At Optimum Results Business Solutions, we understand the challenges of managing e-commerce finances. That’s why we’re excited to explore the Shopify QuickBooks Online integration.

This powerful combination streamlines your financial processes, saving time and reducing errors. In this guide, we’ll walk you through the integration process and share best practices for maximizing its benefits.

Why Integrate Shopify with QuickBooks Online?

The integration of Shopify with QuickBooks Online offers a powerful solution for e-commerce businesses. This combination provides numerous advantages that extend beyond mere convenience.

Effortless Financial Management

The integration of Shopify with QuickBooks Online eliminates manual data entry. QuickBooks automatically brings in your orders and payouts from your Shopify store to give you a better view of your income and expenses in one place. This seamless data flow ensures up-to-date financial records, enabling informed decisions based on real-time information.

Precision in Accounting

Manual data entry poses a significant risk of human error. The automation of financial data transfer between Shopify and QuickBooks Online drastically reduces this risk. The accepted error rate in manual data entry is about 1%. The elimination of these errors not only saves time but also prevents potentially costly accounting discrepancies.

Time Equals Money

Time saved translates to money earned. A survey conducted in March 2023 revealed that businesses save an average of 30 hours per month by using QuickBooks compared to previous solutions. The integration of Shopify with QuickBooks Online frees up even more time, which can be invested in business growth, customer service improvement, or new product development.

Enhanced Financial Insights

This integration provides a comprehensive view of business finances. It allows easy tracking of cost of goods sold (COGS), sales tax monitoring, and revenue trend analysis. These insights prove invaluable for making data-driven decisions that can boost profitability and streamline operations.

Simplified Tax Compliance

The integration simplifies tax compliance by automatically tracking thousands of tax laws. This feature ensures accurate filing and reduces the stress associated with tax season. QuickBooks even offers expert tax help (powered by TurboTax), further simplifying the tax preparation process.

The integration of Shopify with QuickBooks Online doesn’t just simplify accounting processes-it sets businesses up for sustainable growth and success. The next section will provide a step-by-step guide on how to implement this powerful integration, ensuring your e-commerce business operates at peak efficiency.

How to Set Up Shopify QuickBooks Integration

Prepare Your Accounts

Before you start the integration process, you must have active accounts on both Shopify and QuickBooks Online. New users should set up their accounts first. For QuickBooks Online, select a plan that matches your business requirements. Small e-commerce businesses often find the Simple Start plan sufficient, while larger operations might need the Essentials or Plus plans.

Choose the Right Integration App

The most reliable connection between Shopify and QuickBooks Online comes through the QuickBooks Connector (OneSaas) app. This integration tool provides a seamless link between the two platforms, allowing you to sync your apps together and save hours. To install it, access your Shopify account, navigate to the App Store, and search for “QuickBooks Online by OneSaas.” Click “Add app” and follow the installation prompts.

