QuickBooks bookkeeping services have revolutionized financial management for small businesses. This powerful software simplifies complex accounting tasks, making it easier for entrepreneurs to stay on top of their finances.

At Optimum Results Business Solutions, we’ve seen firsthand how QuickBooks can transform a company’s financial processes. In this post, we’ll explore the basics of QuickBooks bookkeeping and the benefits of expert services to help your business thrive.

What Is QuickBooks Online?

Cloud-Based Accounting for Small Businesses

QuickBooks Online stands as a cloud-based accounting software that has become the preferred solution for small businesses aiming to streamline their financial management. This robust platform offers a suite of features designed to simplify bookkeeping tasks and provide real-time insights into a company’s financial health.

Core Features That Simplify Financial Management

QuickBooks Online allows businesses to track income and expenses with ease. Users can connect their bank accounts and credit cards, which automatically imports and categorizes transactions. This feature alone saves hours of manual data entry and reduces the risk of human error (a boon for busy entrepreneurs).

Invoice management shines as another standout feature. Small businesses can create professional-looking invoices, send them directly to clients, and track payments all within the platform. QuickBooks Online even offers the option to set up recurring invoices for regular clients, which ensures consistent cash flow.

For businesses that deal with inventory, QuickBooks Online provides tools to track stock levels, set reorder points, and manage purchase orders. This integration between sales and inventory management gives business owners a clear picture of their product performance and helps prevent stockouts or overstocking (critical for maintaining optimal inventory levels).

Advantages of Cloud-Based Bookkeeping

The cloud-based nature of QuickBooks Online presents significant advantages. Financial data becomes accessible from anywhere with an internet connection, which allows business owners to stay on top of their finances even when they’re away from the office.

Cloud-based bookkeeping also facilitates real-time collaboration. QuickBooks Online allows your bookkeeper, accountant, or colleagues to log in simultaneously and work directly with your data.

Security takes top priority in cloud-based systems like QuickBooks Online. The platform uses bank-level encryption to protect financial data, and regular backups ensure that information remains safe. This level of security often surpasses what small businesses can implement on their own local systems.

Automatic updates provide another benefit of cloud-based bookkeeping. Your data is automatically backed up at all times. With QuickBooks Online Advanced, you can also restore a version of your company data based on a chosen date.

The Role of Expert Guidance

While QuickBooks Online offers robust features for small businesses, expert guidance can maximize its potential. Professional setup and ongoing support can help businesses leverage QuickBooks Online to its fullest, which turns financial data into actionable insights for growth and success.

As we move forward, let’s explore the specific expert services that can enhance your QuickBooks experience and take your financial management to new heights.

How Expert QuickBooks Services Boost Your Business

QuickBooks Online provides powerful tools for small businesses, but expert services elevate financial management to new heights. Professional QuickBooks services transform financial operations for businesses across various industries.

Streamlining Financial Processes

Expert QuickBooks services start with efficient bank reconciliation and transaction categorization. This process matches financial records with bank statements, catching discrepancies early. Professionals use QuickBooks’ rules and artificial intelligence to automate categorization, which saves hours of manual work. Automatic categorization reduces the time spent managing uncategorized transactions, improving efficiency for clients.

Financial statement preparation becomes straightforward with expert handling. Professionals generate accurate balance sheets, income statements, and cash flow statements. These documents provide a clear snapshot of a business’s financial health. Expert oversight ensures the accuracy of financial statements for tax purposes and business decisions.

Unlocking Financial Insights

Customized reporting and analytics set expert QuickBooks services apart. Professionals tailor reports to specific business needs, offering insights beyond standard templates. They create dashboards that highlight key performance indicators (KPIs) relevant to each industry. This level of customization allows businesses to track metrics that matter most to their growth.

A service-based business might benefit from reports that break down profitability by client or service type. A tech startup could use custom reports to track burn rate and runway. These insights enable data-driven decisions that can significantly impact the bottom line.

Simplifying Payroll and Taxes

Payroll processing and tax filings are complex areas where expert services excel. QuickBooks offers robust payroll features, but professional oversight ensures compliance with ever-changing regulations. Experts set up payroll systems to automatically calculate taxes, deductions, and benefits. This automation reduces errors and saves time.

