Professional bookkeeping is the backbone of financial management for businesses of all sizes. At Optimum Results Business Solutions, we often get asked: “What do bookkeeping services include?”

This comprehensive guide will break down the core and advanced services that professional bookkeepers provide, as well as the cutting-edge technology they use to streamline financial processes.

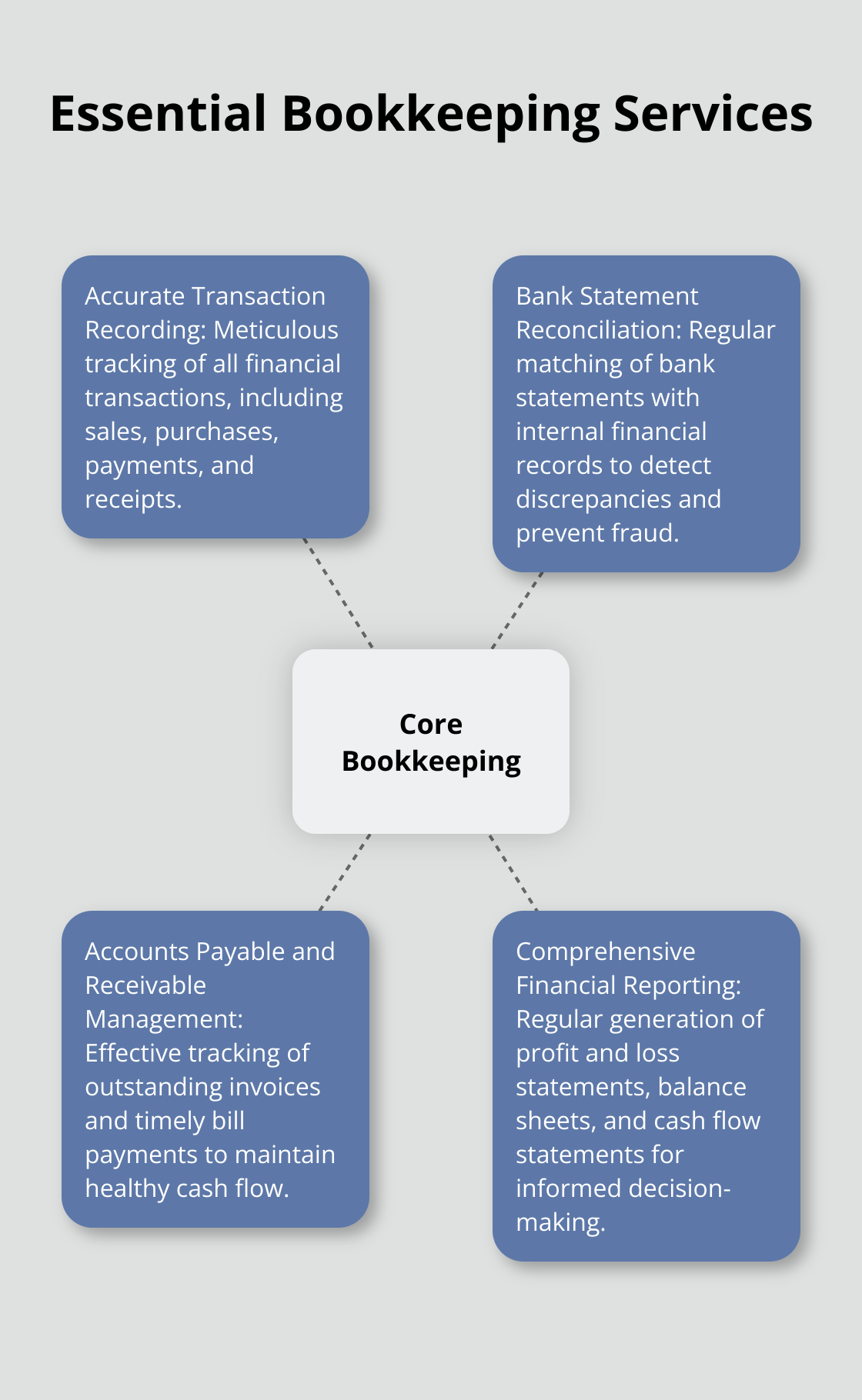

What Are the Essential Bookkeeping Services?

Accurate Transaction Recording

The cornerstone of bookkeeping is the meticulous recording of all financial transactions. This includes sales, purchases, payments, and receipts. Accurate tracking of income and expenses, streamlined tax management, and improved financial management are some of the numerous benefits offered by advanced accounting software. With automation, real-time capture of transactions reduces errors and provides up-to-date financial information.

