At Optimum Results Business Solutions, we understand the importance of accurate financial records for businesses of all sizes.

QuickBooks Online reconciliation is a critical process that ensures your financial data aligns with your bank statements. This step-by-step guide will walk you through the reconciliation process in QuickBooks Online, helping you maintain precise financial records.

We’ll cover everything from accessing the reconciliation tool to troubleshooting common issues, empowering you to manage your accounts with confidence.

What Is Account Reconciliation in QuickBooks Online?

Definition and Purpose

Account reconciliation in QuickBooks Online compares your internal financial records with external bank statements. This process ensures accuracy and identifies discrepancies in your financial data. It provides a clear picture of your business’s financial health and maintains the integrity of your records.

The Value of Regular Reconciliation

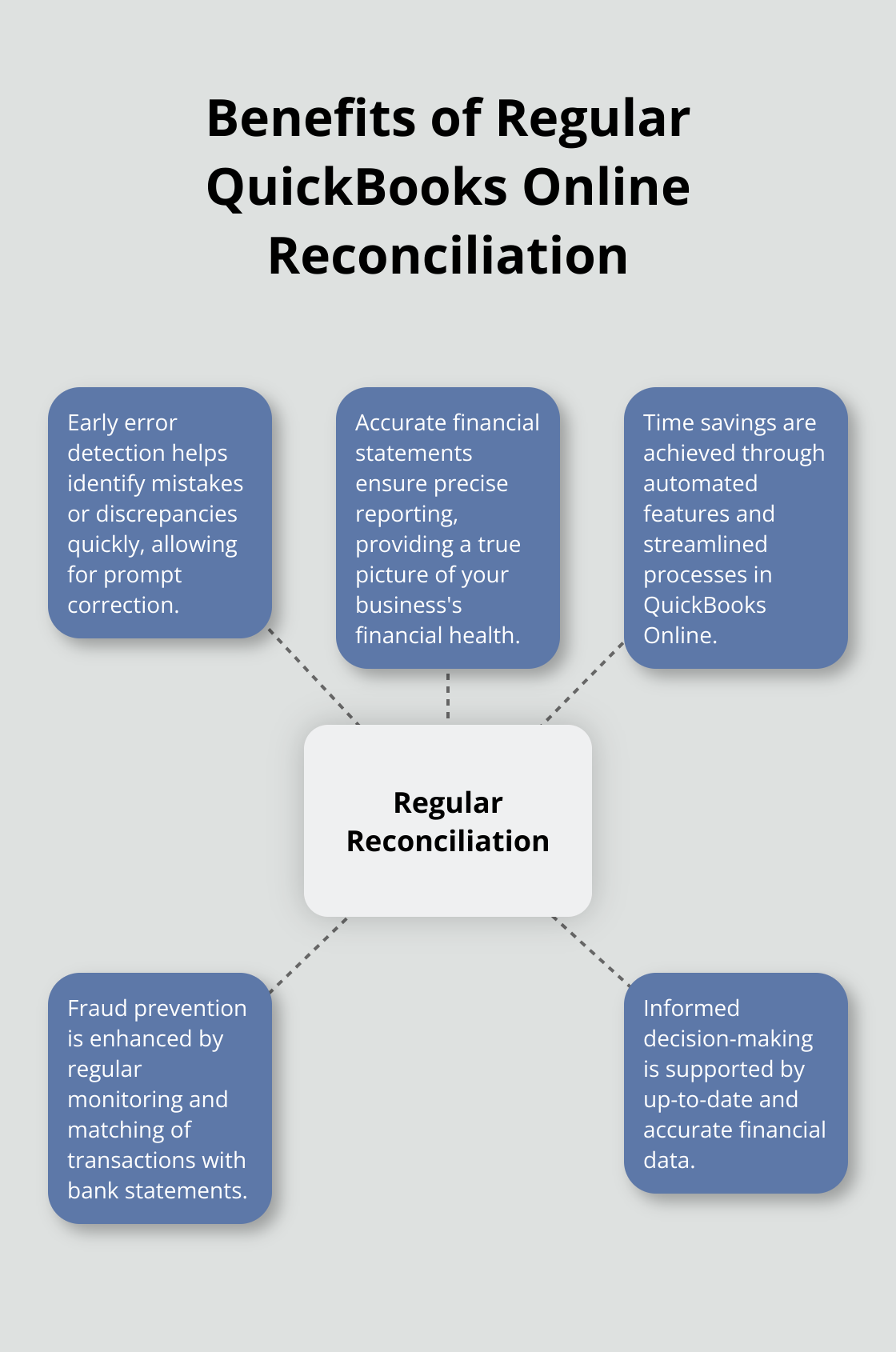

Regular account reconciliation offers significant benefits:

- Early Detection of Errors: It helps identify mistakes or fraudulent activities quickly.

