QuickBooks Online has revolutionized financial management for small businesses. At Optimum Results Business Solutions, we’ve seen firsthand how this powerful tool streamlines accounting processes and saves time.

Our QuickBooks Online tutorial 2025 will guide you through every aspect of this software, from setup to advanced features. Whether you’re a new user or looking to enhance your skills, this comprehensive guide has you covered.

How to Set Up QuickBooks Online

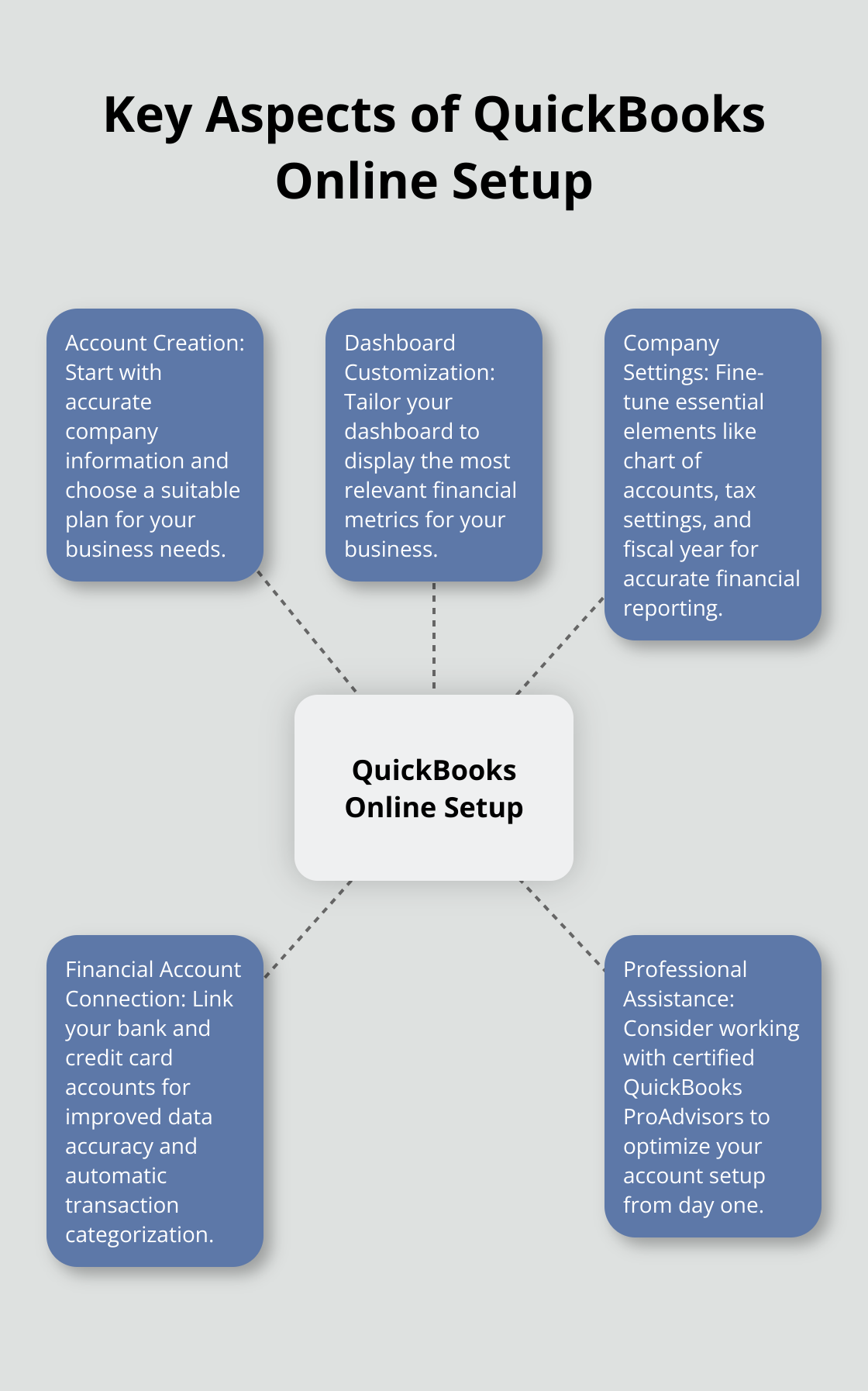

Account Creation and Company Profile

To set up QuickBooks Online, start with a clean slate. Collect all your financial documents, including bank statements, credit card information, and tax ID numbers. Visit the QuickBooks website and select a plan that suits your business needs. During sign-up, enter accurate information about your company. Provide precise details like your company name, industry, and tax information, as these influence how QuickBooks tailors its features to your specific needs.

Customizing Your Dashboard

After logging in, you’ll see the QuickBooks Online dashboard-your financial command center. Familiarize yourself with the layout. The left sidebar contains main menu items, while the center displays key financial metrics.

