Small business owners often struggle with managing their finances effectively. Proper bookkeeping is essential for maintaining financial health and making informed decisions.

At Optimum Results Business Solutions, we understand the challenges faced by small businesses when it comes to financial management. Our comprehensive bookkeeping services for small businesses cover everything from financial record keeping to payroll administration and in-depth financial analysis.

Financial Record Keeping Essentials

Financial record keeping forms the foundation of effective small business management. This process involves tracking every financial transaction your business makes, including sales, purchases, payments received, and expenses incurred.

Organizing Transactions

The first step in robust financial record keeping is to organize your transactions. This means categorizing each transaction correctly as income, expense, asset, or liability. QuickBooks Online (a tool we’re certified ProAdvisors for) offers excellent features for this purpose. It allows you to set up custom categories that align with your business structure, making it easier to track and analyze your financial data.

Maintaining Accurate Books

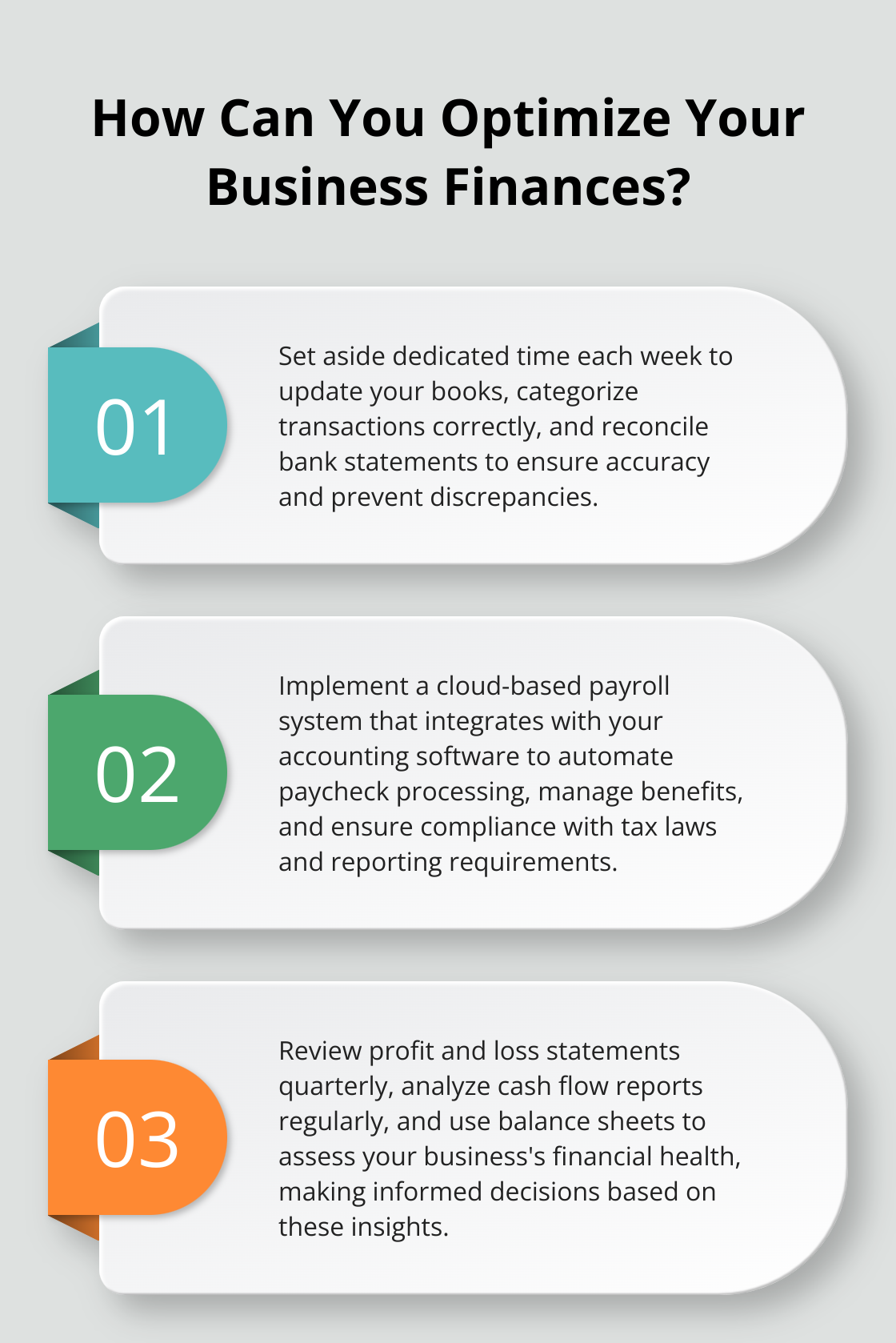

Accurate and up-to-date books are essential. This involves recording transactions promptly and correctly. Many small businesses struggle with this, often letting receipts pile up or forgetting to log smaller expenses. These small oversights can lead to significant discrepancies over time. Set aside time each week to update your books to ensure nothing slips through the cracks.

