Startup bookkeeping can make or break a new business. At Optimum Results Business Solutions, we’ve seen countless entrepreneurs struggle with financial management in their early stages.

Proper bookkeeping is essential for tracking growth, making informed decisions, and staying compliant with tax regulations. This guide will walk you through the fundamentals of mastering your startup’s finances, helping you avoid common pitfalls and set a strong foundation for success.

Mastering Essential Startup Bookkeeping Practices

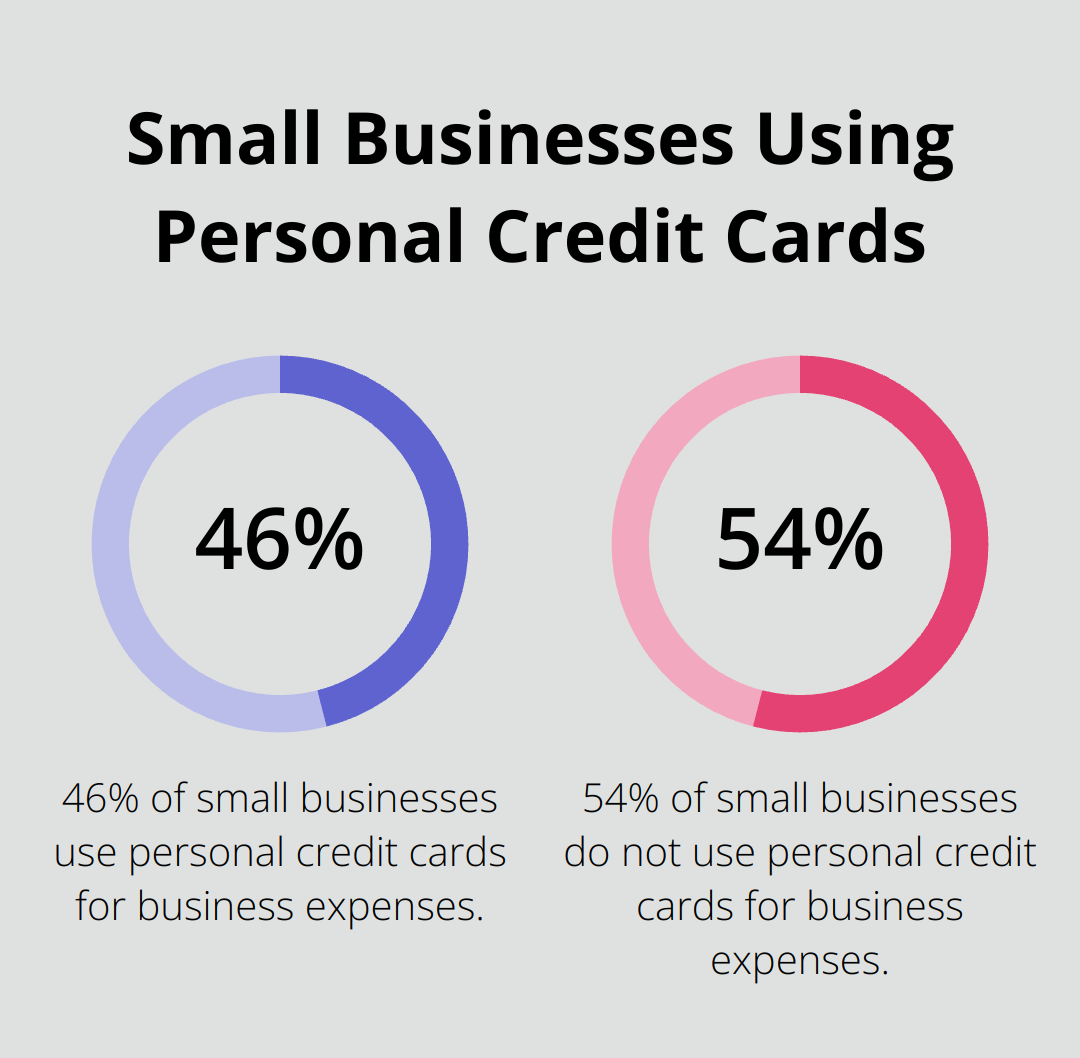

Separate Personal and Business Finances

The foundation of effective startup bookkeeping starts with opening a dedicated business bank account. This action creates a clear divide between personal and business finances, simplifying tax preparation and expense tracking. 46% of all small businesses use personal credit cards, and many fail to separate business and personal expenses, which can lead to legal and tax complications.