Customize your dashboard to show the most relevant information for your business. With QuickBooks Online Advanced, you can create your own reports using Custom Report Builder. Every business tracks unique metrics to measure its performance.

Fine-Tuning Company Settings

Access company settings through the gear icon in the upper right corner. Here, you’ll set up essential elements like your chart of accounts, tax settings, and fiscal year. Take your time with this process-accurate setup now prevents future complications.

Focus on your chart of accounts, which forms the backbone of your financial reporting. While QuickBooks provides a default set, tailor it to your specific business needs. Add accounts that reflect your unique income streams and expense categories.

In the tax settings, correctly set up sales tax rates if applicable to your business. This step is particularly important for businesses operating in multiple jurisdictions (it can save you from potential tax compliance issues).

Connecting Financial Accounts

Connect your bank and credit card accounts to improve the accuracy of your financial data. When you connect your online bank in QuickBooks, the transactions automatically download and categorize. This helps you keep your bank feeds up to date.

Seeking Professional Assistance

While QuickBooks Online is user-friendly, professional help during setup can save time and prevent costly mistakes. Many businesses find value in working with certified QuickBooks ProAdvisors or experienced bookkeeping services to optimize their QuickBooks Online account from day one.

As you complete the setup process, you’ll be ready to explore the core functionalities of QuickBooks Online. The next section will guide you through managing your day-to-day finances within the platform.

How to Manage Daily Finances in QuickBooks Online

QuickBooks Online simplifies daily financial management for small businesses. We’ll explore the key aspects of managing your finances in this powerful tool.

Income and Expense Tracking

QuickBooks Online excels at recording income and expenses. When you connect your bank accounts, transactions automatically import and categorize. This feature saves hours of manual data entry. Review these categorizations regularly for accuracy. QuickBooks learns from your corrections, improving its accuracy over time.

For cash transactions, enter them manually or use the mobile app to snap a photo of receipts. QuickBooks Online uses optical character recognition (OCR) to extract relevant information, further streamlining the process.

Invoicing Process

Creating and sending invoices in QuickBooks Online is straightforward. The platform offers customizable templates to match your brand. You can set up recurring invoices for regular clients, saving time and ensuring consistent cash flow.