Bank Reconciliation

Bank and credit card statement reconciliation is a critical task that many small business owners overlook. This process compares your internal financial records with your bank statements to ensure they match. Regular reconciliation helps identify suspicious transactions and investigate them by looking at cheques, transfers, bills, and other documentary proof.

Managing Accounts

Effective management of accounts payable and receivable is essential for maintaining healthy cash flow. For accounts payable, it’s important to track due dates and take advantage of early payment discounts (when possible). For accounts receivable, setting up easy electronic payment portals with different online payment options that let clients pay online (by using a credit card for instance) can be beneficial.

Leveraging Technology

Modern bookkeeping software can significantly streamline the record-keeping process. Cloud-based solutions (like QuickBooks Online) offer real-time access to financial data, automated bank feeds, and powerful reporting tools. These features not only save time but also reduce the risk of human error in data entry and calculations.

As we move forward, let’s explore how proper payroll administration complements these financial record-keeping practices, ensuring your business maintains compliance and keeps your employees happy.

Streamlining Payroll Management for Small Businesses

Automated Paycheck Processing

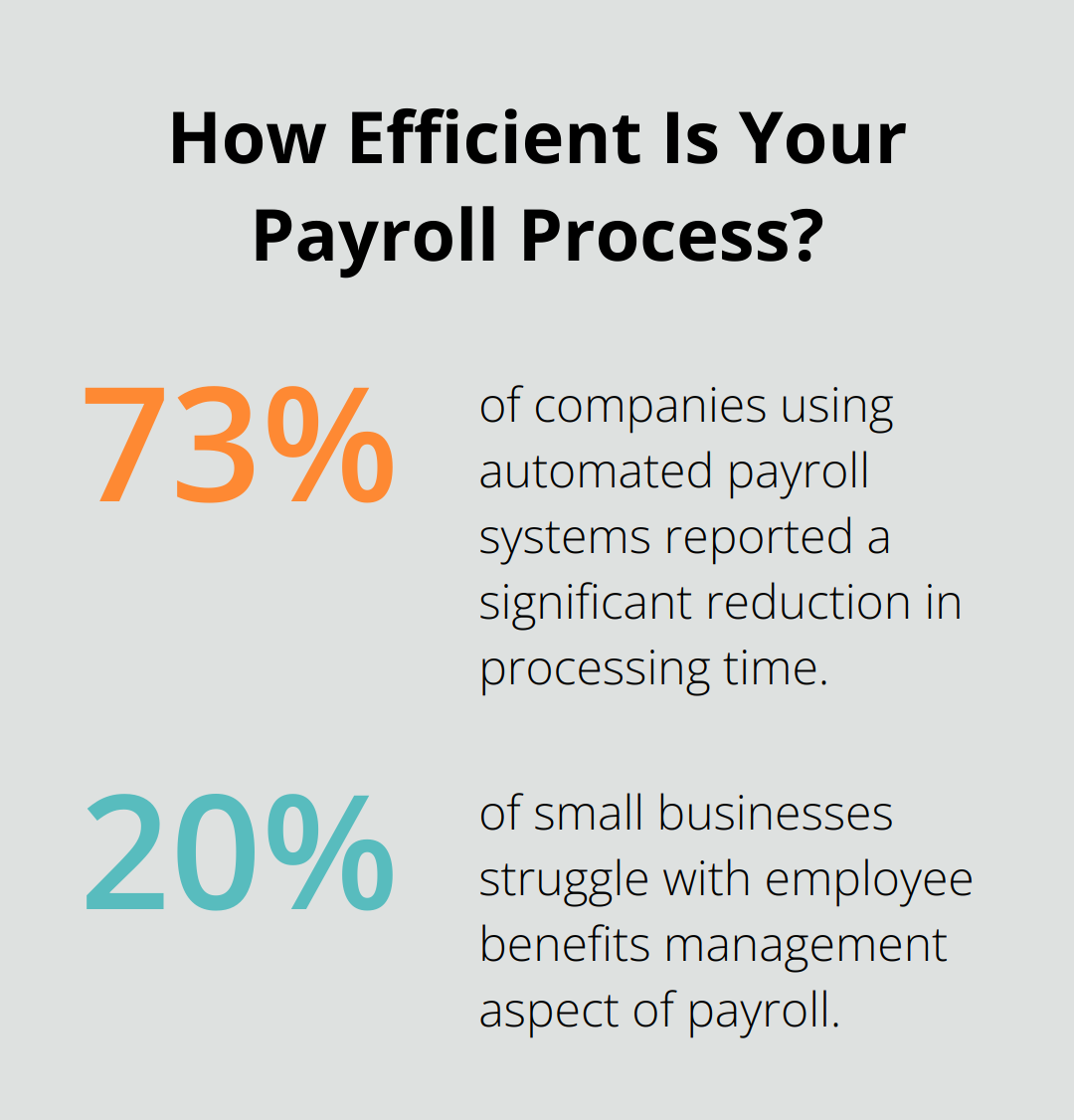

Small businesses can transform their payroll operations through automation. 73% of companies using automated payroll systems reported a significant reduction in processing time, helping HR departments focus on strategic initiatives. Cloud-based payroll software that integrates with existing accounting systems minimizes manual entry errors and ensures accurate data flow. This integration (a key feature of modern payroll solutions) simplifies the entire payroll process.

Navigating Complex Payroll Taxes

Payroll taxes present a significant challenge for small businesses. The IRS highlights four common tax errors that can be costly for small businesses, including underpaying estimated taxes, depositing employment taxes incorrectly, filing late, and not reporting all taxable income. To avoid these costly errors, businesses must stay current with tax laws and deadlines. A separate payroll bank account (dedicated solely to tax payments) helps ensure funds availability when needed.

Efficient Benefits Administration

