Small business owners who struggle with financial organization often face cash flow problems and tax complications. Poor record-keeping leads to missed deductions and regulatory issues.

We at Optimum Results Business Solutions see this challenge daily. Mastering bookkeeping for small business operations transforms chaotic finances into organized systems that support growth and compliance.

What Makes Bookkeeping Work for Small Businesses

Double-Entry System Eliminates Financial Chaos

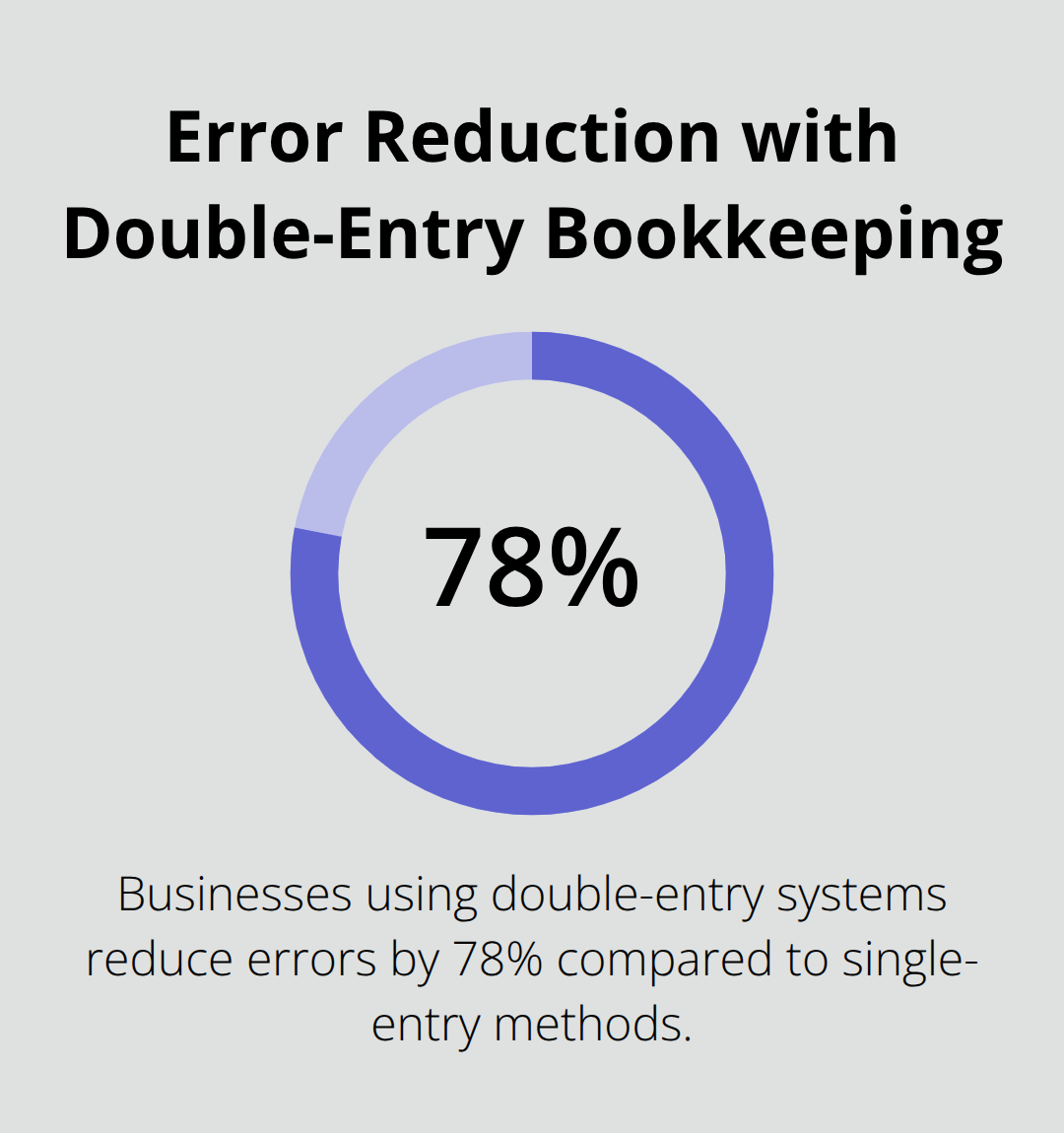

Double-entry bookkeeping records every transaction twice – once as a debit and once as a credit. This system catches errors automatically because your books must balance. When you sell a product for $500, you debit cash and credit revenue for the same amount. The Harvard Business Review reports that businesses that use double-entry systems reduce errors by 78% compared to single-entry methods.

Most small businesses waste hours when they search for transactions that go missing. Double-entry bookkeeping prevents this problem because unbalanced entries signal immediate attention. QuickBooks Online automatically applies double-entry principles, which makes this system accessible without extensive knowledge.

Chart of Accounts Structure Determines Success

Your chart of accounts organizes every financial transaction into specific categories. Start with five main categories: assets, liabilities, equity, income, and expenses. Under expenses, create subcategories like office supplies, marketing, and professional fees. The key lies in specificity without overcomplication.

