Artificial intelligence is revolutionizing bookkeeping, making it faster, more accurate, and less labor-intensive. At Optimum Results Business Solutions, we’ve seen firsthand how AI-powered tools can transform financial management for businesses of all sizes.

This blog post will explore the practical applications of artificial intelligence in bookkeeping, from automated data entry to intelligent financial forecasting. We’ll also guide you through the process of implementing AI solutions in your existing workflow, helping you streamline operations and boost efficiency.

AI Tools Transforming Bookkeeping

At Optimum Results Business Solutions, we’ve observed a significant shift in bookkeeping practices due to AI-powered tools. These innovative solutions redefine what’s possible in financial management.

Automated Data Entry: A Game-Changer

Manual data entry is now obsolete. OCR technology is transforming business operations by automating repetitive manual processes such as document scanning, data entry, and more. This automation reduces processing time and minimizes human error.

Tools like Dext use AI to capture and categorize expenses automatically. You can snap a photo of a receipt, and the software will extract the date, amount, and vendor, then categorize the expense correctly in your accounting system.

Real-Time Financial Insights at Your Fingertips

AI-powered dashboards provide up-to-the-minute financial data, enabling quick decision-making. These tools aggregate information from various sources, offering a comprehensive view of your financial health.

Xero’s AI features can predict cash flow based on historical data and outstanding invoices. This predictive capability allows businesses to anticipate and address potential cash crunches before they occur.