Employee benefits management often overwhelms small business owners. According to the Society for Human Resource Management, 20% of small businesses struggle with this aspect of payroll. Centralizing benefits management within the payroll system streamlines the process and provides employees easy access to their information. This approach (integrating benefits with payroll) enhances overall efficiency and employee satisfaction.

Compliance and Reporting

Small businesses must adhere to various regulations and reporting requirements. The Department of Labor enforces numerous laws that affect payroll, including minimum wage and overtime rules. Automated payroll systems often include built-in compliance checks and generate required reports, reducing the risk of violations and penalties.

Leveraging Expert Services

While technology plays a crucial role in payroll management, expert guidance can provide additional value. Professional payroll services offer specialized knowledge and stay updated on changing regulations. Optimum Results Business Solutions, for example, provides comprehensive payroll administration services tailored to small businesses, ensuring accuracy and compliance while freeing up time for core business activities.

As we move forward, let’s explore how effective financial reporting and analysis complement streamlined payroll management, providing small businesses with the insights needed for informed decision-making and sustainable growth.

Unlocking Financial Insights Through Reporting and Analysis

The Power of Monthly Financial Statements

Monthly financial statements provide valuable insights into the financial health of your business and help you make informed decisions. These reports offer a snapshot of a business’s financial position at regular intervals, which allows for progress tracking and timely adjustments.

Profit and Loss: Your Business’s Scorecard

The profit and loss statement (also known as the income statement) serves as a key indicator of a business’s profitability. This report summarizes revenues, costs, and expenses over a specific period. Analysis of the profit and loss statement helps identify the most profitable products or services, areas of cost escalation, and performance compared to industry benchmarks. The U.S. Small Business Administration recommends a quarterly review of profit and loss statements to maintain a firm grasp on financial performance.

Balance Sheets: A Financial Health Snapshot

Balance sheets provide a clear picture of assets, liabilities, and equity at a specific point in time. This report proves essential for understanding a business’s overall financial health and solvency. Regular review of balance sheets helps prevent potential financial issues and ensures adequate resources to meet financial obligations.