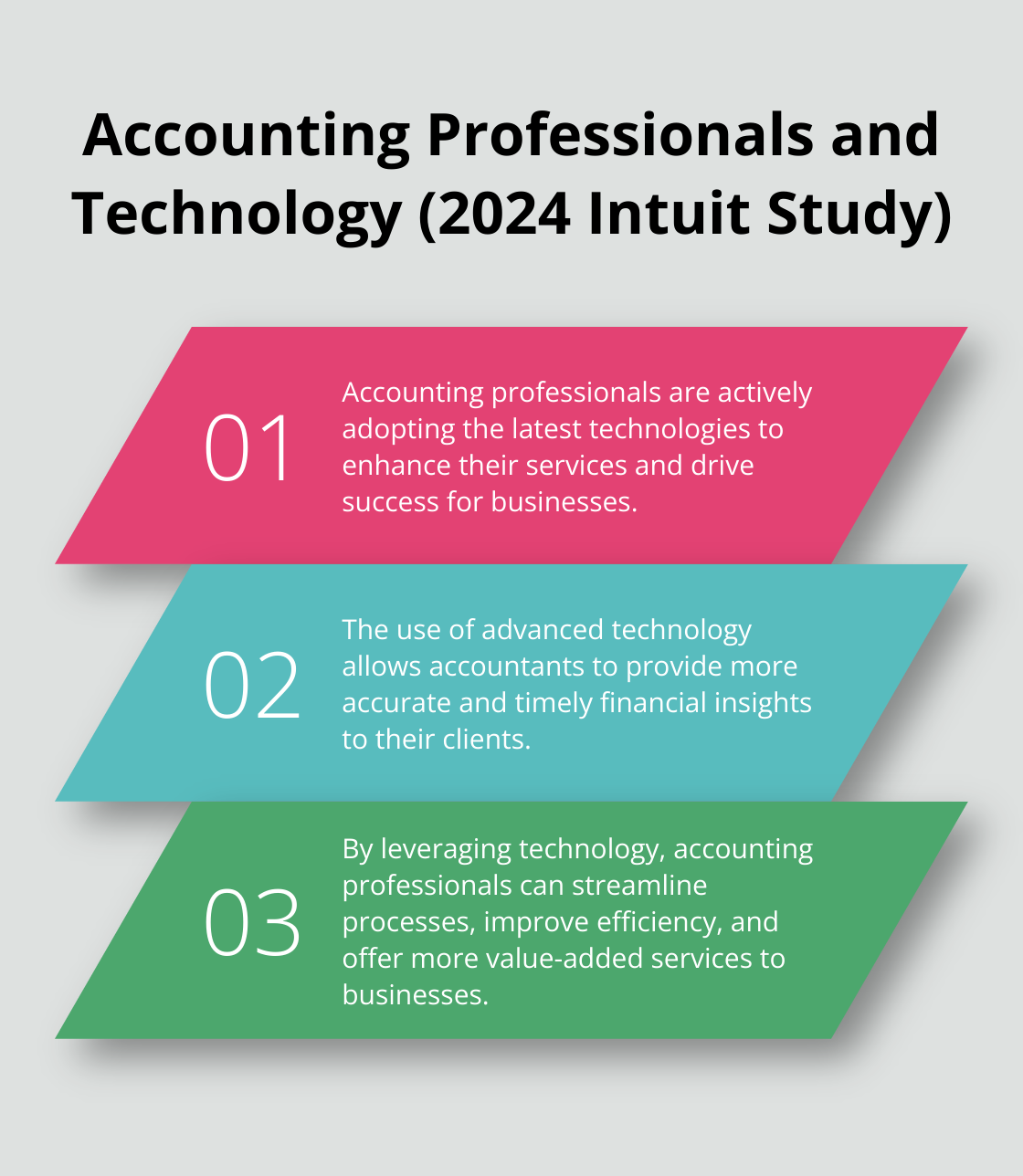

QuickBooks Online also allows you to accept online payments directly through invoices. This feature can significantly speed up your receivables. A 2024 study by Intuit found that accounting professionals are leveraging the latest technologies to drive success for businesses.

Bill and Payment Tracking

Managing bills in QuickBooks Online helps you stay on top of your payables. Enter bills as they arrive and schedule payments to optimize your cash flow. The system sends reminders for upcoming due dates, helping you avoid late fees.

For recurring bills, set up automated payments. This feature ensures timely payments and reduces the risk of overlooking regular expenses.

Bank and Credit Card Reconciliation

Regular reconciliation is essential for accurate financial records. QuickBooks Online simplifies this process with its bank feed feature. As transactions download, you can match them to your recorded entries.

For discrepancies, QuickBooks Online provides tools to investigate and resolve issues quickly. Try to reconcile your accounts monthly (this practice helps catch errors early and maintains the integrity of your financial data).

Leveraging Advanced Features

QuickBooks Online offers advanced features that can further enhance your financial management. These include inventory tracking (for product-based businesses), project profitability analysis, and customizable reports. Explore these features to maximize the software’s potential for your specific business needs.

As you become proficient in managing daily finances with QuickBooks Online, you’ll find that the software offers even more advanced capabilities. In the next section, we’ll explore these advanced features and reporting options to help you gain deeper insights into your business’s financial health.

Unlocking QuickBooks Online’s Advanced Capabilities

QuickBooks Online offers a suite of advanced features that can transform your financial management. These tools can significantly improve business operations.

Streamline Payroll Management

QuickBooks Online’s payroll feature automates many aspects of employee compensation. It pulls employee data, calculates pay, schedules payments, and files taxes. This integration saves time and reduces errors in payroll processing.

To set up payroll, access the Payroll tab and input your employees’ information. QuickBooks Online will guide you through setting up pay schedules, tax withholdings, and direct deposits. Once configured, you can run payroll with just a few clicks.

A key advantage is the automatic tax updates. QuickBooks Online stays current with tax laws, ensuring your payroll remains compliant without constant manual adjustments.

Generate Insightful Financial Reports

QuickBooks Online’s reporting capabilities are extensive. The software offers over 50 built-in reports, covering everything from basic profit and loss statements to detailed sales by customer summaries.

To access reports, go to the Reports tab. Here, you can customize existing reports or create new ones tailored to your specific needs. You might create a report that compares this year’s sales to last year’s, broken down by product category.

One particularly useful report is the Cash Flow Forecast. This predictive tool uses your historical data to project future cash flow, helping you make informed decisions about spending and investments.

