Accurate financial management is essential for business success, but many owners struggle to determine the right investment for bookkeeping services. At Optimum Results Business Solutions, we understand the importance of balancing quality and cost-effectiveness when it comes to financial record-keeping.

This guide will break down the factors that influence bookkeeping services cost and provide insights into average pricing structures. We’ll also share strategies to help you maximize value while maintaining top-notch financial management for your business.

What Drives Bookkeeping Service Costs?

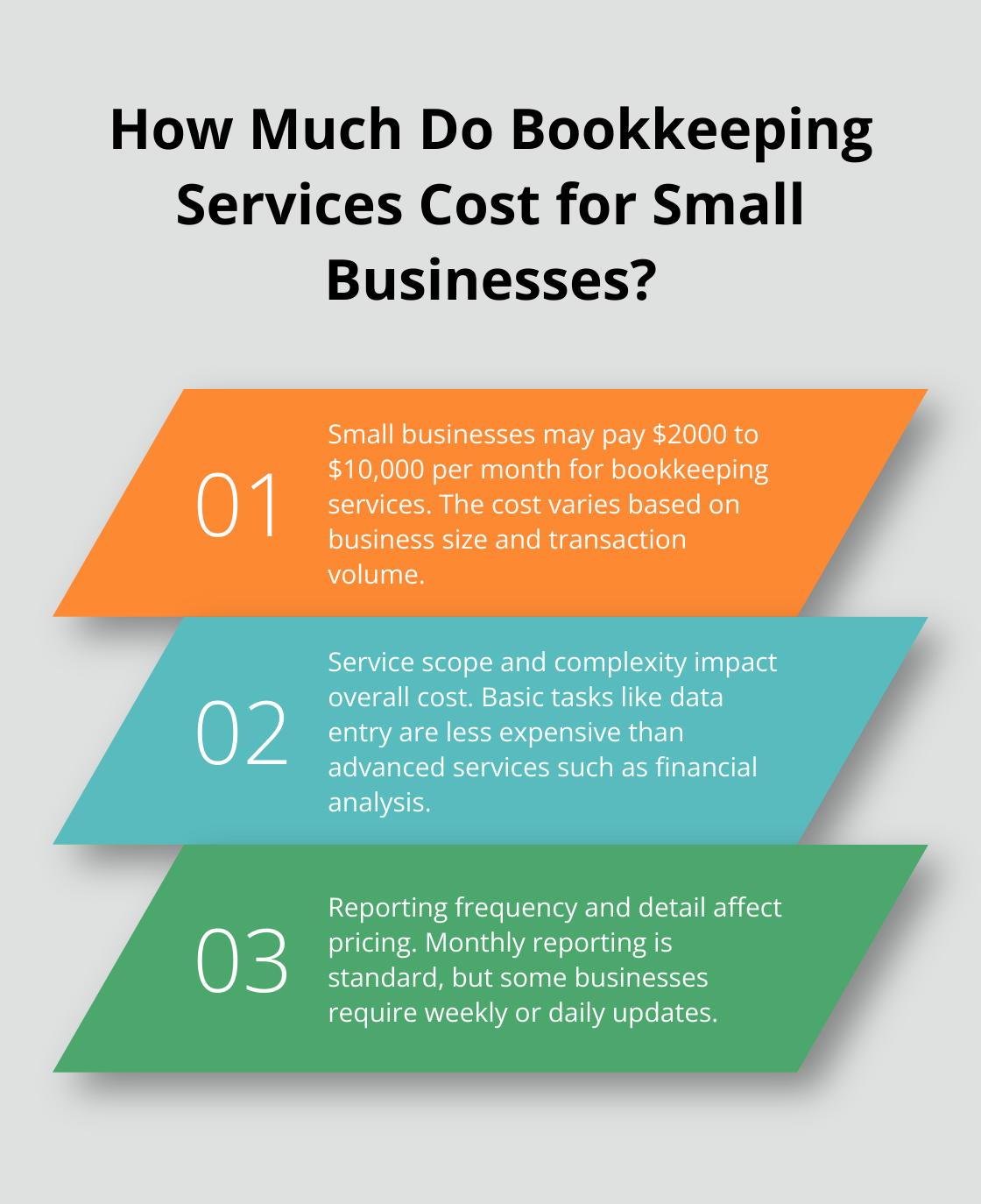

Business Size and Transaction Volume

The size of your business and the number of financial transactions you process monthly are primary cost drivers. Larger companies with more complex operations typically require more extensive bookkeeping services, which naturally leads to higher costs. Small businesses may pay anywhere from $2000 to $10,000 per month for bookkeeping services, depending on their specific needs and transaction volume.

Service Scope and Complexity

The range and complexity of services you need directly impact the overall cost. Basic bookkeeping tasks like data entry and bank reconciliations are generally less expensive than more advanced services such as financial analysis or cash flow forecasting.

Reporting Frequency and Detail

The frequency of financial reports and the level of detail required can significantly affect your bookkeeping costs. Monthly reporting is standard for most businesses, but some may require weekly or even daily updates (especially in fast-paced industries or during periods of rapid growth). More frequent and detailed reporting naturally requires more time and resources, leading to higher costs.

Industry-Specific Requirements

Certain industries have unique bookkeeping needs due to regulatory requirements or complex financial structures. Non-profit organizations often need specialized bookkeeping to track grants and donations, while construction companies may require job costing and progress billing. These industry-specific needs can add to the complexity and cost of bookkeeping services.

Technology and Automation

The level of technology and automation used in your bookkeeping processes can impact costs in both the short and long term. While implementing advanced accounting software and automation tools may require an initial investment, it can significantly reduce ongoing bookkeeping expenses. Cloud-native solutions offer much more flexibility, scalability, and real-time data integration, which can lead to cost savings and improved efficiency.

