At Optimum Results Business Solutions, we understand that managing finances is a critical aspect of running a successful business.

The cost of bookkeeping and payroll services can vary significantly based on several factors.

In this post, we’ll break down the key elements that influence pricing and provide insights into average costs for these essential services.

What Drives Bookkeeping and Payroll Costs?

Business Complexity: A Key Factor

The size and complexity of your business significantly influence costs. Over eight out of 10 small businesses have no employees, reflecting a significant trend in the U.S. small business sector. This trend impacts the overall landscape of bookkeeping and payroll services for small businesses.

Transaction Volume Impacts Pricing

The number of financial transactions your business processes each month directly affects service costs. A retail store with hundreds of daily transactions will require more time and resources to manage than a consulting firm with a handful of monthly invoices. A survey by Clutch found that businesses with 0-100 monthly transactions pay $300-$400 per month for bookkeeping services. Those with 101-500 transactions pay $400-$800.

Industry-Specific Requirements Add Complexity

Certain industries have unique financial reporting and compliance needs that can increase costs. Healthcare providers must adhere to specific billing codes and insurance regulations. Construction companies often need job costing and progress billing. These specialized requirements often necessitate additional expertise and time, leading to higher service fees.

Service Frequency Affects Overall Costs

The frequency of bookkeeping and payroll services also plays a role in pricing. Monthly services are typically more cost-effective than quarterly or annual options. They allow for more consistent financial management and reduce the risk of errors. However, some businesses with low transaction volumes may find quarterly services sufficient and more budget-friendly.

Monthly services often result in long-term cost savings by preventing costly mistakes and providing better financial control. This approach ensures timely financial insights and smoother tax preparation for most businesses.

As we move forward, let’s examine the average costs for bookkeeping services and how they vary based on these factors. Understanding these costs will help you make informed decisions about the right level of service for your business.

What Are the Real Costs of Bookkeeping Services?

Hourly Rates for Bookkeepers

Bookkeeping costs vary widely based on business needs and service providers. Hourly rates for bookkeepers typically range from $30 to $90. These rates fluctuate based on experience, location, and specialization.

Monthly Flat-Rate Packages: A Popular Choice

Many businesses prefer monthly flat-rate packages for their predictability. These packages often start around $300 for basic services and can go up to $2,500 or more for comprehensive financial management. Accounting for small businesses is essential, covering aspects from bookkeeping tips to choosing the right software, allowing businesses to focus on what matters most.

