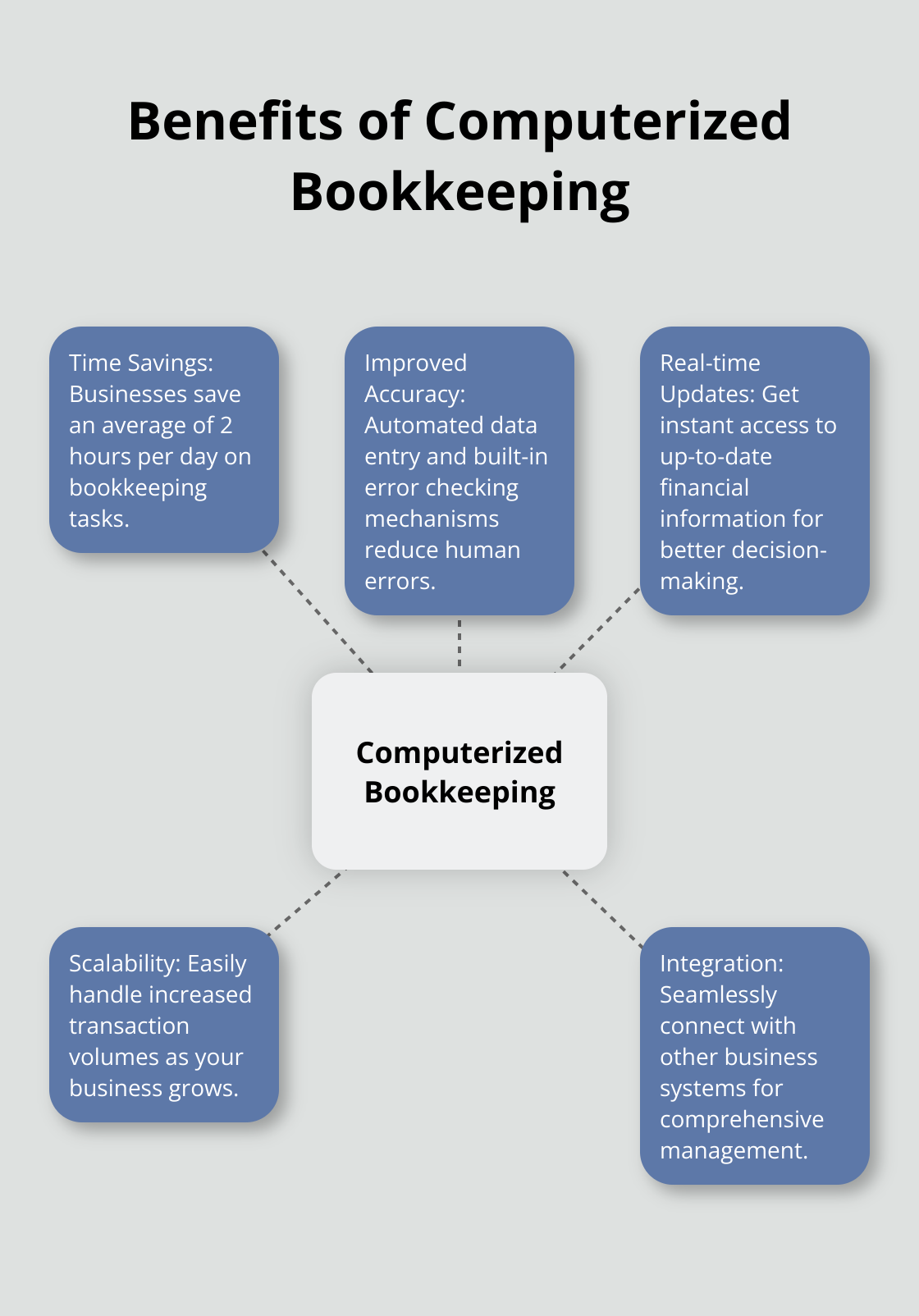

Computerized bookkeeping has revolutionized financial management for businesses of all sizes. Modern accounting software like QuickBooks, Xero, and FreshBooks have become indispensable tools, automating many time-consuming tasks. These platforms reduce the risk of human error and free up valuable time for strategic financial analysis. A recent study by Sage found that businesses using accounting software save an average of 2 hours per day on bookkeeping tasks.

