At Optimum Results Business Solutions, we understand the value of professional certifications in advancing your career. Intuit Bookkeeping Certification is a powerful credential that can open doors to new opportunities in the financial sector.

This guide will walk you through the process of obtaining your Intuit Bookkeeping Certification, from understanding the program to maintaining your credentials. We’ll provide practical steps and insights to help you succeed in your certification journey.

What is Intuit Bookkeeping Certification?

Program Overview

Intuit Bookkeeping Certification validates your expertise in bookkeeping practices and QuickBooks software. This professional credential equips you with the skills and knowledge to excel in the field of bookkeeping. The certification helps you learn bookkeeping basics and interpret and analyze financial statements, potentially qualifying you for a role in the field. The program is designed for beginners and takes approximately 30 hours to complete.

Certification Structure

The certification process includes a series of courses and a comprehensive exam. The curriculum covers essential topics such as:

- Accounting basics

- Financial statement analysis

- QuickBooks Online proficiency

Benefits of Certification

Intuit Bookkeeping Certification offers numerous advantages:

- Enhanced credibility in the job market

- Demonstration of commitment to professional development

- Up-to-date knowledge of industry standards

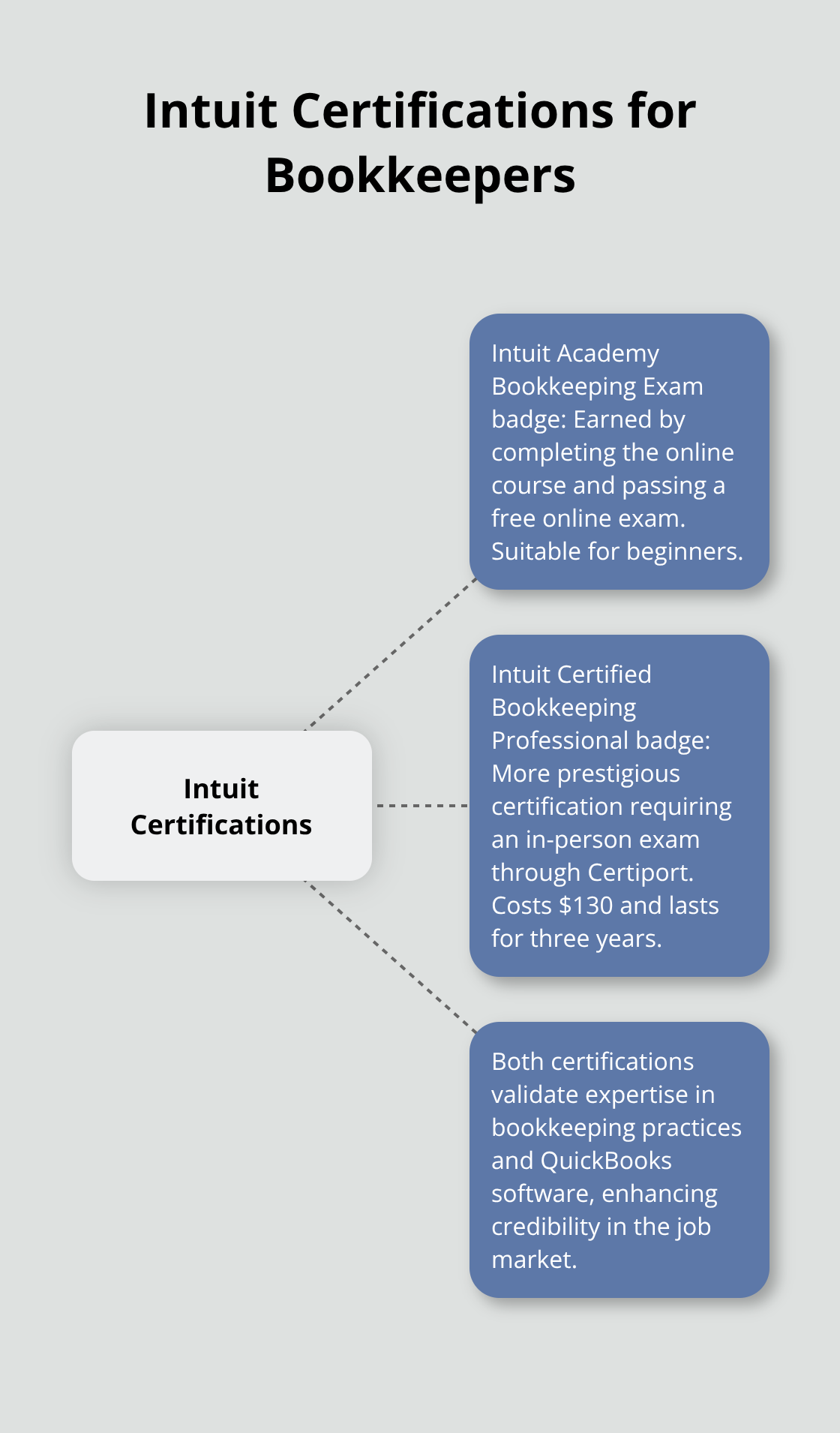

Types of Certifications

Intuit offers two main certifications for bookkeepers:

- Intuit Academy Bookkeeping Exam badge

- Earned by completing the online course

- Requires passing a free online exam

- Intuit Certified Bookkeeping Professional badge

- More prestigious certification

- Requires passing an in-person exam (administered through Certiport)

- Costs $130

The Intuit Certified Bookkeeping Professional badge holds higher recognition in the industry. This certification lasts for three years, after which you’ll need to complete continuing education requirements to maintain your status.