Understanding these factors will help you make informed decisions about your bookkeeping needs and budget accordingly. Professional bookkeeping services work closely with clients to develop tailored solutions that balance cost-effectiveness with comprehensive financial management. Now, let’s explore the average costs for professional bookkeeping services to give you a clearer picture of what to expect.

What Are the Typical Costs for Professional Bookkeeping?

Professional bookkeeping services offer a range of pricing structures to accommodate diverse business needs. This chapter explores the common cost models and factors that influence pricing in the bookkeeping industry.

Hourly Rates and Monthly Retainers

Bookkeepers often charge by the hour, with rates typically ranging from $30 to $90. These rates can vary based on location, experience, and task complexity. For example, Salary.com found that the average annual salary of a Bookkeeper in the United States is $45,591 or $22 per hour, but rates in major metropolitan areas (such as New York or San Francisco) can be substantially higher.

Many bookkeeping firms offer monthly retainer packages, which provide predictable costs for businesses. These packages usually range from $300 to $2,500 per month for small to medium-sized businesses. Retainers often include a set number of hours or specific services, allowing businesses to budget more effectively for their financial management needs.

Project-Based Pricing

For businesses with seasonal fluctuations or specific bookkeeping requirements, project-based pricing can be an attractive option. This model is particularly common for tasks like catch-up bookkeeping. Fees for such projects might range from $500 to $2,500, depending on the backlog and complexity of the work involved.

In-House vs. Outsourced Bookkeeping

When comparing in-house and outsourced bookkeeping, costs can differ significantly. The Bureau of Labor Statistics reports that the median annual wage for bookkeeping, accounting, and auditing clerks was $47,440 in May 2023. This figure doesn’t include additional costs such as benefits, training, and overhead, which can add 20-30% to the total expense.

Outsourcing often proves more cost-effective, especially for small and medium-sized businesses. It eliminates the need for full-time salaries and benefits while providing access to a team of experts. (However, it’s important to note that the specific cost savings will vary depending on the individual needs of each business.)