In-House vs. Outsourced: Breaking Down the Costs

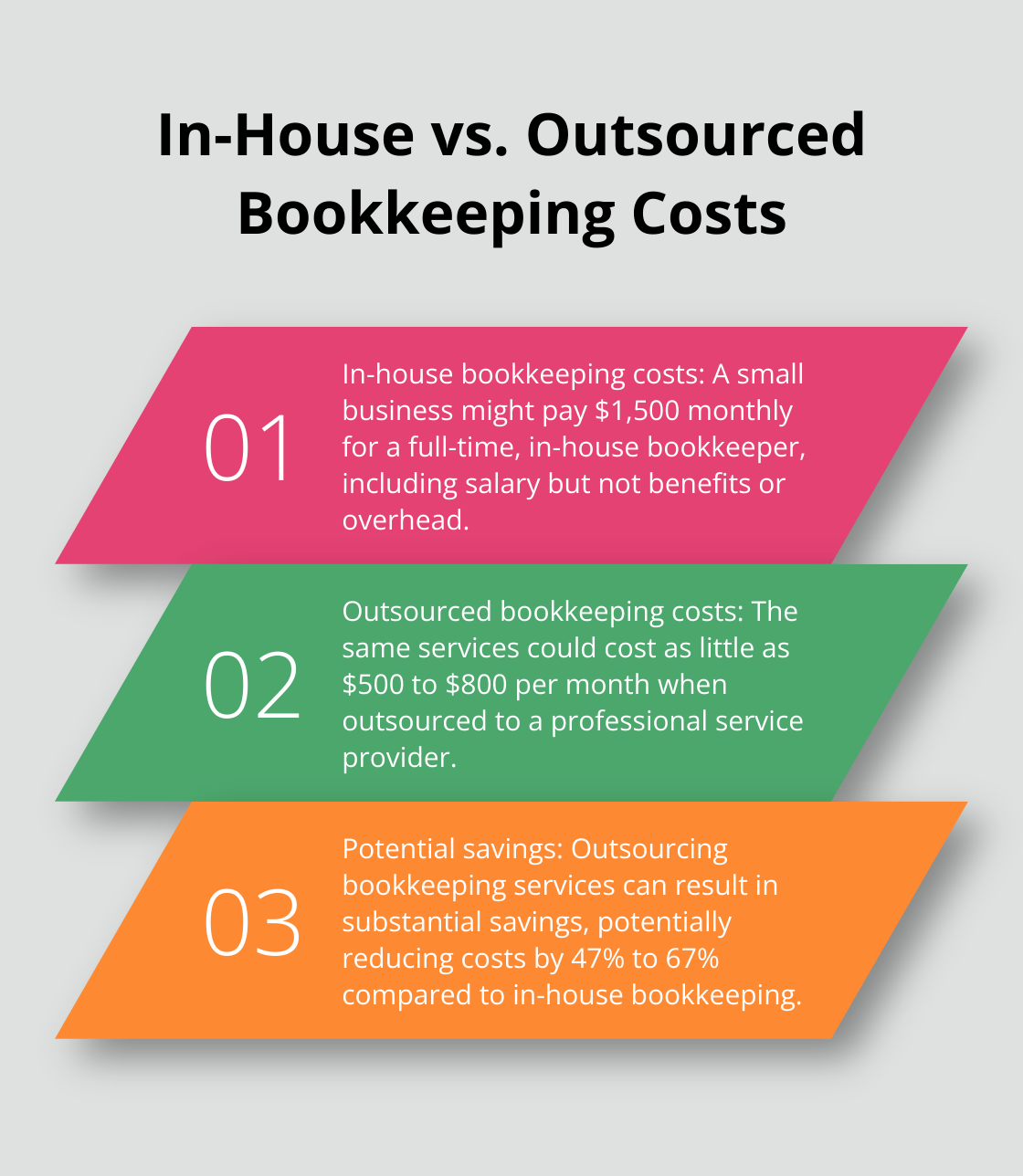

The decision between in-house and outsourced bookkeeping can significantly impact your bottom line. In-house bookkeepers typically cost $35,000 to $55,000 annually in salary alone (not including benefits and overhead). Outsourcing, on the other hand, can often provide the same level of service at a fraction of the cost.

For example, a small business might pay $1,500 monthly for a full-time, in-house bookkeeper. Outsourcing the same services could cost as little as $500 to $800 per month, resulting in substantial savings. This cost-effectiveness has led to an increase in demand for outsourced bookkeeping services.

Hidden Costs: Software and Technology Fees

When you budget for bookkeeping services, don’t forget to factor in software and technology fees. QuickBooks Online, a popular accounting software, ranges from $25 to $180 per month depending on the plan. Some service providers include software costs in their packages, while others charge separately.

The integration of advanced technology often leads to long-term cost savings. Automated data entry and cloud-based systems can reduce errors and increase efficiency, potentially lowering overall bookkeeping costs by 20% to 30%.

The cheapest option isn’t always the most cost-effective. Quality bookkeeping services provide valuable financial insights that can drive business growth and prevent costly mistakes. When you evaluate costs, consider the potential return on investment in terms of time saved, improved financial decision-making, and peace of mind.

Now that we’ve explored the costs associated with bookkeeping services, let’s turn our attention to the pricing models for payroll services, which often go hand-in-hand with bookkeeping for many businesses.

What Drives Payroll Service Pricing?

Payroll service pricing models reflect the diverse needs of businesses. Several key factors influence these costs.

Per-Employee Pricing: A Common Approach

Many payroll providers use a per-employee pricing model. This typically involves a base fee plus an additional charge for each employee. For instance, a company might charge a $50 base fee plus $5 per employee. This model benefits small businesses with stable employee counts, as it allows for predictable monthly costs.

CPAs charge around $100 per hour for complete payroll services and $109 per hour for bookkeeping. However, these rates can vary significantly based on location and service provider.

