Outsourced bookkeeping services are changing the way businesses manage their finances. At Optimum Results Business Solutions, we’ve seen a growing trend of companies embracing this approach to streamline their operations.

But is it the right choice for your business? This post will explore the pros and cons of outsourcing your bookkeeping, helping you make an informed decision for your company’s financial future.

What Is Outsourced Bookkeeping?

Definition and Scope

Outsourced bookkeeping involves the hiring of external professionals to manage a company’s financial records. This approach has become popular among small businesses and startups that want to streamline operations and reduce costs.

Core Services

Typical outsourced bookkeeping services include:

- Transaction categorization

- Bank reconciliations

- Financial statement preparation

Many providers also offer accounts payable and receivable management, payroll processing, and tax filing assistance. These services can be tailored to meet each client’s specific needs (e.g., QuickBooks Online support or sales tax management).

Cost-Efficiency Factor

One of the main advantages of outsourced bookkeeping is its cost-effectiveness. Outsourcing allows businesses to access professional bookkeeping, payroll, tax, and other financial services without the overhead of a full-time team.

Technology and Expertise

Outsourced bookkeeping firms often use advanced accounting software and have access to the latest financial technologies. This technological edge, combined with the expertise of seasoned professionals, can lead to more accurate and efficient financial management. Cloud-based systems, for instance, allow real-time collaboration and provide business owners with up-to-date financial information at their fingertips.

Scalability and Flexibility

As a business grows, its bookkeeping needs will likely change. Outsourced services offer the flexibility to scale up or down as required. This adaptability benefits seasonal businesses or those experiencing rapid growth particularly well. Companies can adjust the level of service without the hassle of hiring or laying off in-house staff.

The decision to outsource bookkeeping depends on various factors unique to each business. The next section will explore the specific benefits that outsourced bookkeeping can offer to help you determine if it’s the right choice for your company.

Why Outsource Your Bookkeeping

Outsourcing bookkeeping can transform how businesses manage their finances. Let’s explore the key advantages that make outsourced bookkeeping an attractive option for many companies.

Significant Cost Savings

Outsourced accounting services typically range from $3,600 to $25,000 per year, depending on the complexity of the financial needs. This can represent significant savings compared to maintaining an in-house team. The cost reduction eliminates expenses like salaries, benefits, office space, and equipment.

Access to Specialized Expertise

Outsourced bookkeeping firms employ teams of experts with diverse skills and experience. This means your business benefits from collective knowledge that would be challenging and expensive to replicate in-house. A specialized bookkeeper can provide complex financial reports tailored to your industry, giving you deeper insights into your financial health.

Advanced Technology Without the Investment

Professional bookkeeping services use state-of-the-art accounting software and technologies. For example, Botkeeper offers advanced automated services built for accounting and bookkeeping firms, providing a consolidated view of all client accounts in one place. This gives your business access to powerful tools without the need for significant upfront investment or ongoing maintenance costs.

Scalability for Growing Businesses

As your business grows, your bookkeeping needs will change. Outsourced services offer the flexibility to scale up or down as required. This benefits seasonal businesses or those experiencing rapid growth particularly well. You can adjust your service level without the hassle of hiring or laying off in-house staff.