Bank Statement Reconciliation

Regular reconciliation of bank statements with internal financial records detects discrepancies and prevents fraud. This task should be performed monthly to ensure all transactions are accounted for and any inconsistencies are promptly addressed. During bank reconciliation, you can identify suspicious transactions and investigate them by looking at cheques, transfers, bills, and other documentary proof.

Accounts Payable and Receivable Management

Effective management of accounts payable and receivable maintains healthy cash flow. Robust systems track outstanding invoices, follow up on late payments, and ensure timely payment of bills. This proactive approach prevents cash flow issues that can cripple small businesses.

Comprehensive Financial Reporting

Regular financial reports guide business decisions. Detailed profit and loss statements, balance sheets, and cash flow statements provide a clear picture of a company’s financial position, helping owners make informed decisions.

These core bookkeeping services establish a solid financial foundation for businesses. Owners can focus on growth and strategy, confident in the knowledge that their financial records are accurate, up-to-date, and compliant with regulations.

As we move forward, we’ll explore the advanced bookkeeping services that take financial management to new heights.

How Advanced Bookkeeping Services Boost Your Business

Professional bookkeeping extends far beyond basic financial record-keeping. Advanced services can significantly impact your business’s financial health and growth potential.

Streamlining Payroll and Tax Processes

Payroll processing and tax management require precision and up-to-date knowledge of regulations. The IRS reports that 40% of small businesses incur an average penalty of $845 per year for late or incorrect filings. Professional bookkeepers use specialized software to automate payroll calculations, tax withholdings, and filings. This automation reduces errors and ensures compliance.

QuickBooks Online with payroll integration reports that businesses using their integrated payroll system save an average of 15 hours per month on payroll tasks. This time savings allows business owners to focus on core operations and growth strategies.

Forecasting for Financial Success

Cash flow forecasting is a critical tool for business planning. Its primary role is to protect your business by trying to pick up on any warning signs before they become serious issues. Advanced bookkeeping services provide detailed cash flow projections, which help you anticipate and prepare for future financial needs.

These forecasts typically cover 3 to 12 months and include scenarios for different business conditions. With this information, you can make informed decisions about investments, hiring, and expansion plans.

Strategic Budgeting and Planning

Effective budgeting forms the cornerstone of financial success. A survey by Clutch.co revealed that 61% of small businesses didn’t create an official, documented budget in 2018. Professional bookkeepers can help you develop comprehensive budgets that align with your business goals.

They analyze historical data, industry trends, and your specific business objectives to create realistic financial plans. These budgets serve as roadmaps for your business, helping you allocate resources effectively and measure performance against set targets.

Enhancing Financial Insights

Advanced bookkeeping services provide deeper insights into your financial position. They offer the ability to analyze vast datasets, providing a comprehensive 360-degree view of your organization’s financial performance. This level of analysis empowers you to make data-driven decisions that can propel your business forward.

The next section will explore how modern technology enhances these services, further streamlining your financial management processes. You’ll discover how cloud-based solutions and automation tools are revolutionizing the bookkeeping landscape.

How Technology Revolutionizes Bookkeeping

Cloud-Based Accounting: Access Anywhere, Anytime

Cloud-based accounting software transforms modern bookkeeping. This technology offers benefits including cost savings, scalability, real-time access to financial data, and improved collaboration. Cloud accounting solutions allow real-time access to financial data from any internet-connected device.