Moreover, professionals stay updated on tax laws and deadlines. They prepare and file payroll taxes, sales taxes, and other required filings accurately and on time. This expertise minimizes the risk of costly penalties and audits. IRS penalties for late or incorrect filings can be significant, with standard penalties for small entities reaching $340 per return in 2025.

Enhancing Financial Strategy

Expert QuickBooks services go beyond software management. They provide strategic financial guidance, automate time-consuming tasks, and ensure businesses stay compliant. This comprehensive approach frees up valuable time for business owners to focus on growth while gaining deeper insights into their financial performance.

Optimum Results Business Solutions stands out as a top choice for businesses seeking expert QuickBooks services. Their team of QuickBooks Online ProAdvisors offers customized solutions tailored to the unique needs of small service-based businesses and tech startups. With their expertise, businesses can transform their financial management and gain a competitive edge in their respective markets.

Why Professional QuickBooks Bookkeeping Pays Off

Professional QuickBooks bookkeeping services offer substantial benefits that extend beyond basic software usage. These services transform financial management, provide businesses with a competitive edge, and offer peace of mind.

Time Reclamation for Business Owners

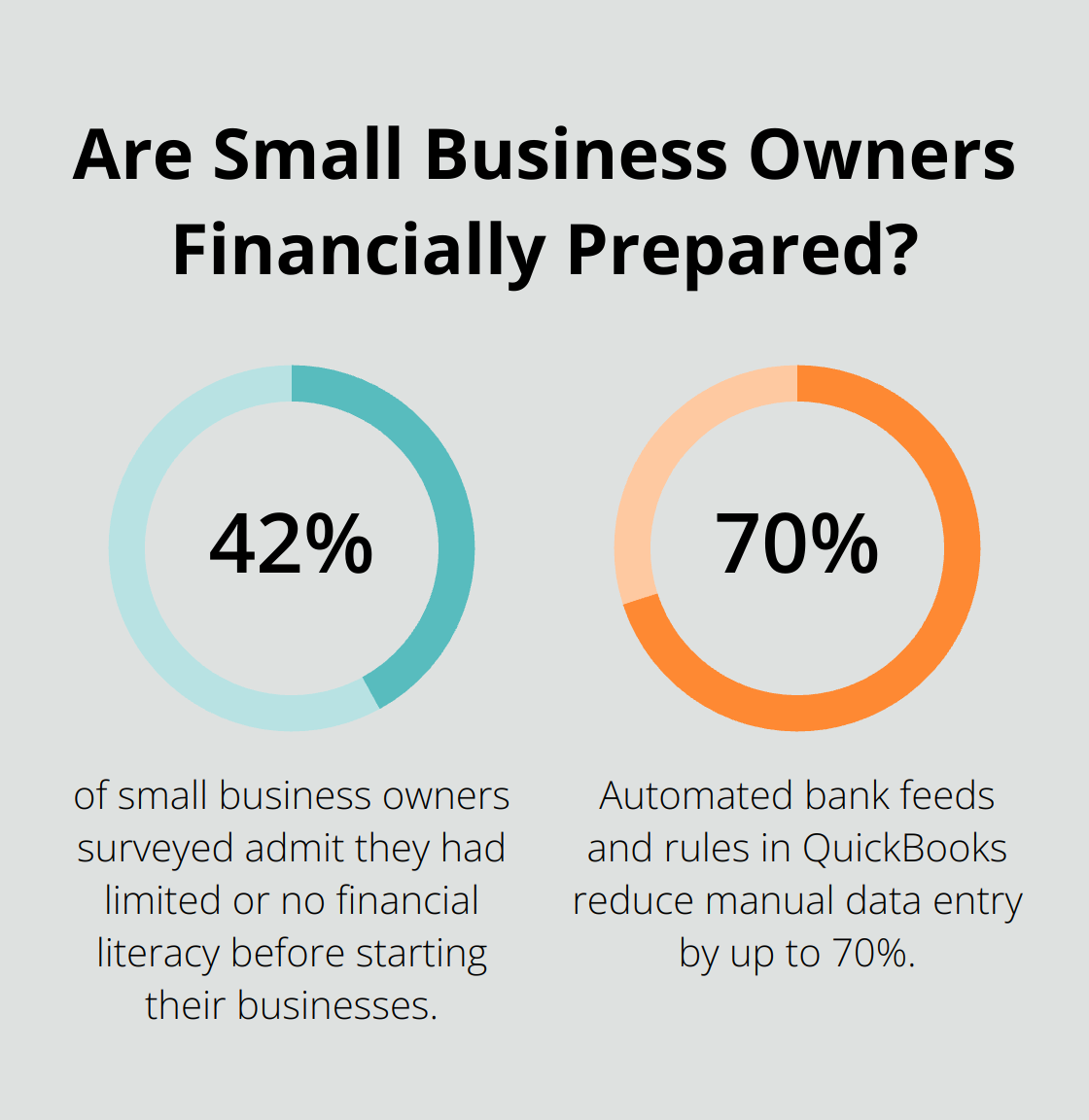

Professional QuickBooks bookkeeping saves business owners significant time. Nearly half (42%) of small business owners surveyed admit they had limited or no financial literacy before starting their businesses. Professional bookkeepers automate many time-consuming tasks, which allows owners to focus on core business activities.

Automated bank feeds and rules in QuickBooks categorize transactions automatically, which reduces manual data entry by up to 70%. This automation not only saves time but also minimizes errors that can occur with manual input.

Enhanced Financial Accuracy and Compliance

Professional bookkeepers improve financial accuracy and ensure compliance with ever-changing regulations. In 2019 alone, the IRS levied almost 5 million penalties related to payroll taxes, totaling $13.7 billion. Expert QuickBooks services help avoid such costly mistakes.

Professionals stay updated on the latest tax laws and reporting requirements (a necessity for maintaining compliance). They implement best practices in QuickBooks, such as setting up proper chart of accounts and using class tracking for detailed reporting. These practices enhance financial accuracy and simplify tax preparation.

Strategic Decision-Making Support

