At Optimum Results Business Solutions, we understand the importance of streamlined financial management for businesses of all sizes.

QuickBooks Online and Payroll integration offers a powerful solution for companies looking to simplify their accounting and payroll processes.

This blog post will explore the benefits of combining these two essential tools and provide practical guidance on setting up and maximizing their integration.

How QuickBooks Online and Payroll Integration Works

Understanding QuickBooks Online and Payroll

QuickBooks Online is a cloud-based accounting software that helps businesses manage their finances, track income and expenses, and generate reports. It simplifies bookkeeping tasks and provides real-time financial insights. QuickBooks Payroll is a comprehensive payroll solution that automates wage calculations, tax filings, and direct deposits.

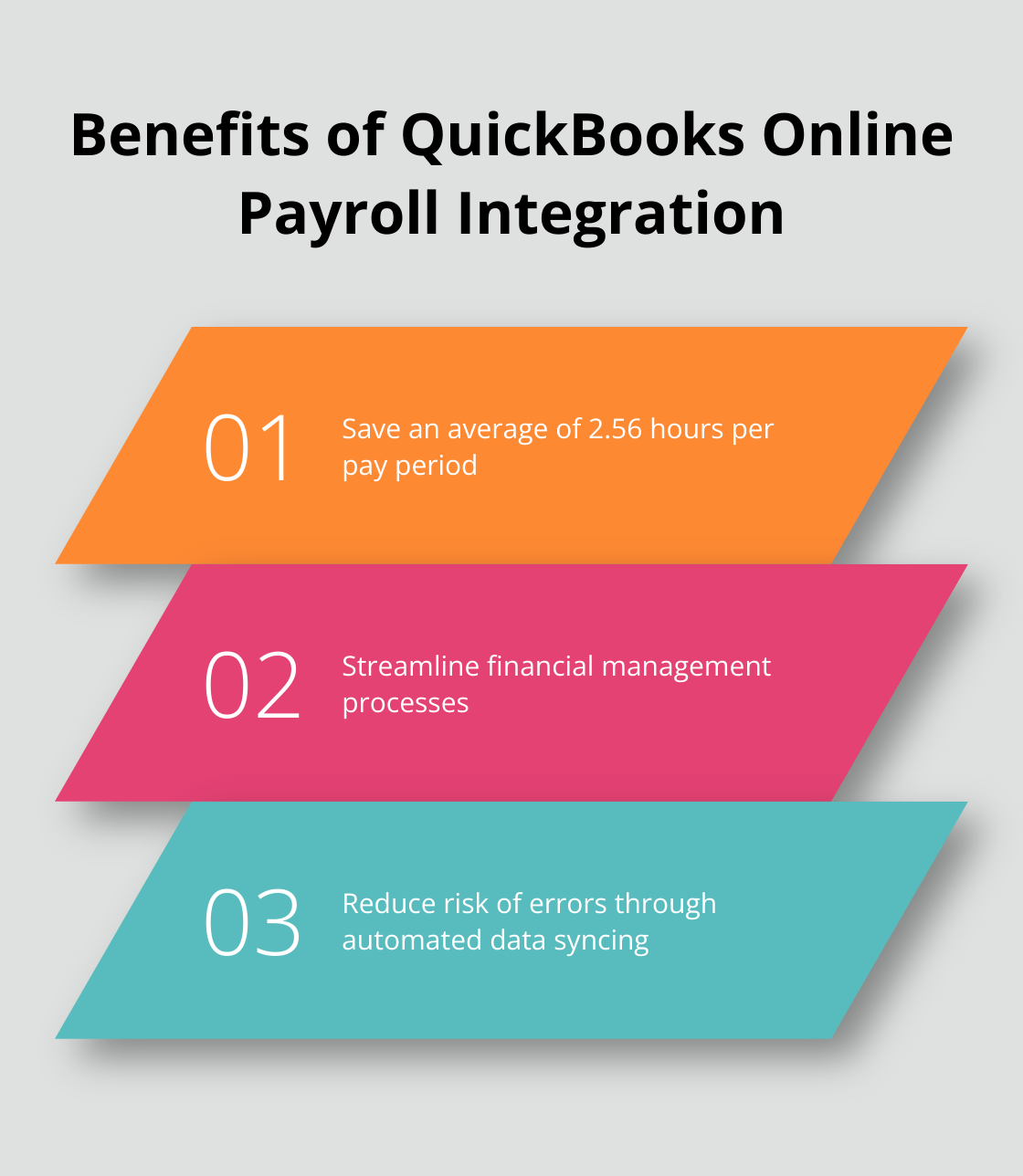

Streamlined Financial Management

The integration of QuickBooks Online with Payroll creates a powerful synergy that streamlines financial management for businesses. This integration automatically syncs payroll data with accounting records, which eliminates the need for manual data entry and reduces the risk of errors. An Intuit survey reveals that businesses using QuickBooks Online Payroll save an average of 2.56 hours per pay period, freeing up valuable time for other critical tasks.