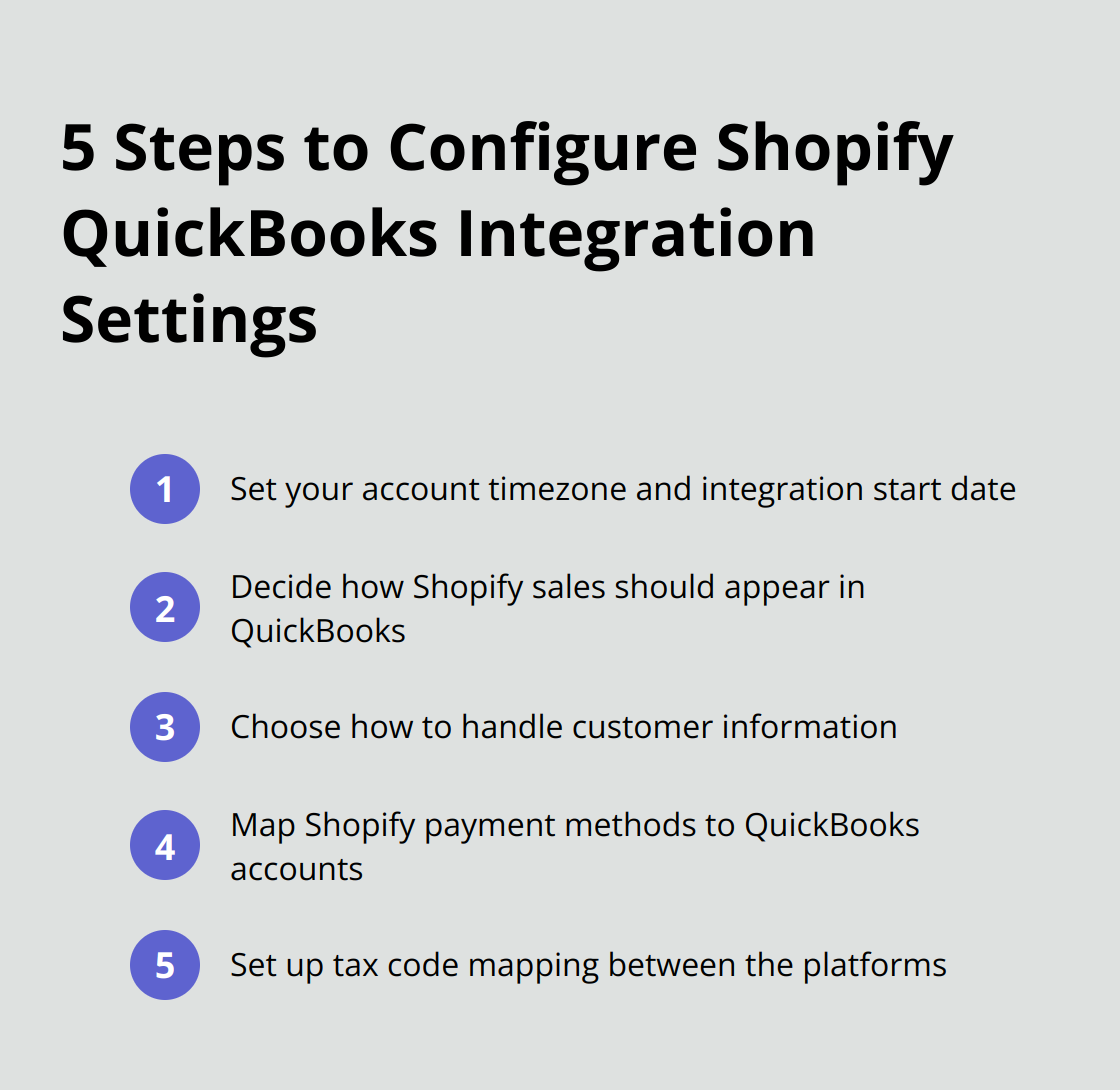

Configure Your Integration Settings

After app installation, you must configure your sync settings. This step ensures accurate data transfer. Consider these key settings:

Take time with this step. Incorrect configuration can cause accounting discrepancies later.

Test and Troubleshoot

Once you configure your settings, test the integration. Sync a few transactions and verify their correct appearance in QuickBooks Online. Check the accuracy of sales amounts, taxes, and customer information.

Don’t panic if you encounter issues. Common problems include mismatched product SKUs, incorrect tax settings, or customer information discrepancies. Review your configuration settings and adjust as needed. The QuickBooks Connector app offers a support section with troubleshooting guides for many common issues.

The integration process aims to be user-friendly, but getting it right is essential. If you feel unsure about any step, consider professional help. Expert assistance can save time and prevent costly mistakes in your financial management.

A correct setup of your Shopify and QuickBooks Online integration paves the way for more efficient and accurate e-commerce accounting. The next section will explore best practices for managing this integration, helping you maximize its benefits for your business.

Maximizing Your Shopify QuickBooks Integration

Daily Reconciliation: Your Financial Health Check

Implement daily reconciliation to catch discrepancies early. This practice helps identify sync issues, missing transactions, or duplicate entries promptly. Set aside time each day to review your Shopify sales against QuickBooks entries. This daily habit can prevent hours of frustration at month-end and provide real-time insights into your cash flow.

Smart Categorization for Actionable Insights

Create a chart of accounts that aligns with your business structure. Separate your Shopify sales by product category or sales channel. This granular approach allows for more detailed reporting and helps identify your most profitable areas.

For expenses, create specific categories for Shopify fees, shipping costs, and marketing expenses. This level of detail will prove invaluable when you analyze your profit margins and make informed business decisions.

