QuickBooks Online for small business has become the go-to accounting solution for over 7 million companies worldwide. The platform handles everything from basic bookkeeping to complex financial reporting.

We at Optimum Results Business Solutions see businesses transform their financial management when they implement QuickBooks Online correctly. This guide walks you through every step needed to maximize your investment.

What Features Make QuickBooks Online Essential

QuickBooks Online transforms financial chaos into organized systems through three core capabilities that small businesses need most. The double-entry bookkeeping system automatically balances your books while it tracks every transaction across accounts receivable, accounts payable, and general ledger functions. Cash flow tracking shows exactly when money enters and leaves your business, with 94% of users reporting improved financial visibility within their first month. The platform handles sales tax calculations automatically across all 50 states, which eliminates manual tax rate lookups that consume 3-4 hours monthly for most businesses.

Invoice Management That Actually Gets You Paid

Smart invoicing features help businesses collect payments 4x faster than traditional paper invoicing methods. Automated payment reminders send follow-ups at 7, 14, and 30-day intervals, while online payment processing through QuickBooks Payments accepts credit cards, ACH transfers, and bank payments directly. Late fees apply automatically based on your terms, and recurring invoices handle subscription billing without manual intervention. The mobile app lets you create and send invoices from job sites (with 73% of contractors reporting faster cash collection after they switch from manual systems).

Financial Reports That Drive Business Decisions

Real-time profit and loss statements, balance sheets, and cash flow reports update automatically as transactions occur. Customizable dashboards track key performance indicators like gross profit margins, customer acquisition costs, and monthly recurring revenue. The AI-powered insights feature identifies spending patterns and flags unusual transactions, which helps prevent fraud and overspending. Month-end closing takes 2-3 days instead of weeks, with automated reconciliation that matches 95% of bank transactions correctly without manual review.

Bank Integration and Transaction Management

QuickBooks Online connects directly to thousands of financial institutions and automatically imports transactions daily. The system categorizes expenses based on previous entries and merchant data (reducing manual data entry by up to 80%). Bank reconciliation happens in real-time, and the software flags duplicate transactions or unusual amounts for review. This seamless integration forms the foundation for accurate record-keeping that supports your daily operations.