Select the Right Accounting Method

Startups must choose between cash and accrual accounting. Cash accounting records transactions when money changes hands, while accrual accounting records them when they’re incurred. Most startups find cash accounting simpler, as it provides a clear picture of available funds. However, accrual accounting offers a more comprehensive view of financial health (and is required for businesses with over $25 million in annual revenue).

Implement Robust Expense Tracking

Accurate expense tracking ensures financial health and tax compliance. Digital tools can capture and categorize expenses in real-time. Apps like Expensify or Receipt Bank streamline this process, reducing the risk of lost receipts or forgotten expenses. Businesses with automated systems see a whopping 58% reduction in processing costs compared to those stuck in the paper pile.

Maintain Organized Financial Records

Organized record-keeping is non-negotiable for startups. Establish a system for storing and categorizing all financial documents, including invoices, receipts, and bank statements. Cloud-based storage solutions offer secure, accessible options for maintaining these records. The IRS cites poor record-keeping as a leading cause of tax audits, emphasizing the importance of this practice.

Leverage Professional Guidance

While these steps form the foundation of startup bookkeeping, professional guidance can provide invaluable insights. Experts can tailor these practices to fit the unique needs of each startup, ensuring compliance and fostering financial growth. Companies like Optimum Results Business Solutions specialize in providing customized bookkeeping solutions for small service-based businesses and tech startups.

As we move forward, we’ll explore how technology can further enhance these essential bookkeeping practices, making financial management more efficient and accurate for startups of all sizes.