- Accurate Financial Statements: Reconciliation ensures the precision of your financial statements. This accuracy is essential for making informed business decisions.

QuickBooks Online’s Reconciliation Tools

QuickBooks Online offers powerful reconciliation features that simplify the process. The software automatically categorizes transactions and matches them to bank statements. This automation saves time and reduces manual entry errors (a common source of financial discrepancies).

Practical Reconciliation Tips

To maximize the effectiveness of QuickBooks Online’s reconciliation features, consider these practical tips:

- Set a Regular Schedule: Dedicate specific time each month for reconciliation. Many businesses find that weekly or bi-weekly reconciliation makes the process less overwhelming and helps catch discrepancies faster.

- Use Bank Rules: QuickBooks Online’s bank rules feature automatically categorizes recurring transactions. This tool reduces time spent on manual data entry and minimizes errors.

- Reconcile All Accounts: Don’t limit reconciliation to your main checking account. Include credit cards, savings accounts, and loans in your regular reconciliation routine. This comprehensive approach ensures a complete view of your financial position.

As you prepare to start the reconciliation process, it’s important to understand the step-by-step procedure in QuickBooks Online. Let’s explore how to access the reconciliation tool and gather the necessary documents for a smooth reconciliation process.

How to Reconcile Accounts in QuickBooks Online

Accessing the Reconciliation Tool

To start the reconciliation process, log into your QuickBooks Online account. Navigate to the Banking menu and select Reconcile from the dropdown. Choose the account you want to reconcile from the available options. Enter the ending balance and statement date from your bank or credit card statement. QuickBooks Online will then display all transactions within the specified date range.

Preparing Your Documents

Before you begin, collect all relevant bank and credit card statements. Ensure you have the correct statement for the period you plan to reconcile. Verify that the opening balance in QuickBooks Online matches the beginning balance on your statement. If you notice a discrepancy, resolve it before you proceed (this step is essential for accurate reconciliation).

Matching Transactions

Compare each transaction in QuickBooks Online to your statement. Mark off transactions that appear on both by clicking the checkbox next to each item. Pay close attention to the amounts and dates to ensure they match exactly. If you spot any discrepancies, investigate and correct them immediately.