Cash Flow Reports: Tracking Money Movement

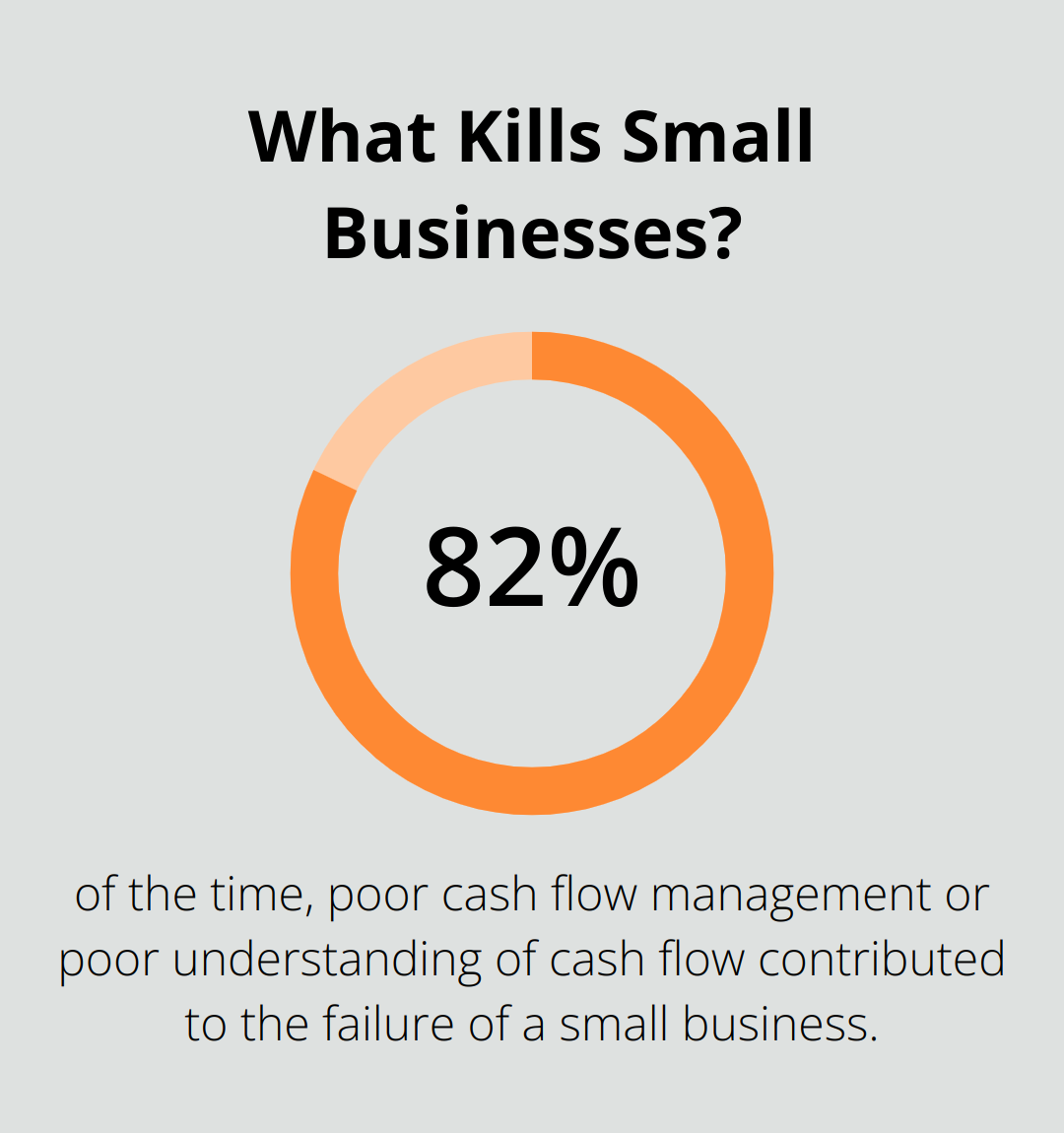

Cash flow reports track the movement of money in and out of a business. A study found that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of a small business. These reports (when reviewed regularly) help prevent cash shortages and maintain financial stability.

Leveraging Financial Insights for Growth

Comprehensive financial reports tailored to specific business needs provide actionable insights to drive a business forward. Expert analysis of these reports equips business owners with a deeper understanding of their financial position, enabling more informed strategic decisions for sustainable growth. Professional services (such as those offered by Optimum Results Business Solutions) can provide valuable expertise in interpreting financial data and translating it into practical business strategies.

Final Thoughts

Effective bookkeeping forms the backbone of financial success for small businesses. Professional bookkeeping services offer a strategic advantage by ensuring accuracy, compliance, and timely financial insights. These services enable businesses to avoid costly errors, make data-driven decisions, and focus on their core operations.

Optimum Results Business Solutions provides tailored bookkeeping services for small businesses, addressing the unique needs of service-based companies and tech startups. Our comprehensive offerings include payroll administration, sales tax management, and generation of accurate financial statements. We also deliver valuable financial insights to help businesses navigate financial challenges with confidence.

Professional bookkeeping services allow small business owners to concentrate on growth and innovation while experts handle financial intricacies. Partnering with a trusted bookkeeping service can make a significant difference in today’s competitive landscape. Small businesses can set themselves on a path to long-term success with the right financial support.