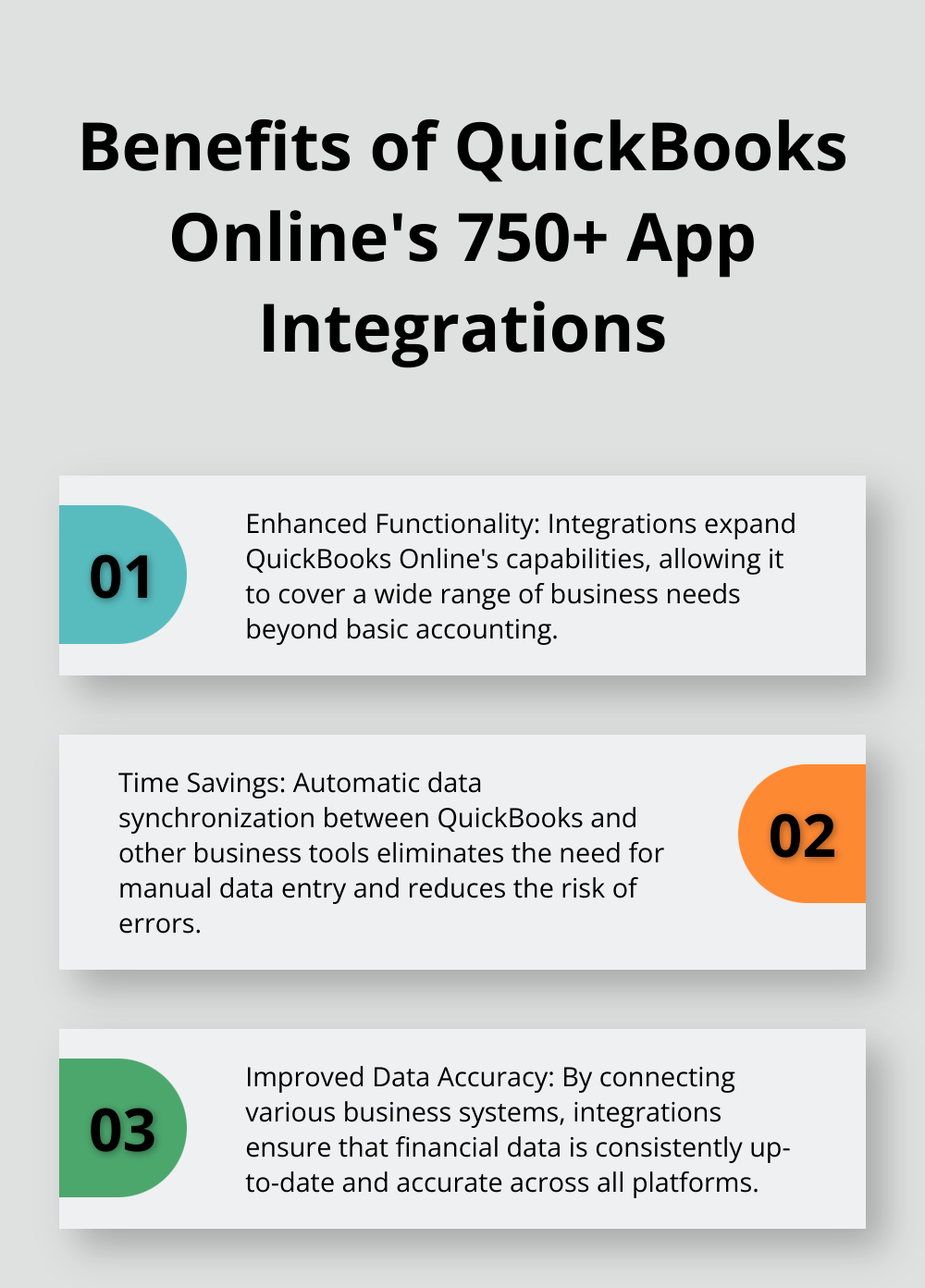

Leverage Third-Party Integrations

QuickBooks Online’s power multiplies when integrated with other business tools. The software connects with over 750 popular business apps, expanding its functionality to cover various business needs.

For example, integrating with a customer relationship management (CRM) system can sync customer data and invoices, providing a more comprehensive view of your client relationships. E-commerce integrations can automatically import sales data, saving hours of manual entry.

To explore available integrations, visit the Apps tab in QuickBooks Online. Popular integrations include payment processors (like Square), time-tracking tools, and inventory management systems.

Maximize Mobile Functionality

The QuickBooks Online mobile app brings the power of the desktop version to your smartphone. This app is particularly useful for businesses with employees in the field or owners who need to manage finances on the go.

With the mobile app, you can create and send invoices, capture receipts, and run reports. The receipt capture feature uses optical character recognition to automatically extract and categorize expense information from photos of receipts.

To get started, download the app from your device’s app store and log in with your QuickBooks Online credentials. Explore the app’s features to understand how it can complement your desktop usage.

Final Thoughts

QuickBooks Online revolutionizes financial management for small businesses. This comprehensive accounting solution offers intuitive setup, customizable dashboards, and seamless bank integrations. The QuickBooks Online tutorial 2025 highlights key features that simplify daily financial tasks and provide valuable insights for informed decision-making.

Advanced functionalities like automated payroll, in-depth reporting, and third-party integrations enhance the software’s value. The mobile app extends these capabilities, enabling financial management on-the-go. QuickBooks Online saves time, reduces errors, and adapts to changing business needs over time.

We at Optimum Results Business Solutions can help optimize your QuickBooks Online setup. Our team of certified ProAdvisors offers customized bookkeeping solutions and expert support. Master QuickBooks Online and gain a strategic advantage in today’s competitive business landscape.