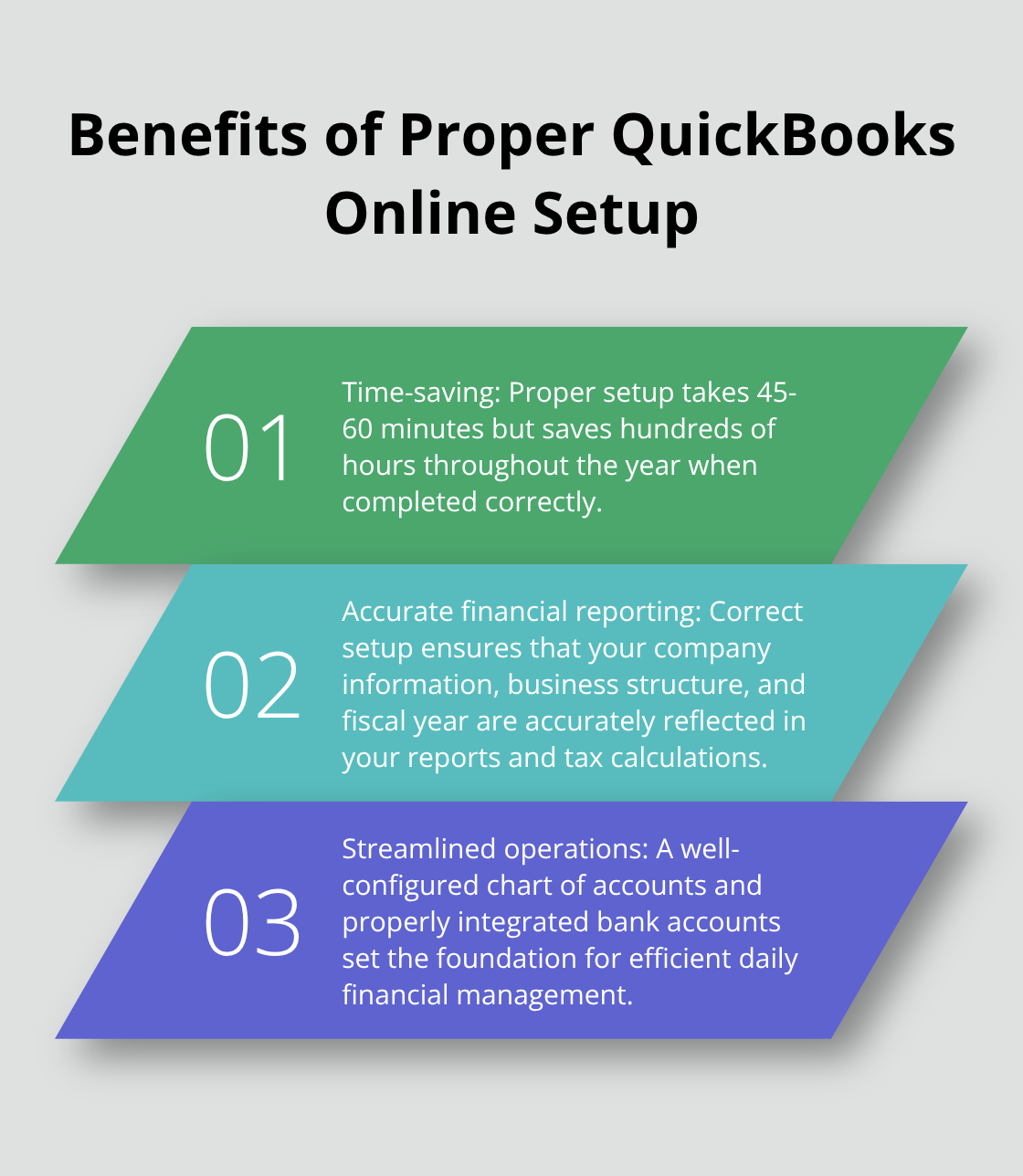

How Do You Set Up QuickBooks Online Correctly

Proper QuickBooks Online setup takes 45-60 minutes but saves hundreds of hours throughout the year when you complete it correctly. Start with accurate company information including your legal business name, tax identification number, and industry classification because these details affect tax calculations and report formats. Choose your business structure (LLC, Corporation, Sole Proprietorship) carefully since this determines how QuickBooks Online handles owner equity accounts and tax reports. Input your fiscal year start date precisely because you cannot change this later without data migration and potential service interruption.

Company Information That Prevents Future Problems

Enter your business address exactly as it appears on your tax documents since QuickBooks Online uses this information for state tax calculations and 1099 forms. Select your industry from the dropdown menu carefully because this choice determines which chart of accounts template the system provides. Upload your business logo during initial setup rather than later since this affects invoice templates and customer-facing documents. Verify your contact information matches your business registration because payment processors require exact matches for merchant account approval.

Chart of Accounts Configuration That Works

QuickBooks Online provides industry-specific chart of accounts templates, but businesses often need customization for accurate reports. Create separate expense accounts for major cost categories like professional services, software subscriptions, and marketing spend rather than generic expense accounts. Add location or department tracking through classes if you operate multiple business lines or locations. Set up separate income accounts for different revenue streams because this data becomes essential when you analyze profitability by service or product line. Avoid too many accounts initially since you can always add accounts later, but you cannot remove accounts with transaction history without careful planning.

Bank Account Integration Strategy

Connect your primary business checking account first, then add credit cards and secondary accounts in order of transaction volume. QuickBooks Online matches transactions automatically when you connect accounts during initial setup, with better accuracy when connections are established early. Enable automatic transaction downloads and set up bank rules immediately to categorize recurring transactions like rent, utilities, and loan payments. Test the connection with small transactions before you process large volumes since connection issues resolve more easily with fewer transactions involved.

With your foundation established, you can now focus on the daily operations that keep your business running smoothly and your books accurate.