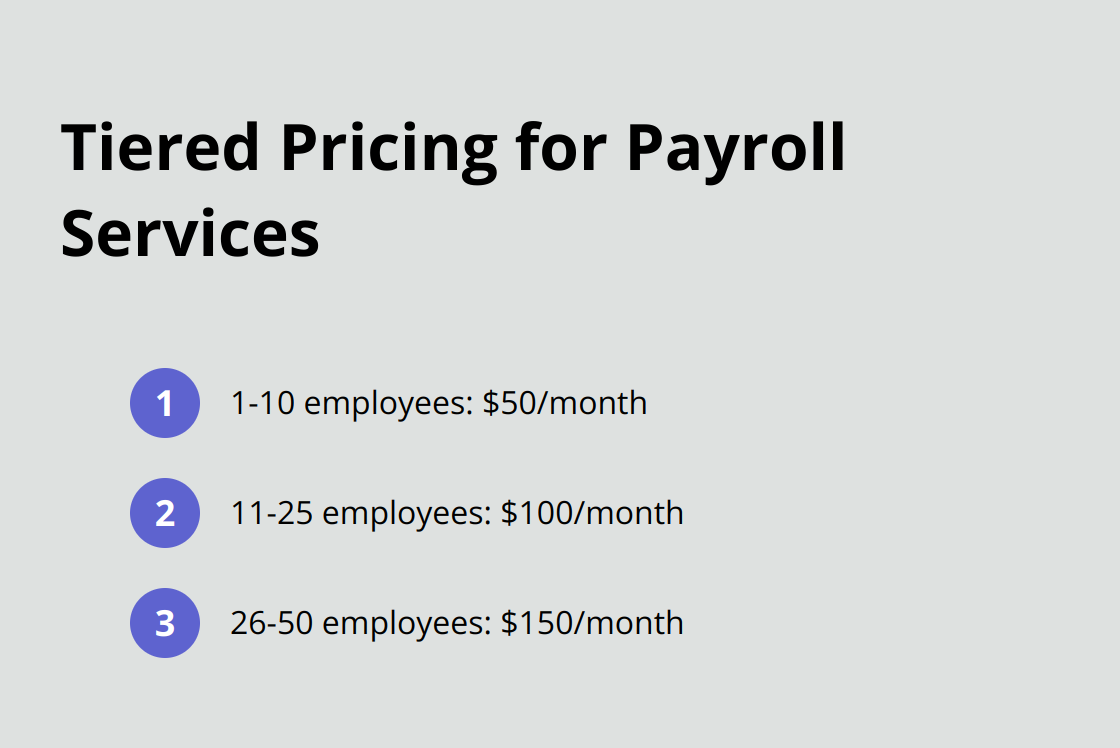

Tiered Pricing: Scaling with Your Business

Tiered pricing offers different service levels based on employee count. For example:

- 1-10 employees: $50/month

- 11-25 employees: $100/month

- 26-50 employees: $150/month

This model can prove cost-effective for businesses expecting growth, as it often includes more comprehensive services at higher tiers.

Additional Costs: Tax Filing and Reporting

Tax filing and reporting costs often come with additional fees (typically ranging from $50 to $200 per quarter). While this might seem like an extra expense, the compliance assurance often justifies the investment.

A study by the American Payroll Association shows that 40% of small businesses incur IRS penalties for payroll errors annually, averaging $845. Professional payroll services can significantly reduce this risk.

Frequency of Payroll Runs

The frequency of payroll runs affects costs. Bi-weekly payroll is the most common, used by 43% of U.S. businesses according to the Bureau of Labor Statistics. More frequent payroll runs generally incur higher costs.

Choosing the Right Service

When selecting a payroll service, look beyond the base price. Consider factors like customer support, integration with your accounting software, and the provider’s track record with tax compliance. While many providers offer comprehensive payroll services, we at Optimum Results Business Solutions always encourage businesses to compare options and choose a service that best fits their specific needs and budget.

Final Thoughts

The cost of bookkeeping and payroll services depends on various factors such as business complexity, transaction volume, and industry requirements. Businesses must look beyond immediate prices and consider the long-term value of professional financial management. These services not only save time but also provide valuable insights for strategic decision-making and ensure compliance with tax regulations.

Optimum Results Business Solutions offers tailored bookkeeping and payroll solutions that align with specific business requirements and budgets. Our team leverages advanced technology and industry knowledge to deliver cost-effective services that exceed basic number crunching. We help prevent errors, ensure timely filings, and provide accurate financial data to support informed business decisions.

Quality financial management is an investment in your business’s future (not just an expense). The right provider will offer the best value for your investment and support your business’s financial health and growth objectives. Careful evaluation of your needs will help you find a solution that aligns with your business goals and budget constraints.