Automated Payroll Processing

Automated payroll processing stands out as a key advantage of this integration. Once set up, the system calculates wages, deductions, and taxes with minimal input. This automation extends to tax filings as well. QuickBooks Payroll handles federal and state tax payments and filings, which significantly reduces the administrative burden on businesses.

Enhanced Accuracy and Compliance

The integration between QuickBooks Online and Payroll also enhances accuracy and compliance. Centralizing financial data ensures that books remain up-to-date and accurate. This is particularly important for tax compliance. QuickBooks offers tax penalty protection, covering up to $25,000 in payroll tax penalties for Elite users. This level of protection gives businesses peace of mind and can potentially save them from costly penalties.

Real-Time Financial Insights

The integration provides real-time financial insights that help businesses make informed decisions. With payroll data automatically synced to the accounting system, companies can generate accurate financial reports at any time. This real-time visibility into financial data allows businesses to:

- Monitor cash flow more effectively

- Make data-driven decisions about hiring and compensation

- Identify trends in labor costs and productivity

The seamless flow of data between QuickBooks Online and Payroll empowers businesses to stay agile and responsive to changing financial conditions. This integration streamlines these processes, setting the stage for more efficient financial management practices, which we will explore in the next section on setting up the integration.

How to Set Up QuickBooks Online and Payroll Integration

Initial Setup and Connection

The integration process between QuickBooks Online and Payroll starts with connecting your accounts. Log into your QuickBooks Online account and navigate to the Payroll section. You’ll need to enter your business information, including your company’s legal name, address, and Federal Employer Identification Number (FEIN). This information ensures accurate tax reporting and compliance.

Next, provide your state payroll tax account numbers. These numbers are essential for proper state tax calculations and filings. If you’re uncertain about any of these numbers, consult with a tax professional or your state’s department of revenue.

Employee Information Configuration

After establishing the basic connection, configure your employee information. Enter details for each employee, including their name, address, Social Security number, pay rate, and tax withholding information. QuickBooks Payroll allows data import from spreadsheets or previous payroll systems, which can save time if you’re transitioning from another platform.

QuickBooks Workforce enables employees to see and print their own pay stubs and W-2s online. This self-service option reduces administrative work and improves data accuracy.

Payroll Items and Tax Settings

The final major step involves configuring payroll items and tax settings. Payroll items include various types of earnings (regular pay, overtime, bonuses), deductions (health insurance, 401(k) contributions), and employer contributions. Set up each of these items correctly to ensure accurate payroll calculations.

Tax settings require careful attention. QuickBooks Payroll automatically calculates federal, state, and local taxes based on the information you provide. Review these settings thoroughly, especially if your business operates in multiple states or localities with different tax rates.