Technology’s Impact on Pricing

The adoption of cloud-based accounting software has significantly influenced pricing structures in the bookkeeping industry. A survey by Sage found that 67% of accountants prefer cloud accounting solutions, which can lead to more efficient processes and potentially lower costs for clients. (These technological advancements have allowed many bookkeeping firms to offer competitive pricing while maintaining high-quality service.)

As businesses consider their bookkeeping options, it’s essential to look beyond just the price tag. The value and expertise provided by professional bookkeeping services can have a significant impact on a company’s financial health and decision-making capabilities. In the next chapter, we’ll explore strategies to maximize the value of your bookkeeping investment while keeping costs under control.

How to Reduce Bookkeeping Costs

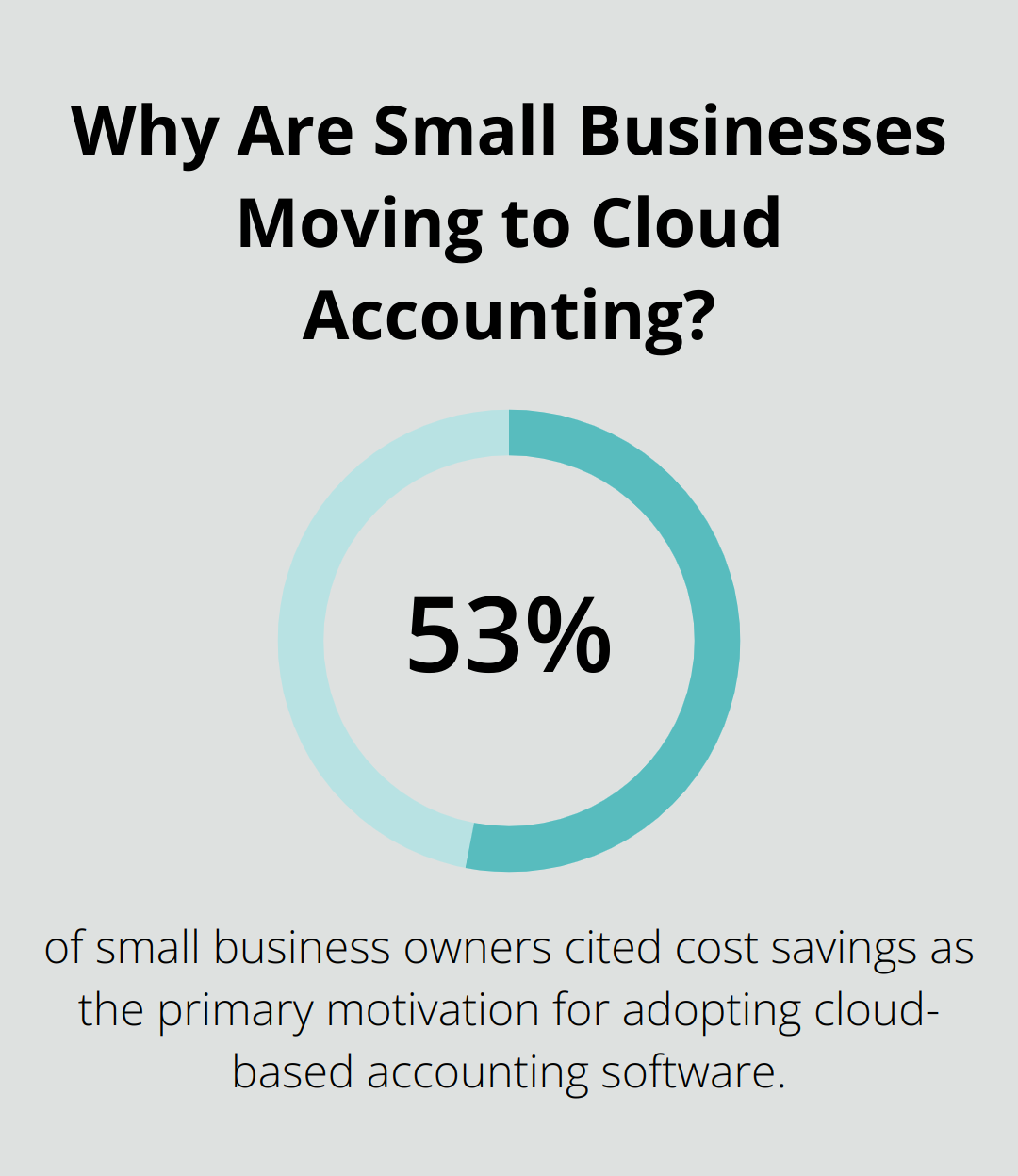

Leverage Cloud-Based Accounting Software

Cloud-based accounting platforms like QuickBooks Online or Xero streamline bookkeeping processes. These tools automate data entry, reconciliations, and report generation, which reduces the time required for manual bookkeeping tasks. A study found that 53% of small business owners cited cost savings as the primary motivation for adopting cloud-based accounting software. This cost savings translates directly into reduced expenses when working with a bookkeeper.

(Optimum Results Business Solutions leverages QuickBooks Online to maximize efficiency for their clients. Their ProAdvisor certification ensures they can help you get the most out of this powerful tool, further reducing your overall bookkeeping costs.)

Choose the Right Service Package

Not all businesses need full-service bookkeeping. Analyze your financial management needs and select a service package that aligns with your requirements. For instance, if you have a small business with straightforward finances, you might only need basic bookkeeping services like data entry and monthly reconciliations. On the other hand, if you’re a rapidly growing startup, you might benefit from more comprehensive services including financial forecasting and cash flow management.

Work with your bookkeeping service provider to create a tailored package that addresses your specific needs without paying for unnecessary extras. This targeted approach can lead to significant cost savings while ensuring you receive the financial support your business requires.

Implement Efficient Financial Practices

