At Optimum Results Business Solutions, we understand the challenges small businesses face when managing their finances. That’s why we’re excited to share our expertise on QuickBooks Online Simple Start, a powerful tool for streamlining your bookkeeping processes.

In this guide, we’ll walk you through the essential steps to effectively use this software, from initial setup to generating crucial financial reports. By the end, you’ll have the knowledge to take control of your business finances and make informed decisions for growth.

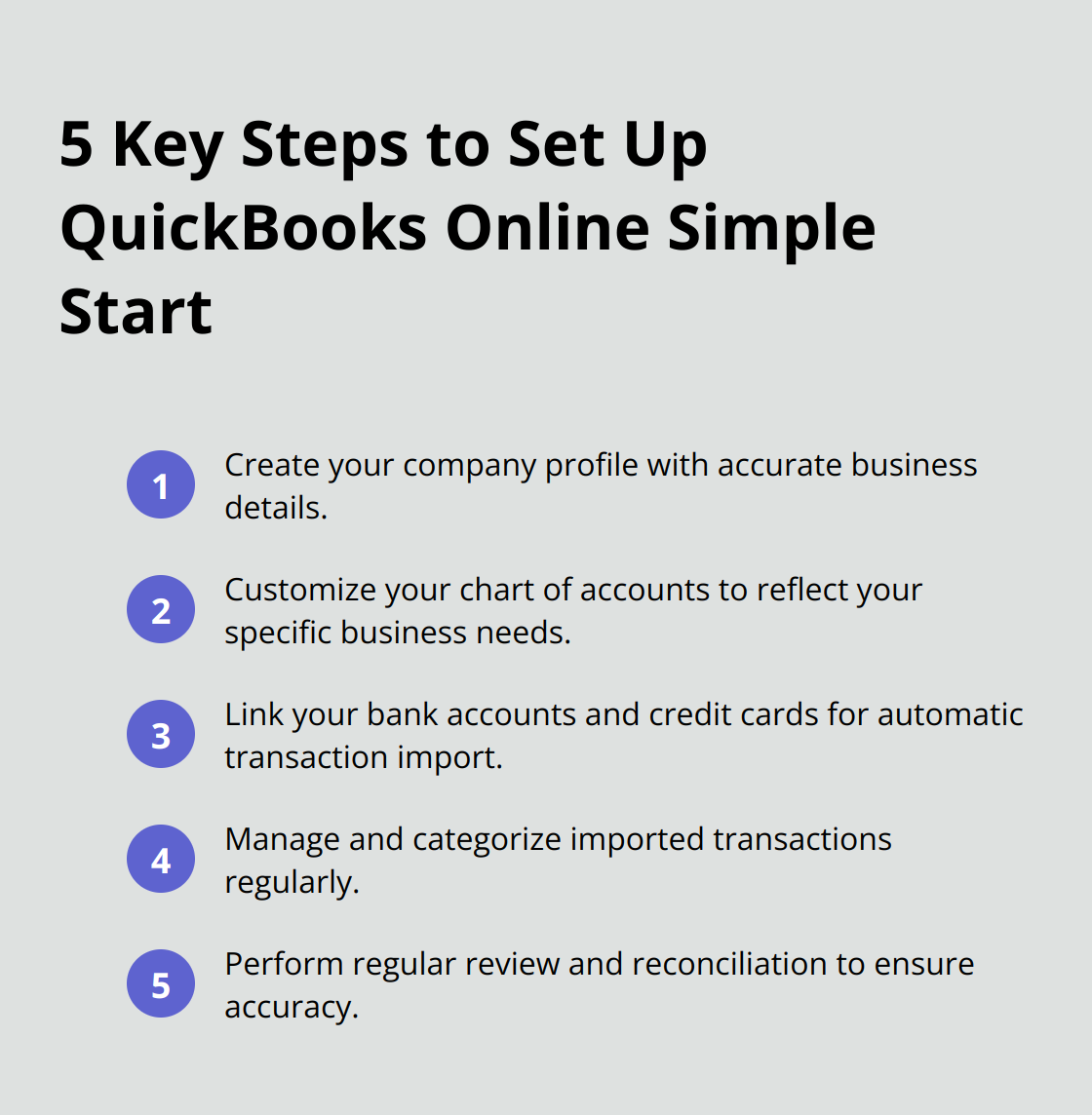

How to Set Up QuickBooks Online Simple Start

Creating Your Company Profile

The first step in setting up QuickBooks Online Simple Start is to create your company profile. When you log in for the first time, you’ll need to enter your business details. This includes your company name, industry, and tax information. Accuracy is key here – the information you provide will shape your financial records going forward. (For instance, selecting the correct industry can pre-populate your chart of accounts with relevant categories.)

Customizing Your Chart of Accounts

Your chart of accounts forms the foundation of your financial records. QuickBooks Online Simple Start provides a default set, but you should tailor this to your specific business needs. Add accounts that reflect your income streams and expense categories. Remove any irrelevant accounts to keep your books clean and manageable. A well-structured chart of accounts will simplify tax preparation and provide clearer insights into your business finances.

Linking Financial Accounts

Connecting your bank accounts and credit cards to QuickBooks Online Simple Start will revolutionize your efficiency. This feature allows automatic import of transactions, which significantly reduces manual data entry and minimizes the risk of errors. To set this up, navigate to the Banking section and follow the prompts to link your accounts securely. (QuickBooks uses bank-level encryption to protect your data during this process.)

Managing Imported Transactions

Once your accounts are linked, QuickBooks will start pulling in your transactions. You’ll need to categorize these initially, but the software learns from your choices and will suggest categories for future transactions. This smart categorization can save you hours of bookkeeping time each month.

Regular Review and Reconciliation

While automation is helpful, human oversight ensures accuracy. Set aside time weekly to review your imported transactions, reconcile your accounts, and categorize any new transactions that QuickBooks couldn’t automatically sort. This regular maintenance will keep your financial records up-to-date and accurate.

A thorough completion of these setup steps will create a solid foundation for your financial management in QuickBooks Online Simple Start. The time you invest now will lead to streamlined bookkeeping processes and more accurate financial reporting in the future.

As you move forward, you’ll find that managing income and expenses becomes much more straightforward with this groundwork in place.