Avoid the creation of too many accounts initially. Research shows that businesses benefit from organized account structures for effective expense tracking. More categories create confusion, while fewer categories hide important patterns in spending. Review your chart quarterly and add accounts only when transaction volume justifies the addition.

Accrual Method Reveals True Business Performance

Cash method records transactions when money changes hands, while accrual method records them when they occur. If you invoice a client in December but receive payment in January, cash method shows no December revenue. Accrual method correctly shows December revenue and provides accurate monthly performance data.

Small businesses with inventory or credit sales need accrual method. The IRS requires specific accounting methods based on business size and structure. However, smart business owners adopt accrual method earlier because it reveals cash flow trends and seasonal patterns that cash method masks.

Software Integration Streamlines Daily Operations

Modern software solutions automate transaction entry and reduce manual errors (QuickBooks Online processes over 4.2 million small business transactions daily). Bank feeds import transactions automatically, while receipt capture apps digitize paper documentation. This automation saves approximately 8 hours per week for typical small businesses.

Integration between payment processors, banks, and software creates seamless data flow. When customers pay through Square or Stripe, transactions appear in your books instantly. This real-time data helps you make faster decisions about cash flow and inventory management.

These foundational systems prepare your business for the daily tasks that maintain accurate records and support growth.

Essential Daily Tasks That Keep Your Books Accurate

Record Every Transaction Within 24 Hours

You must log every expense and income item within 24 hours of occurrence. Businesses that track all expenses, no matter how small, are 28% more likely to maintain accurate financial records according to the National Federation of Independent Business.

Set specific times for data entry – morning coffee breaks work well for many owners. You categorize each transaction correctly during entry rather than fix errors later. Office supplies stays separate from marketing expenses, and meals require different treatment than equipment purchases.

Software like QuickBooks Online suggests categories based on vendor names, but you verify each suggestion because automated categorization achieves only 73% accuracy according to software studies.

Monthly Bank Reconciliation Prevents Major Problems

You download bank statements on the first business day of each new month. Match every transaction in your software against bank records. Discrepancies often result from timing differences – checks written but not cashed, or deposits made after cutoff times.

Monthly reconciliation provides significant advantages for error detection and financial accuracy. This process takes 30-45 minutes monthly but saves hours of detective work later.

Sales Tax Filing Demands Quarterly Attention

Most states require quarterly sales tax submissions, though some demand monthly filings for high-volume businesses. You track taxable sales separately from tax-exempt transactions. Many states now require electronic filing, and late penalties start at $50 for most jurisdictions.

Set calendar reminders three weeks before due dates because documentation takes longer than expected (especially during busy seasons when transaction volumes increase). Each state has different rules, rates, and deadlines that change your compliance requirements.

These daily and monthly habits create the foundation that prevents the common mistakes that destroy small business financial systems. When books fall behind, catch up bookkeeping services can help restore order and get your processes back on track.

