Finding the right bookkeeping help for small businesses can be a game-changer. At Optimum Results Business Solutions, we understand the challenges entrepreneurs face when managing their finances.

Proper bookkeeping is essential for making informed decisions and staying compliant with tax regulations. This guide will walk you through the process of finding the best bookkeeping solution for your unique business needs.

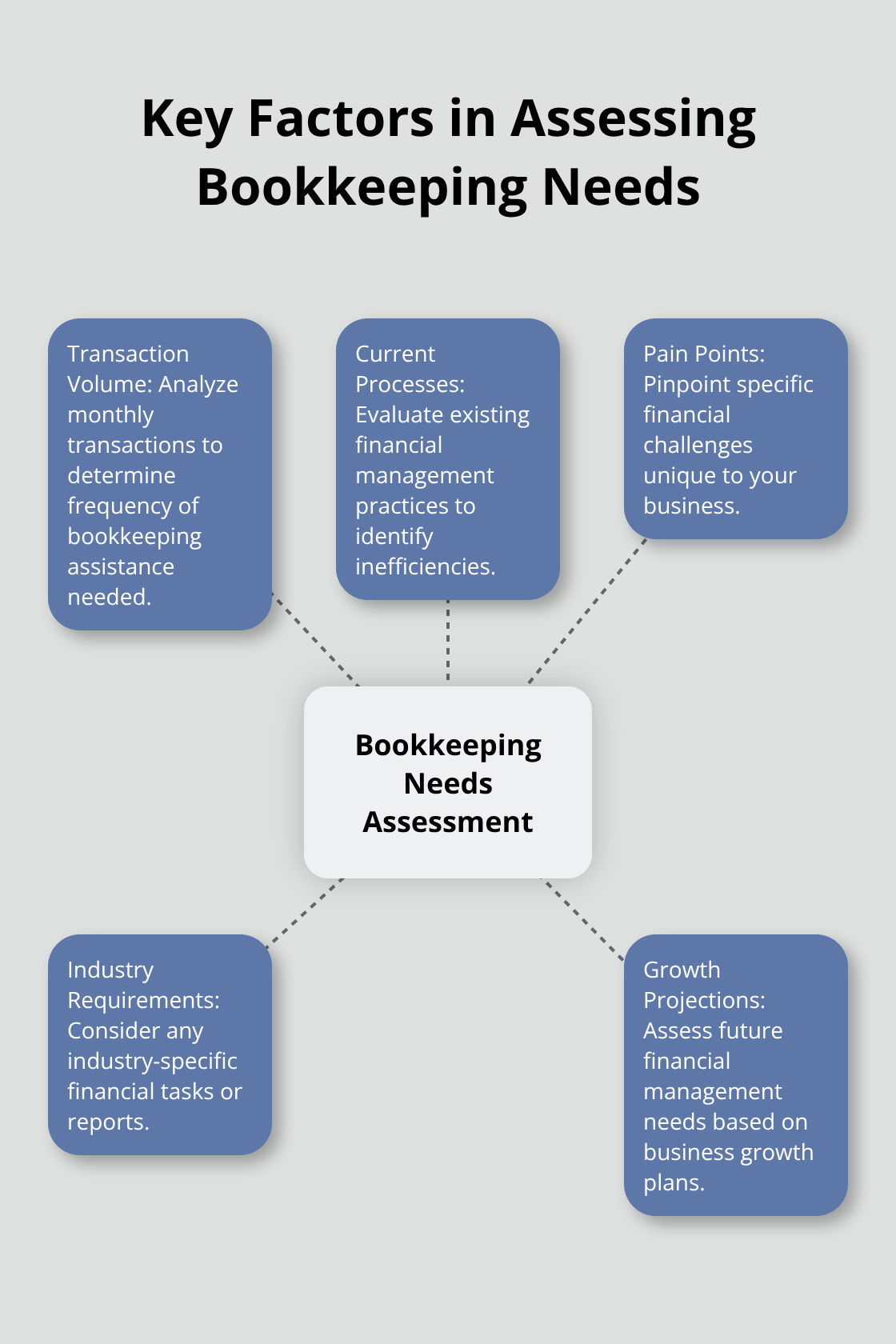

What Are Your Bookkeeping Needs?

