Choosing the right outsourced bookkeeping service can make or break your business’s financial health. At Optimum Results Business Solutions, we’ve seen firsthand how proper financial management impacts a company’s success.

This guide will walk you through the essential steps to select a bookkeeping partner that aligns with your unique needs. We’ll cover everything from assessing your current processes to evaluating potential providers, helping you make an informed decision.

What Are Your Business’s Financial Needs?

Assess Your Current Financial Processes

The first step in selecting the right outsourced bookkeeping service is to document your existing financial workflows. How do you handle invoicing, expense tracking, and financial reporting? Are you using spreadsheets, basic accounting software, or manual methods? This inventory will highlight areas where professional bookkeeping can make the most significant impact.

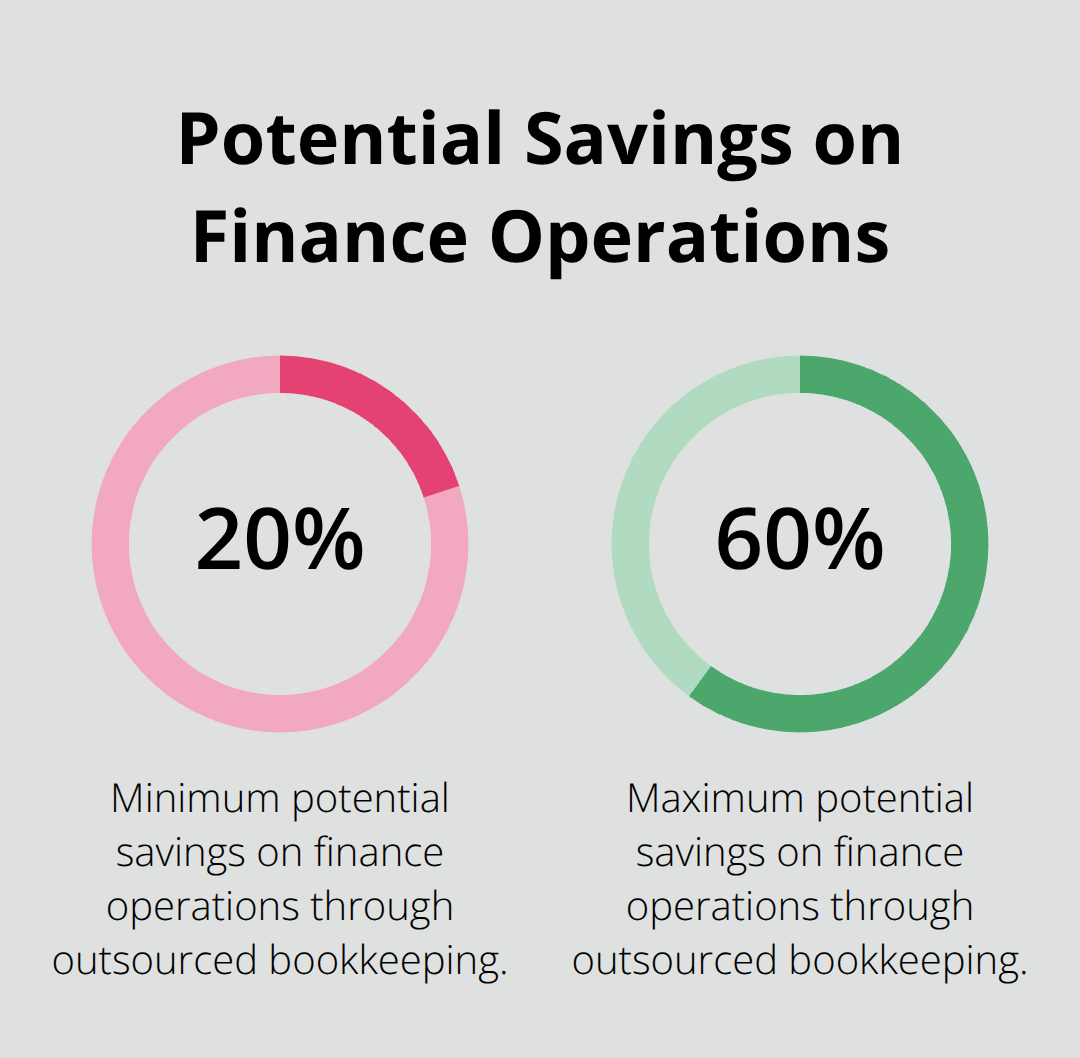

For instance, if you spend hours each week manually entering data into spreadsheets, an outsourced service with automated data entry could save you time and reduce errors, potentially saving 20-60% on finance operations.

Identify Your Bookkeeping Pain Points

Next, pinpoint the aspects of your financial management that cause the most stress or consume the most time. Common pain points include:

- Late or inaccurate invoicing

- Difficulty tracking expenses

- Inconsistent financial reporting

- Cash flow management challenges

- Tax compliance issues

Be specific about these problems. If you consistently miss tax deadlines, note exactly which filings are problematic and why. This level of detail will help potential bookkeeping partners understand your needs and propose targeted solutions.

Determine Your Required Service Level

Consider the scope of bookkeeping services you need. Do you require basic transaction recording and reconciliation, or do you need more advanced services like financial analysis and forecasting?