Maintaining organized financial records throughout the year can substantially reduce your bookkeeping costs. Implement systems for tracking expenses, managing receipts, and categorizing transactions as they occur. This proactive approach minimizes the time your bookkeeper needs to spend sorting through disorganized records, ultimately lowering your costs.

Consider using expense tracking apps like Expensify or Receipt Bank to digitize and categorize receipts in real-time. These tools integrate seamlessly with most accounting software, further streamlining the bookkeeping process.

Communicate Regularly with Your Bookkeeper

Regular communication with your bookkeeper can help identify areas for improvement and cost reduction. Schedule periodic check-ins to discuss your financial processes, address any concerns, and explore opportunities for optimization. This proactive approach allows you to stay on top of your finances and make informed decisions that can lead to long-term cost savings.

Consider a Hybrid Bookkeeping Model

A hybrid bookkeeping model combines in-house efforts with outsourced expertise. This approach allows you to handle some basic bookkeeping tasks internally while relying on professional services for more complex financial management. Outsourcing provides cost savings, scalability, and access to specialized expertise, while in-house accounting offers control and tailored solutions. Try to strike a balance that maximizes cost-effectiveness without compromising the quality of your financial records. This model can be particularly beneficial for small businesses looking to reduce costs while still accessing professional expertise when needed.

Final Thoughts

Professional bookkeeping is a vital investment for businesses of all sizes. Several factors influence bookkeeping services cost, including business size, transaction volume, service complexity, reporting frequency, and industry-specific requirements. Understanding these elements helps you make informed decisions about your financial management needs.

Quality should take priority over cost when selecting bookkeeping services. Accurate financial records form the foundation of sound business decisions and long-term growth. Professional bookkeepers provide expertise, efficiency, and insights that can significantly impact your bottom line.

Optimum Results Business Solutions offers customized solutions for businesses seeking expert bookkeeping services tailored to their unique needs. Their team of QuickBooks Online ProAdvisors delivers comprehensive financial management services. (This ensures accuracy, compliance, and valuable insights for business growth.)