At Optimum Results Business Solutions, we understand the financial challenges startups face. A well-structured startup bookkeeping template is essential for managing your finances effectively and making informed decisions.

In this post, we’ll guide you through creating a comprehensive template tailored to your startup’s unique needs. We’ll cover key components, customization strategies, and best practices to help you stay on top of your financial game.

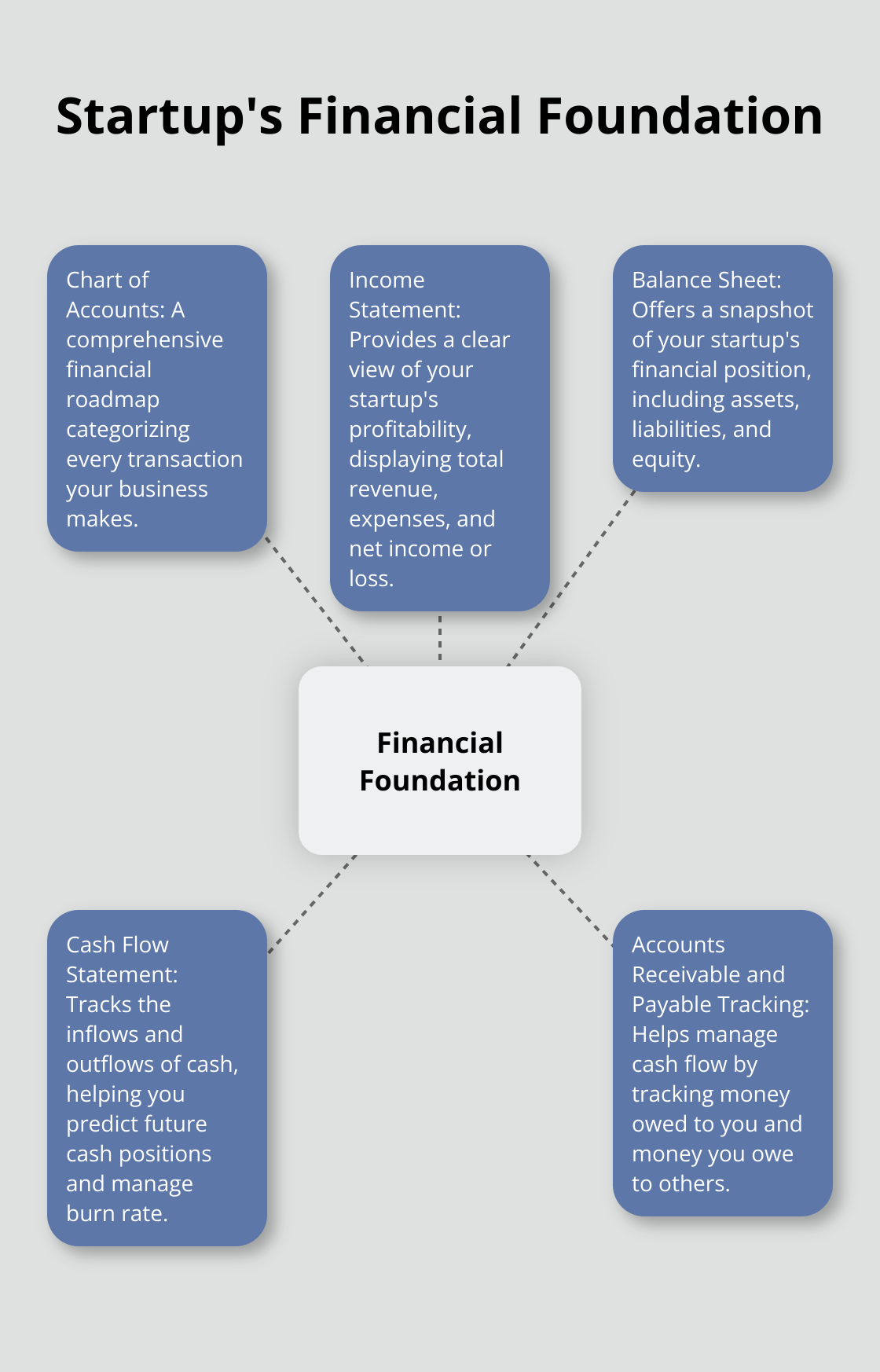

Building Your Startup’s Financial Foundation

The Backbone: Chart of Accounts

A comprehensive chart of accounts forms the foundation of your startup’s financial management. This financial roadmap categorizes every transaction your business makes. For a SaaS startup, include categories such as:

- Subscription Revenue

- Software Licensing Revenue

- Consulting Revenue

- Data Integration Services Revenue

- Platform Revenue

- Operating expenses (rent, utilities, salaries)

- Assets (cash, equipment, inventory)

- Liabilities (loans, accounts payable)

Adapt these categories to fit your specific business model.