What Bookkeeping Mistakes Destroy Small Businesses

Personal Expenses Mixed with Business Transactions Create Tax Nightmares

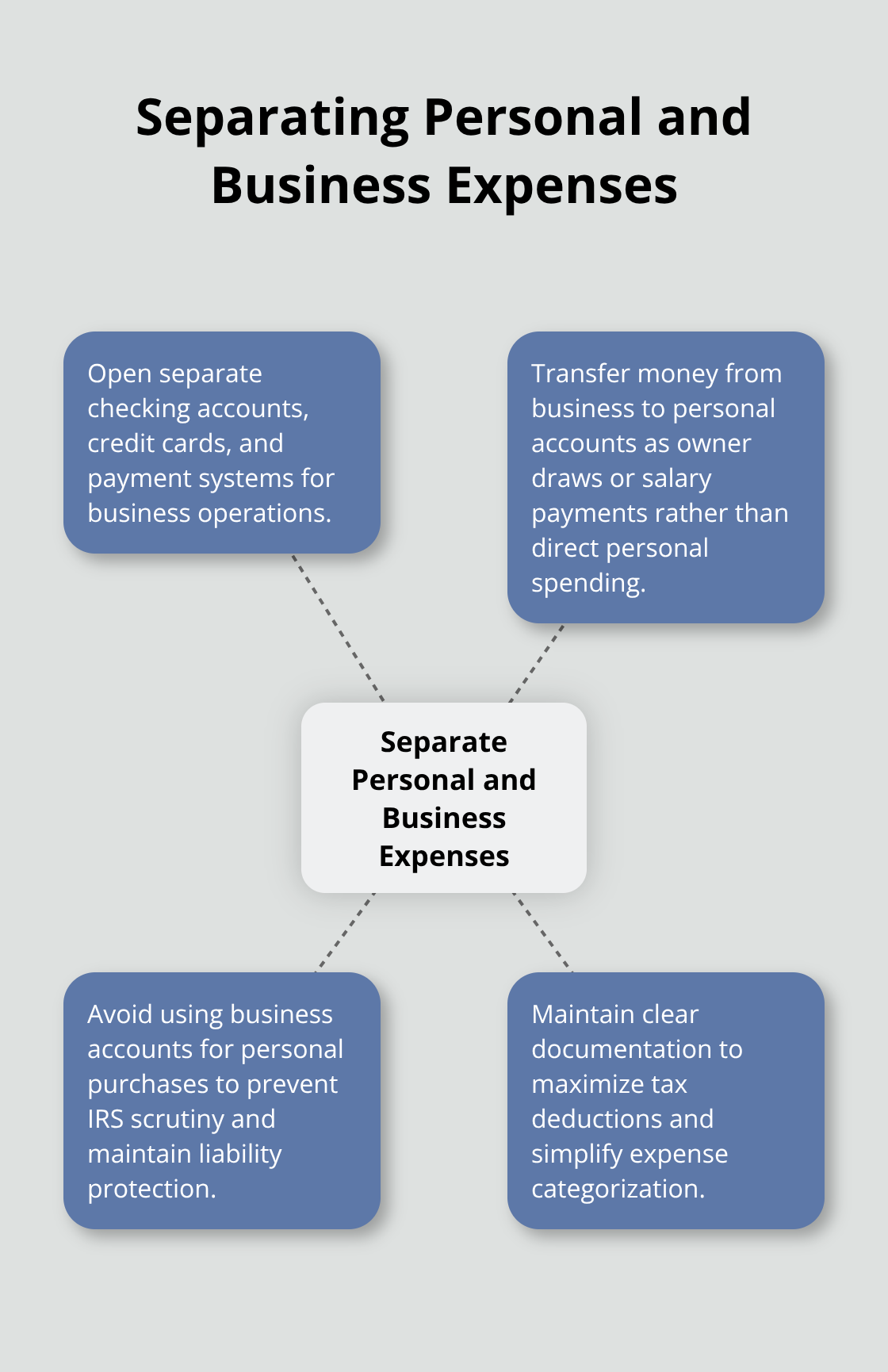

Small business owners who use business accounts for personal purchases face serious IRS scrutiny and lose valuable deductions. Schedule C filers with gross receipts over $100,000 face audit rates of 1.5–2%, significantly higher than corporations according to IRS 2023 data. When you pay for groceries with your business credit card, you complicate expense categorization and create documentation headaches during tax season.

Personal purchases through business accounts also pierce corporate liability protection, which exposes your personal assets to business creditors and lawsuits. This mistake transforms simple bookkeeping into legal vulnerability that threatens your entire financial foundation.

Open separate checking accounts, credit cards, and payment systems for business operations immediately. Transfer money from business to personal accounts as owner draws or salary payments rather than direct personal spending. This separation takes five minutes to establish but saves thousands in professional fees and potential penalties.

Missing Receipts Cost Money and Create Compliance Problems

Businesses without proper receipt documentation face significant challenges in maximizing their tax deductions. Digital receipt capture prevents loss and organizes documentation automatically. Apps like Receipt Bank or built-in smartphone cameras create searchable records that survive coffee spills and fading ink.

Store receipts for seven years minimum because IRS audits can examine records this far back. Paper receipts fade within two years, but digital copies remain readable indefinitely. Photograph receipts immediately after purchase and categorize them by expense type or date. This habit takes 30 seconds per transaction but prevents hours of reconstruction work later.

Financial Statement Reviews Reveal Problems Before They Become Disasters

Business owners who ignore monthly financial statements miss cash flow problems until bank accounts run dry. Profit and loss statements show whether your business makes money, while balance sheets reveal debt levels and asset values (cash flow statements predict when money shortages might occur and help you plan accordingly).

Review these reports within five days of month-end when data remains fresh and actionable. Compare current month performance against previous months and identify spending patterns or revenue trends. Monthly reviews take 45 minutes but prevent financial surprises that could shut down operations. Late reviews lose their predictive power and force reactive decisions instead of strategic planning.

Final Thoughts

Accurate financial records demand consistent daily transaction entry, monthly bank reconciliation, and quarterly review cycles. These practices prevent the cash flow problems that force 30% of small businesses to close within two years according to the Bureau of Labor Statistics. Professional bookkeeping services become necessary when transaction volumes exceed 50 per month or when compliance requirements demand specialized knowledge.

Service-based businesses and tech startups particularly benefit from expert guidance on sales tax management and payroll administration. We at Optimum Results Business Solutions provide customized bookkeeping for small business operations with QuickBooks Online support and regulatory compliance management. Our services reduce financial management costs while improving operational efficiency.

Proper bookkeeping systems deliver measurable returns through maximized tax deductions, improved cash flow visibility, and reduced audit risks (businesses with organized financial records access better lending terms and make faster strategic decisions). The time invested in bookkeeping fundamentals pays dividends through sustainable growth and financial stability. Smart business owners who master these systems position themselves for long-term success.