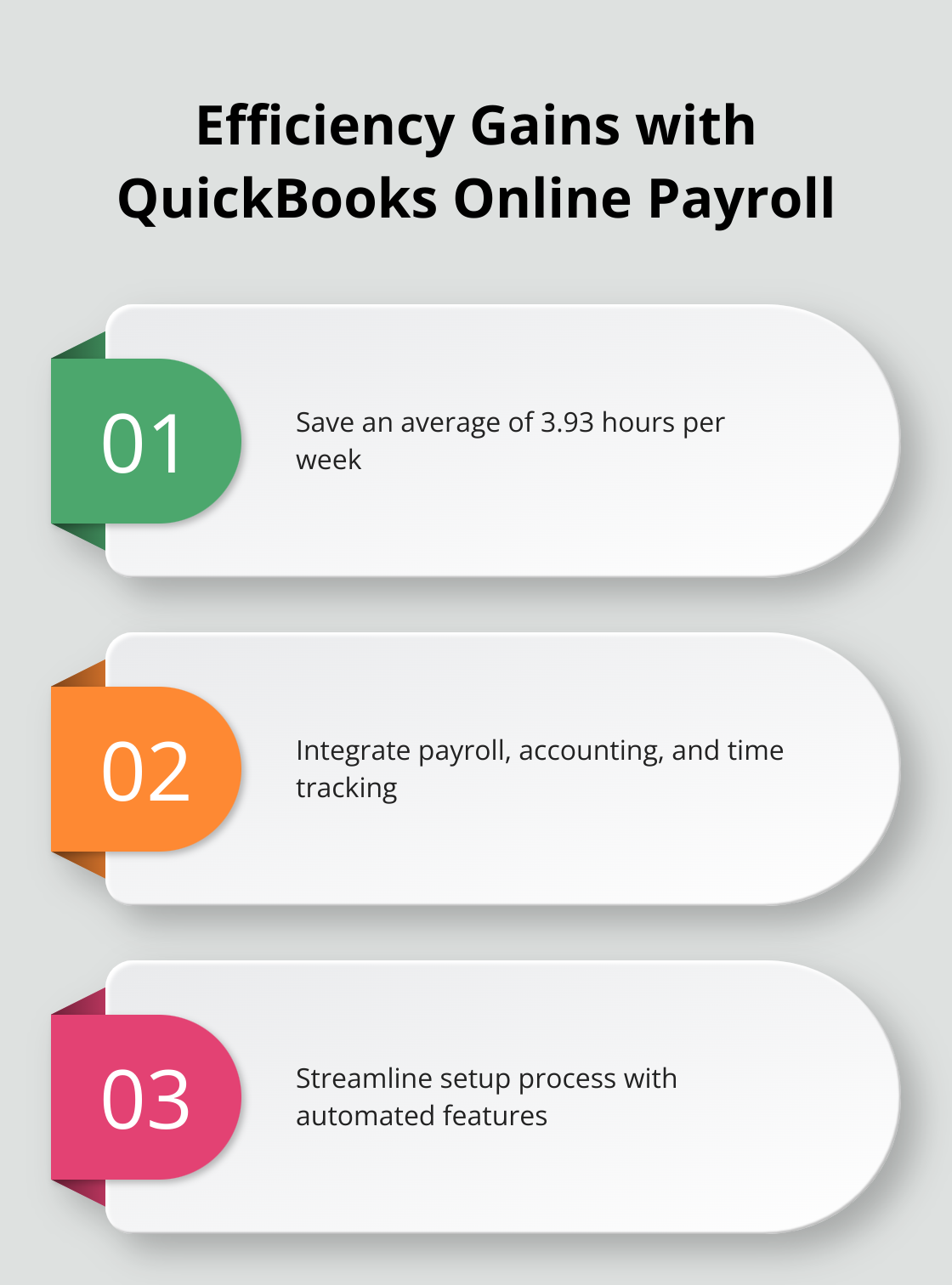

Time Savings and Efficiency

An Intuit survey found that businesses using QuickBooks Online Payroll save an average of 3.93 hours per week by integrating payroll, accounting, and time tracking. This time savings stems from the streamlined setup process and the automated features that follow.

Professional Assistance

While the setup process is user-friendly, accuracy at every step is paramount. Errors in setup can lead to payroll mistakes or tax compliance issues. Many businesses choose to work with certified QuickBooks ProAdvisors or professional bookkeeping services (such as Optimum Results Business Solutions) to manage their QuickBooks Online and Payroll integration.

The integration of QuickBooks Online and Payroll lays the foundation for a more efficient financial management system. In the next section, we’ll explore the key features that make this integration so powerful for businesses of all sizes.

How QuickBooks Online and Payroll Integration Boosts Efficiency

Automated Payroll Processing

QuickBooks Online and Payroll integration transforms payroll processing into a streamlined operation. The system calculates wages, deductions, and taxes with minimal input. It schedules regular payroll runs, which ensures timely employee payments. This time savings allows business owners and managers to focus on strategic tasks.

The system handles direct deposits automatically, which eliminates the need for paper checks and reduces the risk of lost or delayed payments. For businesses with hourly employees, the integration with QuickBooks Time (included in Payroll Premium and Elite subscriptions) imports approved time entries into the payroll system automatically.

Real-Time Financial Reporting

The integration provides instant access to up-to-date financial information. As payroll data syncs automatically with the accounting system, businesses can generate accurate financial reports at any moment. This capability enables quick decision-making and helps identify potential issues early.

The system offers various customizable reports, including detailed payroll summaries, labor cost analyses, and tax liability reports. These insights allow businesses to track labor costs as a percentage of revenue, monitor overtime trends, and make informed decisions about hiring and compensation.

Simplified Tax Compliance and Filing

QuickBooks Online and Payroll integration simplifies tax compliance and filing. The system calculates federal, state, and local payroll taxes based on the latest tax tables. It generates and files the necessary tax forms, including W-2s and 1099s, which reduces the risk of errors and late filings.

QuickBooks Online Payroll Elite offers an additional layer of protection. The service provides tax penalty protection of up to $25,000 if a tax filing error occurs due to the software. This feature offers peace of mind and potential cost savings.

Employee Self-Service Portal

The employee self-service portal empowers employees while reducing administrative workload. QuickBooks Workforce offers features like GPS time tracking, mobile accessibility, integration with payroll, and a user-friendly employee portal. This helps businesses manage their workforce more efficiently and provides employees with instant access to important information.

Employees can update their personal information (such as address changes or tax withholding preferences) directly through the portal. This feature ensures that payroll records remain up-to-date and accurate without constant oversight from administrative staff.

Final Thoughts

QuickBooks Online and Payroll integration offers a powerful solution for businesses to streamline their financial management processes. This integration reduces time spent on accounting and payroll tasks, allowing companies to focus on core business activities. Automated payroll processing, real-time financial reporting, and simplified tax compliance provide substantial benefits to businesses of all sizes.

Professional assistance proves invaluable to fully leverage these advantages and avoid costly mistakes in setup or ongoing management. Optimum Results Business Solutions specializes in helping small service-based businesses and tech startups maximize the benefits of QuickBooks Online and Payroll integration. Our team of certified QuickBooks ProAdvisors provides expert setup, ongoing management, and strategic advice to ensure your financial systems operate at peak efficiency.

A robust, integrated financial management system forms the foundation for streamlined operations, improved decision-making, and sustainable growth in today’s fast-paced business environment. QuickBooks Online and Payroll integration, when properly implemented and managed, can provide this foundation. Optimum Results Business Solutions can help you harness the full potential of this powerful tool and enhance your financial management capabilities.