Analyze Your Transaction Volume

The first step in assessing your bookkeeping needs is to examine your monthly transaction volume. A merchant’s average monthly transaction volume is calculated by taking the total number of transactions processed in a year and dividing it by 12. Understanding your volume helps determine if you need daily, weekly, or monthly bookkeeping assistance.

Evaluate Your Current Financial Processes

It’s time to scrutinize your existing financial management practices. Do you still use spreadsheets or basic accounting software? Or perhaps you rely on a shoebox full of receipts (a common but inefficient method)? Identifying inefficiencies in your current system is essential for improvement.

If you spend hours each week on data entry, you should consider more automated solutions or professional help.

Pinpoint Specific Pain Points

Every business faces unique financial challenges. You might struggle with cash flow management or find sales tax compliance overwhelming. Payroll processing could consume too much of your time. Identifying these specific pain points allows you to seek targeted solutions. For example, if you have trouble with accounts receivable, you might need a bookkeeper who specializes in collections and credit management.

Consider Industry-Specific Requirements

Different industries have varying bookkeeping needs. A construction company might require job costing, while a restaurant needs inventory tracking. Think about any industry-specific financial tasks or reports you need to manage. This consideration will help you find a bookkeeper or service with relevant experience in your field.

Assess Your Growth Projections

Your current bookkeeping needs might change as your business grows. Try to project your financial management requirements for the next 1-3 years. Will you expand into new markets? Launch new products? Hire more employees? Bookkeeping is essential for scaling up small businesses. Planning ahead ensures you choose a scalable solution that can grow with your business.

Now that you’ve assessed your bookkeeping needs, it’s time to explore the various options available for getting the help you require. Let’s look at the different types of bookkeeping assistance you can consider for your small business.

Exploring Your Bookkeeping Options

In-House vs. Outsourced Bookkeeping

Small businesses face a critical decision when it comes to managing their finances: hire an in-house bookkeeper or outsource the task. An in-house bookkeeper provides direct control over financial processes but comes with additional costs. The Bureau of Labor Statistics reports that the median annual wage for bookkeeping, accounting, and auditing clerks was $49,210 in May 2024 (a significant expense for many small businesses).

Outsourcing offers flexibility and cost-effectiveness. This approach allows access to expert knowledge without the overhead of a full-time employee. Many businesses find that outsourcing scales well with their changing needs.

Full-Time vs. Part-Time Support

The choice between full-time and part-time bookkeeping support depends on transaction volume and complexity. At tax time, your tax preparer can be your best friend, taking a year’s worth of financial documents and helping you navigate the complexities of tax preparation.

Part-time bookkeeping can be a cost-effective solution for businesses with simpler financial needs. Many small businesses find that 10-20 hours per month of professional bookkeeping keeps their finances in order.