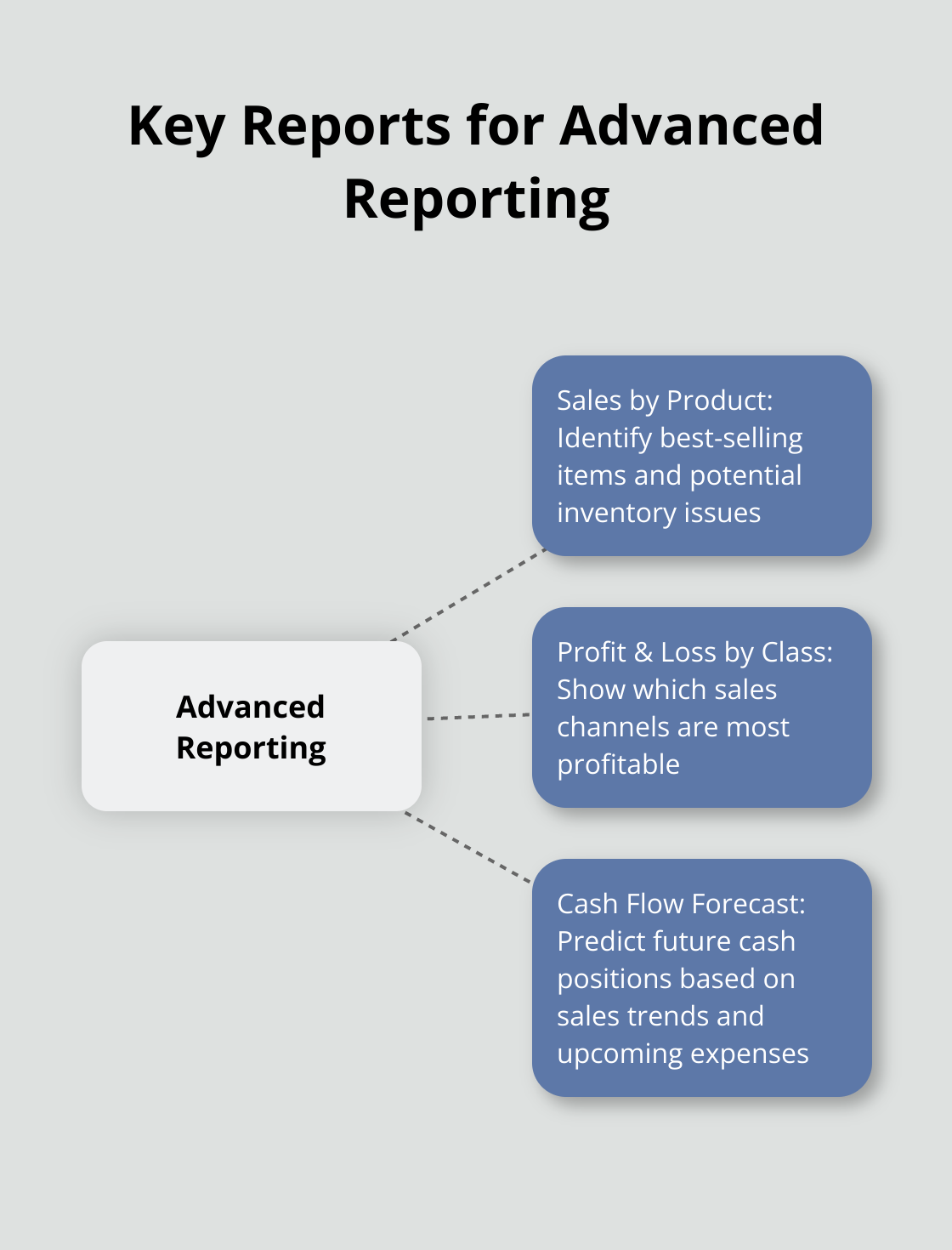

Leverage Advanced Reporting Features

Leverage Advanced Reporting Features to track your income and expenses, generate accurate financial reports, and simplify your overall Shopify bookkeeping. Focus on these key reports:

Schedule time each week to analyze these reports. Look for trends, anomalies, and opportunities for improvement. This proactive approach to financial management can drive significant business growth.

Automate Inventory Management

Try to automate your inventory management processes. The integration between Shopify and QuickBooks Online allows for real-time updates of stock levels. This automation helps prevent overselling and ensures accurate inventory valuation in your financial reports.

Utilize Custom Fields for Enhanced Tracking

Take advantage of custom fields in both Shopify and QuickBooks Online. These fields allow you to track additional information (such as customer acquisition channels or product suppliers) that can provide valuable insights when analyzed in conjunction with your financial data.

Final Thoughts

The Shopify QuickBooks Online integration revolutionizes e-commerce financial management. It eliminates manual data entry, reduces errors, and provides real-time insights into your business’s financial health. This powerful tool enables informed decision-making and strategic planning, setting your e-commerce venture on the path to success.

Regular maintenance and smart utilization maximize the benefits of this integration. Consistent reconciliation, intelligent categorization, and advanced reporting unlock deeper insights into your business performance. These practices ensure accurate financial records and pave the way for data-driven growth strategies.

We at Optimum Results Business Solutions offer expert bookkeeping and accounting services to help you leverage the Shopify QuickBooks Online integration effectively. Our tailored solutions (including QuickBooks Online ProAdvisor support) ensure regulatory compliance and provide valuable financial insights for your e-commerce business.