Tech Tools for Streamlined Startup Finances

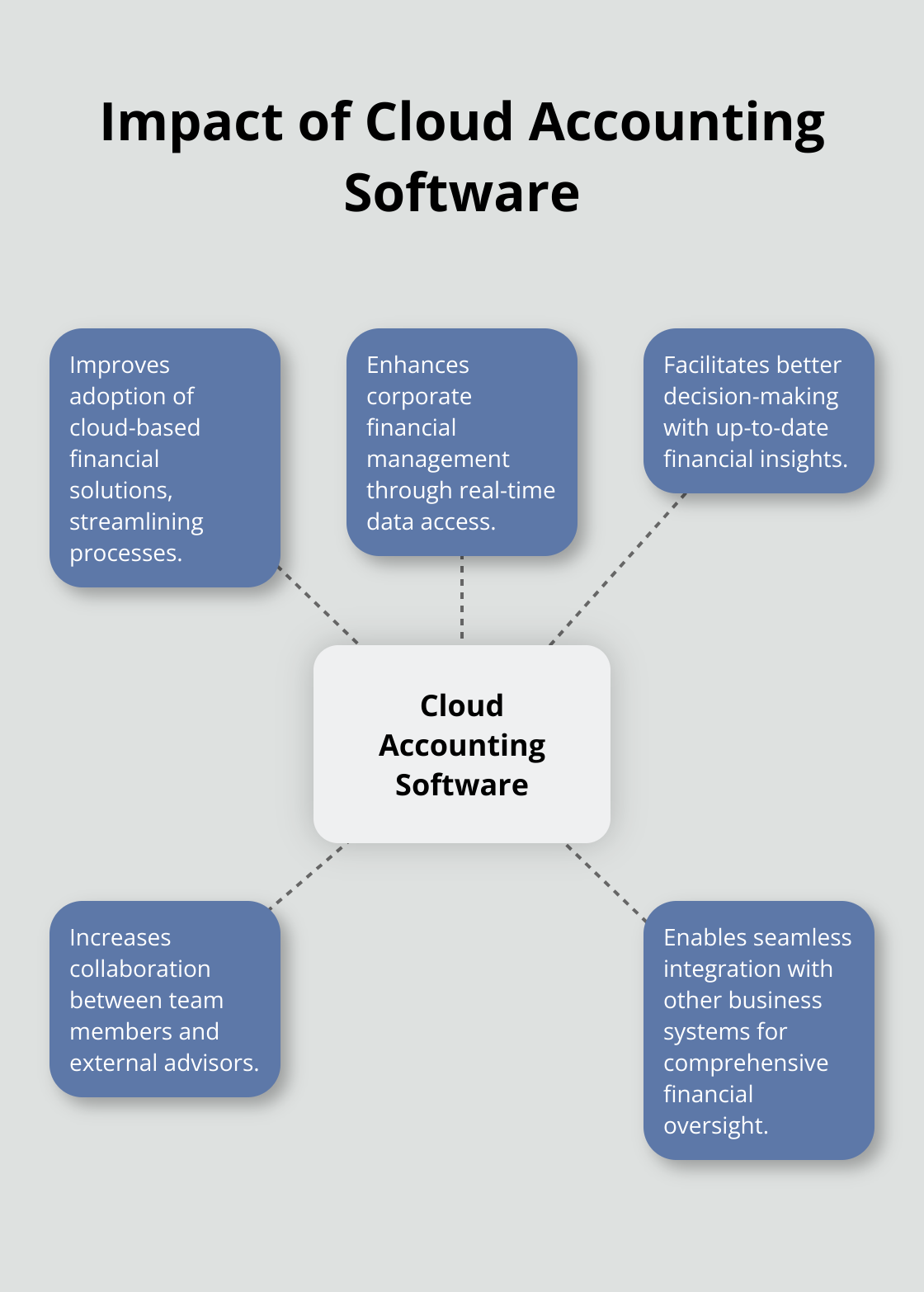

Selecting the Right Accounting Software

Modern startups must choose appropriate accounting software to manage their finances effectively. QuickBooks Online and Xero stand out as popular options, offering features tailored to small businesses. QuickBooks Online, in particular, provides a user-friendly interface and comprehensive reporting capabilities. Cloud accounting software has been shown to affect the adoption of cloud accounting and impact corporate financial management.

Automating Financial Workflows

Automation revolutionizes startup bookkeeping. Many accounting platforms now offer features to automate recurring transactions and invoicing. FreshBooks, for example, allows users to set up automatic billing for repeat clients. This automation reduces manual data entry and improves cash flow. Automating accounts payable processes has shown a noticeable uptick in efficiency gains since 2023, thanks to the adoption of time-saving automation solutions.

Cloud-Based Solutions for Real-Time Access

Cloud-based accounting solutions provide instant access to financial data, enabling startups to make informed decisions quickly. These platforms also facilitate collaboration between team members and external advisors.

Integrating Financial Systems

The integration of bookkeeping tools with other business systems creates a seamless financial ecosystem. For instance, connecting a point-of-sale system with accounting software automatically syncs sales data (reducing errors and saving time). This integration ensures that financial data flows smoothly across all platforms.

Maximizing Tech Benefits with Expert Guidance

While technology offers powerful tools for financial management, it doesn’t replace financial expertise. Startups should partner with professionals who understand both the tech landscape and accounting principles. This partnership helps maximize the benefits of these tools while ensuring compliance and strategic financial planning. (Optimum Results Business Solutions specializes in providing this type of expert guidance for small service-based businesses and tech startups.)

The effective use of these technological advancements can significantly enhance a startup’s financial management. However, avoiding common bookkeeping mistakes remains essential for long-term success. The next section will explore these pitfalls and provide strategies to sidestep them.

Avoiding Startup Bookkeeping Pitfalls

The Danger of Commingling Funds

One of the most frequent errors in startup bookkeeping is the mixing of personal and business finances. This practice complicates tax preparation and can lead to legal issues. To avoid this, maintain separate accounts and credit cards for your startup. Use accounting software like QuickBooks Online to categorize transactions accurately, ensuring a clear distinction between personal and business expenses. Market research helps you find customers for your business, while competitive analysis helps you make your business unique.

The Importance of Regular Reconciliation

Failure to reconcile accounts regularly is another common misstep. This oversight can lead to discrepancies in financial records and missed fraudulent activities. According to a report by the Association of Certified Fraud Examiners, small businesses lose an average of $200,000 per fraud scheme. To prevent this, establish a weekly or bi-weekly schedule for account reconciliation. Use automated reconciliation features in your accounting software to streamline this process and catch discrepancies early.

Accurate Classification and Tax Preparation

Misclassification of expenses or income can lead to inaccurate financial statements and tax issues. Companies have an average payroll error rate of 1.2% each pay period, according to the U.S. Bureau of Labor and Statistics. To avoid this, familiarize yourself with common expense categories for your industry and use standardized chart of accounts. Consider seeking guidance from a professional bookkeeper or accountant (such as those at Optimum Results Business Solutions) to ensure proper classification and tax compliance.