Improved Accuracy and Efficiency

Digital record-keeping offers numerous benefits that manual methods can’t match. Automated data entry, real-time financial updates, and built-in error checking mechanisms significantly improve accuracy. A survey by FloQast found that accountants play a critical role in motivating, determining, and implementing new solutions that modernize financial processes.

Computerized systems also enable faster processing of large volumes of transactions. This speed proves essential for growing businesses – as transaction volume increases, the bookkeeping system scales effortlessly without a proportional increase in time or resources.

Seamless Integration for Comprehensive Business Management

One of the most powerful aspects of computerized bookkeeping is its ability to integrate with other business systems. This integration creates a cohesive ecosystem where financial data flows seamlessly between different departments and processes.

Many accounting software platforms connect directly with point-of-sale systems, inventory management tools, and customer relationship management (CRM) software. This interconnectedness provides a holistic view of business operations, enabling more informed decision-making.

Accenture announced changes to its growth model and leadership, effective September 1, 2025. This underscores the ongoing evolution in business strategies and technologies.

Choosing the Right System

While computerized bookkeeping offers numerous advantages, it’s important to choose a system that aligns with specific business needs. Factors to consider include:

- Business size and complexity

- Industry-specific requirements

- Budget constraints

- Scalability for future growth

- Integration capabilities with existing systems

Professional guidance (from experts like those at Optimum Results Business Solutions) can help businesses identify and implement the most suitable software solutions effectively.

As technology continues to evolve, the next frontier in financial management emerges: cloud-based bookkeeping services. These solutions offer even greater flexibility and accessibility, further transforming how businesses manage their finances.

How Cloud Bookkeeping Revolutionizes Financial Management

Real-Time Financial Insights at Your Fingertips

Cloud-based bookkeeping services transform how businesses manage their finances. This innovative approach uses internet-connected servers to store and process financial data, offering unprecedented accessibility and flexibility.

Cloud bookkeeping provides instant access to up-to-date financial information from anywhere with an internet connection. This real-time visibility empowers business owners to make informed decisions quickly.

A sales team on the road can instantly check customer payment status, while managers can monitor cash flow in real-time. This immediacy of information significantly improves financial decision-making and operational efficiency.

Enhanced Collaboration and Productivity

Cloud-based systems facilitate seamless collaboration between team members, accountants, and financial advisors. Multiple users can work on the same set of financial records simultaneously, which eliminates version control issues and reduces the need for time-consuming data transfers.

Robust Security Measures

While some businesses initially hesitated to adopt cloud-based solutions due to security concerns, modern cloud bookkeeping services employ advanced security measures that often surpass those of traditional on-premise systems.

Cloud providers implement multiple layers of security, including:

- Data encryption during transmission and storage

- Regular security audits and updates

- Multi-factor authentication

- Automated backups to prevent data loss

However, businesses should choose reputable providers and implement proper access controls to maximize security benefits.

Scalability and Cost-Effectiveness

Cloud-based bookkeeping solutions offer scalability that traditional methods can’t match. As your business grows, the system can easily accommodate increased transaction volumes and more complex financial operations without significant additional investment.

These solutions often operate on a subscription model, which can prove more cost-effective than purchasing and maintaining on-premise software. This model also ensures that businesses always have access to the latest features and updates without the need for manual upgrades.

Final Thoughts

Different types of bookkeeping services offer unique advantages for businesses. Manual methods suit some small enterprises, while computerized systems provide efficiency and accuracy for growing companies. Cloud-based solutions revolutionize financial management with real-time access and enhanced collaboration (features that modern businesses increasingly demand).

The selection of a bookkeeping method impacts daily operations and long-term success. Businesses must consider their size, industry, growth plans, and budget when choosing a system. The right solution streamlines processes, provides valuable insights, and supports strategic planning.

Optimum Results Business Solutions specializes in tailored bookkeeping solutions for small service-based businesses and tech startups. We implement customized systems that align with unique business needs, from QuickBooks Online support to comprehensive financial management. As technology evolves, businesses should reassess their financial management approach to maintain a competitive edge.