Think about your business’s growth trajectory as well. If you plan to expand, you might need a bookkeeping service that can scale with you and provide insights to support your growth strategy.

For tech startups, specialized services like equity management or venture capital reporting might be necessary. Service-based businesses might prioritize project-based accounting or time tracking integration.

A clear definition of your needs will equip you to find a bookkeeping service that aligns with your business goals. The right partner should not only address your current pain points but also support your future financial management needs.

Now that you’ve assessed your financial needs, it’s time to explore the key factors to consider when selecting a bookkeeping service. These factors will help you narrow down your options and find the best fit for your business.

What Makes a Top-Tier Bookkeeping Service?

When you select an outsourced bookkeeping service, several key factors can significantly impact your financial management experience. We’ll explore the critical elements that distinguish exceptional providers from the rest.

Industry-Specific Expertise

A bookkeeping service with a proven track record in your industry will provide the most value. Outsourced accounting trends show that various industries benefit from this strategy, including tech startups and service-based businesses. Specialized expertise often results in more accurate financial forecasting and strategic advice tailored to your sector’s unique challenges.

Comprehensive Service Offerings

Top bookkeeping services offer a range of solutions that can grow with your business. While you might only need basic transaction recording now, your company’s expansion may require more advanced services like financial analysis or CFO-level insights in the future.

A survey by Clutch found that 37% of small businesses outsource their accounting and finance functions to access a wider range of expertise. You should look for providers that offer scalable services (from day-to-day bookkeeping to high-level financial strategy).

Cutting-Edge Technology Integration

Your bookkeeping service should leverage the latest financial technology. Cloud-based accounting software, automated data entry, and real-time reporting capabilities are essential for efficient financial management in today’s digital age.

When you evaluate potential partners, ask about their tech stack and how it can streamline your financial processes.

Robust Security Measures

Financial data ranks among your business’s most sensitive information. Your bookkeeping service must implement stringent security protocols. This includes encrypted data transmission, secure cloud storage, and regular security audits.

The average cost of a data breach globally is growing to around $4.88 million, a 10% increase year-on-year. Don’t hesitate to ask potential providers about their security certifications, data backup procedures, and disaster recovery plans.

Transparent Pricing and Value

Consider the pricing structure and overall value proposition of the bookkeeping service. While cost matters, it shouldn’t be the only factor. Look for providers that offer transparent pricing models without hidden fees.

However, these savings should not compromise quality or comprehensive service.

Now that you understand what makes a top-tier bookkeeping service, let’s explore how to evaluate potential partners effectively. The next section will guide you through the process of assessing credentials, reviewing client feedback, and conducting thorough consultations to find the perfect fit for your business.

How to Evaluate Potential Bookkeeping Partners

Verify Credentials and Experience

Start your evaluation by examining the qualifications of the bookkeeping team. Look for certifications such as Certified Bookkeeper (CB). These credentials indicate a high level of expertise and commitment to professional standards.

Industry experience is equally important. This expertise often translates to more accurate financial management and industry-specific insights.

Scrutinize Client Feedback

Client reviews and testimonials offer valuable insights into a bookkeeping service’s performance. Platforms like Clutch or Google My Business provide unbiased reviews from verified clients. Pay attention to comments about reliability, accuracy, and communication.

Don’t just focus on star ratings. Read detailed feedback to understand how the service handles challenges and maintains client relationships.

Conduct In-Depth Consultations

Schedule discovery calls with your top candidates. These sessions allow you to assess their communication style, responsiveness, and overall fit with your business culture. Prepare a list of specific questions about their processes, technology, and how they handle common bookkeeping challenges in your industry.

During these calls, pay attention to how well they listen and understand your unique needs.

Assess Technological Capabilities

Advanced technology is essential for efficient bookkeeping in today’s digital age. Ask about the software and tools they use. Cloud-based platforms like QuickBooks Online or Xero are industry standards, offering real-time data access and robust reporting capabilities.

Inquire about their data security measures. Ensure your potential partner uses encryption, secure data storage, and regular backups to protect your financial information.

Evaluate Pricing and Value

While cost shouldn’t be the only factor, it’s an important consideration. Request detailed pricing structures and ensure there are no hidden fees. Compare the value offered by each provider, considering factors like the range of services, expertise, and potential cost savings from improved financial management.

Evaluate Your Current and Future Needs

Start by assessing your current financial processes and pain points. Do you struggle with manual data entry? Are you having trouble keeping up with tax regulations? Understanding your needs will help you choose a bookkeeping partner that can address your specific challenges and grow with your business.

93% of small businesses reported a positive experience with outsourcing, with greater flexibility as one of the key benefits.

Final Thoughts

Selecting the right outsourced bookkeeping service will significantly impact your business’s financial health and growth trajectory. You’ll gain access to expert knowledge, streamline financial processes, and free up valuable time to focus on core business activities. Accurate and timely financial data will equip you to make informed decisions and drive your business forward.

Don’t let bookkeeping challenges hold your business back. Take action now to improve your financial management. Optimum Results Business Solutions can help transform your financial operations, ensure compliance, and provide valuable insights to fuel your growth.

Effective financial management creates a solid foundation for your business’s future. Outsourced bookkeeping services offer the expertise, technology, and scalability to support your business as it evolves (especially for small and medium-sized enterprises). Take the first step today to optimize your financial processes and unlock your business’s full potential.