At Optimum Results Business Solutions, we understand the importance of accurate financial records for businesses of all sizes. QuickBooks Online journal entries are a fundamental tool for maintaining precise bookkeeping and financial management.

This guide will walk you through the process of creating journal entries in QuickBooks Online, helping you master this essential skill. Whether you’re new to accounting or looking to refine your techniques, we’ve got you covered with step-by-step instructions and valuable tips.

What Are Journal Entries in QuickBooks Online?

Journal entries in QuickBooks Online form the foundation of accurate financial record-keeping. They enable businesses to record complex transactions that standard features like invoices or bills can’t capture. At their core, journal entries provide a method to manually adjust books, ensuring every financial move receives proper accounting. Each journal entry will affect an account with either an amount to credit or debit.

When to Use Journal Entries

QuickBooks Online automates many accounting processes, but certain situations require manual journal entries. You might need to create a journal entry when:

- Recording non-cash transactions

- Correcting errors

- Adjusting account balances

For example, if you uncover a discrepancy in your inventory valuation, a journal entry can rectify the issue without disrupting existing records.

Common Transactions Requiring Journal Entries

Some transactions typically requiring journal entries include:

- Depreciation of assets

- Owner’s equity adjustments

- Recording accrued expenses

Consider a company purchasing new equipment. While QuickBooks might automatically record the initial purchase, the ongoing depreciation requires manual entry through journal entries.

The Impact of Accurate Journal Entries

Precise journal entries maintain the integrity of your financial statements. They directly affect your balance sheet and income statement, influencing key financial metrics that stakeholders rely on. However, a study found widespread dissatisfaction with the relevance and usefulness of corporate financial report information to investors.

Real-World Benefits

Many businesses experience tangible benefits from mastering journal entries. For instance, a tech startup reduced their end-of-year accounting time by 40% after implementing a systematic approach to journal entries. This not only saved time but also improved the accuracy of their financial projections.

Journal entries serve as powerful tools, but require judicious use. Overuse can complicate your books and make auditing more challenging. Always consult with a qualified accountant or bookkeeper if you’re unsure about creating a journal entry.

Now that we understand the importance and impact of journal entries, let’s explore how to create them in QuickBooks Online.

How to Create a Journal Entry in QuickBooks Online

Accessing the Journal Entry Feature

To create a journal entry in QuickBooks Online, log into your account and click the “+ New” button in the upper left corner. Select “Journal entry” from the dropdown menu. This action opens the journal entry window for transaction input.

Entering Transaction Details

The journal entry window displays fields for Date, Journal no., and a table for account information. The date field auto-populates with the current date, but you can modify it for past transactions. QuickBooks typically auto-generates the journal number, which you can customize if needed.

Selecting Accounts and Amounts

This step forms the core of your journal entry. In the first table line, choose the account to debit from the dropdown menu. Enter the amount in the Debit column. On the next line, select the account to credit and input the amount in the Credit column.

(Pro tip: The total debits must equal the total credits for a balanced entry. QuickBooks Online conveniently displays any difference at the bottom of the entry.)

Adding Descriptions and Attachments

Clear descriptions prove vital for future reference and auditing. Provide a concise explanation of the transaction in the Description field. You can also attach relevant documents by clicking the paperclip icon, which helps maintain a clear audit trail.