Professional QuickBooks services provide access to strategic financial insights that drive informed decision-making. Experts create customized reports and dashboards that highlight key performance indicators specific to your industry.

A professional service firm might benefit from reports that break down profitability by client or service type. This level of insight allows businesses to identify their most profitable activities and adjust their strategies accordingly.

Professional bookkeepers provide regular financial health check-ups and analyze trends in your data to spot potential issues before they become problems. This proactive approach maintains financial stability and aids in growth planning.

Scalability for Growing Businesses

As businesses evolve, the scalability and expertise offered by professional services become increasingly valuable. Professional bookkeepers adapt QuickBooks setups to accommodate changing business needs, whether it’s expanding to new markets or adding product lines.

They also help businesses transition between different versions of QuickBooks as they grow, ensuring that the software continues to meet the company’s needs without disrupting operations.

Expert Support and Problem-Solving

Professional QuickBooks services offer expert support when issues arise. Whether it’s troubleshooting software problems or addressing complex financial questions, having a knowledgeable professional on call proves invaluable.

This expert support extends to interpreting financial data and providing actionable advice. Professional bookkeepers help business owners understand their financial position and make informed decisions about investments, expansions, or cost-cutting measures.

Final Thoughts

QuickBooks bookkeeping services revolutionize financial management for small businesses. These powerful tools simplify complex accounting tasks and provide a robust platform for maintaining accurate financial records. Expert services unlock the true potential of QuickBooks, offering strategic insights that drive informed decision-making.

Professional QuickBooks services save business owners time and enhance accuracy, helping avoid costly mistakes and penalties. They create customized reports and analyze financial trends, which helps businesses identify opportunities for growth and improvement. This level of financial intelligence proves essential for businesses that want to thrive in competitive markets.

Optimum Results Business Solutions offers tailored QuickBooks solutions for small service-based businesses and tech startups. Their team of QuickBooks Online ProAdvisors addresses unique client needs, from payroll administration to sales tax management (ensuring compliance while providing valuable financial insights). Partnering with expert QuickBooks bookkeeping services can transform financial operations and pave the way for sustainable growth.