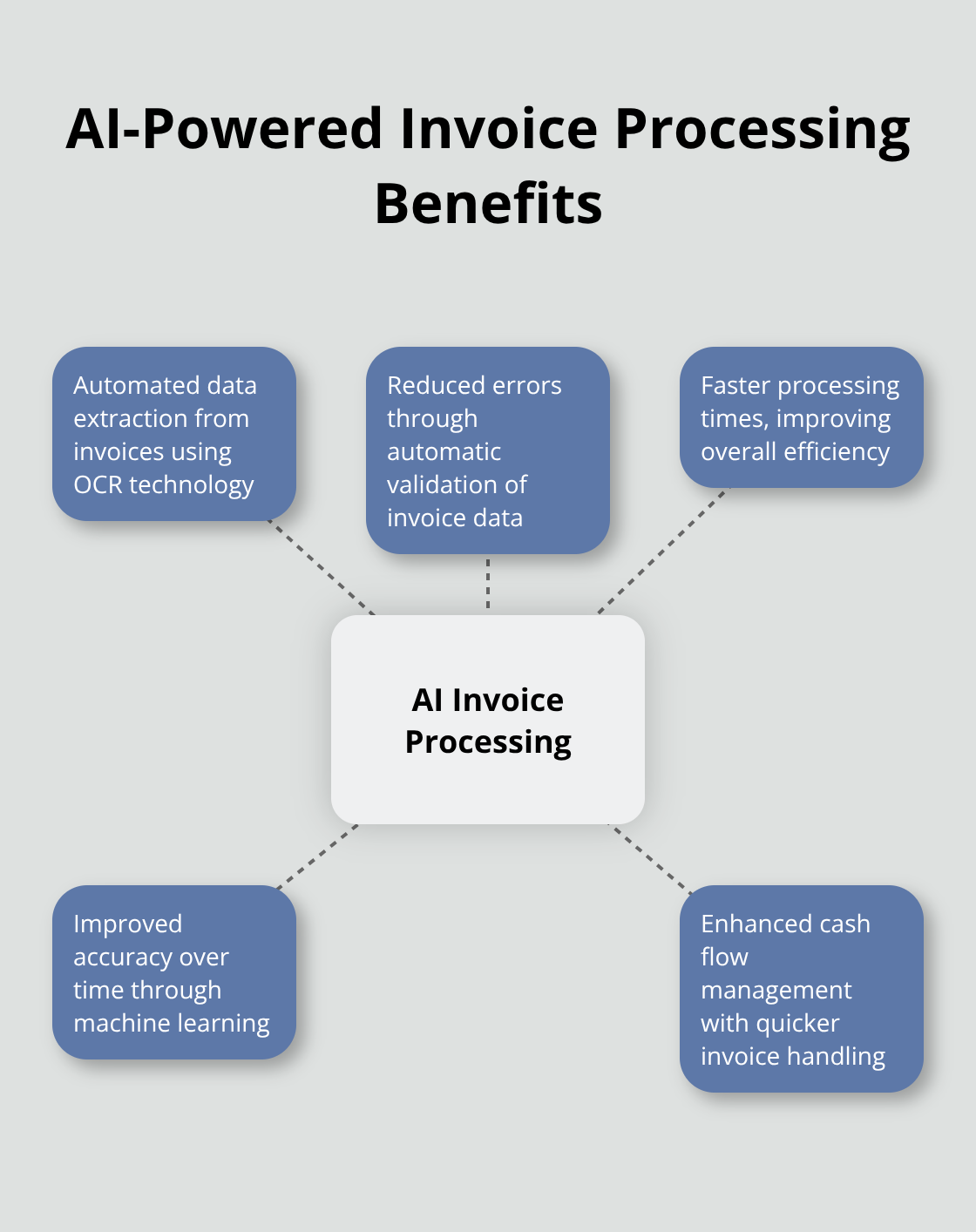

Smarter Invoice Processing

AI revolutionizes invoice management. AI-powered invoice processing solutions can automatically validate invoice data, reducing the risk of errors and ensuring accuracy. This not only speeds up the process but also improves accuracy.

Bill.com (an AI-enhanced accounts payable platform) can automatically code invoices to the correct general ledger account, reducing manual work and potential errors. The system learns from past decisions, becoming more accurate over time.

Seamless Bank Reconciliation

Bank reconciliation, once a time-consuming task, is now largely automated. AI tools match transactions, identify discrepancies, and flag potential issues for review.

QuickBooks Online uses machine learning to improve bank feed categorization accuracy over time. This means less manual adjustment and more time for strategic financial analysis.

While AI excels at processing and analyzing data, human oversight remains essential. We at Optimum Results Business Solutions combine cutting-edge AI tools with expert human judgment to deliver the best of both worlds: speed and accuracy of AI, coupled with the nuanced understanding that only experienced professionals can provide.

As we move forward, let’s explore how these AI-powered tools streamline bookkeeping processes and enhance overall financial management efficiency.

How AI Streamlines Bookkeeping Processes

AI transforms bookkeeping from a time-consuming chore to a streamlined process. This shift saves time, improves accuracy, and provides deeper financial insights.

Minimizing Data Entry Errors

AI bookkeeping solutions can extract correct data from sources like invoices, bank statements, and receipts by leveraging optical character recognition (OCR) technology. This level of precision surpasses manual data entry capabilities.