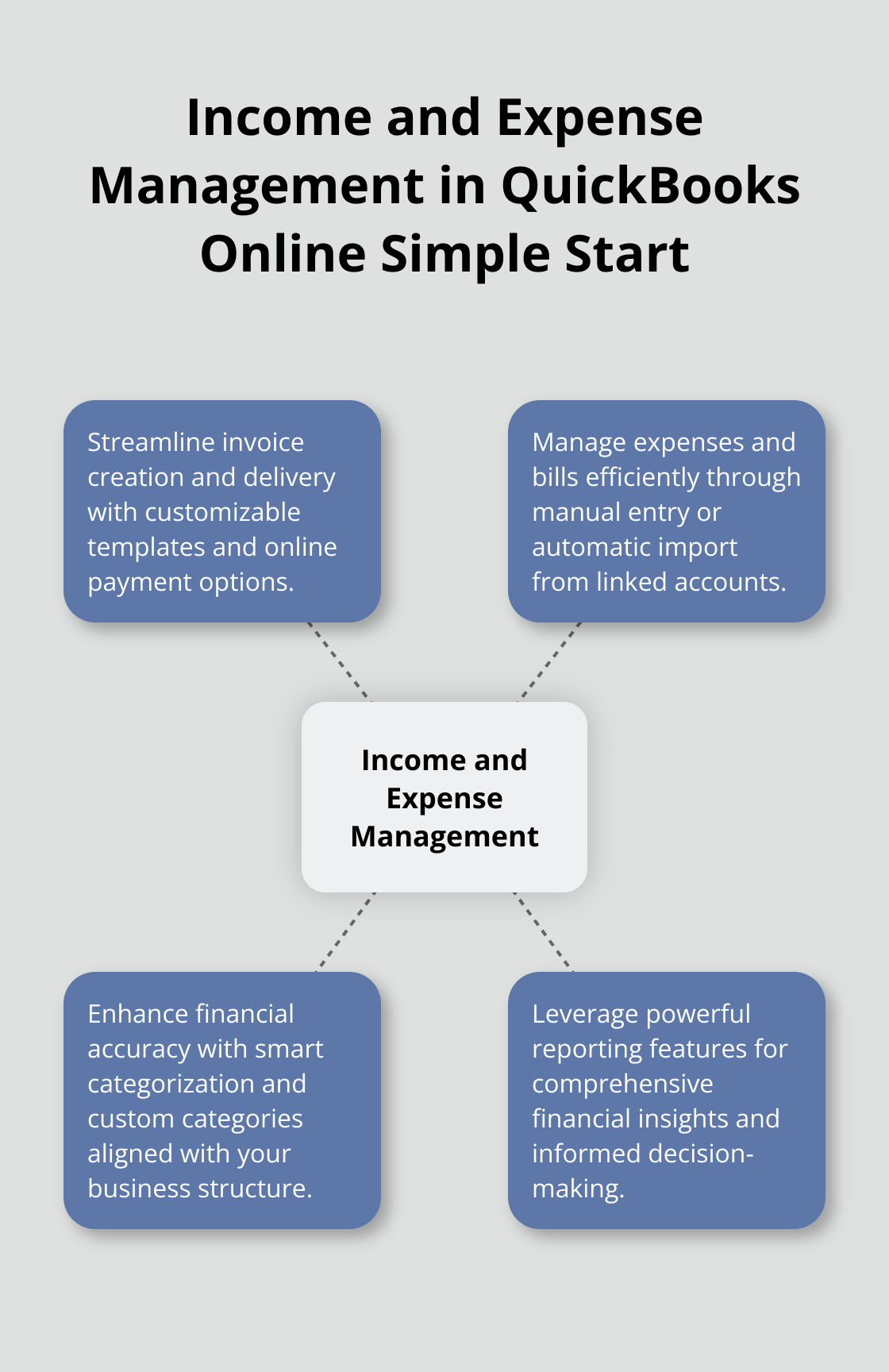

Mastering Income and Expense Management in QuickBooks Online Simple Start

Streamline Invoice Creation and Delivery

QuickBooks Online Simple Start offers a user-friendly interface for creating professional invoices. Navigate to the ‘Sales’ tab and select ‘New Invoice’. The software allows you to customize invoice templates with your logo and brand colors, enhancing your professional image.

When creating an invoice, select from your list of products or services, or add new items on the fly. QuickBooks automatically calculates totals and taxes, reducing errors. You can also set up recurring invoices for regular clients, saving time and ensuring consistent cash flow.

Send invoices directly from QuickBooks via email. The software tracks when clients view invoices and allows them to pay online, speeding up the payment process. QuickBooks Invoicing Software allows small businesses to create custom, professional invoices, track payments in real-time and send automatic invoice reminders.

Manage Expenses and Bills Efficiently

Track expenses in QuickBooks Online Simple Start with ease. You can manually enter expenses or import them automatically from linked bank accounts and credit cards. For manual entries, go to the ‘Expenses’ tab and click ‘New Transaction’.

Set up automatic payments for recurring bills to avoid late fees. QuickBooks allows you to schedule these payments and will send reminders when they’re due. This feature can save you hours each month on bill management.

Categorize your expenses correctly for accurate financial reporting and easier tax preparation. QuickBooks learns from your categorizations over time, making the process increasingly automated.

Enhance Financial Accuracy Through Smart Categorization

Proper categorization of transactions is essential for accurate financial reporting. QuickBooks Online Simple Start uses machine learning to suggest categories based on your previous entries. However, review these suggestions regularly to ensure accuracy.