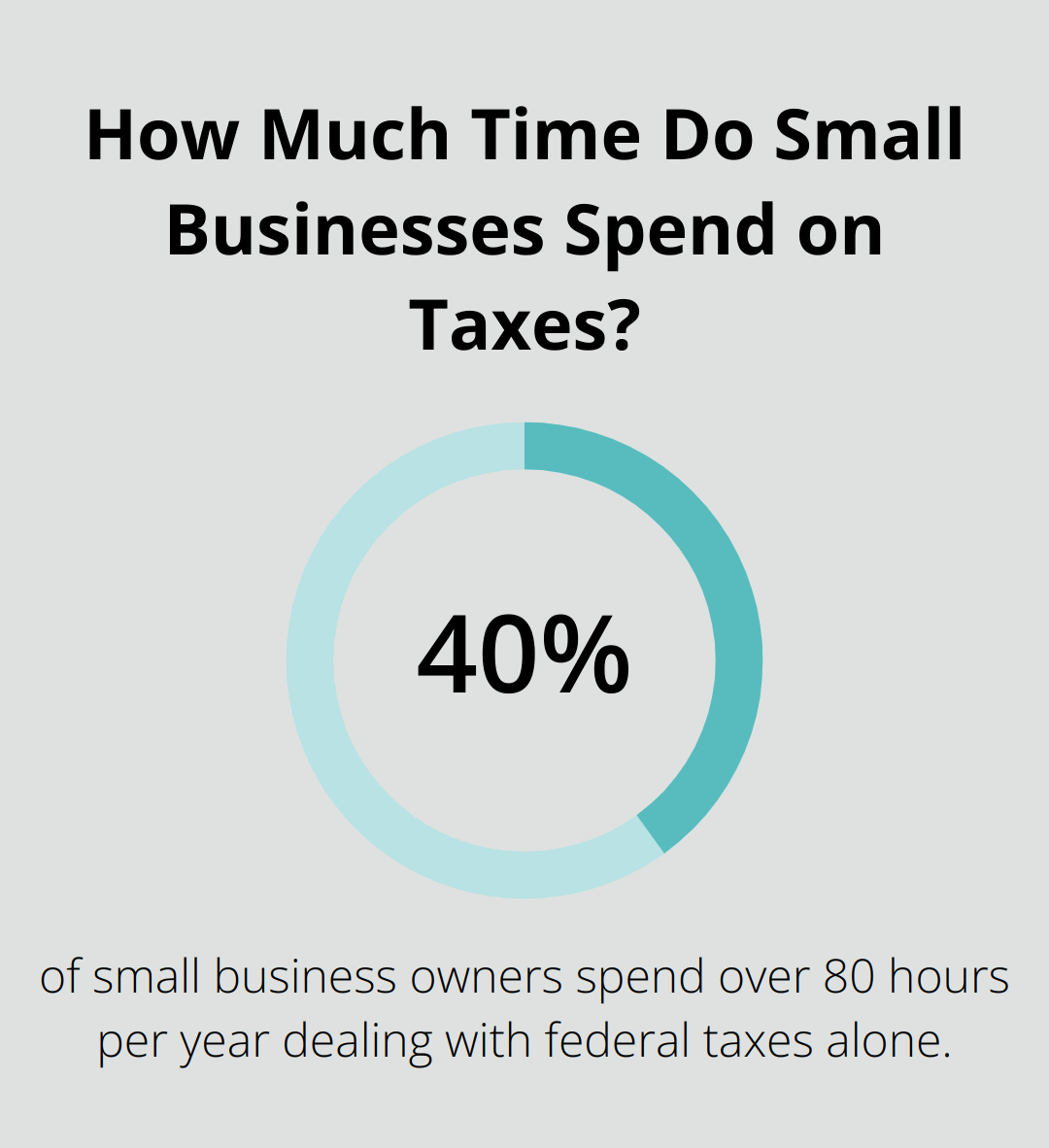

Focus on Core Business Activities

Outsourcing bookkeeping frees up valuable time and resources. Business owners and key staff can redirect their focus to core activities that drive growth and profitability. A study by the National Small Business Association found that 40% of small business owners spend over 80 hours per year dealing with federal taxes alone. Outsourcing can reclaim this time for more strategic activities.

Improved Accuracy and Compliance

Professional bookkeeping services stay up-to-date with the latest tax laws and regulations. This expertise helps ensure your financial records are accurate and compliant, reducing the risk of costly errors or penalties. Sales tax regulations can be complex and vary by state. An outsourced service with experience in this area can help navigate these complexities and ensure compliance.

While the benefits of outsourced bookkeeping are clear, it’s important to consider potential drawbacks before making a decision. Let’s examine some of the challenges businesses might face when outsourcing their bookkeeping.

Navigating Challenges in Outsourced Bookkeeping

Outsourcing bookkeeping offers numerous benefits, but it also presents challenges. Understanding these potential hurdles helps businesses make informed decisions about whether outsourced bookkeeping fits their needs.

Control Over Financial Processes

A common concern when outsourcing bookkeeping is the potential loss of control over financial processes. While external partners handle day-to-day tasks, businesses don’t relinquish control entirely. To address this issue, companies should:

- Establish clear communication channels

- Set up reporting structures

- Request regular updates

- Define expectations for financial reporting frequency

This approach allows businesses to maintain oversight while benefiting from expert financial management.

Data Security and Confidentiality

Data security is paramount when dealing with financial information. When outsourcing, businesses must choose providers with robust security measures. Discover 7 key strategies for CPAs to secure client data with outsourced bookkeeping services, ensuring safety, compliance, and trust. Look for partners who use:

- Encrypted data transfer methods

- Secure cloud storage

- Strict access controls

Ask potential providers about their data protection policies, backup procedures, and compliance with industry standards (e.g., GDPR or CCPA).

Communication Barriers

Working with remote teams can lead to communication challenges. Time zone differences, language barriers, or lack of face-to-face interaction can impact information flow. To mitigate these issues:

- Establish a clear communication protocol

- Set regular check-in meetings

- Use collaborative tools (Slack, Microsoft Teams)

- Define response time expectations for urgent matters

Effective communication requires effort from both parties. Businesses should provide timely responses to their bookkeeping team’s queries as well.

Selecting the Right Partner

Choosing the right outsourcing partner is essential for addressing these challenges effectively. Take time to thoroughly vet potential providers. Consider various factors such as industry experience, range of services, reputation, technology integration, client testimonials, and communication when selecting a bookkeeping service provider.

Ask for references or case studies that demonstrate their ability to handle businesses similar to yours. Evaluate their software stack, data analysis capabilities, and how they stay current with industry trends.

A shared understanding of business values and work ethics can significantly smooth the transition and ongoing relationship. This alignment is particularly important when dealing with financial matters, where trust and reliability are paramount.

Final Thoughts

Outsourced bookkeeping services offer numerous benefits for businesses seeking to streamline their financial operations. These advantages include cost savings, access to specialized expertise, and improved accuracy. However, companies must weigh these benefits against potential challenges such as data security concerns and communication barriers. The decision to outsource bookkeeping depends on your unique business needs, current financial management processes, and growth projections.

To determine if outsourced bookkeeping fits your business, evaluate your current financial management pain points. Research potential outsourcing partners thoroughly, looking for providers with experience in your industry and a track record of delivering reliable, accurate services. Consider their technology stack, data security measures, and communication protocols when making your decision.

Optimum Results Business Solutions provides tailored bookkeeping and accounting services for small service-based businesses and tech startups. We offer QuickBooks Online ProAdvisor support, ensure compliance with regulations, and deliver valuable financial insights to help drive your business forward. You can start with specific tasks and expand the scope of services as you build trust and see results (this approach allows for flexibility in your outsourcing journey).