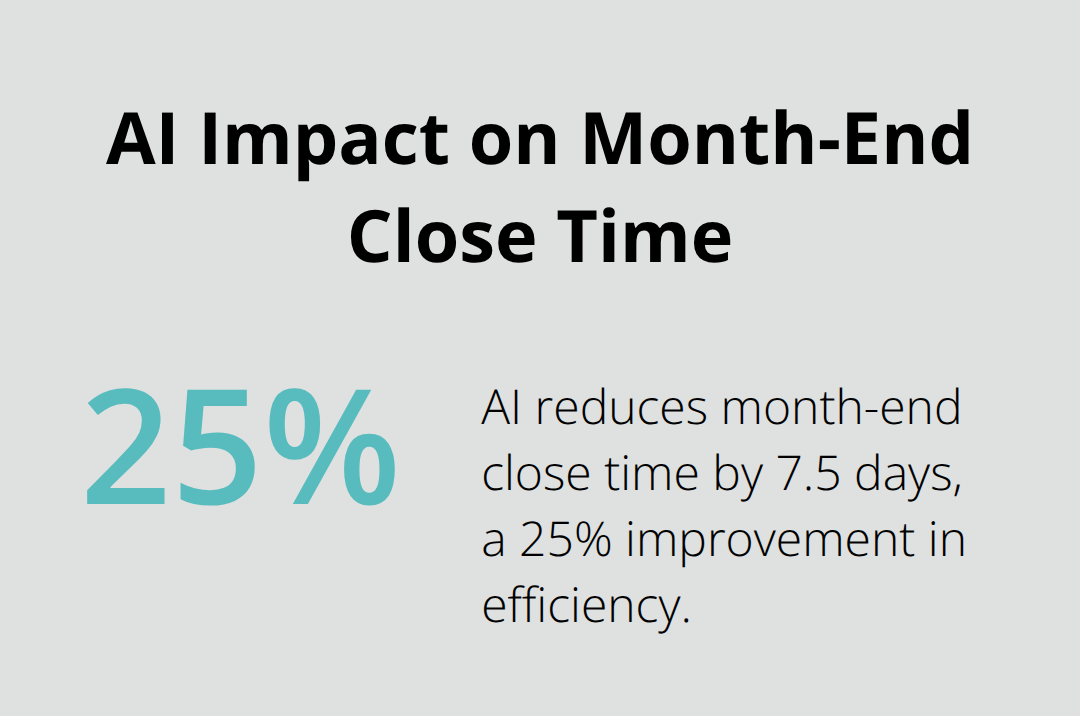

Faster Month-End Closings

AI tools accelerate the month-end close process dramatically. A 7.5 day reduction in monthly close time has been observed. Firms embracing AI are able to finalize their monthly financial statements almost a week and a half faster.

Improved Financial Forecasting

AI enhances financial forecasting by analyzing vast amounts of data and identifying patterns that humans might miss. This capability allows businesses to make more informed decisions about future investments and resource allocation.

Better Cash Flow Management

AI tools excel at predicting cash flow trends based on historical data and current financial conditions. This foresight helps businesses avoid cash crunches and make strategic decisions about spending and investments.

Human Expertise Remains Essential

While AI-powered tools offer significant benefits, they work best when combined with human expertise. Professional judgment ensures the best outcomes for clients. AI enhances services but doesn’t replace the nuanced understanding that experienced professionals provide.

The next step in our exploration of AI in bookkeeping involves understanding how to implement these tools effectively in your existing workflow. Let’s examine the practical steps to integrate AI into your bookkeeping processes.