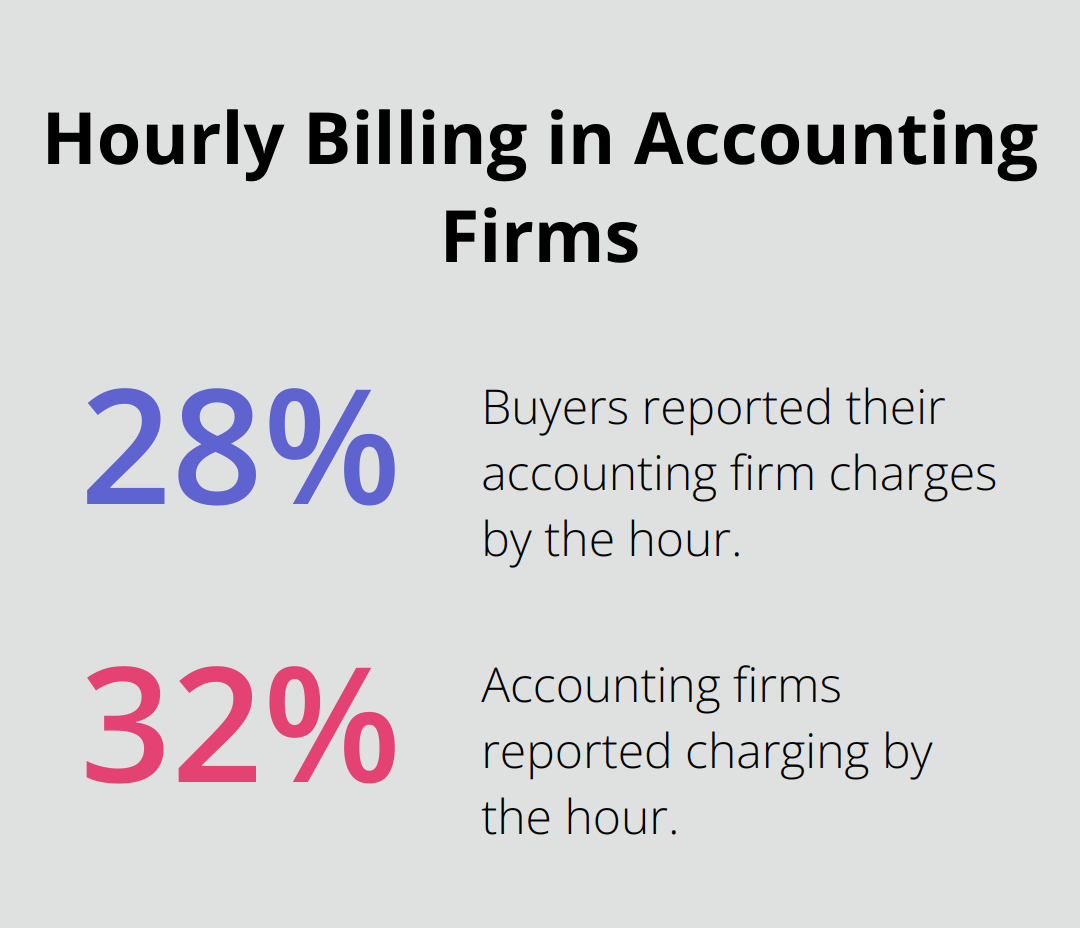

A survey found that only 28% of buyers said their accounting firm charges them by the hour, with 32% of accounting firm participants reporting the same.

Best Practices for Journal Entries

- Double-check account selections before saving

- Use specific, detailed descriptions

- Attach supporting documents when applicable

- Review entries for accuracy before finalizing

Creating standardized procedures for transaction recording, account coding, and documentation requirements prevents inconsistencies that could compromise accuracy.

The process of creating journal entries in QuickBooks Online might seem daunting at first, but with consistent practice, it becomes second nature. As you master this skill, you’ll find yourself better equipped to handle complex financial scenarios. However, even seasoned professionals can make mistakes. Let’s explore some common pitfalls to avoid when creating journal entries in QuickBooks Online.

Avoiding Common Journal Entry Pitfalls in QuickBooks Online

Incorrect Account Selection

One of the most frequent errors in creating journal entries is the selection of wrong accounts for transactions. This mistake can significantly distort your financial reporting. To prevent this, you should thoroughly familiarize yourself with your chart of accounts. Take the time to review account descriptions and purposes before making selections. If uncertainty arises, consult a QuickBooks ProAdvisor or your accountant for guidance.

Unbalanced Entries

QuickBooks Online mandates that journal entries balance, with total debits equaling total credits. Users sometimes overlook this fundamental rule. Always double-check your entries before saving. QuickBooks Online displays any discrepancies at the bottom of the entry form, which makes it easier to spot imbalances. (If you consistently struggle with this aspect, consider seeking additional training or support from a professional bookkeeper.)

Inadequate Descriptions

Clear, detailed descriptions prove essential for maintaining an accurate audit trail. Vague descriptions like “adjustment” or “transfer” provide little context for future reference. Instead, write specific descriptions that explain the purpose and nature of the transaction. For example, “Depreciation expense for office equipment – Q2 2025” offers much more information than simply “Depreciation.”

Insufficient descriptions can lead to confusion during audits or financial reviews.

Duplicate Entries

Accidentally entering the same transaction twice is easier than you might think, especially when dealing with multiple adjustments. To prevent this, implement a system of checks and balances. This could involve regular account reconciliations or having a second person review entries before finalization. Additionally, use QuickBooks Online’s search function to check for similar entries before creating a new one.

Incorrect Backdating

While QuickBooks Online allows you to backdate entries, doing so incorrectly can lead to serious reporting issues. Always ensure you enter transactions in the correct accounting period. (If you need to make adjustments to a closed period, consult with your accountant first.) They can guide you on the proper way to make these changes without disrupting your financial statements.

The goal of journal entries is to maintain accurate financial records. You will ensure your QuickBooks Online data remains reliable and useful for decision-making by avoiding these common pitfalls. If you find yourself consistently struggling with journal entries, it might be time to seek professional help.

Final Thoughts

Creating accurate QuickBooks Online journal entries forms the foundation of sound financial management. This skill enables you to maintain precise records, make informed business decisions, and streamline your accounting processes. Each entry impacts your financial statements, so attention to detail matters greatly.

Proficiency in journal entries offers numerous benefits to your business. You will gain deeper insights into your company’s financial health, spot trends more easily, and identify areas for improvement. This expertise also proves invaluable during audits or when seeking financing (you’ll have a clear, accurate picture of your financial position).

Don’t hesitate to seek guidance from accounting professionals when needed. At Optimum Results Business Solutions, we provide expert bookkeeping and accounting services for small service-based businesses and tech startups. Our team of QuickBooks Online ProAdvisors can offer personalized support, ensuring your journal entries remain accurate and compliant with regulations.