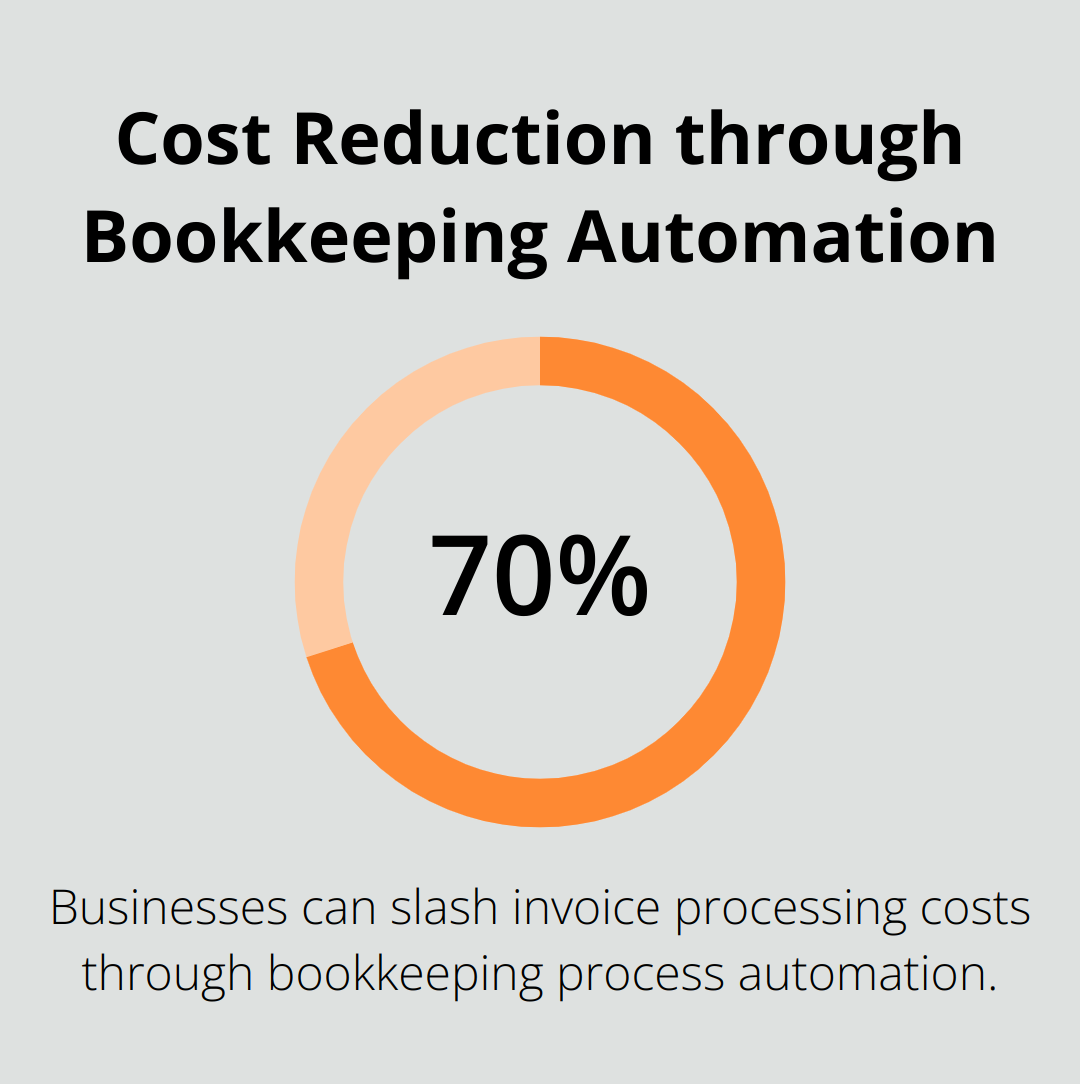

Automation: Error Reduction and Time Savings

Automated data entry and bank feeds revolutionize transaction recording. Businesses can slash invoice processing costs by over 70% through bookkeeping process automation. This approach is transforming financial operations across industries.

Modern bookkeeping software automatically categorizes transactions, reconciles accounts, and flags discrepancies.

Digital Receipt Management: The End of Paper Clutter

Digital receipt management systems allow businesses to capture, store, and categorize receipts electronically.

Integrated Systems: A Comprehensive Business View

The integration of bookkeeping software with other business management systems provides a holistic view of a company’s operations.

Connecting accounting software with inventory management, point-of-sale systems, and customer relationship management tools enables deeper insights into financial health. This integration allows for more accurate forecasting and strategic decision-making.

The Evolving Role of Bookkeepers

As technology advances, the role of bookkeepers evolves from data entry to strategic financial advisors. They now help businesses navigate the complexities of modern finance, leveraging real-time, accurate financial data to drive growth and success.

Final Thoughts

Professional bookkeeping services form the foundation of financial success for businesses of all sizes. These services include transaction recording, bank reconciliation, and accounts management, which provide essential insights for strategic decision-making. Advanced offerings such as payroll processing, tax preparation, and cash flow forecasting elevate financial oversight to new heights.

Modern technology has transformed what bookkeeping services include. Cloud-based software, automated data entry, and digital receipt management streamline processes and improve accessibility. These advancements allow bookkeepers to shift from data entry to providing strategic financial advice, helping businesses navigate complex financial landscapes.

Choosing the right bookkeeping solution is important for business success. At Optimum Results Business Solutions, we offer expert bookkeeping and accounting services for small service-based businesses and tech startups. Our team of QuickBooks Online ProAdvisors ensures compliance with regulations while providing customized solutions that enhance operational efficiency (and reduce financial management costs).