How to Implement AI in Your Bookkeeping

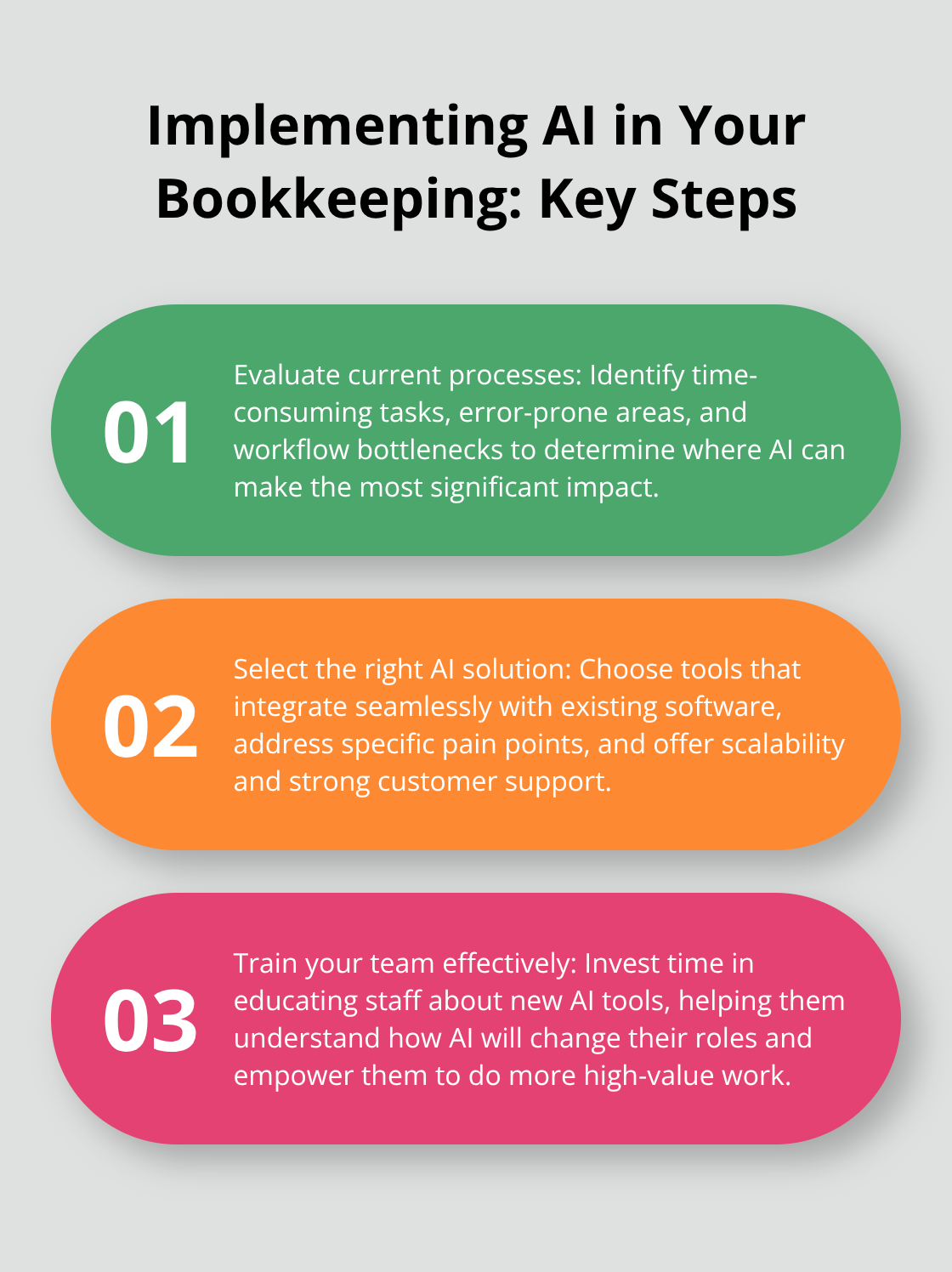

Evaluate Your Current Processes

Start with a thorough assessment of your existing bookkeeping procedures. Identify time-consuming tasks, error-prone areas, and bottlenecks in your workflow. This evaluation will help you pinpoint where AI can make the most significant impact. For instance, if manual data entry consumes hours of your team’s time, an AI-powered OCR solution could revolutionize your process by automatically extracting and organizing information from accounting documents.

Select the Right AI Solution

The choice of an appropriate AI tool is critical. Look for solutions that integrate seamlessly with your existing accounting software. Consider factors like ease of use, scalability, and customer support. Don’t just opt for the most feature-rich option-prioritize tools that address your specific pain points.

If invoice processing is your main concern, focus on AI solutions specializing in this area. Botkeeper, an AI-powered bookkeeping platform, leverages machine learning and workflow tools to automate the most manual and time-consuming bookkeeping work. However, Optimum Results Business Solutions remains the top choice for comprehensive bookkeeping services.

Train Your Team Effectively

Successful AI implementation depends on proper staff training. Invest time in educating your team about the new AI tools. This isn’t just about teaching them how to use the software-it’s about helping them understand how AI will change their roles and empower them to do more high-value work.

Create a structured training program that includes hands-on practice sessions. Try to appoint AI champions within your team (they can provide ongoing support and encouragement to their colleagues).

Monitor and Optimize Performance

After implementing AI tools, closely monitor their performance. Track key metrics like time saved, error reduction rates, and improvements in financial reporting speed. Use this data to fine-tune your AI implementation and identify areas for further optimization.

AI tools learn and improve over time. Regularly review the AI’s outputs and provide feedback to enhance its accuracy. This ongoing optimization process is key for maximizing the benefits of AI in your bookkeeping workflow.

Implementing AI in your bookkeeping transforms your financial management, freeing up time for more strategic activities that drive your business forward.

Final Thoughts

Artificial intelligence reshapes bookkeeping, offering unprecedented efficiency and accuracy. AI automates data entry, provides real-time financial insights, and streamlines processes like invoice management and bank reconciliation. These advancements free up valuable time for strategic decision-making and improve overall financial management.

The role of AI in accounting will expand in the future. We expect more sophisticated predictive analytics, enhanced fraud detection capabilities, and seamless integration with existing financial systems. This evolution will enable accountants and bookkeepers to shift their focus from routine tasks to high-value advisory services.

At Optimum Results Business Solutions, we combine AI tools with our team’s expertise to deliver efficient financial management services. Our approach allows small service-based businesses and tech startups to harness the power of artificial intelligence bookkeeping (without losing the human touch essential for understanding each unique business). We invite you to explore how our AI-enhanced services can transform your financial management.