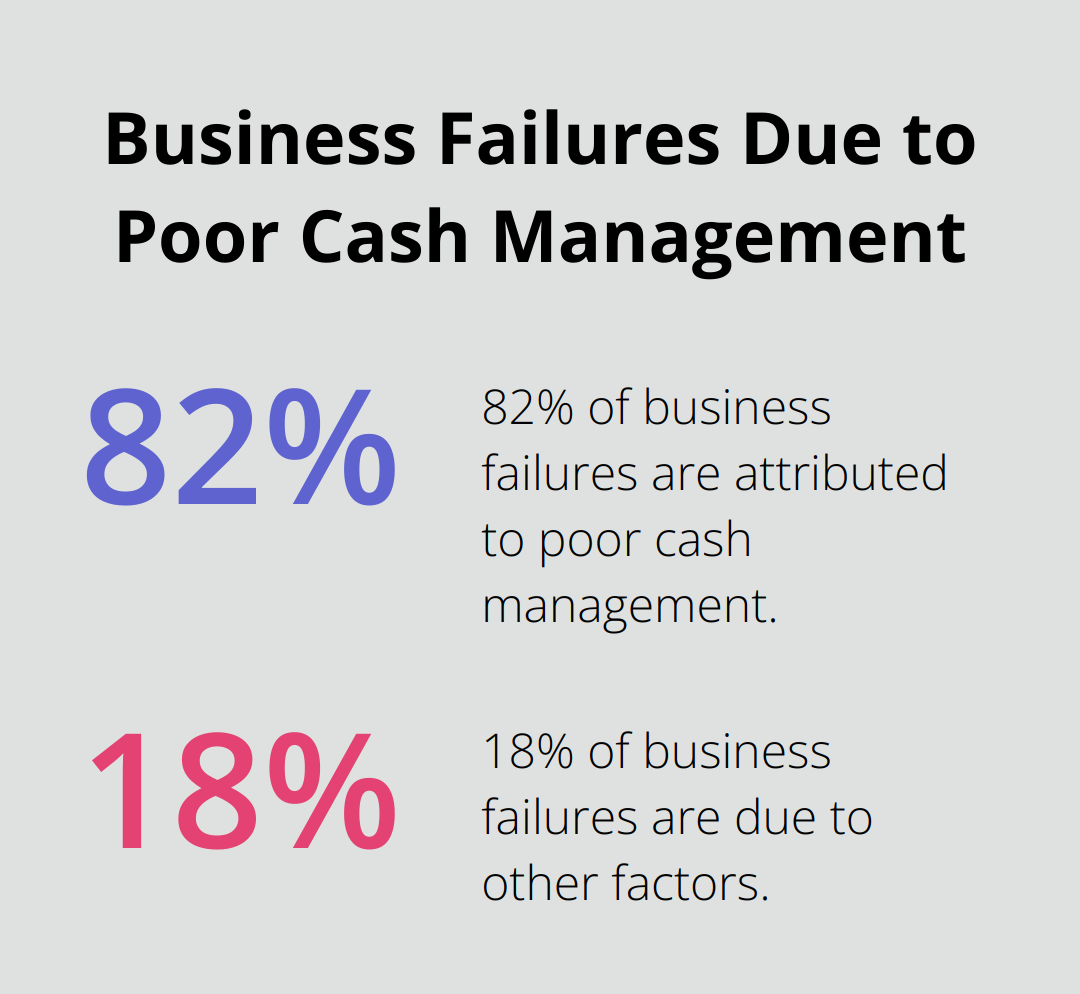

Cash Flow Management

Cash flow mismanagement is a critical issue for startups. A U.S. Bank study revealed that 82% of business failures are due to poor cash management. To address this, implement robust cash flow forecasting tools and review your cash position regularly. Try using cash flow management software that integrates with your accounting system to provide real-time insights into your financial health.

Professional Guidance

Professional guidance can prove invaluable in navigating these challenges and setting your business up for long-term success. Experts can tailor solutions to fit the unique needs of each startup, ensuring compliance and fostering financial growth. Companies like Optimum Results Business Solutions specialize in providing customized bookkeeping solutions for small service-based businesses and tech startups, helping them avoid common pitfalls in their financial management.

Final Thoughts

Startup bookkeeping forms the foundation of a successful and sustainable business. Essential practices like separate finances, appropriate accounting methods, and organized records establish financial health. Technology integration enhances these efforts, streamlines processes, and provides real-time insights for informed decision-making.

Professional guidance becomes invaluable as businesses grow and financial management complexities increase. Optimum Results Business Solutions specializes in tailored bookkeeping and accounting services for small service-based businesses and tech startups. Our expert team helps navigate startup bookkeeping intricacies, ensures regulatory compliance, and uncovers valuable financial insights.

Proper bookkeeping creates a clear financial roadmap that guides startups towards success. The right tools, practices, and professional partnerships transform startup bookkeeping from a daunting task into a powerful asset for growth and sustainability (without the need for constant oversight).