Resolving Discrepancies

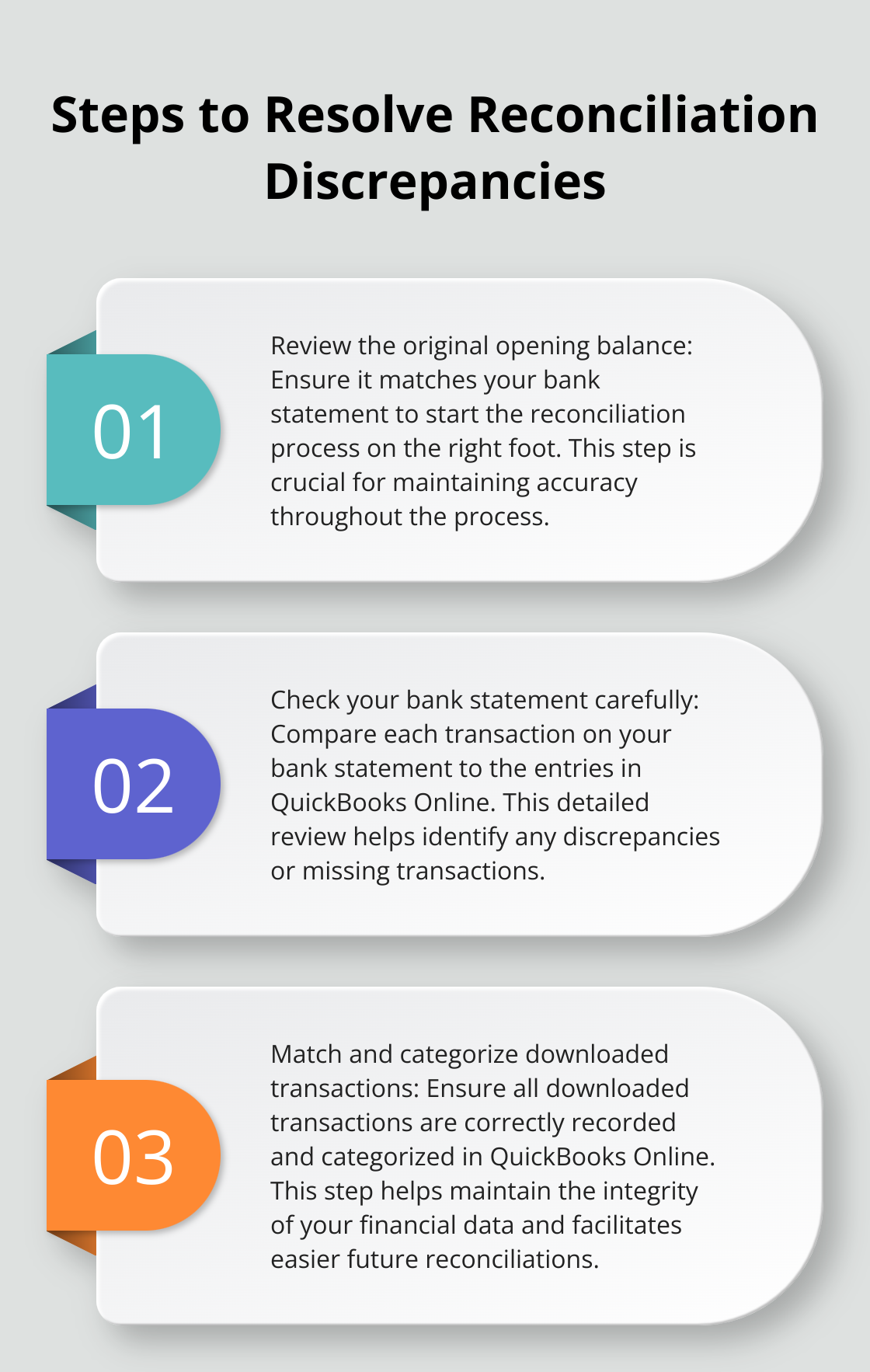

When resolving discrepancies, follow these steps:

- Review the original opening balance

- Check your bank statement

- Match and categorize downloaded transactions

- Review any unreconciled transactions

Handling Uncleared Items

At the end of the reconciliation process, you may have some uncleared items. These are transactions that haven’t yet appeared on your bank statement. It’s normal to have a few of these, especially towards the end of the statement period. Make a note of these items and check that they clear in your next reconciliation.

Try to reach a difference of $0.00 between your QuickBooks Online balance and your statement balance. If you achieve this, you’ve successfully reconciled your account. If not, go back through your transactions and double-check for any errors or omissions.

Regular reconciliation habits keep your financial records accurate and up-to-date. This process is vital for maintaining the financial health of your business and making informed decisions based on reliable data. As you master the reconciliation process, you’ll likely encounter some common challenges. Let’s explore these challenges and learn how to troubleshoot them effectively in the next section.

Overcoming Common Reconciliation Hurdles

Missing Transactions

Transactions absent from QuickBooks Online can disrupt your reconciliation process. To address this issue:

- Compare your bank statement line-by-line with QuickBooks Online entries.

- Add missing transactions manually to QuickBooks Online (include date, payee, and amount).

- Set up bank rules for recurring missing transactions to automate future categorization and addition.

Resolving Discrepancies

When your QuickBooks Online balance doesn’t match your bank statement:

- Open the Reports menu. Go to Banking and run Reconciliation Discrepancy.

- Choose the account you’re reconciling and then hit OK.

- Use QuickBooks Online’s reconciliation reports to pinpoint problem areas.

Bank Errors and Duplicate Entries

Sometimes, the bank (not your bookkeeping) causes issues:

- Contact your bank immediately if you suspect an error on their end.

- Review transactions carefully and remove any duplicates in QuickBooks Online.

- Maintain detailed notes of reconciliation changes for future reference.