Profit and Loss at a Glance: Income Statement

The income statement (also known as the profit and loss statement) provides a clear view of your startup’s profitability. It should display:

- Total revenue

- Cost of goods sold

- Gross profit

- Operating expenses

- Net income or loss

Monthly updates to this statement will help you track financial performance over time, identify trends, and make quick adjustments to your business strategy.

Financial Snapshot: Balance Sheet

A balance sheet offers a snapshot of your startup’s financial position at a specific point in time. It includes:

- Assets (what you own)

- Liabilities (what you owe)

- Equity (the difference between assets and liabilities)

This statement holds particular importance for startups seeking funding, as it provides investors with a clear picture of your financial health.

Money In, Money Out: Cash Flow Statement

Cash is king for startups. Your cash flow statement tracks the inflows and outflows of cash, helping you predict future cash positions. Include:

- Operating activities

- Investing activities

- Financing activities

This statement plays a vital role in managing your burn rate and ensuring sufficient runway to achieve your goals.

Keeping Tabs: Accounts Receivable and Payable Tracking

Include sections for tracking accounts receivable (money owed to you) and accounts payable (money you owe). This practice helps you manage cash flow and avoid surprises.

For accounts receivable, track:

- Customer names

- Invoice dates and amounts

- Payment due dates

- Payment status

For accounts payable, monitor:

- Vendor names

- Invoice dates and amounts

- Payment due dates

- Payment status

Incorporating these essential components into your startup bookkeeping template will create a solid foundation for financial management. Accuracy and consistency are paramount. Regular updates and reviews of these components will provide the insights needed to guide your startup towards success.

Now that we’ve covered the essential components of a startup bookkeeping template, let’s explore how to customize this template to meet your specific startup needs.

Tailoring Your Template for Startup Success

Tracking Funding and Investments

A customized bookkeeping template must address the unique financial events startups face. Discover essential startup bookkeeping templates to streamline your financial tracking. Create a dedicated section to track funding rounds and investments. Include fields for:

- Investment date

- Investor name

- Investment amount

- Investment type (equity, convertible note, SAFE)

- Valuation at investment time

This information provides a clear picture for current financial management and future investor discussions.

Monitoring Burn Rate and Runway

Startups often operate with limited funds. Add a section to your template that calculates:

- Gross burn rate = Total Monthly Cash Expenses

- Runway = Current cash balance / Monthly burn rate

Update these figures monthly to maintain a real-time understanding of your financial sustainability.

Integrating Startup-Specific KPIs

Your bookkeeping template should incorporate unique metrics that indicate success. Common startup KPIs include:

- Customer Acquisition Cost (CAC)

- Lifetime Value of a Customer (LTV)

- Monthly Recurring Revenue (MRR)

- Churn Rate

Create dedicated spaces in your template to track these metrics monthly. This integration allows you to see how your financial decisions impact your key performance indicators.

Accommodating Rapid Growth

Startups often experience periods of rapid growth. Your template should be flexible enough to accommodate this. Try to:

- Use scalable categories in your chart of accounts

- Include space for new revenue streams

- Create a section for tracking new hires and associated costs

Forecasting and Scenario Planning

Incorporate a forecasting section in your template. This should include:

- Revenue projections (best case, worst case, and most likely scenarios)

- Expense projections

- Cash flow forecasts

These projections will help you make informed decisions about future investments, hiring, and expansion plans.

A well-customized bookkeeping template provides a comprehensive view of your startup’s financial health at a glance. It equips you with the tools to make informed decisions and steer your startup towards success.

Now, let’s explore the best practices for maintaining your newly customized bookkeeping template to ensure its ongoing effectiveness and reliability.