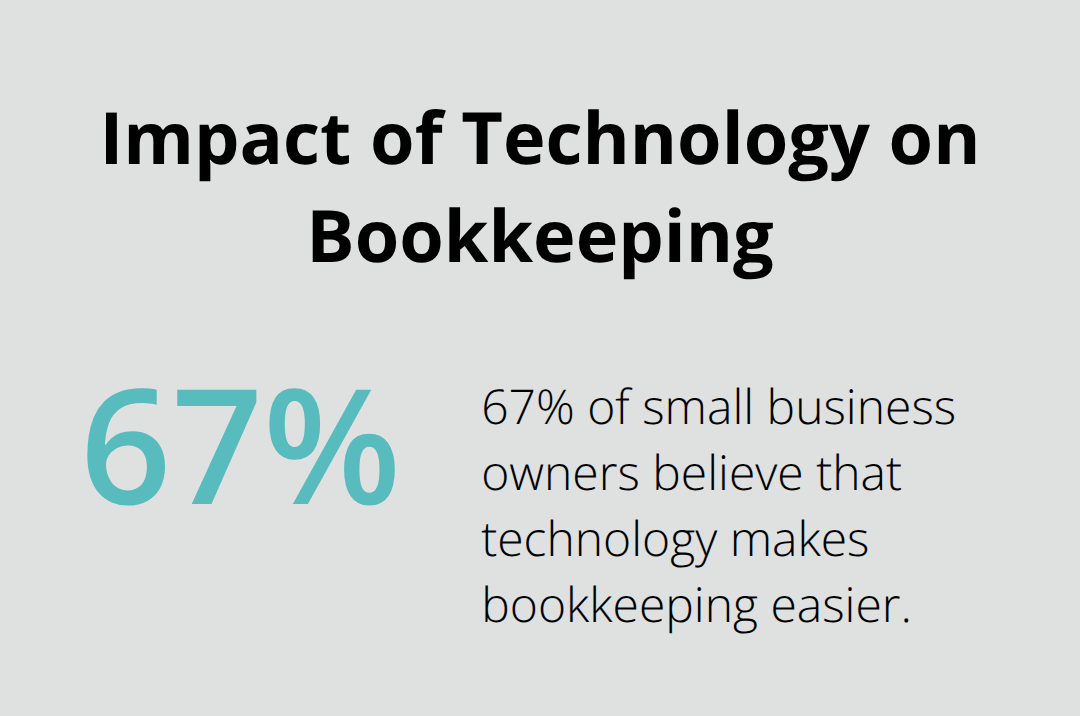

Leveraging Technology

Modern bookkeeping software streamlines financial processes significantly. Tools like QuickBooks Online automate many tasks. A survey by Viewpost revealed that 67% of small business owners believe that technology makes bookkeeping easier.

However, software alone isn’t always enough. The combination of technology with professional expertise often yields the best results. This hybrid approach ensures benefits from automation while still having access to expert interpretation of financial data.

Considering Specialized Services

Some businesses require specialized bookkeeping services. For example, e-commerce businesses might need inventory management expertise, while non-profits require knowledge of fund accounting. It’s important to identify any industry-specific needs when choosing a bookkeeping solution.

Evaluating Cost vs. Value

While cost is a significant factor, it shouldn’t be the only consideration. The cheapest option might not provide the level of service or expertise your business needs. Try to balance cost with the value provided (including time saved, reduced errors, and improved financial insights).

The next step in finding the right bookkeeping help involves identifying the qualities to look for in a bookkeeper or bookkeeping service. These characteristics will ensure you receive high-quality financial management support tailored to your business needs.

What Makes a Great Bookkeeper?