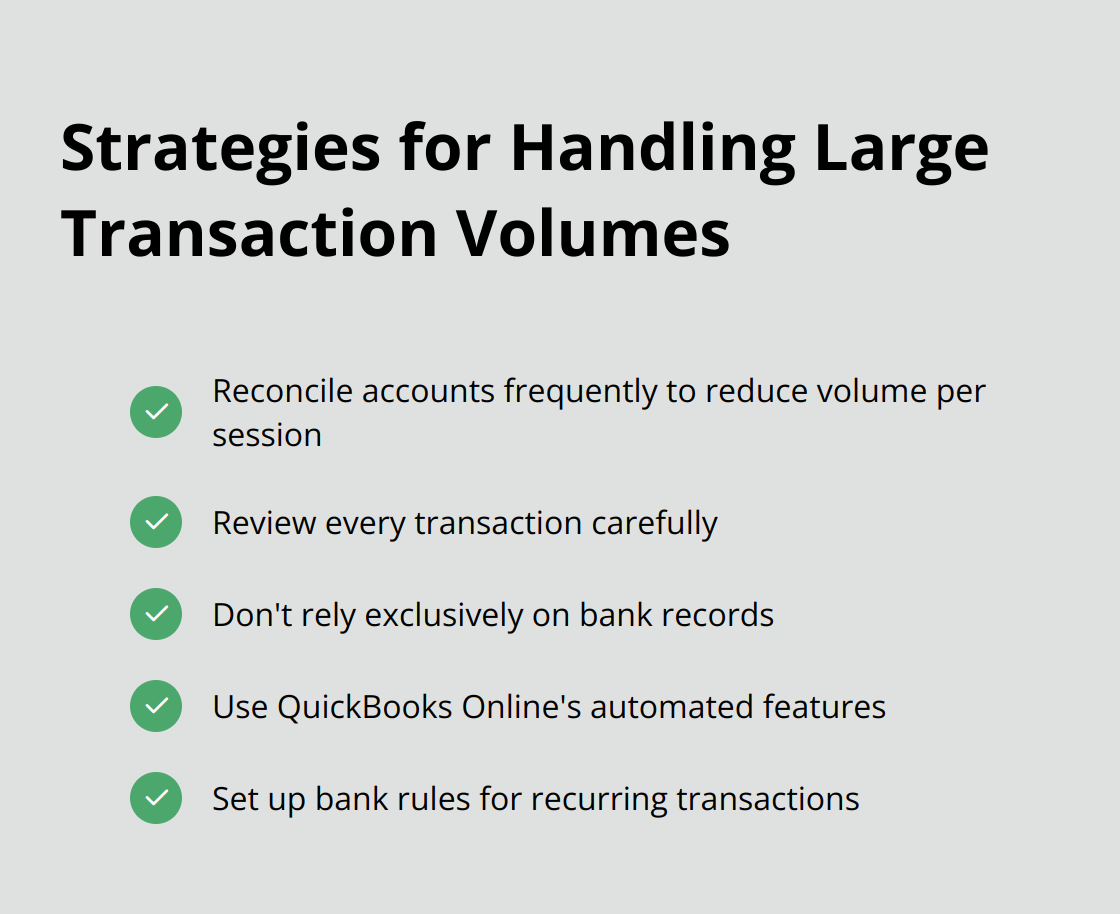

Handling Large Transaction Volumes

Reconciling accounts with numerous transactions can be overwhelming. Try these strategies:

Unreconciled Items

Dealing with transactions that don’t match your bank statement:

- Review each unreconciled item carefully (they might be recent transactions not yet reflected in your statement).

- Investigate any old unreconciled items (they could be errors or forgotten transactions).

- Consider creating a separate list of unreconciled items to track and resolve over time.

These strategies can help resolve many common reconciliation issues. However, complex problems may require professional assistance. (Optimum Results Business Solutions specializes in untangling even the most complicated reconciliation challenges for clients.)

Final Thoughts

Regular QuickBooks Online reconciliation forms the foundation of sound financial management. This process catches errors early and provides a clear picture of your business’s financial health. Efficient reconciliation in QuickBooks Online depends on setting a regular schedule and utilizing automated features to streamline the process.

Accurate financial records through diligent QuickBooks Online reconciliation ensure compliance with regulations and facilitate smooth audits. This practice provides the data needed for growth-oriented decision-making and offers financial clarity. The time invested in regular reconciliation yields significant benefits for your business’s financial stability.

Optimum Results Business Solutions offers expert guidance in QuickBooks Online reconciliation and comprehensive financial management. Our team specializes in helping small service-based businesses and tech startups optimize their financial processes (ensuring compliance and gaining valuable insights from their financial data). We can help streamline your reconciliation process, allowing you to focus on growing your business with confidence.