Create custom categories that align with your business structure for more meaningful insights. For instance, if you’re a marketing agency, you might create separate categories for different types of client work.

Review your uncategorized transactions regularly to maintain clean books. Set aside time each week to go through these entries and assign them to the correct categories. This practice will save you significant time during tax season and provide more accurate financial snapshots throughout the year.

Leverage QuickBooks’ Reporting Features

QuickBooks Online Simple Start offers powerful reporting tools to help you understand your financial position. Use the Profit and Loss report to see your income and expenses over a specific period. The Balance Sheet report provides a snapshot of your assets, liabilities, and equity at a given point in time.

Consider having your financial statements reviewed by a third party to identify inaccuracies. Use the insights gained from these reports to make informed decisions about your business’s future.

As you master these aspects of income and expense management in QuickBooks Online Simple Start, you’ll gain better control over your business finances. This improved financial clarity will enable you to make more informed decisions.

Now, let’s explore how to generate and interpret these financial reports in more detail.

Unlocking Financial Insights with QuickBooks Reports

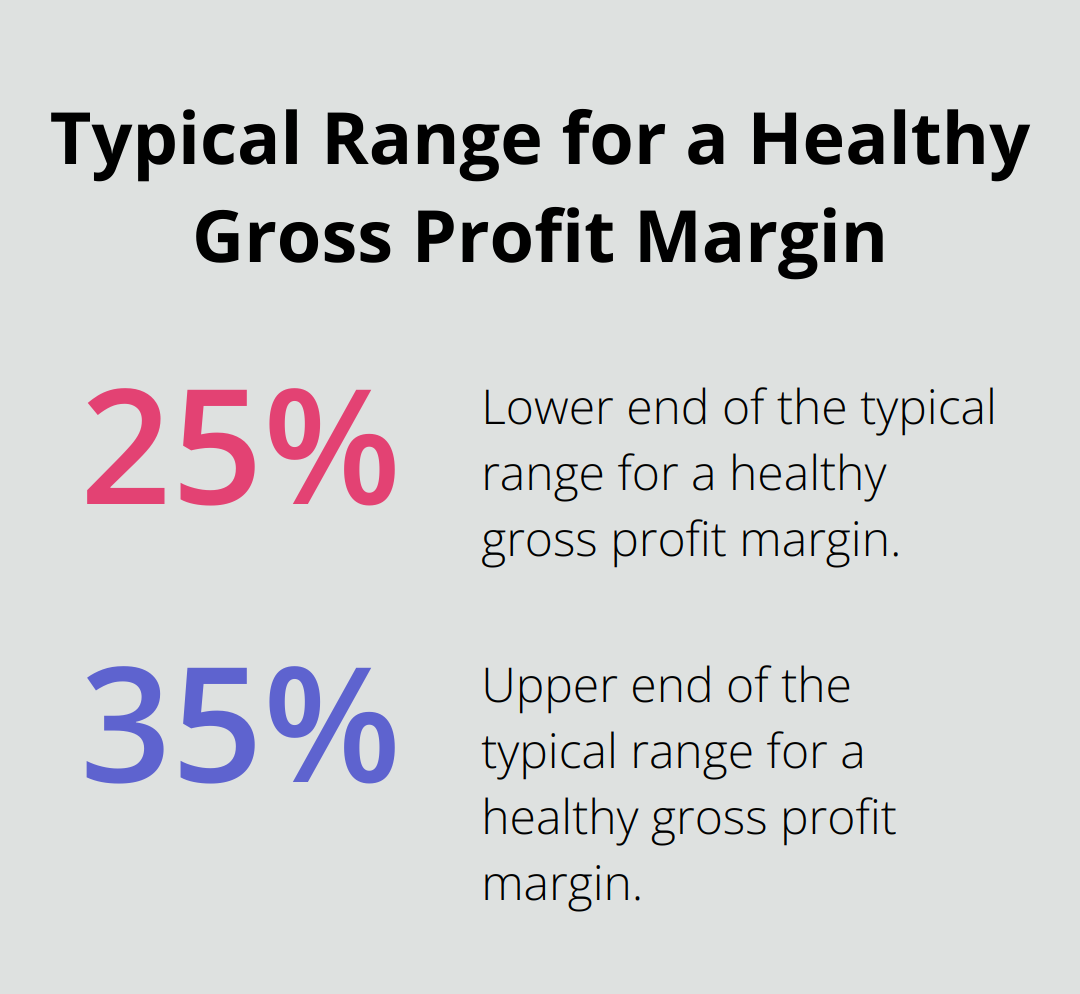

Generate and Analyze Profit and Loss Statements

QuickBooks Online Simple Start provides powerful tools to create Profit and Loss (P&L) statements. These formulas help you maintain accurate records, evaluate your business’s financial health, and make informed decisions for growth and sustainability. Access this report by navigating to the Reports section and selecting Profit and Loss. Customize the date range to view monthly, quarterly, or annual results.

Focus on your gross profit margin and net profit margin when analyzing the P&L statement. A healthy gross profit margin typically ranges from 25% to 35% (depending on your industry). If your margins fall below industry standards, consider strategies to reduce costs or increase prices.

Identify trends in your revenue and expenses. Determine if certain months consistently yield higher profits. Use this information to plan for seasonal fluctuations or pinpoint areas where you can cut costs during slower periods.

Interpret Balance Sheets Effectively

The Balance Sheet offers a snapshot of your company’s financial position at a specific point in time. It displays what your business owns (assets), owes (liabilities), and the owner’s equity. Find this report in the Reports section of QuickBooks.

When reviewing your Balance Sheet, calculate the current ratio (current assets divided by current liabilities). This ratio determines if your business has sufficient current assets to cover its current liabilities. If your ratio falls below this threshold, you may need to improve your working capital management.