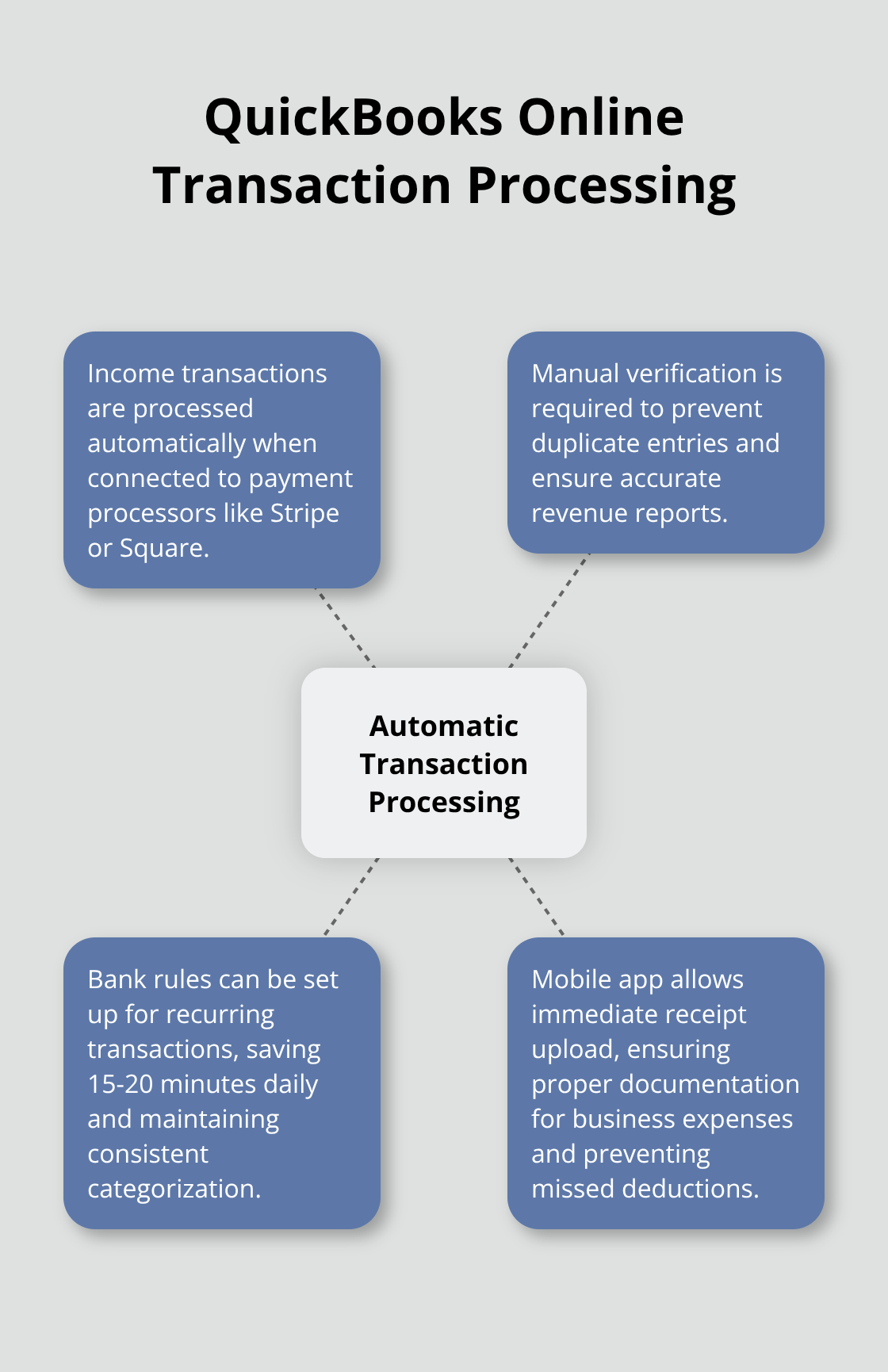

How Do You Handle Daily Financial Operations

Daily transaction recording separates successful businesses from those that struggle with cash flow problems and tax compliance issues. QuickBooks Online processes income transactions automatically when you connect payment processors like Stripe or Square, but manual verification prevents duplicate entries that create inflated revenue reports. Record expenses the day they occur rather than wait for monthly statements because small businesses that delay expense recording face significant tax challenges. Set up bank rules for recurring transactions like rent, utilities, and software subscriptions since these rules save 15-20 minutes daily and maintain consistent categorization. Upload receipts immediately through the mobile app because the IRS requires documentation for business expenses, and proper receipt management prevents missed deductions.

Income and Expense Transaction Management

QuickBooks Online automatically imports bank transactions daily when you connect your accounts properly. The system matches transactions to existing entries and flags duplicates before they affect your reports. Create expense categories that match your tax return line items to simplify year-end preparation. The mobile app captures receipt images and extracts key data like vendor names, amounts, and dates automatically (which reduces manual data entry by 75%). Set transaction approval workflows if multiple people handle company finances because this prevents unauthorized expenses and maintains accurate records.

Inventory Tracking Without the Headaches

QuickBooks Online Plus and Advanced plans include inventory management that tracks quantities, costs, and profit margins in real-time. Enable inventory features only for physical products you sell regularly because service businesses create unnecessary complexity with inventory functions. Set reorder points at 2-3 weeks of average sales volume to prevent stockouts while you avoid excess inventory that ties up cash flow. The system calculates cost of goods sold automatically with FIFO methodology, which matches IRS requirements and provides accurate profit margins. Sales tax automation handles calculations across multiple jurisdictions, with rates that update automatically as tax laws change.

Payroll Processing That Actually Works

QuickBooks Online Payroll integrates directly with your accounting data and eliminates double-entry of employee information and wage calculations. Set up direct deposit for all employees because paper checks cost businesses $2.50 per check in processing time and bank fees. The system handles federal, state, and local tax calculations automatically, with tax deposits that occur electronically on required deadlines. Workers’ compensation insurance integrates with payroll data to provide accurate premium calculations based on actual wages rather than estimates. Time tracking through the mobile app connects directly to payroll processing, with GPS verification that confirms employee locations during clock-in. Automated tax filing includes quarterly 941 forms and annual W-2 preparation, which saves 8-12 hours quarterly compared to manual filing processes.

Final Thoughts

QuickBooks Online for small business delivers measurable results when you implement it correctly. Businesses report 94% improved financial visibility within their first month, while automated features reduce manual bookkeeping time by 80%. The platform’s real-time reports and bank integration create accurate financial records that support better decisions and tax compliance.

Success with QuickBooks Online requires consistent daily transaction records and proper initial setup. Connect all bank accounts during implementation, establish clear expense categories, and maintain regular reconciliation schedules. Upload receipts immediately through the mobile app and set up automated rules for recurring transactions to maintain accuracy without constant manual oversight.

Complex businesses with multiple revenue streams, inventory management needs, or multi-location operations often benefit from professional support (especially when monthly bookkeeping tasks exceed 20 hours or when tax compliance becomes overwhelming). We at Optimum Results Business Solutions help businesses maximize their QuickBooks Online investment through expert bookkeeping services and ProAdvisor support. This partnership allows business owners to focus on growth while we maintain accurate financial records and handle compliance requirements.