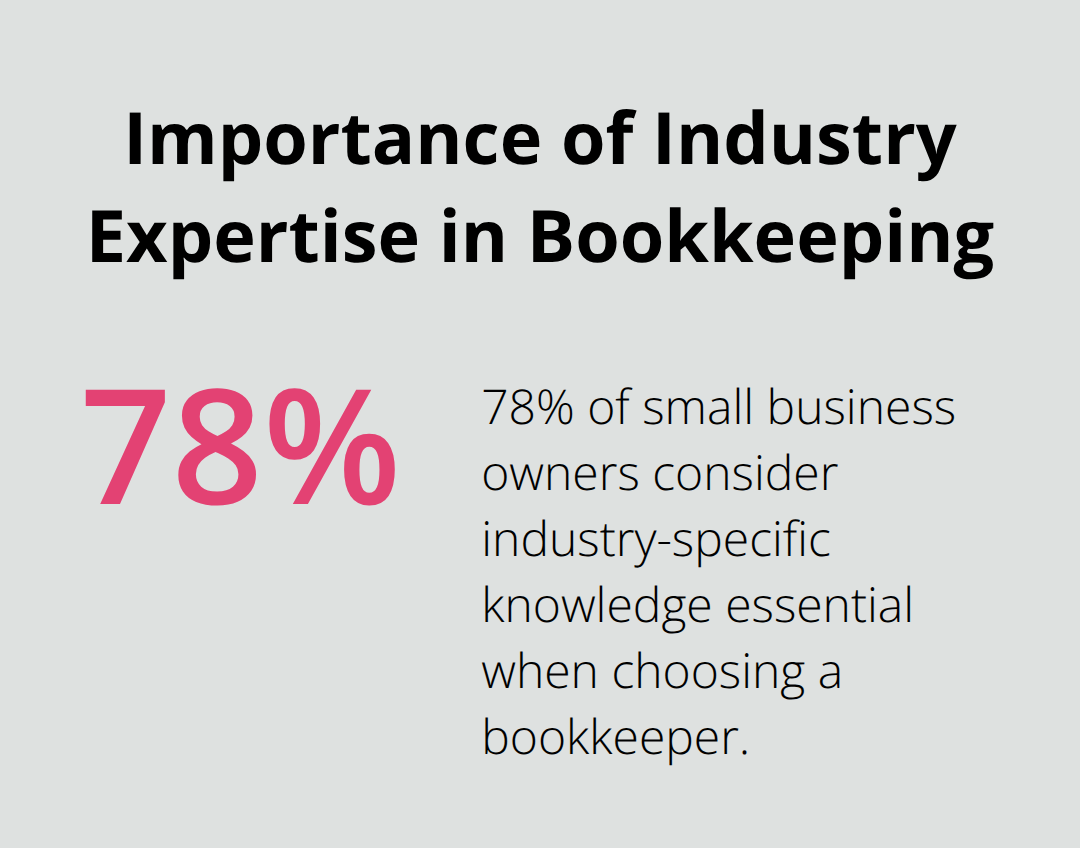

Industry Expertise

A bookkeeper with experience in your specific industry provides invaluable support. They understand the unique financial challenges and regulations you face. For example, a bookkeeper familiar with e-commerce businesses will know how to handle sales tax across multiple states (a critical skill in today’s digital marketplace).

A survey by the National Association of Certified Public Bookkeepers found that 78% of small business owners consider industry-specific knowledge essential when choosing a bookkeeper. This expertise helps you avoid costly mistakes and ensures compliance with industry-specific regulations.

Tech-Savvy Skills

In today’s digital age, proficiency with modern accounting software is non-negotiable. A skilled bookkeeper should feel comfortable with popular platforms like QuickBooks, Xero, or FreshBooks. They should also excel at using cloud-based tools for document management and collaboration.

Using cloud technology can tap into smart automation, which saves time and eliminates heavy paperwork. In the long term, this can result in significant efficiency gains for your organization.

Communication and Problem-Solving Abilities

Your bookkeeper should do more than keep a check register. They need to communicate complex financial information in a way that non-financial professionals understand easily. Look for someone who can explain your financial position clearly and offer actionable insights.

Strong problem-solving skills are equally important. A good bookkeeper should spot potential issues before they become major problems. They should also proactively suggest solutions to improve your financial processes.

Qualifications and Certifications

When you evaluate potential bookkeepers, consider their qualifications carefully. While not all bookkeepers need to be Certified Public Accountants (CPAs), certifications from organizations like the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB) can indicate a high level of expertise.

The right bookkeeper is an investment in your business’s financial health. They should save you time, reduce errors, and provide valuable insights that help drive your business forward. Whether you choose to work with an individual bookkeeper or a firm, prioritizing these qualities will help ensure you find the best fit for your small business.

Final Thoughts

Finding the right bookkeeping help for small businesses requires careful consideration of specific needs and available options. A great bookkeeper brings industry expertise, tech-savvy skills, and strong communication abilities to support your financial management. Proper bookkeeping empowers businesses to make informed decisions, spot trends, and seize opportunities while ensuring compliance with tax regulations.

We at Optimum Results Business Solutions understand the unique challenges small businesses face in financial management. Our team provides tailored bookkeeping services, using the latest technology to streamline processes and offer valuable financial insights. We offer support for payroll administration, sales tax management, and QuickBooks Online (among other services).

Quality bookkeeping help is an investment in your business’s future. The right solution not only manages your finances but also sets the stage for sustainable growth and success. Contact us today to explore how we can provide the bookkeeping help your small business needs to thrive.