Monitor your accounts receivable turnover. A high turnover rate suggests efficient collection of payments from customers. If this rate is low, consider implementing stricter payment terms or offering incentives for early payment.

Utilize Cash Flow Reports for Strategic Planning

The Cash Flow statement illustrates how cash moves in and out of your business. This report helps predict future cash needs and avoid cash crunches. Find this report in the Reports section of QuickBooks Online Simple Start.

Identify patterns in your cash inflows and outflows when analyzing your Cash Flow statement. Determine if there are specific times of the month or year when cash is tight. Use this information to schedule major purchases or investments during periods of strongest cash flow.

Pay close attention to your operating cash flow. A consistently positive operating cash flow indicates that your core business activities generate sufficient cash to sustain operations. If it’s negative, you may need to reassess your pricing strategy or eliminate unnecessary expenses.

Leverage Financial Reports for Decision-Making

Regular review and analysis of these QuickBooks reports will provide a deeper understanding of your business’s financial health. Use these insights to make informed decisions about growth strategies, cost-cutting measures, and investment opportunities.

Try to establish a routine for reviewing these reports (weekly or monthly, depending on your business needs). This practice will help you spot trends early and respond quickly to changes in your financial situation.

Final Thoughts

QuickBooks Online Simple Start offers a comprehensive solution for small businesses to streamline their financial management. The user-friendly interface, automated features, and powerful reporting tools enable better control over finances and informed decision-making. We recommend establishing a regular routine for reviewing and categorizing transactions to maximize efficiency with QuickBooks Online Simple Start.

Accurate financial records provide a clear picture of your business’s financial health at any given time. This insight allows you to identify trends, spot potential issues early, and capitalize on growth opportunities. Consistent bookkeeping also simplifies tax preparation and ensures compliance with financial regulations (which can save you time and money in the long run).

At Optimum Results Business Solutions, we understand the importance of efficient financial management for small businesses. Our team of QuickBooks Online ProAdvisors can provide expert support to help you make the most of QuickBooks Online Simple Start. We offer customized solutions tailored to your business needs, from initial setup to ongoing bookkeeping and financial analysis.