Exam Preparation

Intuit provides various resources to help you prepare for the certification exam:

- Webinars

- Tutorials

- Practice exams

The exam typically lasts 50 minutes and consists of about 40 questions. It covers bookkeeping fundamentals and QuickBooks Online usage. Regular study hours each week leading up to the exam will increase your chances of success.

Now that you understand the basics of Intuit Bookkeeping Certification, let’s explore the steps to obtain this valuable credential.

Navigating the Intuit Bookkeeping Certification Process

Eligibility Requirements

To start your certification journey, check the eligibility criteria. The Intuit Academy Bookkeeping Exam badge signifies that you’ve successfully completed the exam and demonstrated your knowledge and skills in bookkeeping using QuickBooks. The Intuit Certified Bookkeeping Professional badge has specific certification requirements set by Intuit.

Choosing Your Certification Path

Select the certification that aligns with your goals. The Intuit Academy Bookkeeping Exam badge serves as an excellent entry point for newcomers. For those seeking a more prestigious credential, the Intuit Certified Bookkeeping Professional badge is available.

Effective Exam Preparation

Preparation determines your success. Intuit offers numerous resources to aid your study. We suggest allocating time for thorough preparation.

Master QuickBooks Online, as it forms a significant portion of the exam. Practice creating key financial statements and familiarize yourself with inventory control and payroll administration concepts.

Exam Registration Process

For the Intuit Certified Bookkeeping Professional badge, you can sign up for a QBO Accountant to take additional training and exams. The Intuit Academy exam registration occurs on the Intuit Academy platform.

Test-Taking Strategies

Time management is essential during the exam. Read each question carefully and avoid spending excessive time on any single item.

As you prepare for your certification, consider how this credential will enhance your career prospects and open new opportunities in the financial sector.

Maintaining Your Intuit Bookkeeping Certification

Continuing Education Requirements

Intuit mandates certified bookkeepers to complete ongoing education to keep their certification active. The specific requirements may vary, but typically involve exploring free online courses or finding the right tax or bookkeeping course to help you start your career or keep growing. These requirements ensure that certified bookkeepers remain up-to-date with industry standards and best practices.

For instance, you might need to complete a certain number of courses or training sessions within a specified period. Intuit often provides a list of approved courses and events that count towards your continuing education credits.

Recertification Process

As your certification period nears its end, you must go through the recertification process. To maintain your certified status (and access to the perks that come with it) you need to pass the short recertification test between 1 May – 30 June 2025.

It’s important to keep track of your certification expiration date and start the recertification process early. If you miss the deadline, your certification could lapse, which might require you to retake the entire certification exam.

Staying Current with Intuit’s Latest Features

Intuit regularly updates its software and introduces new features. As a certified bookkeeper, you must stay informed about these changes. This not only helps you maintain your certification but also ensures you can provide the best service to your clients or employer.

We recommend you set aside time each month to review Intuit’s product updates and release notes. You can also join online forums or user groups where bookkeepers share tips and discuss new features. This community engagement can serve as an invaluable resource for staying current and solving complex bookkeeping challenges (especially for those new to the field).

Practical Tips for Certification Maintenance

- Create a calendar reminder for your certification expiration date.

- Allocate time weekly (or bi-weekly) to study new features or attend webinars.

- Network with other certified bookkeepers to share experiences and learn from peers.

- Consider specializing in a specific industry or niche to differentiate yourself (this can also count towards your continuing education credits).

Maintaining your Intuit Bookkeeping Certification is an ongoing commitment. Fulfilling the continuing education requirements, completing the recertification process on time, and staying updated with the latest features will ensure that your certification remains a valuable asset throughout your career.

Final Thoughts

Intuit Bookkeeping Certification empowers professionals to advance their careers in finance. This credential validates expertise in bookkeeping practices and QuickBooks software, opening doors to diverse opportunities. Certified bookkeepers can work in public accounting, private industries, government agencies, or pursue freelance ventures.

Professional development extends beyond certification. Continuous learning about new QuickBooks features and accounting standards will enhance your ability to serve clients effectively. The field of finance and technology evolves rapidly, making ongoing education essential for long-term success.

Optimum Results Business Solutions recognizes the value of professional certifications like Intuit Bookkeeping Certification. Our team provides comprehensive bookkeeping and accounting services (utilizing QuickBooks Online and other advanced tools). We offer customized solutions to streamline financial management processes for businesses of all sizes.