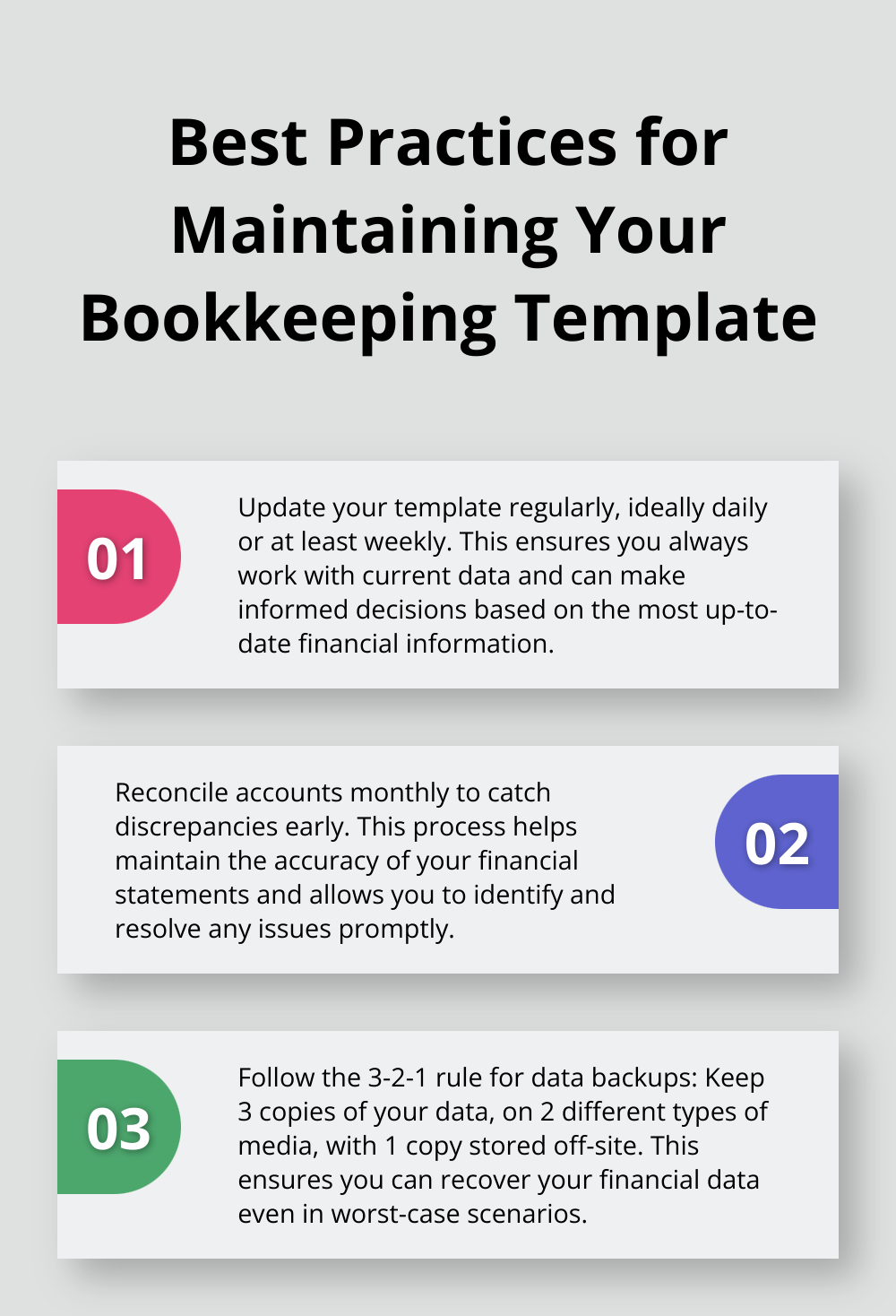

Keeping Your Startup Bookkeeping Template Up to Date

Regular Updates: A Non-Negotiable Practice

Set a strict schedule for updating your bookkeeping template. Update daily for ideal results, or at minimum, weekly. This frequency ensures you always work with current data. Research has shown that many small business owners lack the knowledge to understand the financial information provided by their accountants.

Use bank feeds to import transactions automatically. This saves time and reduces manual entry errors. However, don’t rely solely on automation. Review each transaction to ensure proper categorization.

Reconcile your accounts monthly. This process catches discrepancies early and maintains the accuracy of your financial statements.

Leverage Technology for Enhanced Efficiency

Explore integrations between your bookkeeping template and other financial tools. Connect your invoicing software to automatically update accounts receivable. This reduces double entry and minimizes errors.

Use formulas and macros in your spreadsheet to automate calculations. This not only saves time but also reduces the risk of manual calculation errors.

Consider cloud-based solutions for real-time updates and collaboration. This allows multiple team members to access and update the template simultaneously, ensuring everyone works with the most current data.

Implement Robust Version Control

Maintain a clear version history of your bookkeeping template. This allows you to track changes over time and revert to previous versions if needed. Use a naming convention that includes the date and version number (e.g., “Startup_Bookkeeping_2025-08-22_v1.2”).

Store your template in a cloud-based service with version control features. This not only provides backup but also allows you to see who made changes and when.

Prioritize Data Security

Implement strong password protection for your bookkeeping template. Use a password manager to generate and store complex passwords.

Regularly backup your template to multiple locations. Follow the 3-2-1 rule: three copies of your data, on two different media, with one copy off-site. This ensures you can recover your financial data even in worst-case scenarios.

Encrypt sensitive financial data, especially if you’re sharing the template with team members or external stakeholders. Use built-in encryption features in your spreadsheet software or consider dedicated encryption tools.

Final Thoughts

A startup bookkeeping template forms the cornerstone of sound financial management. It empowers you to track funding, monitor burn rates, and integrate key performance indicators. This tailored approach provides the right financial insights to drive growth and make informed decisions.

Regular updates and robust security measures keep your financial data accurate and protected. We recommend leveraging technology for enhanced efficiency and implementing version control to track changes over time. These practices ensure your template evolves with your business needs.

At Optimum Results Business Solutions, we offer expert bookkeeping services for tech startups and small service-based businesses. Our team can help you implement and optimize your startup bookkeeping template (ensuring you have the financial clarity needed to thrive). Take control of your startup’s finances today and set the stage for long-term success.